WW Cloud IT Infrastructure Market Grows by 25% to $6.3 Billion in 1Q15 – IDC

Led by HP, Dell, Cisco, EMC, NetApp and Lenovo

This is a Press Release edited by StorageNewsletter.com on July 22, 2015 at 3:23 pmAccording to the International Data Corporation‘s Worldwide Quarterly cloud IT Infrastructure Tracker, vendor revenue from sales of infrastructure products (server, storage, and Ethernet switch) for cloud IT, including public and private cloud, grew by 25.1% year over year to nearly $6.3 billion in 1Q15.

This was the second highest growth in the five quarters in which IDC has tracked year-over-year revenue and the second largest in terms of total spending in nine quarters of tracking.

Cloud IT infrastructure spending climbed to nearly 30% of overall IT infrastructure spending in 1Q15, up from 26.4% a year ago.

Revenue from infrastructure sales for private cloud grew 24.4% year over year to $2.4 billion while sales for public cloud grew 25.5% to $3.9 billion. In comparison, the non-cloud IT infrastructure segment increased by 6.1% in the first quarter, largely driven by increased sales of servers while storage sales declined and sales of Ethernet switches grew just by 1%. All three technology markets showed strong year-over-year growth in both private and public cloud segments, with servers experiencing the highest growth at 28% and 33%, respectively.

“Cloud IT infrastructure growth continues to outpace the growth of the overall IT infrastructure market, driven by the transition of workloads onto cloud-based platforms,” said Kuba Stolarski, research manager, server, virtualization and workload research, IDC. “Both private and public cloud infrastructures have been growing at a similar pace, suggesting that customers are open to a broad array of hybrid deployment scenarios as they modernize their IT for the 3rd Platform, begin to deploy next-gen software solutions, and embrace modern management processes that enable agile, flexible, and extensible cloud platforms.”

At the regional level, vendor revenues from cloud IT infrastructure sales declined only in Central and Eastern Europe, which is experiencing political and economic turmoil that impacts overall IT spending. In all other regions year-over-year growth in IT infrastructure sales for public and private cloud remained strong and even accelerated compared to growth rates in the previous quarter.

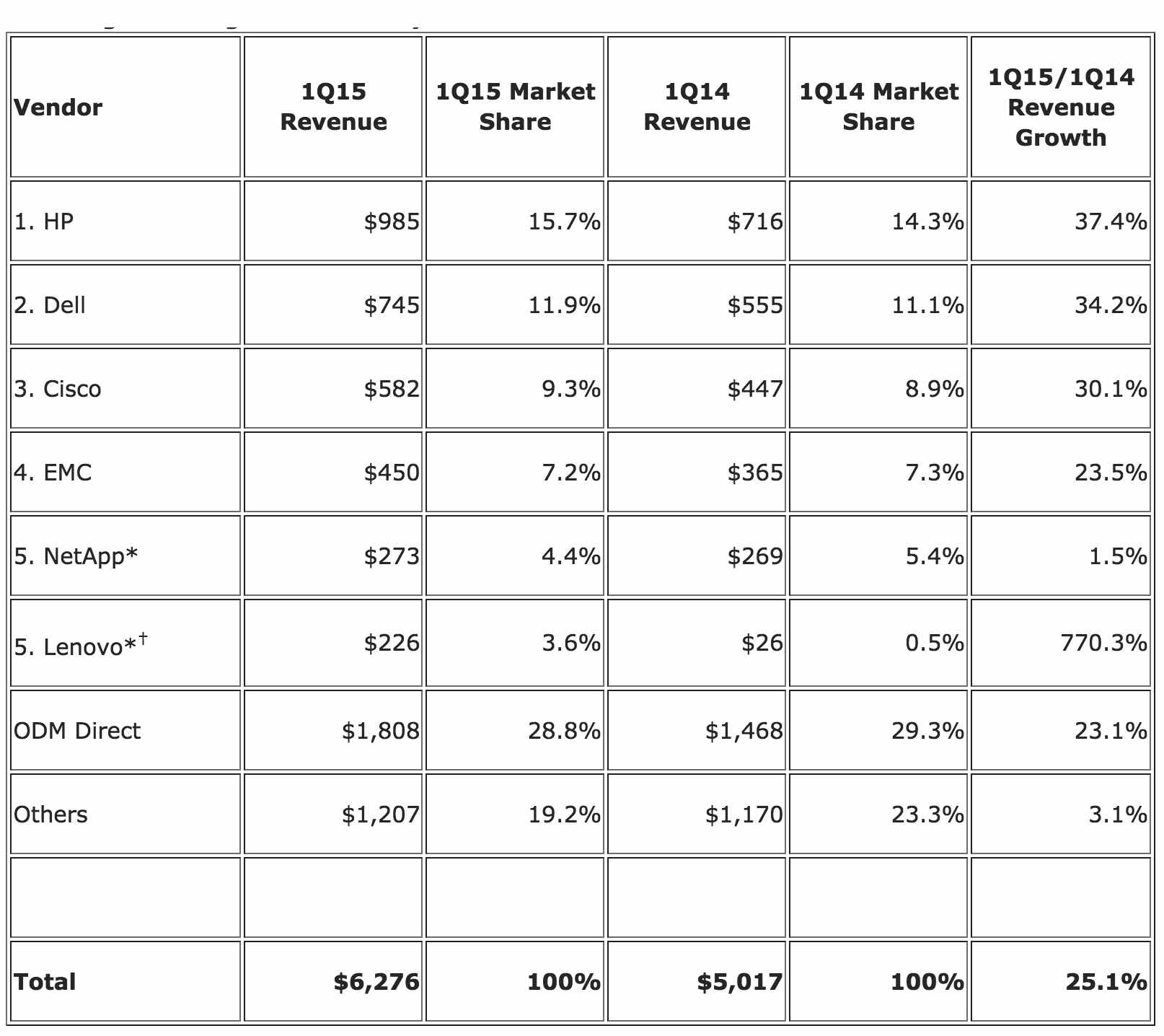

Top 5 Corporate Family, WW Cloud IT Infrastructure Vendor Revenue,

Market Share, and Year-Over-Year Growth, 1Q15

(revenues in $million, excludes double counting of storage and servers)

*IDC declares a statistical tie in the worldwide cloud IT infrastructure market when there is less than one% difference in the factory revenue share of two or more vendors.

† IBM’s divestiture of its x86 business to Lenovo on October 1, 2014 has a highly positive impact on year-over-year comparisons for Lenovo for 1Q15.

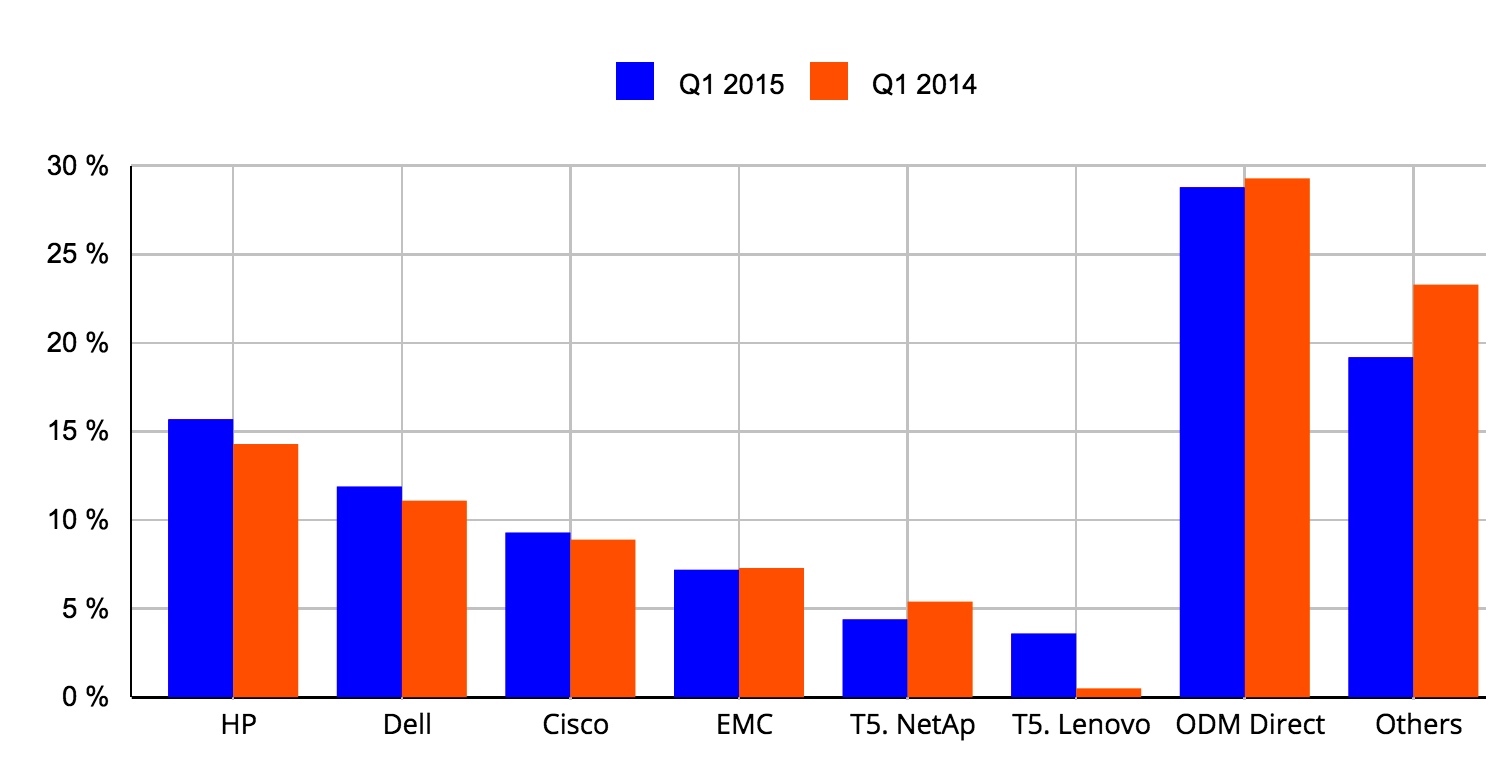

WW Cloud IT Infrastructure Top 5 Cloud Vendors, 1Q14, 1Q15

(shares based on vendor revenue)

(Source: IDC’s Worldwide Quarterly cloud IT Infrastructure Tracker, July 2015)

Read also:

WW Cloud IT Infrastructure Market Grew 14% in 4Q14 at $8 Billion – IDC

Top 5 vendors: HP, Dell, EMC, Cisco and IBM

2015.04.24 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter