WD: Fiscal 2Q15 Financial Results

Business slightly down, like WW HDD market

This is a Press Release edited by StorageNewsletter.com on January 28, 2015 at 3:03 pm| (in $ million) | 2Q14 | 2Q15 | 6 mo. 14 | 6 mo. 15 |

| Revenue | 3,972 | 3,888 | 7,776 | 7,831 |

| Growth | -2% | 1% | ||

| Net income (loss) | 430 | 460 | 925 | 883 |

Western Digital Corp. reported revenue of $3.9 billion and net income of $460 million, or $1.93 per share, for its second fiscal quarter ended Jan. 2, 2015.

On a non-GAAP basis, net income was $539 million or $2.26 per share. In the year-ago quarter, the company reported revenue of $4.0 billion and net income of $430 million, or $1.77 per share. Non-GAAP net income in the year-ago quarter was $532 million, or $2.19 per share.

The company generated $243 million in cash from operations during the December quarter, net of the Seagate arbitration award payment of $773 million, ending with total cash and cash equivalents of $4.9 billion.

During the December quarter, the company utilized $309 million to repurchase 3.2 million shares of common stock. On November 4, the company declared a $0.40 per common-share dividend, which was paid on January 15.

“We delivered strong financial results in the December quarter, with better-than-anticipated revenues, gross margins, and earnings,” said Steve Milligan, president and CEO. “The diversified nature of our business and solid execution by our HGST and WD subsidiaries are enabling us to consistently deliver strong financial performance. Also, I am encouraged by the market’s response to our strategic growth initiatives, which we believe position the company to thrive in the evolving storage ecosystem.”

Comments

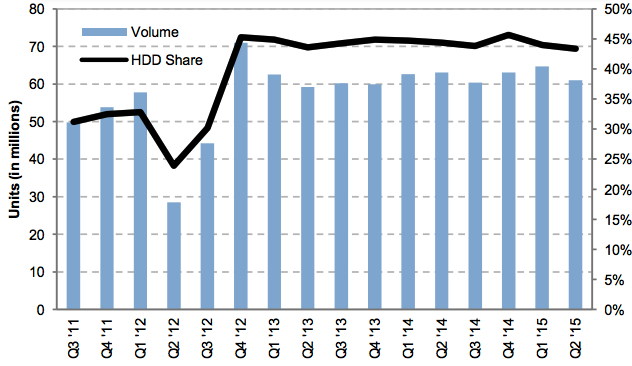

Trendfocus confirmed that Q/Q the worldwide market of HDDs or TAM was down 4%% from 147 million to 141 million units sold, the three manufacturers registering lower volume: Seagate -4.4%, Toshiba -0.3% and WD at -5.7% losing market shares sequentially from 44.0% to 43.4%, this time according to WD figures.

Next march quarter is not going to be better. WD expects revenue to be in a range of $3.6 billion (-8% Q/Q) to $3.7 billion (-5%) and TAM continuing to decline, from 141 million to mid-130 million range.

Milligan commented:" The demand outlook for the March quarter reflects a normal seasonal decline with moderation in client, branded products and performance enterprise with stable demand and capacity enterprise."

Net income was much higher for Seagate primarily because it got a73 million from WD related to an arbitration award in the December quarter.

Looking at the WD's HDD line for the quarter, there was a high sequential decline for desktop and notebook units and an increase for enterprise and branded products.

Flash platform solution business maintained its growth trajectory in the quarter delivering revenue of $187 million, up 20% Y/Y.

| WD's HDDs (units in million) |

Enterprise | Desktop | Notebook | CE | Branded | Exabyte Shipped |

Average GB/drive |

ASP |

| 2Q13 | 6.6 | 17.7 | 21.3 | 6.5 | 7.1 | 47.6 | 804 | $62 |

| 3Q13 | 7.2 | 18.4 | 21.5 | 6.5 | 6.5 | 48.4 | 807 | $61 |

| 4Q13 | 7.9 | 16.2 | 24.0 | 6.5 | 5.3 | 47.7 | 797 | $60 |

| 1Q14 | 7.8 | 17.3 | 22.9 | 8.5 | 6.1 | 50.8 | 811 | $58 |

| 2Q14 | 7.8 | 16.8 | 22.7 | 8.8 | 7.0 | 55.1 | 874 | $60 |

| 3Q14 | 7.1 | 16.6 | 21.8 | 8.6 | 6.3 | 53.6 | 888 | $58 |

| 4Q14 | 7.1 | 16.2 | 22.9 | 10.9 | 6.0 | 55.2 | 875 | $56 |

| 1Q15 | 7.8 | 16.3 | 23.4 | 10.5 | 6.8 | 64.9 | 1,002 | $58 |

| 2Q15 | 8.0 | 15.4 | 21.2 | 9.3 | 7.2 | 66.4 | 1,087 | $60 |

Seagate vs.WD for 2FQ15 (units in million)

| Seagate | WD | % in favor of WD |

|

| Revenue* | 3,696 | 3,888 | 5% |

| Net income* | 933 | 460 | 11% |

| Notebook | 19.7 | 21.2 | 8% |

| Desktop | 16.0 | 15.4 | -4% |

| Branded | 6.0 | 7.2 | 17% |

| CE | 6.1 | 9.3 | 53% |

| Enterprise | 9.1 | 8.0 | -12% |

| Total HDDs | 56.9 | 61.0 | 7% |

| Market share | 40.0% | 43.4% | 3.4% |

| Average GB/drive | 1,077 | 1,087 | 1% |

| EB shipped | 61.3 | 66.4 | 8% |

| ASP | $61 | $60 | -2% |

* in $ million

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter