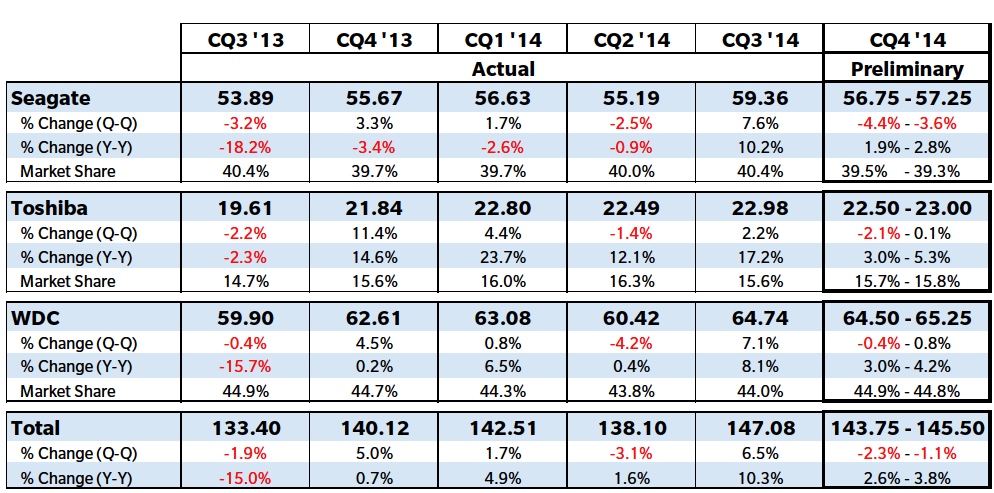

Around 570 Million HDDs Shipped in 2014, Up 3% Y/Y – Trendfocus

Down 1% to 2% from 3Q14 to 4Q14; WD, Seagate and Toshiba in order as usual

This is a Press Release edited by StorageNewsletter.com on January 14, 2015 at 6:19 pmHere is a report, Preliminary CQ4 ’14 Quarterly Update, January 6, 2015, from the SDAS: HDD Information Service by analysts of Trendfocus, Inc.

Summary

- Estimated at 144-145 million HDDs for CQ14

- 2014 total grew to ~570 million, up 3% Y/Y

- Mobile HDDs offset modest declines in desktop demand

- Nearline HDD shipments top expectations and remained flat Q/Q

- Consumer HDD shipments dip as game console HDD sales ease seasonally

3.5″ Desktop /CE HDDs

Desktop/CE HDD sales softened in CQ4 as commercial end-of-the-year spending failed to spur demand. Additionally, 3.5″ CE sales remained stagnant as HDDs bound for xVR applications maintained unit levels consistent with the prior quarter. Holiday sales season managed to lift 3.5″ external HDD sales, but the modest gains were easily overshadowed by weaker than expected desktop HDD demand. The downward trend is expected to continue through CQ1, and unit shipments will likely be off another 4-5% for the quarter.

2.5″ Mobile/CE HDDs

This market was driven by stronger mobile HDD demand, which erased the deficits from weak gaming HDD sales. Unit shipments for the quarter were off modestly to around 72 million. Similar to the 3.5″ market, sales for 2.5″ external HDDs also grew in CQ4.

3.5″/2.5″ Enterprise HDDs

The nearline HDD market continues to impress, as CQ4 shipments ended relatively flat from the record level set in CQ3. Traditional enterprise HDD sales were also consistent, and combined sales in CQ4 remained around 18 million.

Note: Final shipments numbers to be published in Trendfocus’ CQ4 ’14 Quarterly Update and Executive Summary may change measureably

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter