EMEA Integrated Infrastructure and Platform Revenue Grows 38% Y/Y in 3Q14 – IDC

Top three being VCE, NetApp/Cisco anf HP

This is a Press Release edited by StorageNewsletter.com on January 16, 2015 at 3:17 pmThe integrated infrastructure and platforms (II&P) market in EMEA reported vendor revenue of $616 million in 3Q14, for year-on-year growth of 38.2%, according to International Data Corporation.

II&P continued to increase its contribution to the EMEA storage market, contributing 238TB in 3Q14, a year-on-year growth of 63.5%.

The II&P market in 3Q14 also saw the ASP per gigabyte remain on its downward trend, decreasing 15.5% on figures seen in 3Q13.

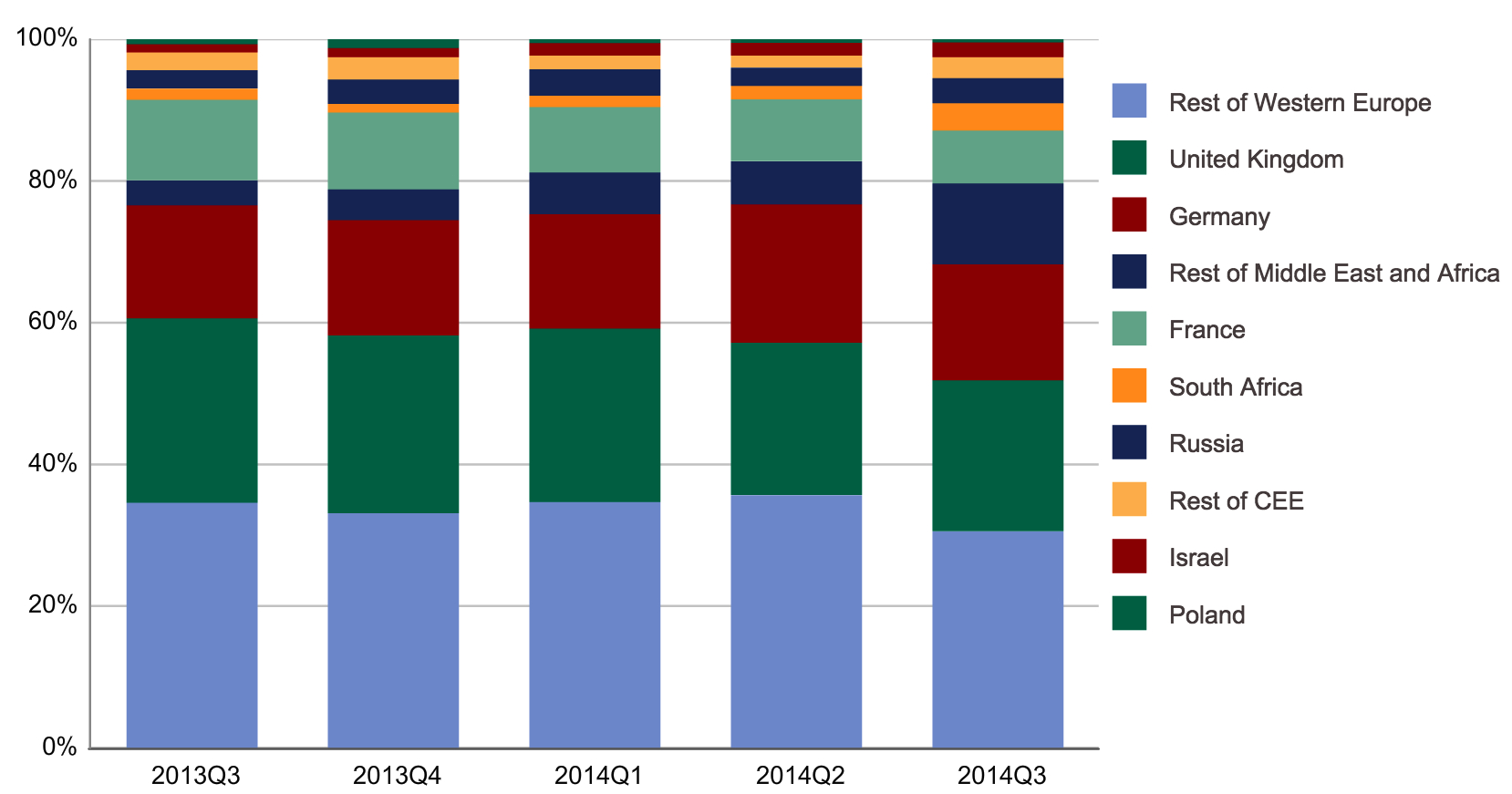

Although 3Q14 saw Western Europe report year-on-year vendor revenue growth of 19% in EMEA, it lost almost 13 percentage points revenue share to Central and Eastern Europe and the Middle East and Africa (CEMA), a market growth trend that was reported by IDC in 2Q14. The CEMA region reported an overall vendor revenue gain of 178.2% on its 2Q13 figures, the majority of which was seen in the Middle East and Africa (MEA), which accounted for $107 million of the $149 million seen in the CEMA market this quarter.

“Increased traction seen by integrated systems can be strongly linked to the fast spreading adoption of business intelligence [BI] solutions and the benefits that are to be gained by their implementation,” said Eckhardt Fischer, research analyst, IDC EMEA enterprise server Group.

CEMA captured 24% of EMEA market value in the third quarter of 2014, which was a significant improvement over the previous quarters. MEA was once again the fastest-growing region in EMEA with revenue up 282% year over year, driven by large integrated infrastructure projects in the Middle East. The Central and Eastern Europe (CEE) region also recorded strong annual performance with revenue growth of 66% benefitting from several sizeable deals in Russia.

“In the CEMA region, greenfield deployments are still a major driver for the uptake of factory preintegrated solutions, which help to address business requirements for scalable, reliable, and virtualized datacenters,” said Jiri Helebrand, research manager, IDC CEMA.

IDC defines integrated infrastructure and platforms as preintegrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment, and basic element/systems management software at the point of sale.

IDC segments this market into two categories:

- Integrated platforms: systems sold with additional preintegrated packaged software and customized system engineering optimized to enable functions such as application development software, databases, testing, and integration tools

- Integrated infrastructure systems: leveraging the same infrastructure building blocks as integrated platforms but not optimized for a specific workload and designed for general-purpose, distributed workloads instead

In 3Q14 integrated infrastructure systems accounted for 69% of total revenue generated in EMEA, a 4.4 percetage point gain on 3Q13 – an increase that can be explained by the increased traction seen by the larger vendors this quarter.

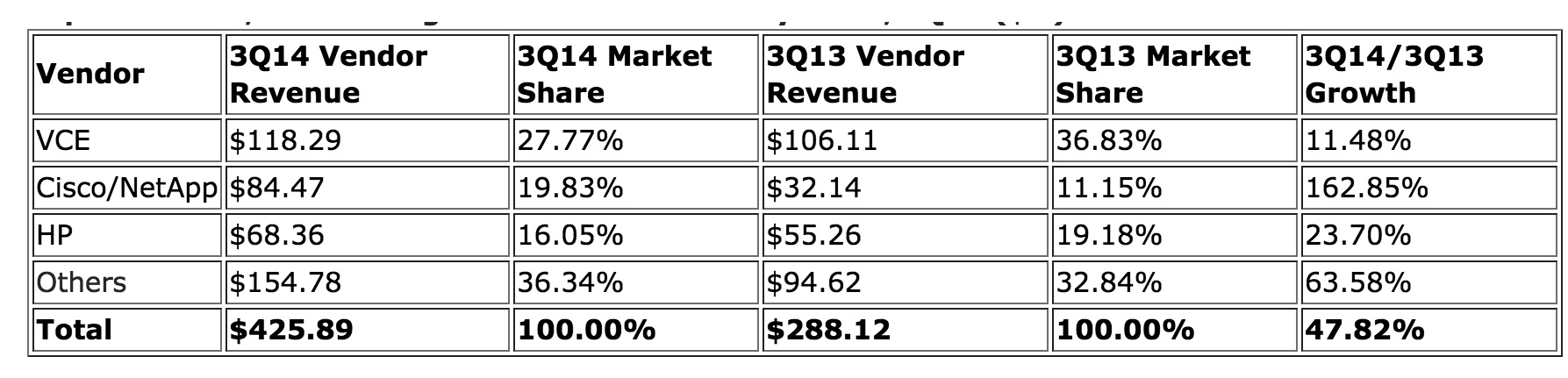

Top 3 Vendors, EMEA Integrated Infrastructure Systems, 3Q14

(in $ million)

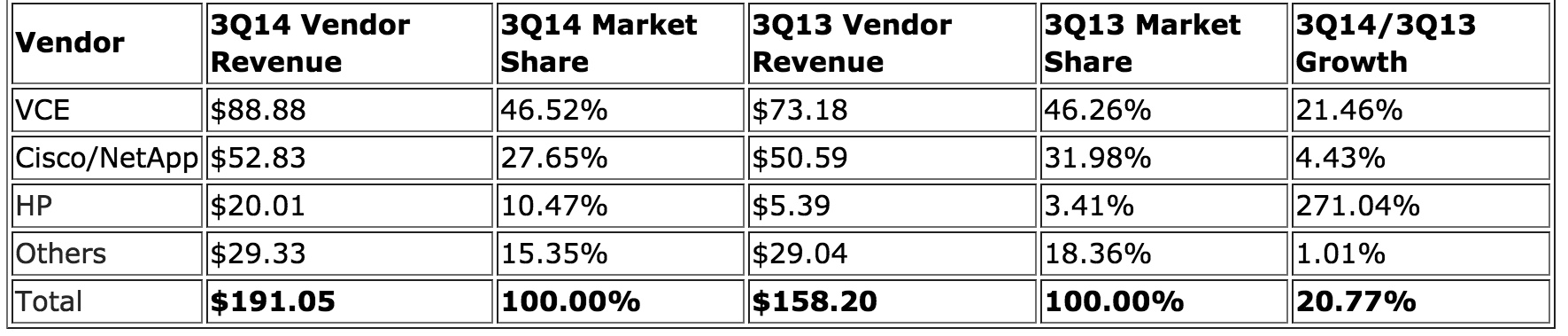

Top 3 Vendors, EMEA Integrated Platforms, 3Q14

(in $ million)

Major Country and Region Revenue Share of EMEA Integrated System Market, 3Q14

(Source: IDC’s EMEA Quarterly Integrated Infrastructure and Platforms Tracker,

December 22, 2014)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter