Brocade: Fiscal 4Q14 Financial Results

SAN product revenue at $325 million, flat Y/Y and Q/Q

This is a Press Release edited by StorageNewsletter.com on November 25, 2014 at 2:52 pm| (in $ million) | 4Q13 | 4Q14 | FY13 | FY14 |

| Revenue | 558.8 | 564.4 | 2,223 | 2,212 |

| Growth | 1% | -1% | ||

| Net income (loss) | 64.2 | 83.4 | 208.6 | 238.0 |

Brocade Communication Systems, Inc. reported financial results for its fourth quarter and fiscal year 2014 ending November 1, 2014.

It reported fourth quarter revenue of $564 million, representing an increase of 1% year-over-year and an increase of 3% quarter-over-quarter.

Revenue for fiscal year 2014 was $2,211 million, down 1% year-over-year due to the divestiture and repositioning of certain product lines.

The resulting GAAP diluted earnings-per-share (EPS) was $0.19 for Q4 and $0.53 for fiscal year 2014, up 36% and 18% year-over-year, respectively. Non-GAAP diluted EPS was $0.24 for Q4, unchanged year-over-year, and $0.90 for fiscal year 2014, up 12% from fiscal year 2013.

“We delivered another strong quarter, highlighted by above-market growth of 9% in IP networking product revenue and 2% SAN product revenue growth, on continuing products,” said Lloyd Carney. “Our focus is on helping customers migrate to the New IP, accelerating data center innovation, building on our software networking leadership, and delivering a world-class customer experience.”

Highlights

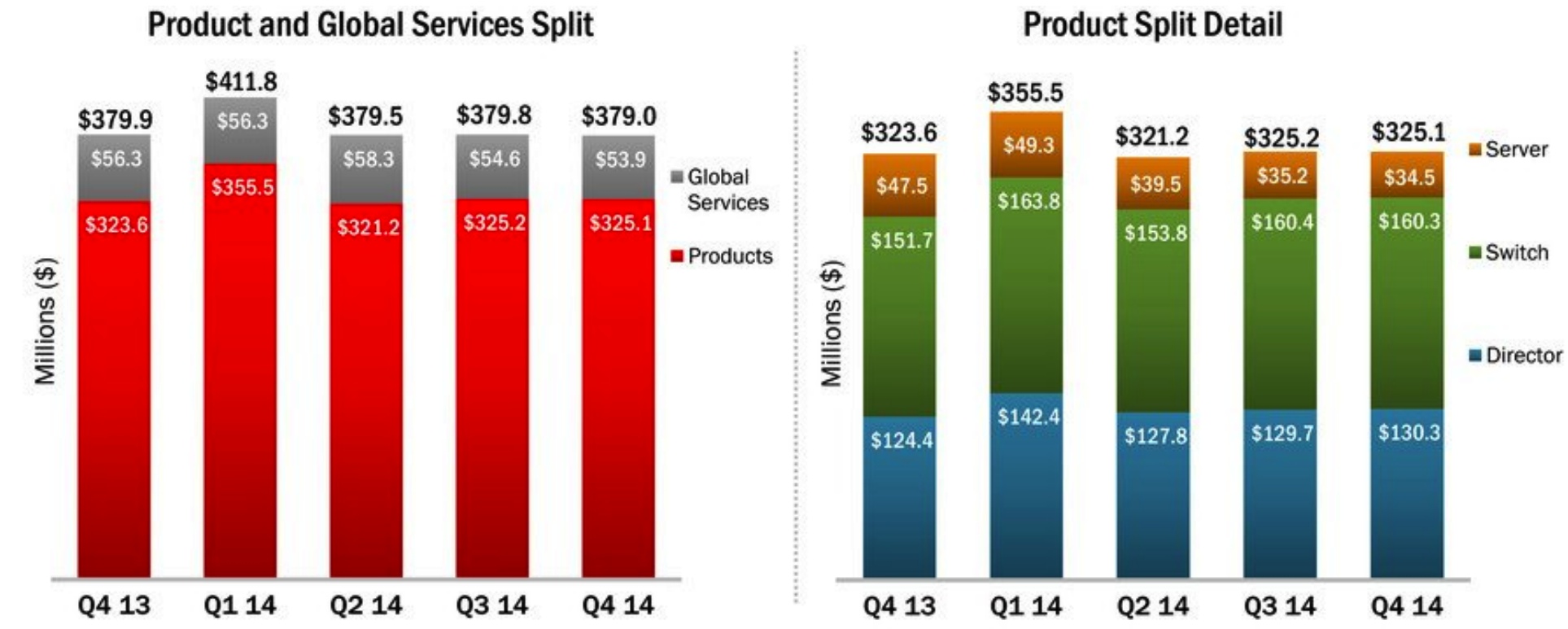

Q4 2014 SAN product revenue was $325 million, flat year-over-year and quarter-over-quarter. The SAN year-over-year product revenue performance reflects improvement in director and switch product sales offset by lower server product sales. Fiscal year 2014 SAN product revenue was $1,327 million, up 1% year-over-year. Excluding the divestiture of the HBA business, Q4 and fiscal year 2014 SAN product revenue were both up 2% year-over-year.

Q4 2014 IP networking product revenue was $152 million, up 5% year-over-year and 15% quarter-over-quarter. The year-over-year increase was primarily driven by stronger switch and router sales into the U.S. Federal government and router sales into the service provider market. Fiscal year 2014 IP networking product revenue was $525 million, down 5% year-over-year. Adjusting for the discontinuation of the wireless and network adapter products, and the repositioning of the Brocade ADX product line, Q4 and fiscal year 2014 IP networking product revenue grew 9% and 1%, respectively.

In fiscal year 2014, Brocade’s full-year GAAP gross margins and operating margins were 66.3% and 17.5%, respectively. Non-GAAP gross margins and operating margins reached 67.3% and 25.9%, respectively. Full-year operating cash flow was $542 million, a 20% increase over fiscal year 2013. During fiscal year 2014, the company repurchased $335 million of stock, or 38 million shares, and paid $30 million in dividends. This return of capital to shareholders represents 66% of adjusted free cash flow for the year.

During Q4, the company acquired the network visibility and analytics technology assets from privately-held Vistapointe in an all cash transaction. The Vistapointe technologies are software-based, carrier-grade network visibility and analytics solutions for mobile operators. This acquisition expands Brocade’s capabilities in the strategic area of software networking and enables the company to address the emerging opportunities and requirements of mobile service provider customers.

The Brocade board of directors has declared a quarterly cash dividend of $0.035 per share of the company’s common stock. The dividend payment will be made on January 2, 2015, to shareholders of record at the close of market on December 10, 2014.

Comments

For SAN revenue by product family, director revenue was up 5% Y/Y and flat sequentially. The yearly growth was due to continued customer migration to Gen 5.

SAN switch revenue was up 6% Y/Y and flat Y/Y, similar to director performance.

Server product group, including embedded switches and server adapter products, was down 27% Y/Y and 2% Q/Q. The year-over-year decline was due to certain OEM specific operational factors and a shift in end-user buying patterns, as well as the divestiture of the HBA business in 1Q14.

SAN-based support and services revenue was $54 million in the quarter, down 4% yearly and down 1% sequentially.

For 1Q15, the company expects SAN revenue to be up 5% to 7% from 4Q14 and see stronger buying patterns from OEMs in calendar Q4.

Total SAN business revenue

Note: Above global services revenue includes only SAN-based support and services

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter