96% of US Institutions Are Likely to Adopt Software-Defined Storage – Maxta/Intel/451 Research

And 82% hyper-converged infrastructure

This is a Press Release edited by StorageNewsletter.com on November 20, 2014 at 3:02 pmMaxta, Inc. in hyper-convergence and software-defined storage, released results of an independent study conducted by 451 Research LLC of IT purchasers in midmarket companies.

A few hundred companies with annual revenues of $100 million to $1 billion were surveyed. The survey, sponsored by Maxta and Intel Corp., revealed a strong interest in deploying Software-Defined Storage (SDS), with 96% of respondents stating that they were “somewhat or very likely” to adopt SDS and 82% stating they were “somewhat or very likely” to adopt a hyper-converged infrastructure.

Midmarket storage management problems, often similar to those of larger enterprises, were seen in the survey, amplified by the need for simplification of IT management. These challenges were compounded by additional difficulties in finding staff to maintain complex storage infrastructures.

The research findings also confirmed that midmarket companies are very willing to take on new technologies that will help them with the vexing problem of exponential storage growth.

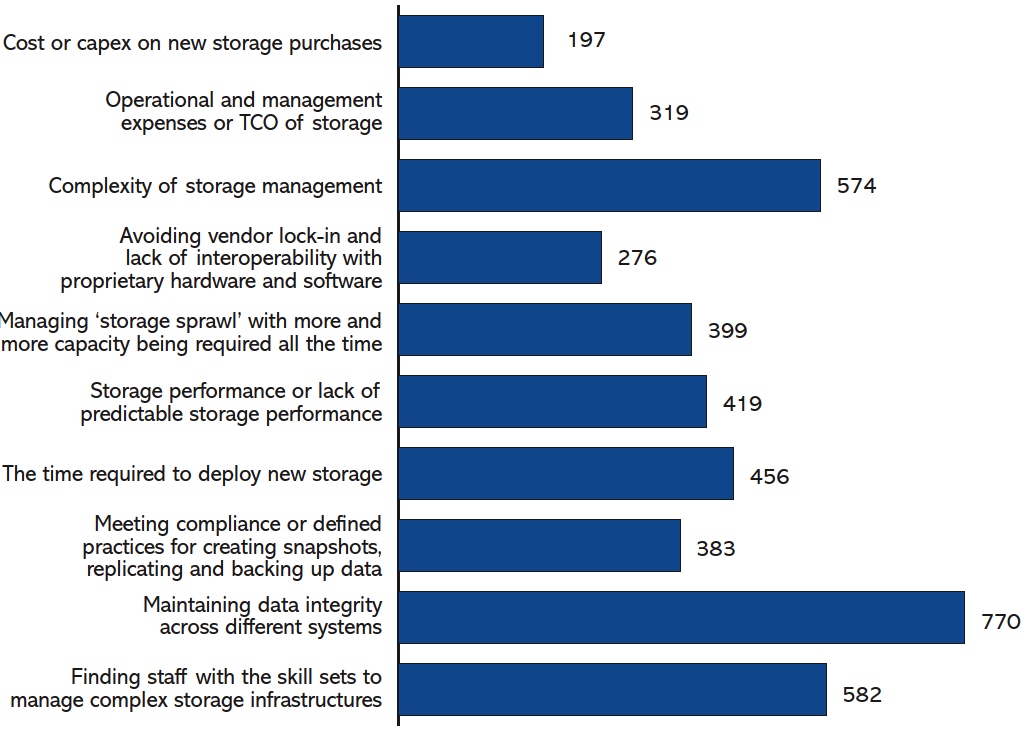

Top storage challenges among survey base

Survey Highlights Software-Defined Storage

Midmarket companies are showing strong adoption of server virtualization solutions, with a strong interest in SDS solutions. Simplifying storage infrastructure management is seen as a major driver, with VM-level management seen as one of the most appealing features, followed by improving data protection, data integrity and scalability. CAPEX savings have not been a driving factor.

- 96% of respondents are aware of SDS, with 71% of respondents stating they were “somewhat likely” to consider deploying SDS, while 25% said they were “very likely.”

- 77% of companies surveyed indicated that 50% or more of their servers are already virtualized.

- Given the strong rate of adoption of virtualized servers, it is not surprising that 52% of respondents cite simplification of storage management as the key consideration to move to SDS, with 61% stating VM-level storage management as the main appeal to move to SDS. High-level skill sets needed to manage complex storage (35%), followed closely by the complexity itself (35%) were noted as top challenges.

- 53% seek compression and a consistent interest was displayed in enterprise data services such as thin provisioning, tiering, de-duplication, snapshots and cloning.

- 40% seek to improve their data protection policies with SDS and 35% cite SDS snapshots and cloning as a motivator to SDS.

- Maintaining data integrity across different systems was a challenge for 46%, with scalability being highlighted by 41% as a motivator to move to SDS.

- 53% of respondents want the ability to support mixed drive types – server side, SSD, spinning disk, indicating broad use case and workload interest.

- Somewhat surprising was that only 16% of respondents selected price (CAPEX) or the ability to deploy on less expensive commodity x86 hardware as a significant benefit of SDS solutions.

Survey Highlights Hyper-Convergence

Respondents’ interest in hyper-convergence appears to be driven by the reduction of operating expenses which many would find synonymous with the simplification of IT management. Half of the respondents cited that cost savings would be part of their evaluation consideration. Compatibility and configuration also made the list of concerns validating the need for reference architectures and ordering simplicity. Maxta has seen interest in MaxDeploy reference architectures, which provide pre-configured and pre-validated solutions that can run on any x86 server platform, with recent evaluators of hyper-converged solutions expressing strong interest in MaxDeploy running on Intel and Supermicro servers. These solutions provide organizations greater than 30% savings over a hyper-converged solution running on branded server platforms and greater than 55% savings compared to an appliance-based hyper-converged architecture.

- 87% of respondents were aware of hyper-convergence, with 82% of respondents stating they were “somewhat likely” or “very likely” to consider a hyper-converged infrastructure; 36% of those aware of hyper-convergence stated they were unclear of the total benefits and/or full meaning of hyper-convergence, indicating that an improved understanding could increase results to be more consistent with the SDS findings.

- 62% state simplification of IT infrastructure as a key motivator to consider hyper-convergence.

- More than SDS at 35%, 52% of respondents are seeking to reduce management and operational costs with hyper-convergence. 50% stated they would want to see a cost savings use case as part of their evaluation process.

- 29% shared some concern about compatibility and configuration along with 42% requiring a demo as part of the evaluation process. Results indicate a need for pre-configured systems and validated reference architectures.

- ueling the debate of whether hyper-convergence is a virtualization or storage purchase, 37% would evaluate hyper-convergence in the same way they evaluated server virtualization and 28% in the same way they would evaluate a storage array.

“Storage has not kept pace with compute in terms of the simplicity, availability, agility, and overall cost,” said Yoram Novick, Maxta founder, president and CEO. “The 451 Research findings show significant demand for SDS and hyper-convergence, including the need for the simplification of IT, enterprise data services, and cost efficiencies. By offering the choice of MxSP VM-centric software-defined storage and MaxDeploy family of hyper-converged solutions, customers have the maximum flexibility to choose the best solution for them with the complete flexibility to run on the server, hypervisor, and storage of their choice.”

“Software-defined infrastructure (SDI) is the foundation for the future of the data center. The survey demonstrated a strong market interest from midmarket organizations to simplify infrastructure management. Software-defined storage and hyper-converged systems are ways to do just that: simplify management,” said Bev Crair, GM of the storage division, Intel. “The recently announced IntelR XeonR E5-2600 v3 processors provide the performance and scale to enable organizations to transform their storage.”

“Software-defined storage and hyper-converged infrastructure are coming of age,” said Tim Stammers, senior analyst, 451 Research. “Midmarket companies face mounting challenges storing and managing ever-growing volumes of data. Clearly there is a demand for IT infrastructure that is simpler to manage, and can scale out as data grows. Hyper-converged systems and software-defined storage are strong candidates to meet these needs.”

Maxta and Intel commissioned 451 Research to poll online 200 midmarket U.S. businesses, defined as those companies with $100 million to $1 billion in annual revenue. Respondents were IT, data center, storage, networking and operations managers, as well as executive managers with responsibility for or influence on IT infrastructure purchasing decisions. The majority of these businesses were managing 25TB or more of data as their storage infrastructure.

Complete survey (registration required)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter