NetApp: Fiscal 1Q15 Financial Results

Revenue down 2% Y/Y and 10% Q/Q

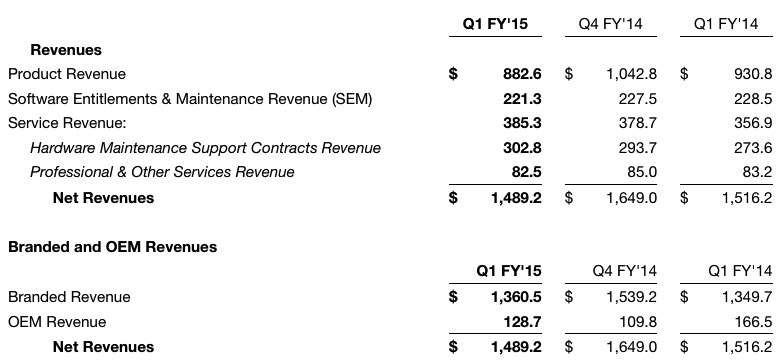

This is a Press Release edited by StorageNewsletter.com on August 15, 2014 at 2:47 pm| (in $ million) | 1Q14 | 1Q15 |

| Revenue | 1,516 | 1,489 |

| Growth | -2% | |

| Net income (loss) | 81.6 | 88.4 |

NetApp, Inc. reported financial results for the first quarter of fiscal year 2015 ended July 25, 2014.

First Quarter Financial Results

Net revenues for the first quarter of fiscal year 2015 were $1.49 billion. GAAP net income for the first quarter of fiscal year 2015 was $88 million, or $0.27 per share, compared to GAAP net income of $82 million, or $0.23 per share, for the comparable period of the prior year. Non-GAAP net income for the first quarter of fiscal year 2015 was $198 million, or $0.60 per share,2 compared to non-GAAP net income of $192 million, or $0.53 per share, for the comparable period of the prior year.

Cash, Cash Equivalents and Investments

NetApp ended the first quarter of fiscal year 2015 with $5.56 billion of total cash, cash equivalents and investments and during the quarter generated $216 million in cash from operations. The company returned $172 million to shareholders during the quarter through share repurchases and a cash dividend. The next dividend in the amount of $0.165 per share will be paid on October 22, 2014 to shareholders of record as of the close of business on October 10, 2014.

“More large enterprises are relying on NetApp to help them bridge the on-premises architectures of today with the requirement to leverage multiple cloud services in the future,” said Tom Georgens, chairman and CEO. “Our best-in-class portfolio is driving momentum, enabling us to invest in continued innovation while delivering shareholder value.“

Financial guidance for the second quarter of fiscal year 2015:

- Net revenues are expected to be in the range of $1.49 billion to $1.59 billion

- GAAP earnings per share is expected to be in the range of $0.45 to $0.50 per share

- Non-GAAP earnings per share is expected to be in the range of $0.66 to $0.71 per share

Business Highlights

Delivers New Products:

- FAS8080 EX. The unified array is purpose-built for demanding business-critical applications with quality-of-service capabilities to enable predictable performance.

- FAS2500. It delivers optimal price/performance at an entry-level price point, while simplifying storage management operations.

- All-Flash FAS Products. New products combine the performance and low latency of flash with the enterprise reliability and extensive data management of Data ONTAP software.

- Updated OnCommand Portfolio. OnCommand enables customers to better control clustered Data ONTAP and multivendor storage environments, driving down storage costs, improving service delivery through open integration, and maximizing investment by providing flexible reporting and cost analysis.

Strengthens Partnerships:

- Delivered NetApp Private Storage (NPS) for Azure. Building on its portfolio of Microsoft cloud solutions, NetApp introduced NPS for Azure, enabling customers to extend their IT infrastructure to Azure to create a seamless, secure hybrid cloud environment.

- Deepened Equinix Hybrid Cloud Partnership. The Equinix Cloud Exchange can dynamically connect NetApp Private Storage customers to multiple public clouds so that they can explore multi-cloud deployments to handle large, complex workflows more efficiently.

- Achieved $3 billion in FlexPod Joint Sales for NetApp and Cisco. The integrated infrastructure solution has generated $3 billion in joint sales since its launch in 2010.

Provides Cloud Service Architecture:

State Government Agency Implements NetApp Private Cloud Architecture. The agency is a model for cloud service architectures deploying clustered Data ONTAP OS, OnCommand System Manager, and FAS hybrid storage systems as part of its multitenant private cloud.

Comments

Among good news:

- Clustered Data ONTAP node shipments increased 177% Y/Y, the attach rate increasing across all product lines with midrange and high-end platforms approaching a 50% attach rate and the recent cluster optimized FAS8000 family above 60%.

- Flash capacity shipped more than doubled Y/Y

- Shipments of all-flash arrays, EF family and all-flash FAS products grew 48%.

- Year-on-year, high-end and midrange FAS shipments grew 14% and 10%, respectively.

- Converged architecture solution FlexPod continues to perform well with shipments up 25% from last year.

- Deals over $1 million in 1Q15 increased from the same quarter last year.

- Net income is up 8% Y/Y

Among bad news:

- Global revenue down 2% Y/Y and 10% Q/Q, with 5% for products, 3% for software entitlements and maintenance but up 8% for services

- Net income down 55% Q/Q

- OEM sales declining 33% at only $129 million and branded revenue up only 1% Q/Q

- Entry FAS systems decreasing 19% Y/Y

Other news:

- Majority of midrange and high-end system shift in a hybrid configuration with the mix of flash and HDDs.

- Arrow and Avnet contributed 22% and 16% of company's net revenues.

- For fiscal year 2015, NetApp anticipates mid-single-digit branded revenue growth ramping over the course of the year and partially offset by declines in OEM revenue of up to 40% for the year.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter