Emulex: Fiscal 3Q14 Financial Results

Storage connectivity revenue down 7% Y/Y

This is a Press Release edited by StorageNewsletter.com on May 1, 2014 at 3:00 pm| (in US$ million) | 3Q13 | 3Q14 | 9 mo. 13 | 9 mo. 14 |

| Revenues | 111.8 | 109.7 | 358.2 | 347.6 |

| Growth | -2% | -3% | ||

| Net income (loss) | (6.8) | (7.2) | (0.6) | (14.9) |

Emulex Corporation announced earnings results for the third quarter of fiscal 2014, which ended on March 30, 2014.

Third Quarter Financial Highlights

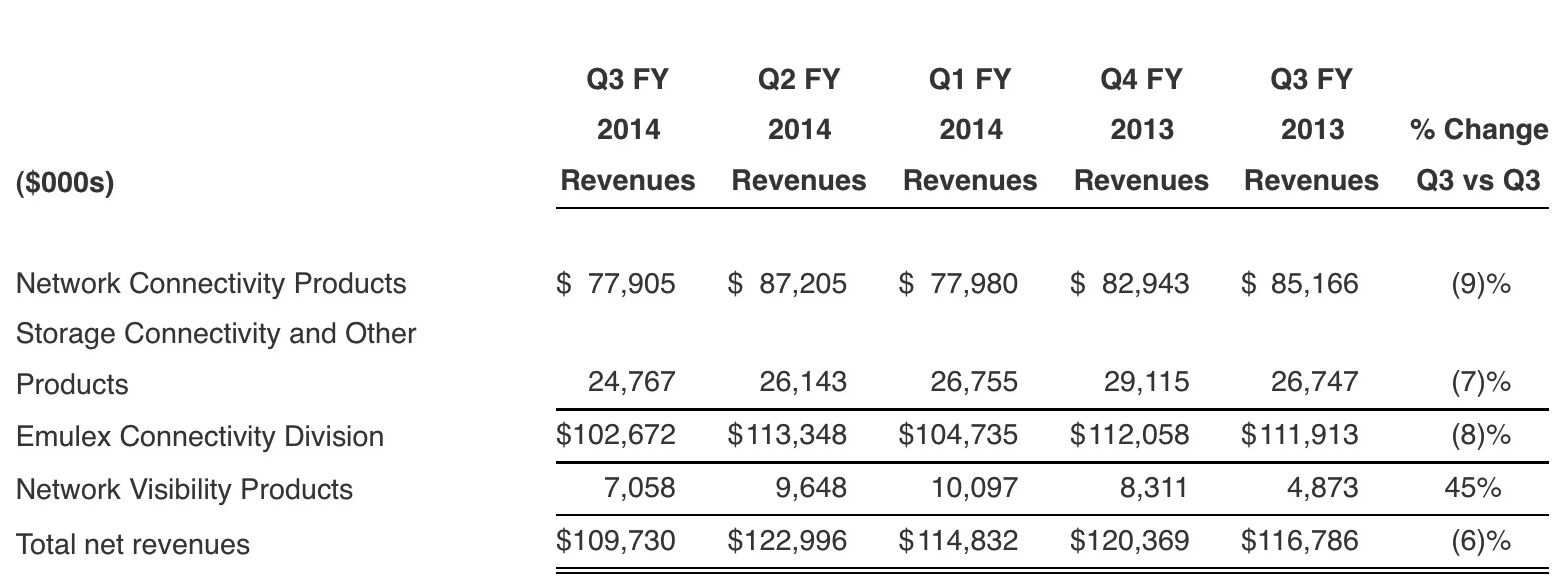

- Total net revenues of $109.7 million

- Network Connectivity Products (NCP) net revenues of $77.9 million, representing 71% of total net revenues

- Network Visibility Products (NVP), net revenues of $7.1 million, representing 6% of total net revenues

- Storage Connectivity and Other Products (SCOP), net revenues of $24.8 million, representing 23% of total net revenues

- Non-GAAP gross margins of 66% and GAAP gross margins of 58%

- Non-GAAP diluted earnings per share of $0.15 and GAAP loss per share of $0.09, which includes a $0.06 cent per share impact related to the accrual of the settlement of the patent litigation with Broadcom

- Cash, cash equivalents and investments at the end of the quarter of $209.3 million

- Weighted share count of 82.3 million shares in the March quarter compared to 92.2 million in the comparable quarter of last year

Third Quarter Business Highlights

- Signed a dismissal agreement relating to the Broadcom patent lawsuit, canceling the re-trial

- Delivered 10GbE-based Converged Network Adapters for Dell PowerEdge rack, blade and tower platforms, designed for virtualized, enterprise and cloud data centers

- Announced 10 and 40GbE Adapters for Open Compute Project (OCP)-based global cloud hardware platforms

- Introduced Endace Fusion Connector for Cisco Sourcefire Defense Center, enabling seamless click-through workflow between the security event and the packets on the EndaceProbe Intelligent Network Recorders (INRs)

- Announced next generation, high performance PCIe 3.0 EndaceDAG Data Capture Card portfolio, which provides extended features and capabilities that provide reliable, accurate timestamping for high-bandwidth enterprise network monitoring

- Joined the OpenPOWER Foundation, which seeks to create an open ecosystem, using the IBM POWER architecture, to help spur innovation for enterprise and Web-scale data centers

“Our team did a nice job of protecting profit in 3Q despite a softer demand environment among our OEMs and lack of predictability from NVP. We remain squarely focused on capturing the growth opportunity inherent to traffic visibility. Within connectivity, we are not immune to near-term disruptions associated with strategic developments at our major customers and we have taken steps to position us to better weather this period of transition in the market,” commented Jeff Benck, president and CEO, Emulex.

“Looking forward, we are pleased to have reached a dismissal agreement with Broadcom, effectively ending the current litigation process between the two companies. During the quarter, we experienced strong sequential 10GbE revenue growth, contrary to typical seasonality. Our ability to now participate in the full market, combined with a robust set of OEM design wins based on our next generation Ethernet products, positions Emulex well for the upcoming server refresh cycle. Coupled with ongoing execution of our operational transformation, we intend to ensure Emulex remains positioned for long term, profitable growth,” Benck concluded.

Business Outlook

Although actual results may vary depending on a variety of factors, many of which are outside the company’s control, including uncertainty related to the macro IT spending environment and the timing of new server and storage launches by our customers, Emulex is providing guidance for its fourth fiscal quarter ending June 29, 2014.

For the fourth quarter of fiscal 2014, Emulex is forecasting total net revenues in the range of $94-$100 million. The company expects non-GAAP earnings per diluted share of breakeven to $0.05 in the fourth quarter. GAAP estimates for the fourth quarter reflect approximately $0.21 per diluted share in expected charges arising primarily from amortization of intangibles, stock-based compensation, the royalties, mitigation expenses and license fees associated with the Broadcom patent litigation, accretion of debt discount on convertible senior notes, site closure and related restructuring costs and Internal Revenue Service Notice of Proposed Adjustment (IRS NOPA), as well as the associated tax effects and the impact of our GAAP tax valuation allowance.

Comments

Abstracts of the earnings call transcript:

Jeff Benck, president and CEO:

"We are also well down the path of completing the closure of the Bolton development site targeted for the end of June. With that action complete, we expect to deliver upon our commitments to a targeted reduction of $30 million in annual OpEx for the ECD business as we exit fiscal 2014.

"As you think about FC, a lot of the analysts are seeing mid single-digit decline. We saw 10% last year. I mean that's what published numbers out for the calendar year.

"The other thing that's in our favor is 16Gb is now over, a clear 10%. It is north of 10% of our revenue in the March quarter.

"When you look at 16Gb specifically, we got 50% share so 16Gb adopts, so a 6- adoption, that is helpful to us, and that is where we see some of the target opportunities.

"So our strategy is really been, don't bet against Ethernet and as Ethernet goes more to storage that plays to our strength because storage networking is where we started with our FC business and while the FCoE will play a role there, we think that over time Ethernet will playa bigger role than IB in storage interconnects."

Kyle Wescoat, CFO:

"Frank Yoshino, our VP of finance will be leaving Emulex on May 30th.

"I want to announce our appointment of Paul Mansky as Emulex's senior director of corporate development and investor relations.

"Coming off a strong December, FC products which are the bulk of the NCP revenues typically see seasonality in the March quarter.

"I believe it's prudent to anticipate higher rate of secular decline in the FC business than previously anticipated.

"FC revenue will decline in the high single to low double-digit range year-over-year."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter