WW Disk Systems Market Up Only 1% From 4Q12 to 4Q13 – IDC

And decreased 3% from 2012 to 2013.

This is a Press Release edited by StorageNewsletter.com on March 10, 2014 at 3:02 pmWorldwide external disk storage systems factory revenues increased year over year by 2.4%, totaling $6.9 billion, during 4Q13, according to the International Data Corporation’s (IDC) Worldwide Quarterly Disk Storage Systems Tracker.

For the quarter, the total (internal plus external) disk storage systems market generated $8.8 billion in revenue, representing a 1.3% increase from the prior year’s fourth quarter and a sequential increase of 17.2% compared to the seasonally lower 3Q13. Total disk storage systems capacity shipped surpassed 10.2EB, growing 26.2% year over year.

“The disk storage systems market was able to break free of recent headwinds due to traditional year-end budget flushes, improved economic sentiment, and a strong desire to address long-standing storage infrastructure inefficiencies,” said Eric Sheppard, research director, IDC storage. “Industry stakeholders able to capitalize the most on this demand were often those with recent product refreshes and strong go-to-market initiatives targeted at integrated infrastructure and storage optimization.”

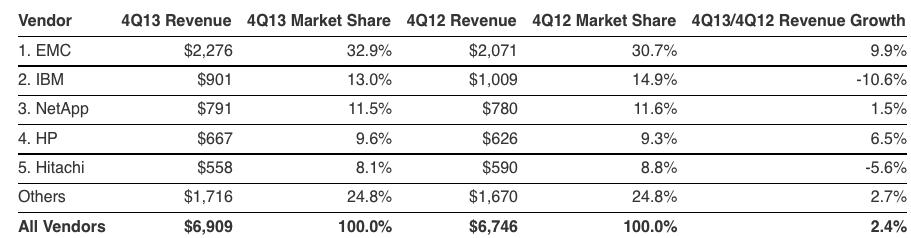

4Q13 External Disk Storage Systems Results

EMC experienced the greatest year-over-year share gains during the quarter, improving its share in the external disk storage systems market from 30.7% (4Q12) to 32.9% of total 4Q13 revenue. IBM was the second largest supplier in the market with 13.0% share of external revenue followed by NetApp which accounted for 11.5%. HP and Hitachi rounded out the top 5 vendors with 9.6% and 8.1% revenue shares respectively during the quarter.

Top 5 Vendors, Worldwide External Disk Storage Systems Market

(in $ million)

(Source: IDC Worldwide Quarterly Disk Storage Systems Tracker, March 6, 2014)

Open Networked Disk Storage Systems Highlights

The total open networked disk storage market (NAS combined with non-mainframe SAN) grew by 4.0% year over year to almost $6 billion in revenue. EMC maintained its leadership in the total open networked storage market with 35.6% revenue share, followed by NetApp’s 13.3% and IBM’s 12.1% revenue share.

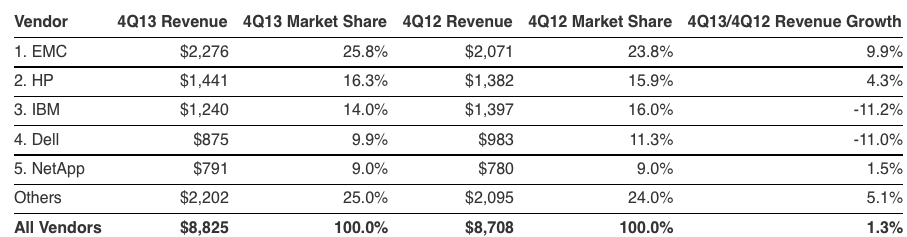

4Q13 Total Disk Storage Systems Market Results

In the total worldwide disk storage systems market, EMC finished in the top position followed by HP with market shares of 25.8% and 16.3% respectively.

Top 5 Vendors, Worldwide Total Disk Storage Systems Market

(in $ million)

(Source: IDC Worldwide Quarterly Disk Storage Systems Tracker, March 6, 2014)

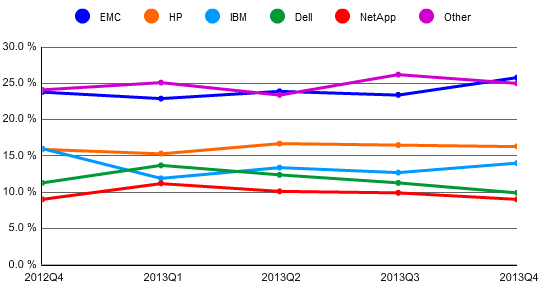

Worldwide Total Disk Storage Systems Market, Top 5 Vendors

(shared based on revenue)

(Source: IDC Worldwide Quarterly Disk Storage Systems Tracker, March 6, 2014)

In addition to the table above, an interactive graphic showing the worldwide market share of the top 5 total disk storage systems vendors over the previous five quarters is available here. Instructions on how to embed this graphic into online news articles and social media can be found by viewing this press release on IDC.com.

Taxonomy Notes:

IDC defines a Disk Storage System as a set of storage elements, including controllers, cables, and (in some instances) HBAs, associated with three or more disks. A system may be located outside of or within a server cabinet and the average cost of the disk storage systems does not include infrastructure storage hardware (i.e. switches) and non-bundled storage software.

The information in this quantitative study is based on a branded view of the disk storage systems sale. Revenue associated with the products to the end user is attributed to the seller (brand) of the product, not the manufacturer. OEM sales are not included in this study. In this study, HDS sales do not reflect their OEM sales to Sun Microsystems and HP.

Worldwide Disk Storage Systems Quarterly Tracker is a quantitative tool for analyzing the global disk storage market on a quarterly basis. It includes quarterly shipments and revenues (both customer and factory), terabytes, $/gigabyte, gigabyte/unit, and average selling value. Each criteria can be segmented by location, installation base, OS, vendor, family, model and region.

Comments

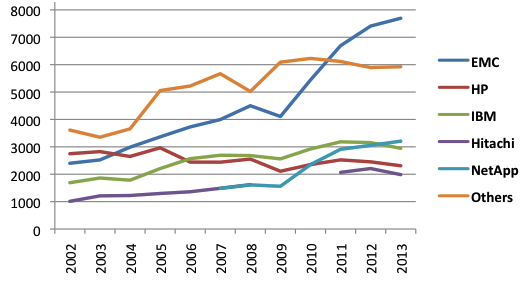

2013 was a bad year for the worldwide total disk systems market decreasing 2.7% in revenue, a percentage based on IDC numbers for 2012 and 2013. It's the first time the industry registers a decrease at least since ten years if you exclude 2009 for economical reasons.

As total capacity increases yearly 26% from 2012 to 2013, it means that price/GB for disk systems decreased sharply as competition is hot.

EMC continues to largely dominate the market, as usual, and growing substantially. Dell and IBM are losing market share.

In the table below, we are comparing the figures of IDC of top 5 storage companies for their 2013 total disk systems revenue and the published financial results of their official global storage revenue (but IBM) in $ million, including disk systems, for the same companies, and for the same year, 2013, and according to their SEC filings. There are some huge differences, especially for Dell and HP, and really inexplicable as IDC also gets its figures from the vendors.

| Rank | Disk systems for IDC | Revenue | Y/Y growth | Rank | Total storage revenue | Y/Y growth |

| 1 | EMC | 7,695 | 4% | 1 | 16,132 | 4% |

| 2 | HP | 5,205 | -10% | 4 | 3,475 | -9% |

| 3 | IBM | 4,181 | -15% | 3 | 5,850* | -10% |

| 4 | Dell | 3,769 | 1% | 5 | 1,699 | -13% |

| 5 | NetApp | 3,207 | 5% | 2 | 6,332 | 2% |

* estimate, and without Tivoli software

Total Disk Systems Revenue

(in $ million)

| Year |

Revenues |

Yearly Growth |

| 2002 | 19,651 | |

| 2003 | 20,219 | 2,9% |

| 2005 | 20,862 | 3,2% |

| 2005 | 23,059 | 10,5% |

| 2006 | 24,443 | 6,0% |

| 2007 | 26,335 | 7,7% |

| 2008 | 27,565 | 4,7% |

| 2009 | 24,465 | -11,2% |

| 2010 | 28,718 | 17,4% |

| 2011 | 31,079 | 8,2% |

| 2012 |

32,566 | 4.8% |

| 2013 | 31,688 | -2.7% |

(Source: numbers calculated by StorageNewsletter.com using IDC figures)

WW External Disk Systems From 2002 to 2013

(Source: numbers calculated by StorageNewsletter.com using IDC figures)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter