WD: Fiscal 2Q14 Financial Results

Low guidance, $155 million from enterprise SSDs

This is a Press Release edited by StorageNewsletter.com on January 24, 2014 at 2:58 pm| (in US$ million) | 2Q13 | 2Q14 | 6 mo. 13 | 6 mo. 14 |

| Revenues | 3,824 | 3,972 | 7,859 | 7,776 |

| Growth | 4% | -1% | ||

| Net income (loss) | 335 | 430 | 854 | 925 |

Western Digital Corp. reported revenue of $4.0 billion and net income of $430 million, or $1.77 per share for its second fiscal quarter ended Dec. 27, 2013.

On a non-GAAP basis, net income was $532 million or $2.19 per share.1 In the year-ago quarter, the company reported revenue of $3.8 billion, net income of $335 million, or $1.36 per share. Non-GAAP net income in the year-ago quarter was $513 million, or $2.09 per share.

The company generated $727 million in cash from operations during the December quarter, ending with total cash and cash equivalents of $4.7 billion.

During the quarter, the company utilized $150 million to buy back 2.0 million shares of common stock. On Nov. 13, the company declared a $0.30 per common-share dividend, which was paid on Jan. 15.

“We executed well in the December quarter as we continue participating in the ongoing growth of data in all of our served markets,” said Steve Milligan, president and CEO. “The industry TAM was slightly higher than anticipated driven by seasonal demand as we saw strength in gaming and branded products.”

“We continue to be very excited about our unique position in the storage ecosystem, enabling a broad-based perspective on the dramatic changes that are underway,” said Milligan. “We serve very large markets underpinned by strong data growth prospects. Strategically, we are well positioned to play a leadership role by innovating and collaborating with our customers to define the future digital data landscape.”

Comments

Abstracts the earnings call transcript:

Steve Milligan, president and CEO:

"We exceeded our expectations on revenue, gross margin and earnings per share in the December quarter, and our cash generation remained strong."

Tim Leyden, CFO:

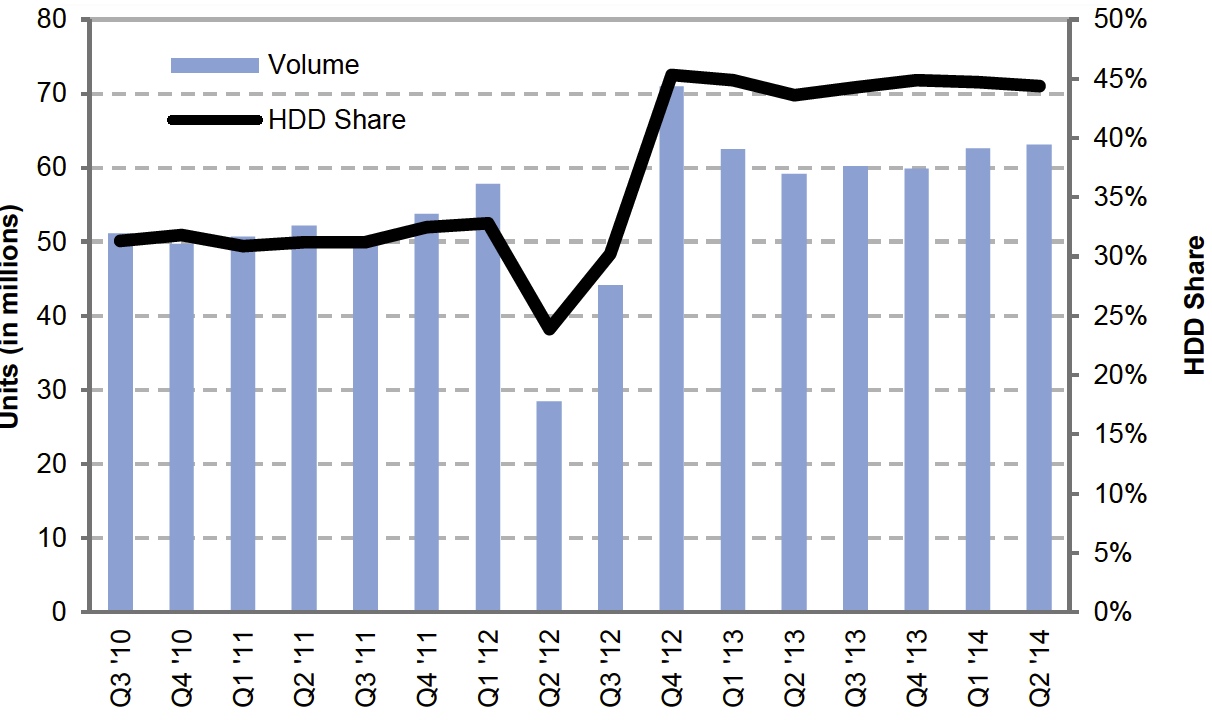

"The hard drive industry shipped approximately 142 million units during the December quarter, up from the September quarter in the year ago period, and the TAM came in slightly higher than the guidance we gave on our October call.

"Our revenue for the December quarter was $4 billion, including $155 million from enterprise SSDs.

"Overall, 34% of our revenue came from non-PC applications.

"We shipped a total of 63.1 million hard drives at an average selling price of $60. The quarter-over-quarter increase in overall ASP, was primarily driven by the seasonal uptick in branded products and strength and distribution.

"I will now provide our guidance for the March quarter. We expect revenue to be seasonally down and in the range of $3.65 billion to $3.75 billion, reflecting the seasonally lower TAM."

| Units in million |

Enterprise | Desktop | Notebook | CE | Branded | Exabyte Shipped |

Average GB/drive |

ASP |

| 1Q12 | 2.4 | 21.6 | 19.6 | 7.1 | 7.1 | 36.7 | 634 | $46 |

| 2Q12 | 1.7 | 11.4 | 9.8 | 2.4 | 3.2 | 16.5 | 578 | $69 |

| 3Q12 | 3.6 | 16.0 | 18.1 | 3.6 | 2.9 | 25.7 | 581 | $68 |

| 4Q12 | 7.9 | 21.2 | 32.8 | 4.2 | 5.0 | 47.4 | 668 | $65 |

| 1Q13 | 6.0 | 16.8 | 25.9 | 8.0 | 5.8 | 44.3 | 708 | $62 |

| 2Q13 | 6.6 | 17.7 | 21.3 | 6.5 | 7.1 | 47.6 | 804 | $62 |

| 3Q13 | 7.2 | 18.4 | 21.5 | 6.5 | 6.5 | 48.4 | 807 | $61 |

| 4Q13 | 7.9 | 16.2 | 24.0 | 6.5 | 5.3 | 47.7 | 797 | $60 |

| 1Q14 | 7.8 | 17.3 | 22.9 | 8.5 | 6.1 | 50.8 | 811 | $58 |

| 2Q14 | 7.8 | 16.8 | 22.7 | 8.8 | 7.0 | 55.1 | 874 | $60 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter