Company’s Profile: Barracuda Networks

Raised $75 million in IPO last month

By Corentin Béchade | December 5, 2013 at 2:09 pmCompany

Barracuda Networks, Inc.

Location

- HQ in Campbell, CA

- Offices in the US, Austria, India, UK

- R&D in Ann Arbor, MI

- Manufacturing and customer support in San Jose, CA

Founded in

2003

Financial Funding

$40 million in venture capital from Sequoia Capital and Francisco Partners in 2006. Raised $75.5 million following IPO in November 2013.

Revenue and Profit (Loss) in $ Million

| Fiscal year* | 2009 | 2010 | 2011 | 2012 | 2013 | 6 mo 2012** | 6 mo 2013** |

| Revenue | 101.2 | 123.7 | 142.1 | 160.9 | 198.9 | 95.0 | 114.1 |

| Growth | NA | 22% | 15% | 13% | 24% | NA | 34% |

| Net income (loss) |

5.4 | 5.7 | 3.0 | 0.6 | (7.4) | (3.7) | (4.6) |

* ended in February 28/29

** ended August 31

Main Executives

- William Jenkins, CEO, 47: was president of EMC’s backup recovery systems division until November 2012 when he joined Barracuda (total compensation of $18.9 million in 2013)

- Michael Perone, co-founder and EVP, 46:. previously co-founded Adress.com, Spinway and Affinity Path (total compensation of $1.4 million in 2013)

- Zachary Levow, co-founder, EVP and CMO, 41:. also co-founded Affinity Path and Spinway

- David Faugno, CFO, 43: at company since March 2006; previously at Cisco, Actona Technologie, Soltima and AT&T (total compensation of $5.5 million in 2013)

Number of employees

In August 31, 2013 the company had 1,108 full-time employee and plans to expand its workforce as the business expands.

Revenue and profitability

Operating at loss for the most recent quarters. Declining profits for the last 3 years, $7 million loss in 2013. Not yet profitable and no exact date known where the company could reach profitability despite gross margins around 77%.

Acquisitions

- 2007 – Net Continuum – Application controllers for web application

- 2008 – BitLeap – DR and backup solutions

- 2008 – 3SP – SSL VPN solution

- 2009 – Yosemite Technologies – Backup for Exchange and SQL Servers

- 2010 – PureWire – Cloud web filtering technologies

- 2013 – SignNow – Electronic signing and document storing platform

Technology

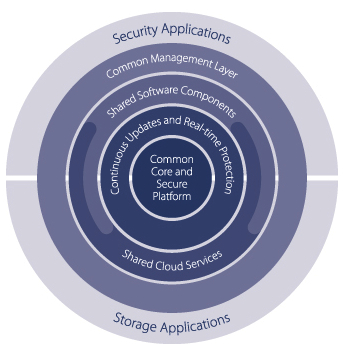

In security and storage solutions: spam, IM and website firewalls, load balancer, email archiver, backup software and servers. Technology architecture for both security and storage solutions consists of several common foundational components.

Recently released V3.5 of Message Archiver bringing compatibility with Outlook 2013 and mobile email client.

Patents

43 issued and 63 pending US patents

Main Products

Barracuda Spam firewall and email backup and recovery services. Barracuda Backup is a solution that simplifies the backup process and enables secure offsite replication to other Barracuda Backup appliances and to the Barracuda storage cloud. Also operates Copy.com backup and sync cloud service. SignNow is a mobile eSignature application. Appliances represent 31% of revenue, subscription 69%.

Prices

For example 2U Barracuda Backup 890, a cloud-integrated solution for protecting physical and virtual environments that includes software, appliance, and offsite replication costs €21,549 with 8TB suggested backup volume and 16TB usable internal capacity. Copy.com is sold for $22,475/year for 250 users.

Distribution

Online and through 5,000 distributors and VARs. In fiscal 2013 and for the six months ended August 31, 2013, one distribution partner accounted for 13% and 17% of revenue, respectively.

Number of customers

150,000 customers in 100 countries

Competitors

Blue Coat Systems, Check Point Software, CommVault, Dell, EMC, F5, Fortinet, HP, IBM, Imperva, Juniper Networks, McAfee, Palo Alto Networks and Symantec

Comments

The recent IPO of the company testify of a certain trust in what the future holds. Even though it is currently recording losses, Barracuda is growing at a fast rate and hopes to broaden its customer base and product portfolio.

Stéphane Castagné, country sales manager for France and North Africa, says that the company's mission in now focused three major axes, simplification, expansion and education.

- Simplification: A more direct and integrated approach to the market. The Apple way, a vertical integration where every steps of the production is managed by Barracuda to achieve better control over the final products.

- Expansion: The subscription-based economic model of the company can be challenging, even though the renewal rate is growing steadily it is harder to value the financial health of the company. The company needs to expand its customer base and keep its current one to grow its business and to finally be profitable.

- Education: This one has more to do with communication, in a highly-competitive marketplace like this one, convincing clients that their solution is the best one is no easy task, and much has to be made about guiding them during the entire process of installation and utilization.

To stay competitive, Baracuda needs to predict what are the next trends in the industry and go along with it, to grow its existing solutions and reach out to bigger clients if it wants to restore a positive financial balance. With huge competitor like EMC, Dell, IBM, HP and Symantec, the company needs to invest in communication and education for a better understanding of its products.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter