Brocade: Fiscal 4Q13 Financial Results

SAN revenue at $380 million, down 4% Y/Y and up 3% Q/Q

This is a Press Release edited by StorageNewsletter.com on November 19, 2013 at 2:46 pm| (in $ million) | 4Q12 | 4Q13 | FY12 | FY13 |

| Revenue | 578.4 | 558.8 | 2,238 | 2,223 |

| Growth | -3% | -1% | ||

| Net income (loss) | 54.0 | 64.2 | 195.2 | 208.6 |

Brocade Communications Systems, Inc. reported financial results for its fourth quarter and full fiscal year 2013 ended October 26, 2013.

Brocade reported fourth quarter revenue of $559 million, representing a decrease of 3% year-over-year and an increase of 4% quarter-over-quarter.

Revenue for fiscal year 2013 was $2,223 million, down 1% year-over-year. The resulting GAAP diluted earnings-per-share (EPS) was $0.14 for Q4 and $0.45 for fiscal 2013, up 27% and 10% year-over-year, respectively. Non-GAAP diluted EPS was $0.24 for Q4 and $0.80 for fiscal 2013, up 41% and 21% year-over-year, respectively.

“Q4 was a quarter in which we executed successfully across many facets of our business strategy,” said Lloyd Carney, CEO, Brocade. “We exceeded expectations for non-GAAP operating margin, non-GAAP EPS, and cash flow despite the U.S. Federal budget issues and continued softness in the overall storage market. This resulted in record non-GAAP net income and non-GAAP EPS for both Q4 and fiscal 2013. Our solid performance in our fourth quarter was a great end to a transformative year for Brocade. I am pleased with the focus and execution of our team and excited about building upon our success in fiscal year 2014 and beyond.”

Summary of Q4 and fiscal 2013 results:

Q4 2013 SANing (SAN) business revenue, including products and services, was $380 million, down 4% year-over-year and up 3% quarter-over-quarter. The lower year-over-year SAN business revenue was impacted by continued soft demand in the overall storage market. Brocade Gen 5 16Gb FC products represented 69% of director and switch revenue in the quarter, up from 34% in Q4 2012. Fiscal 2013 SAN business revenue was $1,540 million, down 2% year-over-year.

Q4 2013 IP Networking business revenue, including products and services, was $179 million, down 3% year-over-year and up 7% quarter-over-quarter. From a product standpoint, Ethernet switch revenue was down 8% year-over-year and up 4% quarter-over-quarter, while routing revenue was up 1% year-over-year and up 28% quarter-over-quarter. From a customer standpoint, both Service Provider and Enterprise revenues were up sequentially and year-over-year. Federal revenue was up sequentially, but down year-over-year in a challenging Federal spending environment. Fiscal 2013 IP Networking business revenue was $682 million, up 3% year-over-year.

Q4 2013 GAAP gross margin was 64.9%, compared to 62.4% in Q4 2012 and 63.0% in Q3 2013. Non-GAAP gross margin was 67.2%, compared to 64.8% in Q4 2012 and 65.6% in Q3 2013. Fiscal 2013 GAAP and non-GAAP gross margin improved to 63.4% and 66.0%, respectively, compared to 61.8% and 64.5%, respectively, in fiscal 2012. The year-over-year and sequential improvements in gross margin were due to a favorable product mix within the IP Networking business and lower manufacturing and overhead costs.

Q4 2013 GAAP operating margin was 15.0%, compared to 14.9% in Q4 2012 and 13.9% in Q3 2013, and includes $25 million in restructuring and related costs. Non-GAAP operating margin was 26.6% in Q4 2013, compared to 22.5% in Q4 2012 and 21.6% in Q3 2013. Fiscal 2013 GAAP and non-GAAP operating margin improved to 13.9% and 22.7%, respectively, compared to 12.4% and 20.5%, respectively, in fiscal 2012. The year-over-year and sequential improvements in operating margin were a result of expanded gross margin and lower operating expenses. Based on the Q4 2013 results, the company has achieved its spending reduction goal of $100 million in annualized savings, as compared to Q1 2013.

Q4 2013 GAAP net income was $64 million, compared to $54 million in Q4 2012 and $119 million in Q3 2013. Non-GAAP net income was $109 million, compared to $78 million in Q4 2012 and $87 million in Q3 2013. Fiscal 2013 GAAP and non-GAAP net income increased to $209 million and $373 million, respectively, compared to $195 million and $311 million, respectively, in fiscal 2012.

Average diluted shares outstanding for Q4 2013 were 14.0 million lower compared to Q4 2012 and down slightly from Q3 2013. The company repurchased 41.2 million shares ($240 million) during fiscal 2013, including 7.8 million shares ($53 million) in Q4 2013. Share repurchases in Q1 2014 to date total 8.1 million ($65 million).

Operating cash flow was $170 million in Q4 2013, down 19% year-over-year and up 66% quarter-over-quarter. Fiscal 2013 operating cash flow was $451 million, down 24% year-over-year. The changes in cash flow for Q4 2013 and fiscal 2013 are due to an increase in accounts receivable and timing of variable compensation payments. During the quarter, the company received a $71 million payment relating to the A10 Networks litigation settlement and ended the year with a cash balance of $987 million or $382 million, net of senior debt and capitalized leases.

Additional Financial Information

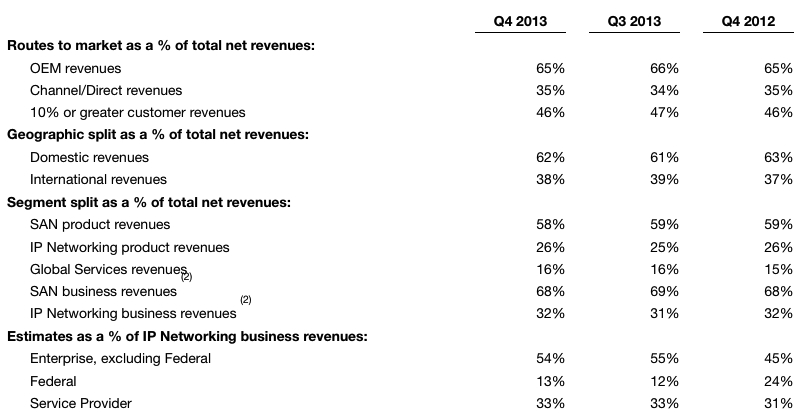

2) SAN and IP Networking business revenues include product, support and services revenues.

Q4 2013 ending headcount excludes 224 employees that were notified of their termination during the quarter, but were still on Brocade payroll as of the end of the quarter

Comments

Abstracts the earnings call transcript: Lloyd Carney, CEO: "In terms of business highlights, we're pleased with our SAN results for the quarter. Our SAN product revenue was up sequentially, increasing in the Americas, EMEA and APAC, while lower in Japan. We continue to see new opportunities for SAN in high-growth markets like China and Eastern Europe, where SAN is used as key technology for new data center the build-outs. In addition, our Gen 5 products now represent approximately 69% of our SAN product shipments, underscoring our customers' requirements for additional features and performance in their FC networks." Dan Fairfax, CFO: "For Q1 '14, we expect SAN revenue to be up 3% to 5% quarter-over-quarter as we're entering our strongest seasonal quarter of the fiscal year."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter