Imation: Fiscal 3Q13 Financial Results

Sale of Memorex Consumer Electronics and XtremeMac

This is a Press Release edited by StorageNewsletter.com on October 31, 2013 at 3:01 pm| (in US$ million) | 3Q12 | 3Q13 | 9 mo. 12 | 9 mo. 13 |

| Revenues | 227.4 | 191.9 | 739.9 | 628.0 |

| Growth | -16% | -15% | ||

| Net income (loss) | (6.3) | (34.9) | (30.5) | (61.1) |

Imation Corp. released financial results for the quarter and nine months ended September 30, 2013.

The company also announced that, consistent with its strategic transformation, it has divested its Memorex consumer electronics business, as well as signed a letter of intent to sell its XtremeMacbusiness.

Q3 Overview

For the third quarter, Imation reported net revenue of $191.9 million, down 15.6% from Q3 2012, an operating loss from continuing operations of $26.5 million, including special charges of $11.7 million, which are primarily related to a non-cash loss associated with the settlement of a UK pension plan, and diluted loss per share from continuing operations of $0.65. Excluding special charges, Q3 2013 operating loss would have been $14.8 million, and diluted loss per share from continuing operations would have been $0.42.

Imation’s CEO Mark Lucas commented: “Our top line revenues continue to be impacted by secular declines in optical as well as tape media where we saw decreases that were higher than we had anticipated. We had revenue gains from our Nexsan acquisition and growth in mobile security; however, these were not yet large enough to offset our storage media declines. As we invest for growth in our storage solutions and information security businesses, we also remain focused on generating cash from our legacy businesses. We generated $14.5 million in cash from operations during Q3 and ended the quarter with a cash position of $108.4 million.”

Sale of Non-core Businesses

On October 15, 2013, Imation completed the sale of the Memorex consumer electronics business. Following that, on October 17, 2013, the company signed a letter of intent to sell the XtremeMac consumer electronics business; this transaction is anticipated to close by December 31. Total proceeds to be received from discontinuing these businesses are estimated at approximately $19 million, with approximately $10 million spread between the fourth quarter of 2013 and early 2014, and the balance over the next several years.

Lucas said: “We have made important progress in our strategic transformation by signing agreements to divest our lower margin, non-core Memorex and XtremeMac consumer electronics businesses. This was a key objective for our team this year.”

Business Segment Overview

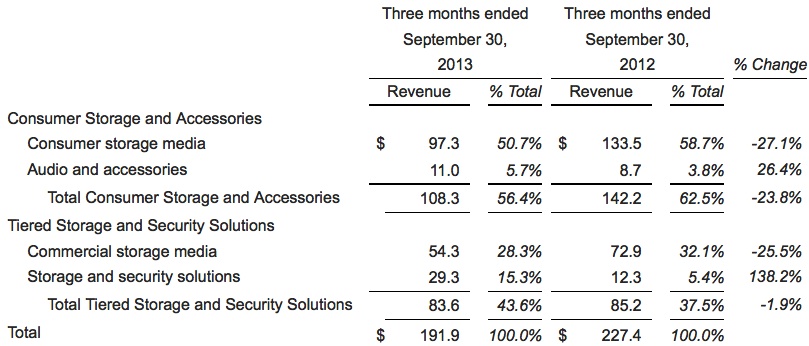

The Consumer Storage and Accessories (CSA) business revenue decreased 23.8% in Q3 2013 from the prior year due chiefly to the continued secular declines in optical media products. Gross margin remained solid for this segment. The primary focus of this business is cash generation which was particularly strong this quarter due to reductions achieved in inventory levels. CSA was a major contributor to the $14 million increase in cash during the quarter.

Tiered Storage and Security Solutions (TSS) revenue for Q3 2013 was down slightly, 1.9%, from a year ago due to accelerated declines in tape media. The company believes it is holding its market share, but has been impacted by industry wide dynamics including competing formats as well as continuing improvements in compression and deduplication technologies. TSS gross margin rose 1 percentage point to 19.3% from 18.3% a year ago as the company added higher margin storage and security solutions products. Imation expects this to continue as the mix shifts to higher margin Nexsan and IronKey products.

According to Lucas, “In TSS, we continue to invest in our Nexsan business by aggressively hiring sales talent, introducing new products and promoting Nexsan solutions globally. In the third quarter, like other companies in our space, we did see some effect from the disruption in U.S. government spending. Imation Mobile Security showed year over year growth, though revenues were also constrained by Federal Government issues. Combined, these two businesses are very important to the future of Imation, and we expect growth going forward.”

As part of Imation’s transformation, the company has a focus on cost reductions. Imation continued to cut staffing levels in its legacy businesses and in administrative areas, but has increased investment in priority growth initiatives for storage solutions and information security.

Lucas concluded: “We know we are taking the right actions – and with urgency – to build Imation for long-term success in higher growth, higher margin markets.”

Detailed Q3 2013 Analysis

As a result of the planned and completed consumer electronics divestitures, the financial results for those operations are presented as discontinued operations. The following financial results are for continuing operations for the current and prior periods unless otherwise indicated.

Net revenue for Q3 2013 was $191.9 million, down 15.6% from Q3 2012. From a segment perspective, TSS and CSA declined 1.9% and 23.8 percent, respectively. Foreign currency exchange negatively impacted total Q3 2013 revenues by 4 percent.

Gross margin for Q3 2013 was 18.8 percent, relatively unchanged from 19.0% in Q3 2012. TSS gross margin for Q3 2013 was 19.3 percent, up from 18.3% in Q3 2012. CSA gross margin was 18.5 percent, down from 19.3% in Q3 2012.

Selling, general and administrative (SG&A) expenses in Q3 2013 were $46.3 million, up $0.5 million compared with Q3 2012 expenses of $45.8 million. Imation reduced SG&A expenses by approximately $8.6 million due to cost reduction efforts and prior intangible write-offs, almost enough to offset the Nexsan operating expenses added as a result of the acquisition.

R&D expenses in Q3 2013 were $4.6 million, flat compared with Q3 2012. The company has reduced legacy R&D spending and has channeled its investments into high-margin projects in TSS, primarily through Nexsan.

Special charges were $11.7 million in Q3 2013, including a $10.6 million non-cash loss associated with the settlement of a UK pension plan, compared with a benefit of $3.6 million in Q3 2012, due primarily to the adjustment of an acquisition-related contingent liability at that time.

Operating loss was $26.5 million in Q3 2013 compared with an operating loss of $3.7 million in Q3 2012. Excluding the impact of special charges described above, adjusted operating loss would have been $14.8 million in Q3 2013 compared with adjusted operating loss on the same basis of $7.3 million in Q3 2012.

Income tax benefit was $2.0 million in Q3 2013 compared with no income tax loss/benefit in Q3 2012. The company maintains a valuation allowance related to its U.S. deferred tax assets and, therefore, no tax provision or benefit was recorded related to its U.S. results in either period.

Discontinued operations loss for the quarter totaled $8.7 million (after-tax). Discontinued Operations include both the ongoing results of the XtremeMac and Memorex consumer electronics businesses as well as a charge of approximately $5.5 million recorded to adjust the carrying value of the assets associated with the discontinued operations, based on proceeds expected to be received upon the sale of the businesses. The loss in Q3 2012 was $2.5 million.

Loss per diluted share from continuing operations was $0.65 in Q3 2013 compared with $0.10 in Q3 2012. Excluding the impact of special charges, adjusted loss per diluted share would have been $0.42 in Q3 2013, compared with a loss of $0.20 in Q3 2012.

Cash and cash equivalents balance was $108.4 million as of September 30, 2013, up $14 million during the quarter, driven primarily by improvements in working capital.

Year-To-Date Summary

For the nine months ended September 30, 2013, Imation reported net revenue of $628.0 million, down 15.1% compared with the same period last year, an operating loss of $41.2 million, including special charges of $21.0 million, and a diluted loss per share from continuing operations of $1.08.

Excluding special charges, the operating loss for the nine months ended September 30, 2013 would have been $20.2 million and diluted loss per share from continuing operations would have been $0.62.

For the nine months ended September 30, 2012, Imation reported net revenue of $739.9 million, an operating loss of $16.8 million, and a diluted loss per share from continuing operations of $0.60. Excluding special charges, the operating loss for the nine months ended September 30, 2012 would have been $0.55 (See Tables Five and Six for non-GAAP measures).

Operating results for the nine months ended September 30, 2013 include the second quarter reversal of an accrual of $13.6 million for copyright levies as a result of an Italian Court ruling.

Comments

Abstracts the earnings call transcript: Mark Lucas, president and CEO: "Nexsan business saw some weakness in OEM revenues due to a short term disruption of one of our major OEMs. And as other storage solutions providers have said, there was some market place sluggishness in Q3 with certain customers delaying their purchasing orders. "During the third quarter, we continue to cut staffing levels in legacy Imation businesses and administrative areas due to the secular decline in optical and tape media." Paul Zeller, CFO: "Our revenues in consumer storage and accessories represented 56% of the total and may decrease 23.8% in the quarter. This was driven by consumer storage media primary optical, the over category declining 27%. Audio and accessory revenues under the TDK brand were up 26% to $11 million driven by increased sales really in all product categories. "Tier Storage and Security Solutions revenues represented about 44% of total and decreased 2% in the quarter. The main driver was a particularly soft quarter in commercial storage media, primarily magnetic tape which was down 25%."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter