Micron: Fiscal 2Q25 Financial Results

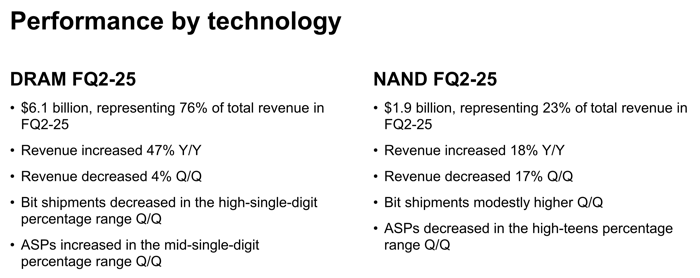

HBM revenue crosses $1 billion, robust AI demand drives record data center DRAM revenue.

This is a Press Release edited by StorageNewsletter.com on March 24, 2025 at 2:03 pmMicron Technology, Inc. announced results for its second quarter of fiscal 2025, which ended February 27, 2025.

Fiscal Q2 2025 highlights

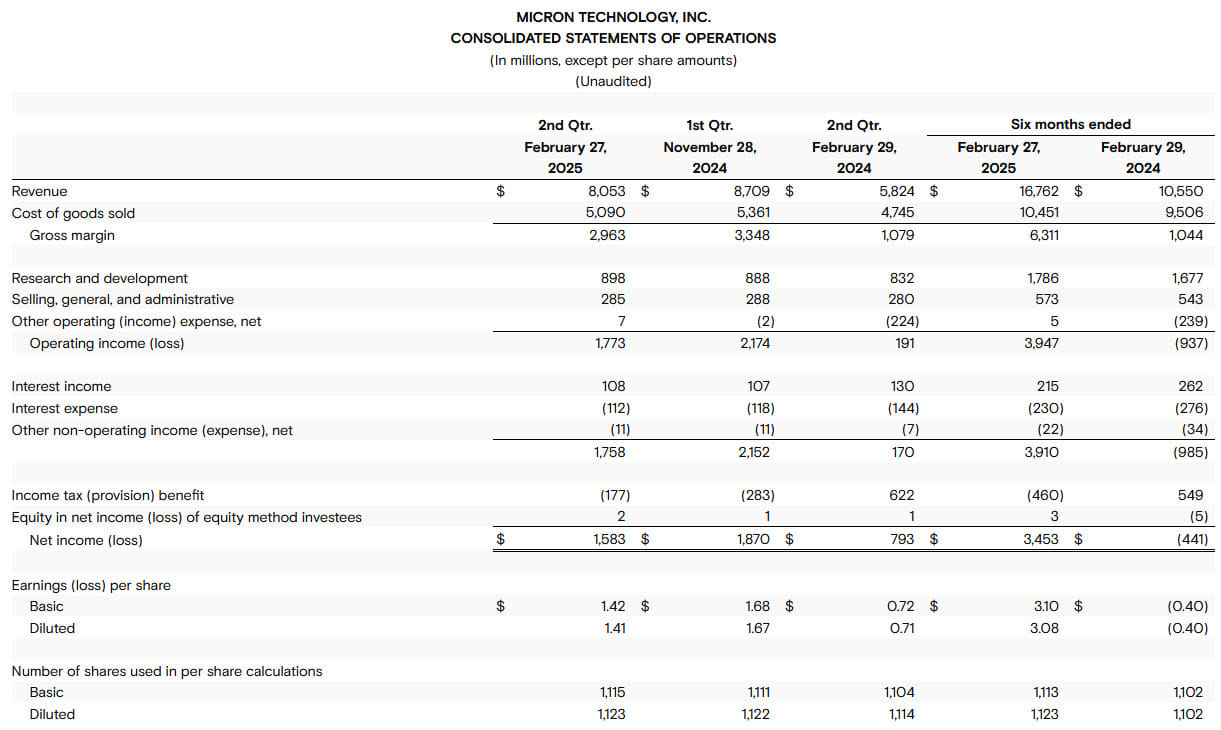

- Revenue of $8.05 billion $8.71 billion for the prior quarter and $5.82 billion for the same period last year

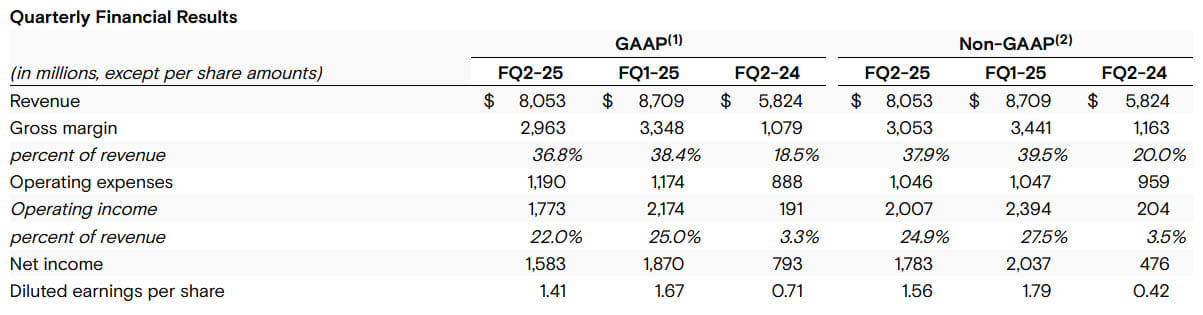

- GAAP net income of $1.58 billion, or $1.41 per diluted share

- Non-GAAP net income of $1.78 billion, or $1.56 per diluted share

- Operating cash flow of $3.94 billion $3.24 billion for the prior quarter and $1.22 billion for the same period last year

“Micron delivered fiscal Q2 EPS above guidance and data center revenue tripled from a year ago,” said Sanjay Mehrotra, chairman, president and CEO, Micron Technology. “We are extending our technology leadership with the launch of our 1-gamma DRAM node. We expect record quarterly revenue in fiscal Q3, with DRAM and NAND demand growth in both data center and consumer-oriented markets, and we are on track for record revenue and significantly improved profitability in fiscal 2025.“

Micron Fiscal 2Q25 Financial Results, Quarterly Financial Results (click on tables to enlarge)

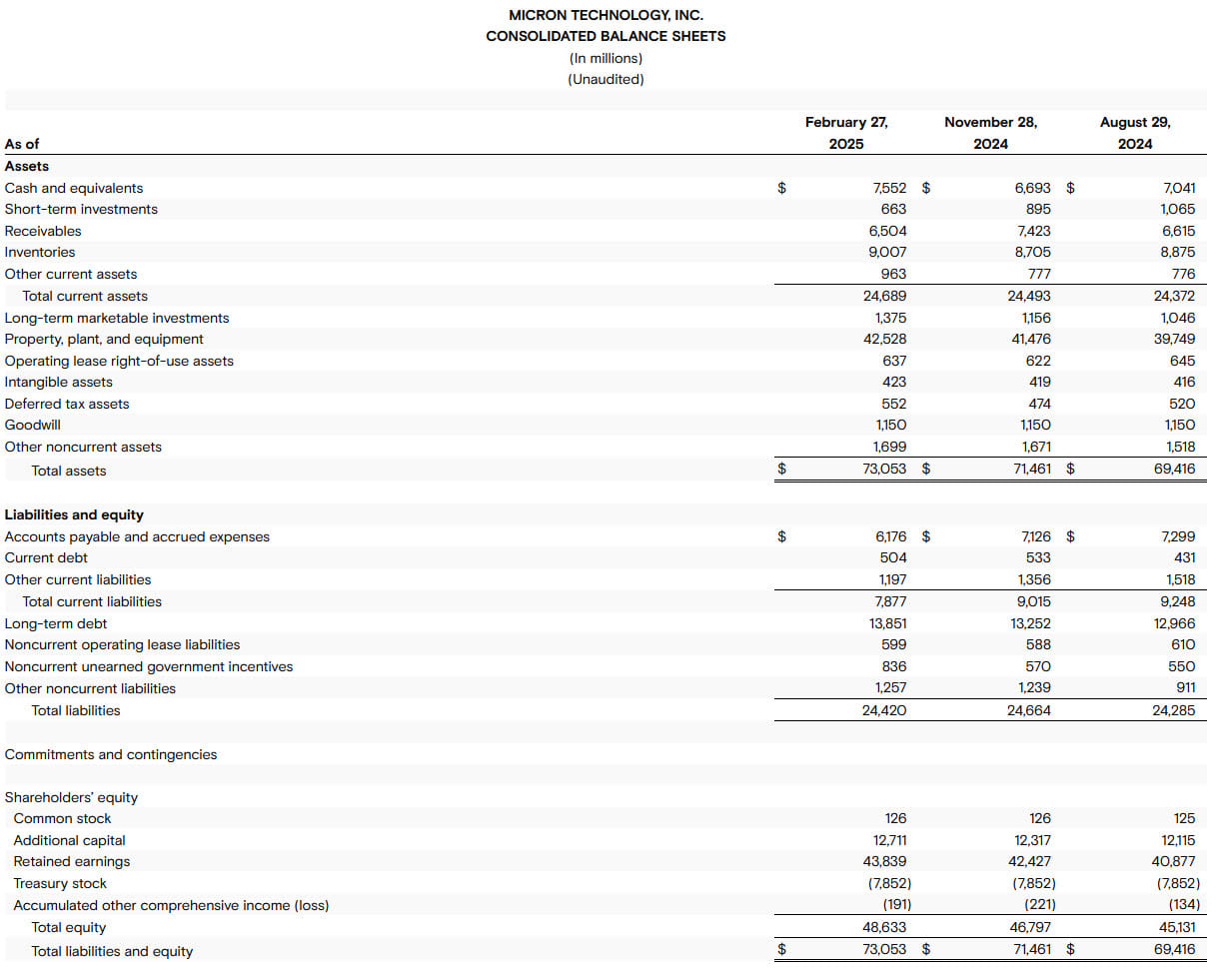

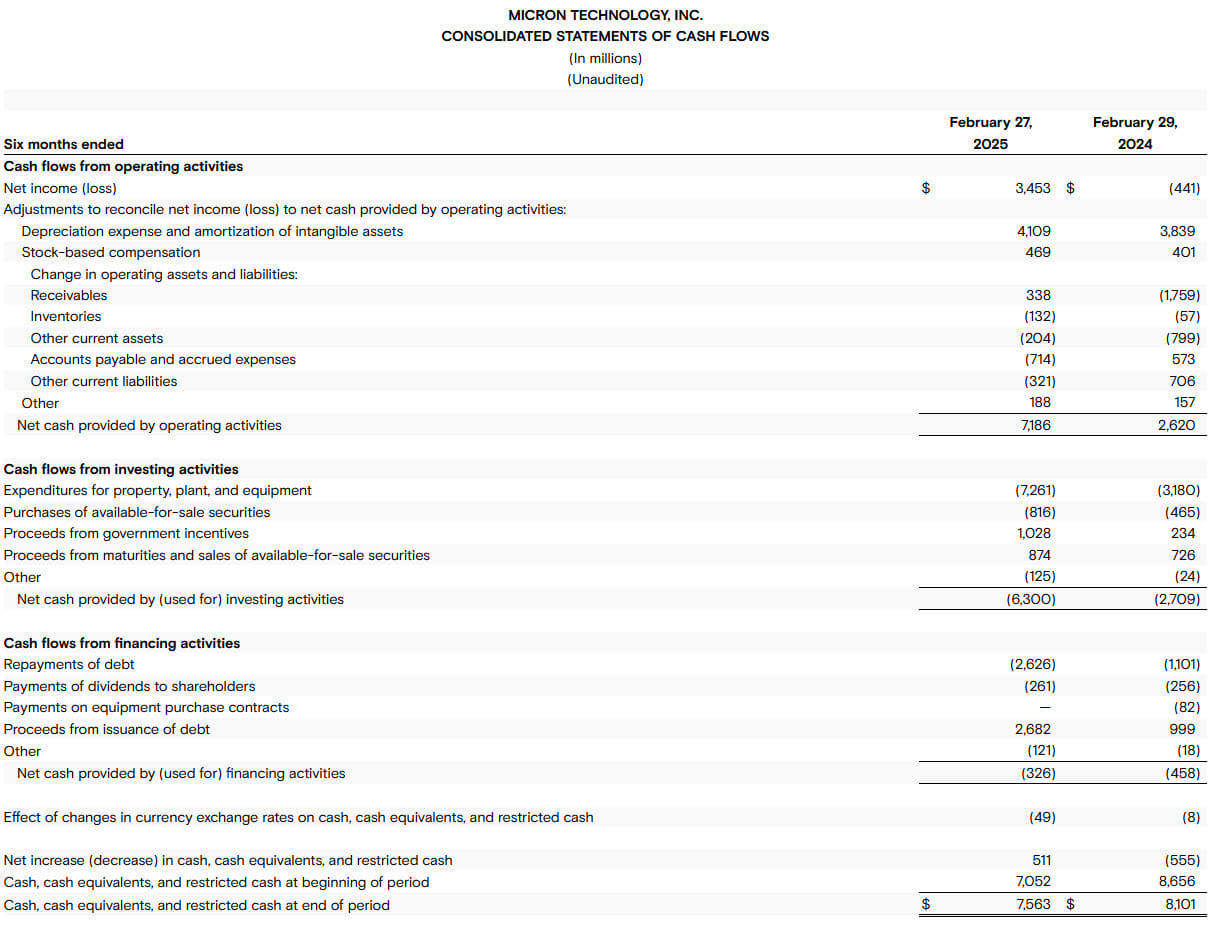

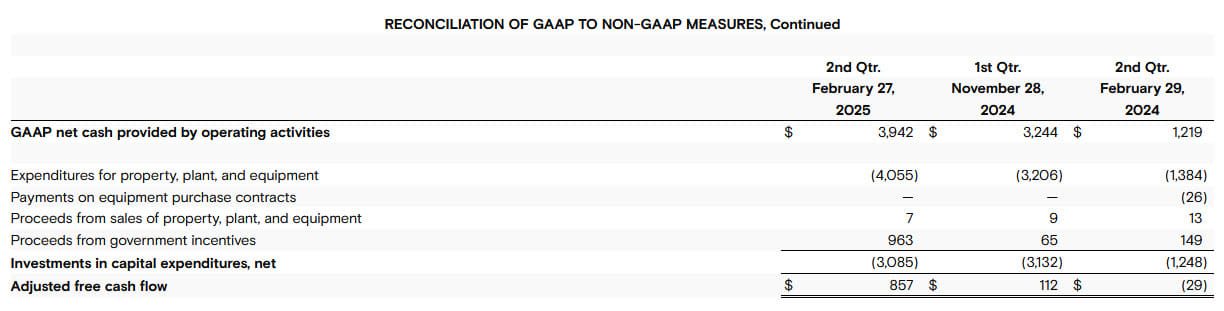

For the second quarter of 2025, investments in capital expenditures, net (2) were $3.09 billion and adjusted free cash flow (2) was $857 million. Micron ended the quarter with cash, marketable investments, and restricted cash of $9.60 billion. On March 20, 2025, Micron’s Board of Directors declared a quarterly dividend of $0.115 per share, payable in cash on April 15, 2025, to shareholders of record as of the close of business on March 31, 2025.

For the second quarter of 2025, investments in capital expenditures, net (2) were $3.09 billion and adjusted free cash flow (2) was $857 million. Micron ended the quarter with cash, marketable investments, and restricted cash of $9.60 billion. On March 20, 2025, Micron’s Board of Directors declared a quarterly dividend of $0.115 per share, payable in cash on April 15, 2025, to shareholders of record as of the close of business on March 31, 2025.

Business Outlook

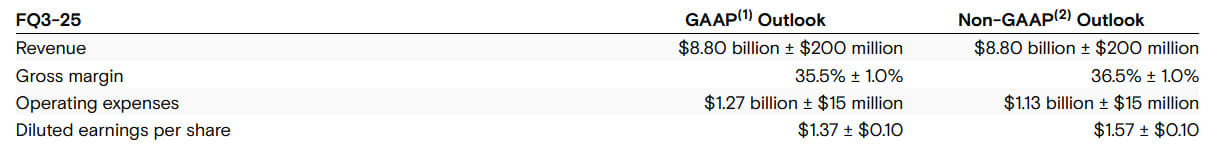

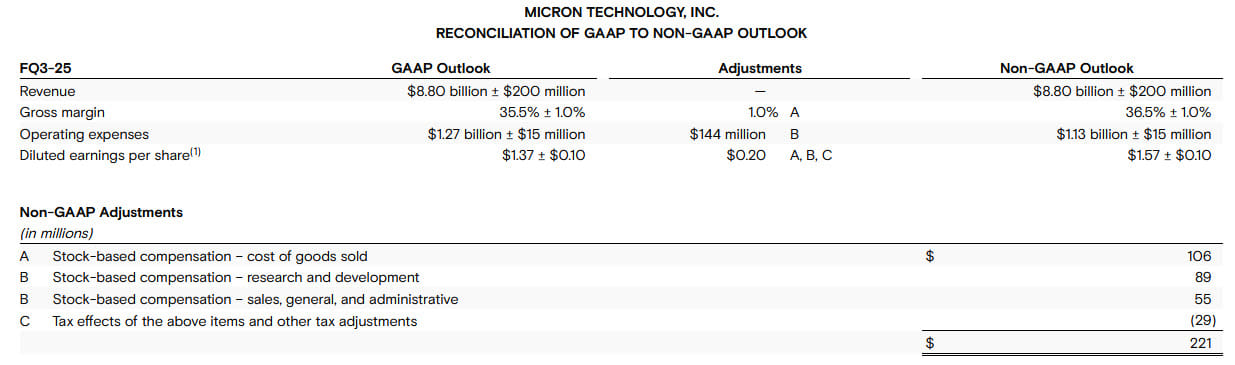

The following table presents Micron’s guidance for the third quarter of 2025:

Further information regarding Micron’s business outlook is included in the prepared remarks and slides, which have been posted at investors.micron.com.

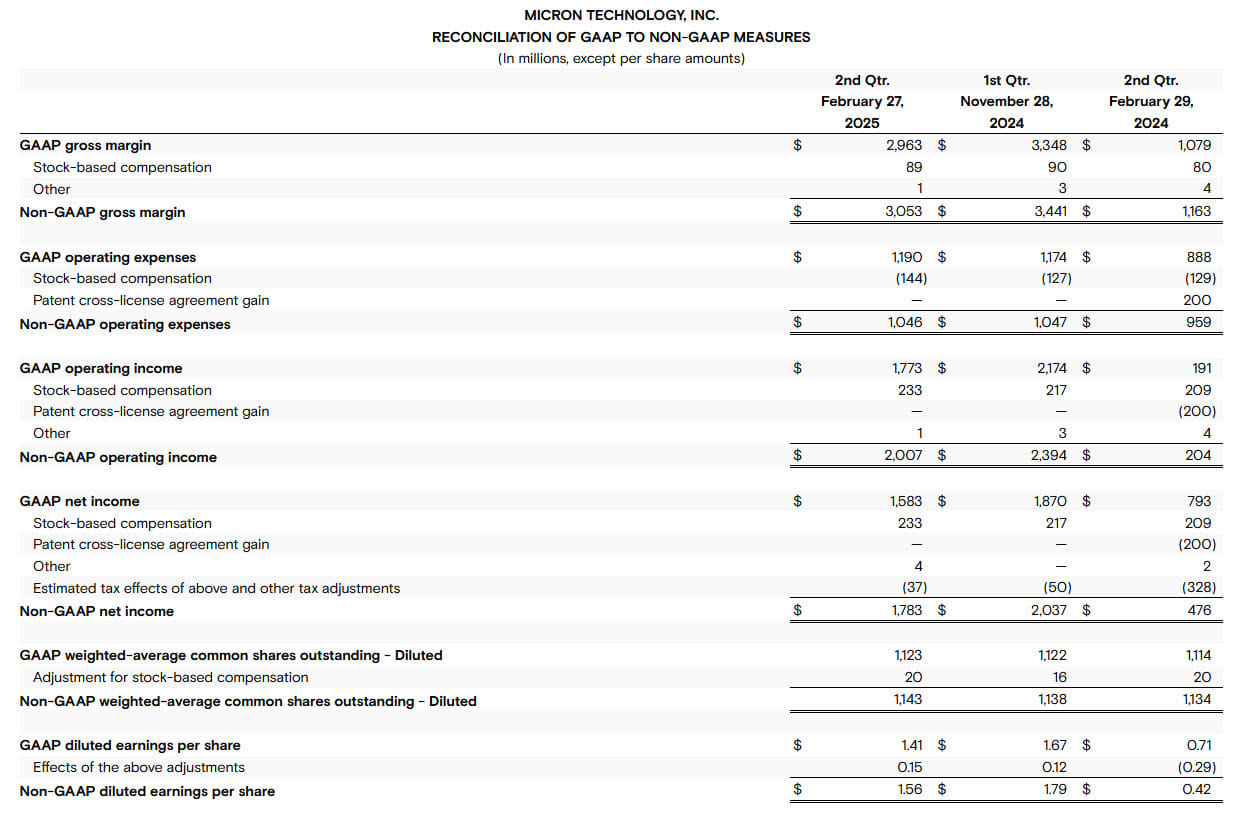

(1) GAAP represents US Generally Accepted Accounting Principles.

(2) Non-GAAP represents GAAP excluding the impact of certain activities, which management excludes in analyzing our operating results and understanding trends in our earnings, adjusted free cash flow, and business outlook. Further information regarding Micron’s use of non-GAAP measures and reconciliations between GAAP and non-GAAP measures are included within this press release.

The tables above reconcile GAAP to non-GAAP measures of gross margin, operating expenses, operating income, net income, diluted shares, diluted earnings per share, and adjusted free cash flow. The non-GAAP adjustments above may or may not be infrequent or nonrecurring in nature, but are a result of periodic or non-core operating activities. We believe this non-GAAP information is helpful in understanding trends and in analyzing our operating results and earnings. We are providing this information to investors to assist in performing analysis of our operating results. When evaluating performance and making decisions on how to allocate our resources, management uses this non-GAAP information and believes investors should have access to similar data when making their investment decisions. We believe these non-GAAP financial measures increase transparency by providing investors with useful supplemental information about the financial performance of our business, enabling enhanced comparison of our operating results between periods and with peer companies. The presentation of these adjusted amounts varies from amounts presented in accordance with US GAAP and therefore may not be comparable to amounts reported by other companies. Our management excludes the following items as applicable in analyzing our operating results and understanding trends in our earnings:

- Stock-based compensation;

- Gains and losses from settlements;

- Restructure and asset impairments; and

- The estimated tax effects of above, non-cash changes in net deferred income taxes, assessments of tax exposures, certain tax matters related to prior fiscal periods, and significant changes in tax law. The divergence between our GAAP and non-GAAP income tax provision relates to the difference in our GAAP and non-GAAP estimated annual effective tax rates, which are computed separately.

Non-GAAP diluted shares are adjusted for the impact of additional shares resulting from the exclusion of stock-based compensation from non-GAAP income.

(1) GAAP earnings per share based on approximately 1.13 billion diluted shares and non-GAAP earnings per share based on approximately 1.14 billion diluted shares.

The tables above reconcile our GAAP to non-GAAP guidance based on the current outlook. The guidance does not incorporate the impact of any potential business combinations, divestitures, additional restructuring activities, balance sheet valuation adjustments, strategic investments, financing transactions, and other significant transactions. The timing and impact of such items are dependent on future events that may be uncertain or outside of our control.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter