Synchronoss Technologies: 4Q24 and FY 2024 Financial Results

4Q revenue grew 6.8% Y/Y to $44.2 M, GAAP gross margin expands to 69.1%; adjusted gross margin rises to 79.3%

This is a Press Release edited by StorageNewsletter.com on March 14, 2025 at 2:03 pmSynchronoss Technologies Inc. reported financial results for its 4th quarter and full year ended December 31, 2024.

Fourth Quarter and Recent Operational Highlights

- Reported total revenue of $44.2 million, driven primarily by 6.0% cloud subscriber growth Y/Y.

- Quarterly results included net income of $7.9 million, $7.3 million in income from operations, $9.1 million in free cash flow, and $13.9 million in adjusted EBITDA.

- Signed a three-year extension with a major US telecom provider to continue offering white labeled Synchronoss Personal Cloud solution to their 100+ million subscribers, which follows last quarter’s announcement of a three-year extension with a leading French telecom service provider.

- Unveiled Capsyl, a new turn-key Synchronoss-branded personal cloud platform designed for mobile operators and broadband service providers to deploy secure, scalable, and revenue-generating personal cloud services with minimal deployment time.

- Announced the launch of the next gen Synchronoss Personal Cloud platform including AI-powered genius tools to edit and optimize photos as well as improved security and storage, which is available through AT&T, Verizon, SoftBank, and other global carriers.

“We just completed a transformational year for Synchronoss, opening a new chapter for us as a high margin, free cash flow positive global cloud solutions provider. We achieved revenue growth of 5.7% and reported total revenue of $173.6 million for the year and adjusted EBITDA of $50 million, which was a 61% improvement Y/Y and above the high end of our raised financial outlook,” stated Jeff Miller, president and CEO, Synchronoss. “Looking ahead to 2025, we now have over 90% of our revenue under contract for the year thanks to key contract renewals that the team secured in 2024. We’re confident in our business, product offering, and strategy, and believe that there is near-term opportunity for growth in our existing customers, our ability to add new customers, and the promising rollout of Capsyl.“

Fourth Quarter 2024 Financial Results:

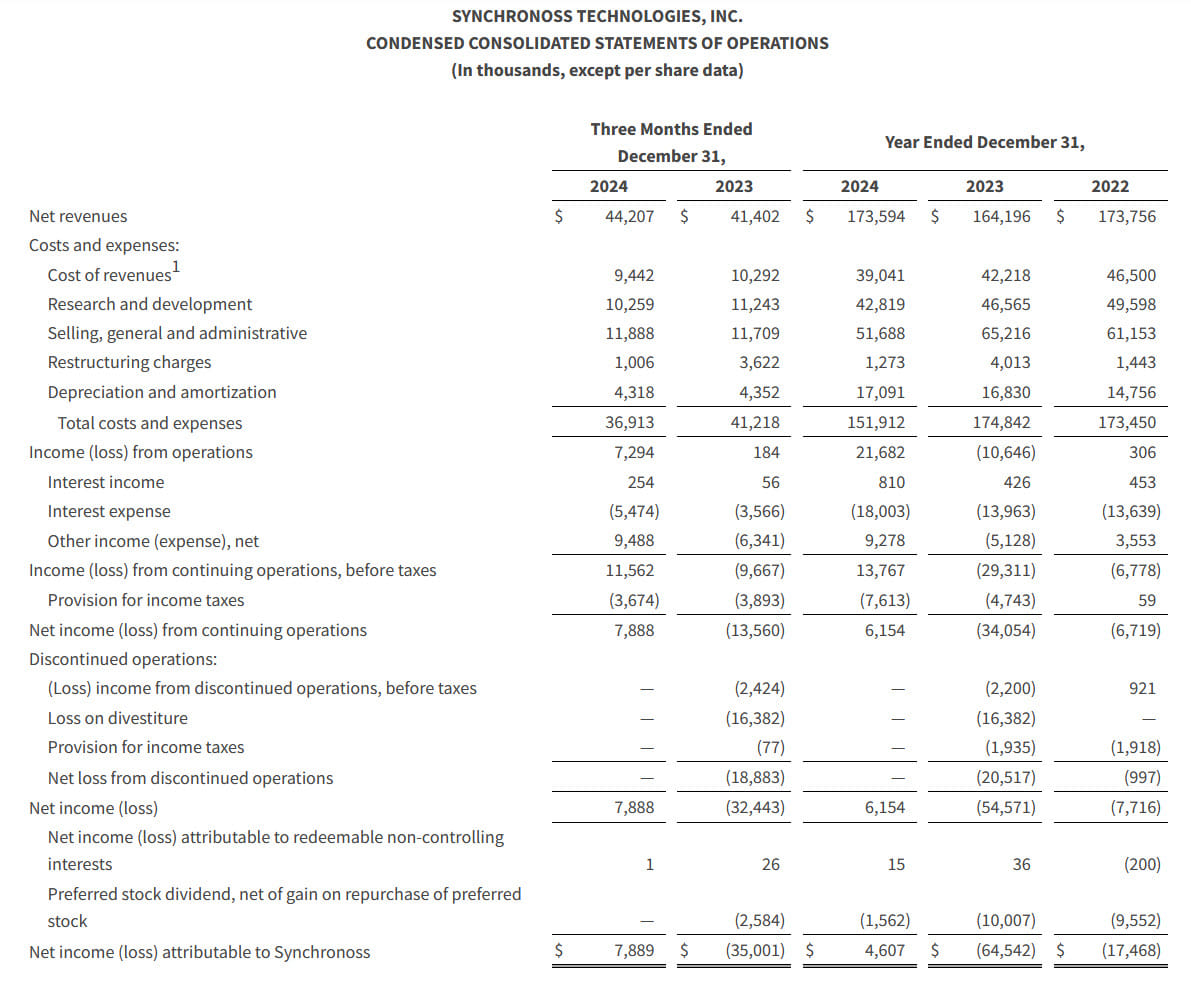

Results compare the 3 months ended December 31, 2024 to 3 months ended December 31, 2023.

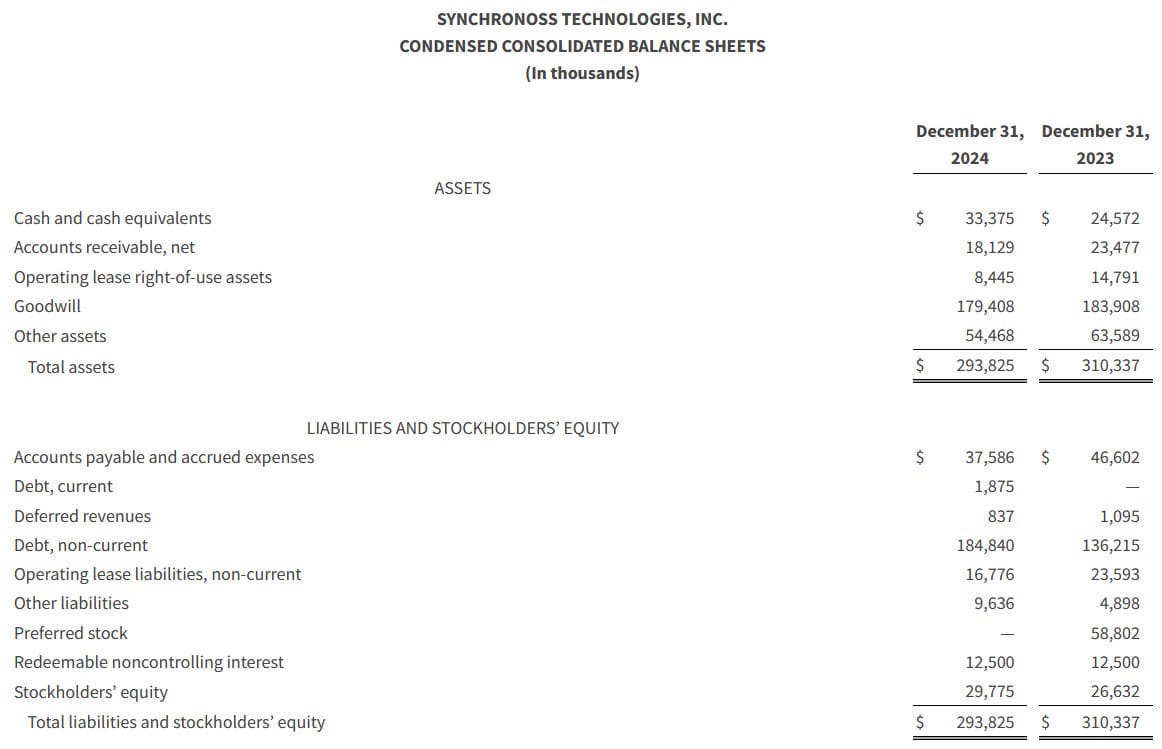

On October 31, 2023, the company entered into an Asset Purchase Agreement to divest its Messaging and NetworkX businesses. As such, unless otherwise noted, all financial metrics herein represent continuing operations, except for comparative purposes to the Consolidated Statements of Cash Flows for full year 2023, which were presented for the whole company at the time.

- Total revenue increased to $44.2 million from $41.4 million in the prior year period, driven primarily by 6.0% cloud subscriber growth.

- Quarterly recurring revenue was 91.0% of total revenue, compared to 88.0% in the prior year period.

- Gross profit increased 15.5% to $30.6 million (gross margin of 69.1%) from $26.5 million (gross margin of 63.9%) in the prior year period.

- Adjusted Gross profit increased 12.7% to $35.0 million (adjusted gross margin of 79.3%) from $31.1 million (adjusted gross margin of 75.1%) in the prior year period.

- Income from operations was $7.3 million, a significant improvement from $0.2 million in the prior year period.

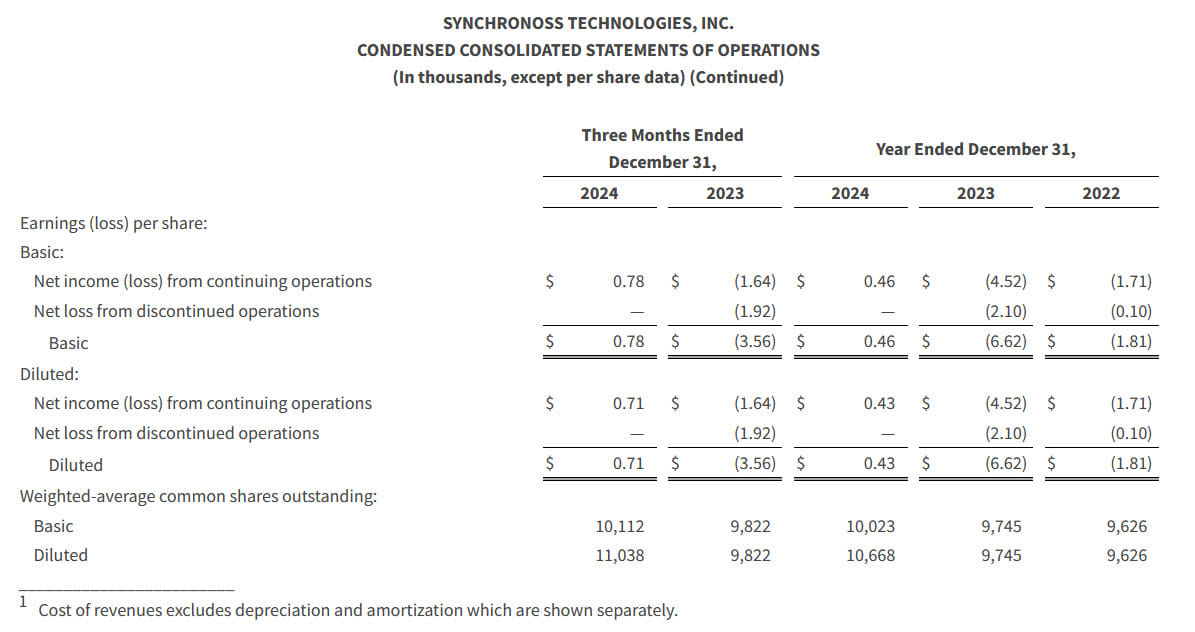

- Net income (loss) was income of $7.9 million, or $0.71 per diluted share, compared to a loss of $35.0 million, or $(3.56) per diluted share, in the prior year period. Net income (loss) from continuing operations was $0.71 per diluted share, compared to $(1.64) in the prior year. Net loss from discontinued operations was $(1.92) per diluted share in the prior year.

- Adjusted EBITDA(1) increased 38.9% to $13.9 million (adjusted EBITDA margin of 31.4%) from $10.0 million (adjusted EBITDA margin of 24.1%) in the prior year period.

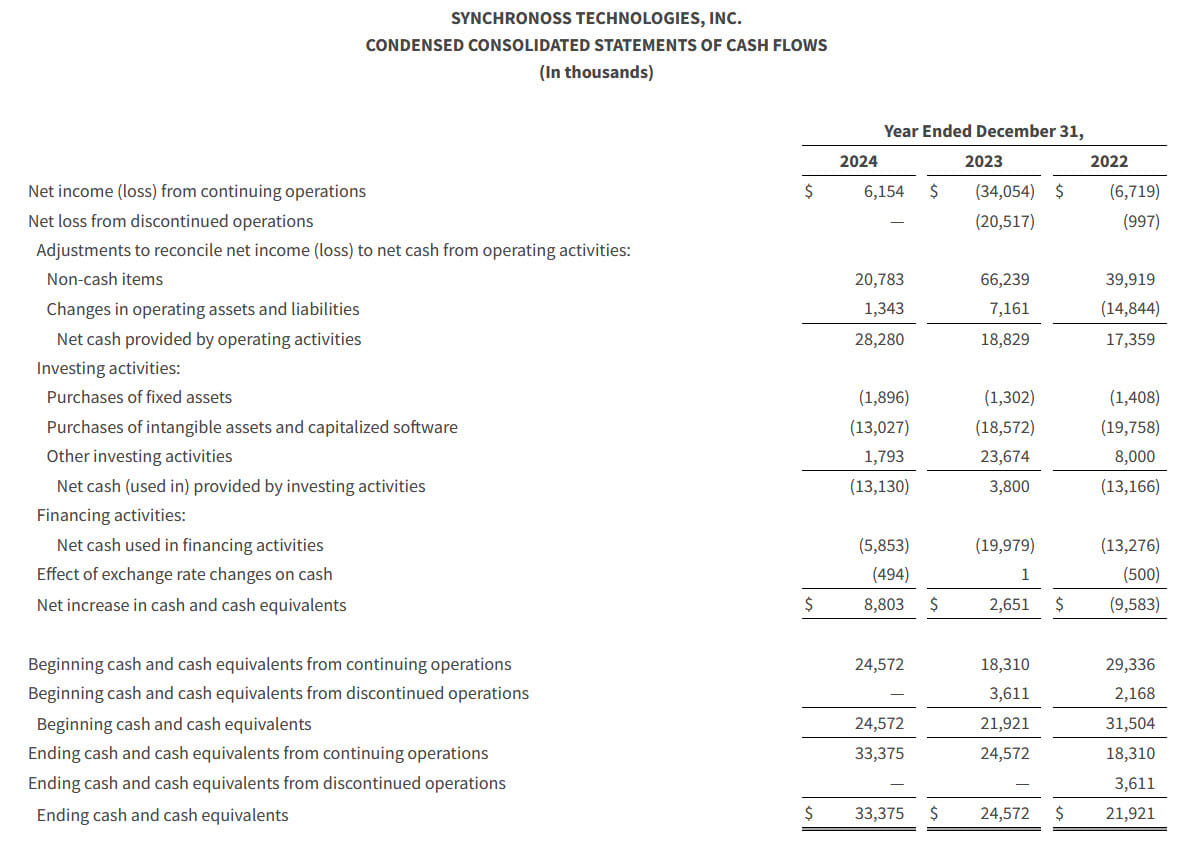

- Cash and cash equivalents were $33.4 million on December 31, 2024, compared to $25.2 million on September 30, 2024. In the fourth quarter of 2024, free cash flow was $9.1 million and adjusted free cash flow was $12.0 million, compared to cash flow of $(4.4) million and positive adjusted free cash flow of $1.4 million in the prior year period. The Company did not receive additional US federal tax refunds during the period, leaving its remaining anticipated balance due at approximately $28 million plus applicable interest, which is expected to be received in 2025.

Full Year 2024 Financial Results:

Results compare 2024 fiscal year end (December 31, 2024) to 2023 fiscal year end (December 31, 2023) unless otherwise indicated.

- Total revenue increased 5.7% to $173.6 million from $164.2 million in the prior year, driven primarily by 6.0% cloud subscriber growth.

- Annual recurring revenue was 91.2% of total revenue, compared to 88.7% in the year prior.

- Gross profit increased 12.1% to $118.6 million (gross margin of 68.3%) from $105.8 million (gross margin of 64.4%) in the prior year.

- Adjusted Gross profit increased 10.5% to $135.7 million (adjusted gross margin of 78.2%) from $122.7 million (adjusted gross margin of 74.7%) in the year prior.

- Income (loss) from operations was income of $21.7 million, a significant improvement compared to a loss of $10.6 million in the prior year.

- Net income (loss) was $4.6 million, or $0.43 per diluted share, compared to net loss of $64.5 million, or $(6.62) per diluted share, in the prior year. Net income (loss) from continuing operations was $0.43 per diluted share, compared to $(4.52) in the prior year. Net loss from discontinued operations was $(2.10) per share in the prior year.

- Adjusted EBITDA(1) increased 60.6% to $50.4 million (adjusted EBITDA margin of 29%) from $31.4 million (adjusted EBITDA margin of 19.1%) in the prior year.

(1) A reconciliation of GAAP to non-GAAP results has been provided in the financial statement tables included in this press release. An explanation of these measures is included below under the heading “Non-GAAP Financial Measures.”

Based on information available as of March 11, 2025, the Company is announcing full 2025 outlook items as follows:

- Revenue range of between $170 and $180 million.

- Recurring revenue of at least 90% of total revenue.

- Adjusted gross margin of between 78%-80%.

- Adjusted EBITDA of between $52 million and $56 million, which equals at least 30% adjusted EBITDA margin.

- Free Cash Flow of between $11 and $16 million. This excludes the effect of the federal tax refund that the Company expects to receive in 2025.

- The Company continues to receive indications from the IRS that solidifies our high level of confidence in receiving the entire $28 million tax refund plus applicable interest in 2025.

Upcoming Conference Participation

The Company announced that members of the management team will participate in 2 upcoming investor conferences:

- 37th Annual Roth Conference on March 16, 2025. To register for one-one-one meetings with management, please contact a Roth sales representative.

- 20th Annual Needham Technology, Media, & Consumer 1×1 Conference on May 15, 2025. To register for one-one-one meetings with management, please contact a Needham sales representative.

A reconciliation of GAAP to non-GAAP results has been provided in the financial statement tables included in this press release. An explanation of these measures is included below under the heading ‘Non-GAAP Financial Measures.’ With respect to forward-looking statements related to adjusted EBITDA, adjusted gross margin and free cash flow, the Company has relied upon the exception in item 10(e)(1)(i)(B) of Regulation S-K and has not provided a quantitative reconciliation of (i) forecasted adjusted EBITDA to forecasted GAAP net income (loss) attributable to Synchronoss or to forecasted GAAP income (loss) from operations, before taxes, (ii) adjusted gross margin to GAAP gross margin and (iii) free cash flow to income (loss) from operations within this earnings release because the Company is unable, without making unreasonable efforts, to calculate certain reconciling items relating to those financial measures with confidence. These items include, but are not limited to, other income, other expense, (provision) benefit for income taxes, depreciation and amortization expense, stock-based compensation expense, restructuring charges, gain (loss) on divestitures, net (loss) income attributable to redeemable non-controlling interests.

Conference Call

Synchronoss held a conference call on March 11, 2025. The conference is available for replay and via the Investor Relations section of Synchronoss’ website.

Non-GAAP Financial Measures

Synchronoss has provided in this release selected financial information that has not been prepared in accordance with GAAP although this non-GAAP financial information is derived from numbers that have been prepared in accordance with GAAP. This information includes adjusted gross profit, adjusted gross margin, adjusted EBITDA, non-GAAP net income (loss) attributable to Synchronoss, diluted non-GAAP net income (loss) per share, free cash flow, adjusted free cash flow (which excludes cash payments and receipts related to non-core business activities) and recurring revenue. The Company believes that the exclusion of non-routine cash-settled expenses, such as litigation and remediation costs (net) and restructuring costs in the calculation of adjusted free cash flow which do not correlate to the operation of its business, provide for more useful period-to-period comparisons of the Company’s results. Synchronoss uses these non-GAAP financial measures internally in analyzing its financial results and believes they are useful to investors, as a supplement to GAAP measures, in evaluating Synchronoss’ ongoing operational performance. Synchronoss believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends, and in comparing its financial results with other companies in Synchronoss’ industry, many of which present similar non-GAAP financial measures to investors. As noted, the non-GAAP financial results discussed above add back or deduct certain expenses. These expenses include but are not limited to the following: fair value of stock-based compensation expense, acquisition-related costs, restructuring, transition and cease-use lease expense, litigation, remediation and refiling costs, depreciation and amortization, interest income, interest expense, net loss (income) from discontinued operations, loss (gain) on divestitures, other (income) expense, provision (benefit) for income taxes, net loss (income) attributable to non-controlling interests and preferred dividends.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measures as detailed above. Investors are encouraged to also review the Balance Sheet, Statement of Operations, and Statement of Cash Flow. As previously mentioned, a reconciliation of GAAP to non-GAAP results has been provided in the financial statement tables included in this press release.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter