Weak Consumer Market Dampens Enterprise SSD Price Growth

4Q24 supplier revenue declines 0.5%, says TrendForce

This is a Press Release edited by StorageNewsletter.com on March 13, 2025 at 2:33 pmTrendForce‘s latest research shows that 4Q24 enterprise SSD demand remained stable compared to the previous quarter, driven by the arrival of NVIDIA H-series products and continued procurement from large CSPs in China

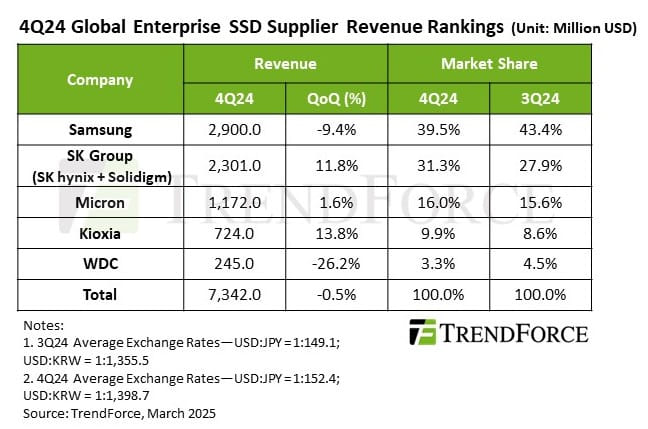

However, contract prices stagnated due to weakness in the consumer electronics market, ultimately keeping levels at Q3 levels. Consequently, enterprise SSD revenue for major suppliers totaled $7.34 billion, marking a slight 0.5% Q/Q decline.

Looking ahead to 1Q25, while demand for 4TB and 8TB enterprise SSDs continues to benefit from AI training workloads, overall procurement growth remains constrained by season demand slowdowns. Additionally, an oversupply persists in the market, with some suppliers aggressively clearing 16TB and 30TB SSD inventory. This is expected to result in a significant contract price decline of 18 – 23%, with enterprise SSD revenue projected to drop by nearly 30%. Market conditions are expected to gradually improve in the 2nd half of 2025.

Samsung retained the top market share but experienced a near 10% revenue decline in 4Q24, totaling $2.9 billion. Capacity adjustments fell short despite stronger-than-expected order growth, causing delays in order fulfillment.

SK Group (including SK hynix and Solidigm) secured the second position, with enterprise SSD revenue rising 11.8% Q/Q to $2.3 billion. The synergies from Solidigms’ integration are becoming evident, and mass production of SK TLC-based PCIe 5.0 SSDs is expected to further boost market share.

Micron Technology, Inc. maintained revenue levels from the previous quarter, reaching $1.17 billion and holding a 16% market share. Despite slower demand for 30TB SSDs, the company continued to expand its server customer base, ensuring stable performance.

Kioxia Corporation capitalized on growing partnerships with North American CSPs, aggressively expanding enterprise SSD shipments. Consequently, Q4 revenue increased 13.8% Q/Q to $724 million, securing the fourth position. Western Digital/SanDisk struggled due to lackluster demand for high-capacity products, generating only $245 million in revenue for 4Q24, ranking fifth.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter