Qualstar: Fiscal 4Q24 Financial Results

Revenue decreased by 40% Q/Q, data storage segment reports FY pre-tax income of $127,000

This is a Press Release edited by StorageNewsletter.com on March 13, 2025 at 2:32 pm

Qualstar Corporation announced its financial results for the 3 months and year ended December 31, 2024

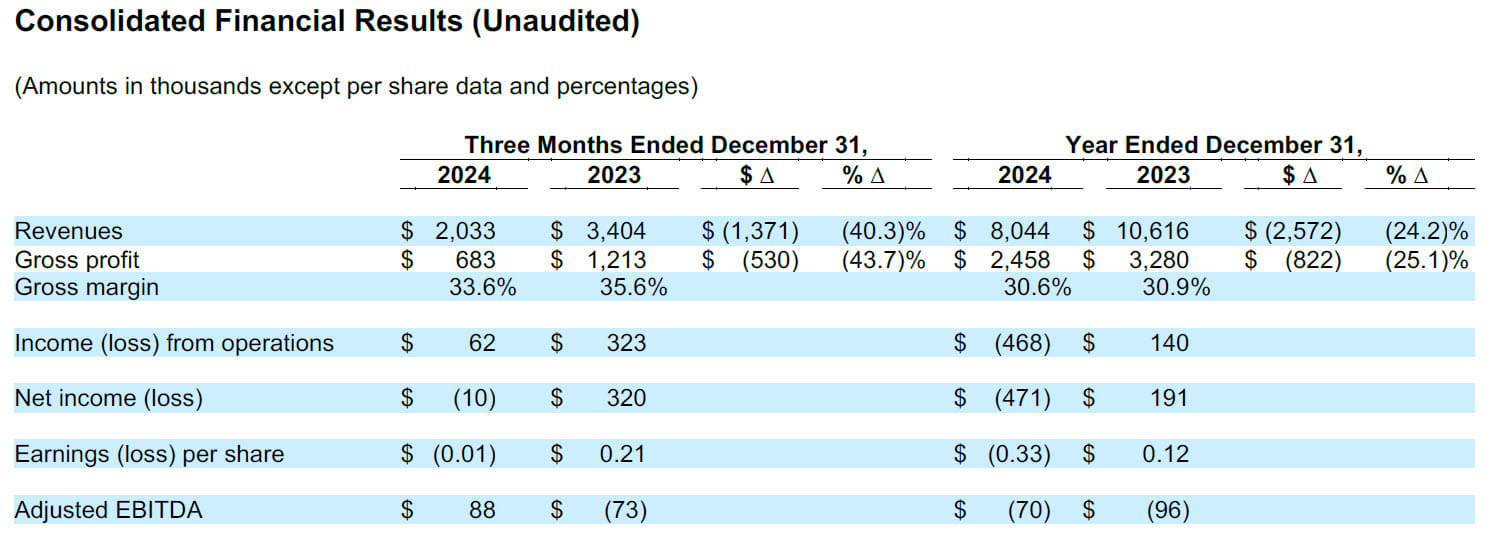

Consolidated Financial Results (Unaudited)

Key Highlights:

- Revenue decreased 40% for the 3 months ended December 31, 2024, compared to the 3 months ended December 31, 2023, and decreased 24% for the year ended December 31, 2024, compared to the prior year. The declines in revenues were primarily due to lower shipments of our power supplies products in 2024 compared to 2023, and also in part to lower shipments of our storage products this year compared to last year. In our power supplies business, as previously reported, we experienced the loss of a large customer in 2024, and this is expected to reduce revenues for the foreseeable future.

- Gross margin percentage declined slightly to 34% for the 3 months ended December 31, 2024, compared to 36% for the 3 months ended December 31, 2023, and was approximately flat at 31% for the years ended December 31, 2024 and 2023. The gross margin percentage changes were due to changes in the mix of our products, services, and customers.

- The Company’s storage business segment reported pre-tax income of $49,000 for the 3 months ended December 31, 2024, and pre-tax income of $127,000 for the year ended December 31, 2024, marking the 8th consecutive year of reporting pre-tax income. The Company’s power supplies business segment reported pre-tax loss of $56,000 for the 3 months ended December 31, 2024, and pre-tax loss of $595,000 for the year ended December 31, 2024.

- Net loss for the 3 months and year ended December 31, 2024 were impacted by revenue levels and also by certain non-routine expenses and non-cash charges. As discussed below, we use an Adjusted EBITDA financial measure to evaluate our core operating performance. Adjusted EBITDA for the 3 months ended December 31, 2024 was $88,000, compared to negative $73,000 for the 3 months ended December 31, 2023. Adjusted EBITDA for the year ended December 31, 2024 was negative $70,000, compared to negative $96,000 for the year ended December 31, 2023.

- The Company has repurchased 471,161 shares of its common stock during the years 2021 to 2024 under a stock repurchase program. In March 2025, the Company’s Board of Directors approved an extension of the Company’s stock repurchase program through December 31, 2026 for up to an additional 100,000 shares of common stock.

- We continue to pursue acquisitions and partnerships with companies in the data management software and hardware systems spaces.

- We ended the year with $2.4 million in cash and cash equivalents.

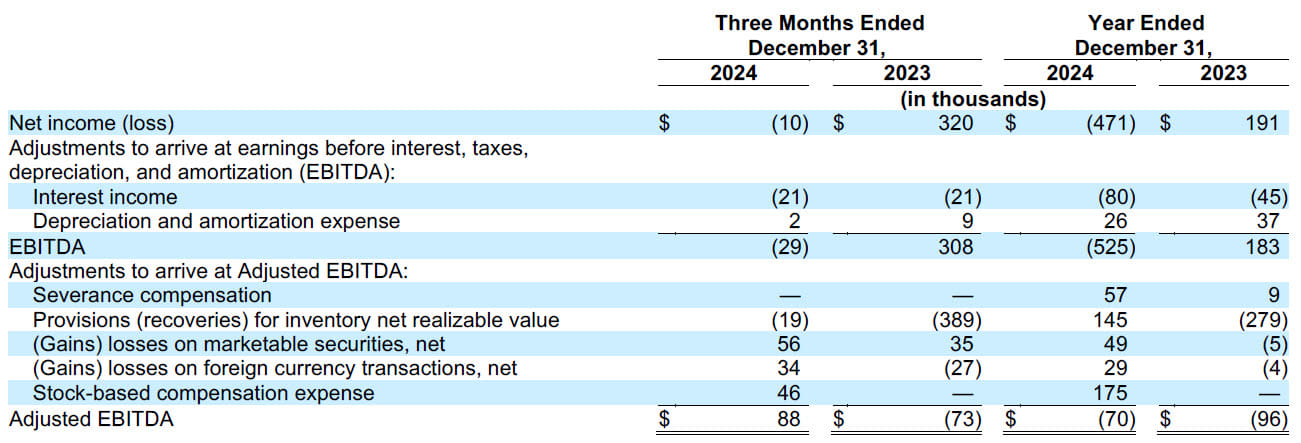

Non-GAAP Financial Measure

To supplement our condensed consolidated financial statements, which are prepared and presented in accordance with US generally accepted accounting principles (‘GAAP’), we use the following non-GAAP financial measure: Adjusted EBITDA. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We define Adjusted EBITDA for a particular period as net income (loss) before interest, taxes, depreciation and amortization, and as further adjusted for non-routine expenses that may not be indicative of our core business operating results such as severance compensation, provisions (recoveries) for inventory net realizable value, gains/losses on marketable securities, gains/losses on foreign currency transactions, and non-cash expenses such as stock-based compensation expense.

We use this non-GAAP financial measure for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that this non-GAAP financial measure provides meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our core business operating results. We believe that both management and investors benefit from referring to this non-GAAP financial measure in assessing our performance and when planning, forecasting, and analyzing future periods. This non-GAAP financial measure also facilitates management’s internal comparisons to our historical performance and liquidity as well as comparisons to our competitors’ operating results. We believe this non-GAAP financial measure is useful to investors both because (1) is allows for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) it is used by our investors to help them analyze the health of our business.

There are a number of limitations related to the use of non-GAAP financial measures. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from these non-GAAP financial measures and evaluating these non-GAAP financial measures together with their relevant financial measures in accordance with GAAP.

The following table reconciles Net Income (Loss) to Adjusted EBITDA for the 3 months and years ended December 31, 2024 and 2023:

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter