Lenovo Group Definitive Agreement to Acquire Infinidat Further Expanding its Enterprise Storage Portfolio

Transaction is subject to customary regulatory approvals and other closing conditions and terms of the transaction are not being disclosed.

This is a Press Release edited by StorageNewsletter.com on January 17, 2025 at 2:02 pmLenovo Group Ltd. has announced that its subsidiary has entered into a definitive agreement to acquire Infinidat Ltd., a global provider of high-end enterprise storage solutions.

The acquisition is part of Lenovo’s growth strategy to bring differentiated technology solutions to market. This move will further strengthen Lenovo’s enterprise storage offerings globally and underscores a commitment to delivering innovative storage solutions that meet the evolving needs of modern data centers.

The acquisition is part of Lenovo’s growth strategy to bring differentiated technology solutions to market. This move will further strengthen Lenovo’s enterprise storage offerings globally and underscores a commitment to delivering innovative storage solutions that meet the evolving needs of modern data centers.

With the strong storage solutions and R&D capabilities of Infinidat, the transaction will create strategic synergies with the Group’s infrastructure solutions business and enterprise storage capabilities:

-

Access to enterprise storage products and innovation

Infinidat provides high performance, mission critical enterprise storage solutions for scalable, cyber-resilient data management and has a strong track record of in-house software R&D capabilities, complementing Lenovo’s innovation and R&D capabilities and heritage.

-

Expands Lenovo’s storage solutions portfolio to cover high-end enterprise storage

The transaction will build on Lenovo’s existing position in the entry and mid-range enterprise storage market, including a portfolio of flash and hybrid arrays, HCI, SDS, and TruScale data management solutions.

-

Opportunity to drive sustainable profitable growth of the Group’s storage business

Infinidat, combined with Lenovo’s existing global infrastructure business, access to and relationships with customers, and global supply chain scale and capabilities, will create new opportunities for high-end enterprise storage products and unlock new revenue opportunities for the Group’s storage business.

“Lenovo offers a comprehensive range of storage solutions designed with a customer-centric, data-first approach to meet diverse enterprise needs. With the acquisition of Infinidat, we are excited and well-positioned to accelerate innovation and deliver greater value for our customers,” said Greg Huff, CTO, Lenovo Infrastructure Solutions Group. “Infinidat’s expertise in high-performance, high-end data storage solutions broadens the scope of our products, and together, we will drive new opportunities for growth.”

“Infinidat delivers award-winning high-end enterprise storage solutions providing an exceptional customer experience and guaranteed SLAs with unmatched performance, availability, cyber resilience and recovery, and petabyte-scale economics,” said Phil Bullinger, CEO, Infinidat. “With Lenovo’s extensive global capabilities, we look forward to expanding the comprehensive value we provide to enterprise and service provider customers across on-premises and hybrid multi-cloud environments.”

The transaction is subject to customary regulatory approvals and other closing conditions. The terms of the transaction are not being disclosed.

Morgan Stanley Asia Limited is acting as financial advisor, and Skadden, Arps, Slate, Meagher & Flom LLP and H-F & Co. are acting as legal counsel to Lenovo. Evercore is acting as lead financial advisor with Lincoln International LLC providing an independent fairness opinion to the Infinidat Board of Directors. Infinidat’s legal counsel was led by Kirkland & Ellis LLP and Arnon, Tadmor-Levy.

Comments

This acquisition is a surprise at least it is a surprise from the acquirer perspective.

For Infinidat, what could have been their choice? IPO? is the climate good? Exit like this one (IPO is a form of exit)? probably the best path, or continue as an independent private entity? potentially difficult quarters after quarters.

The company raised a total of $370 million and joined several years ago the unicorn club as published twice a year by Coldago Research.

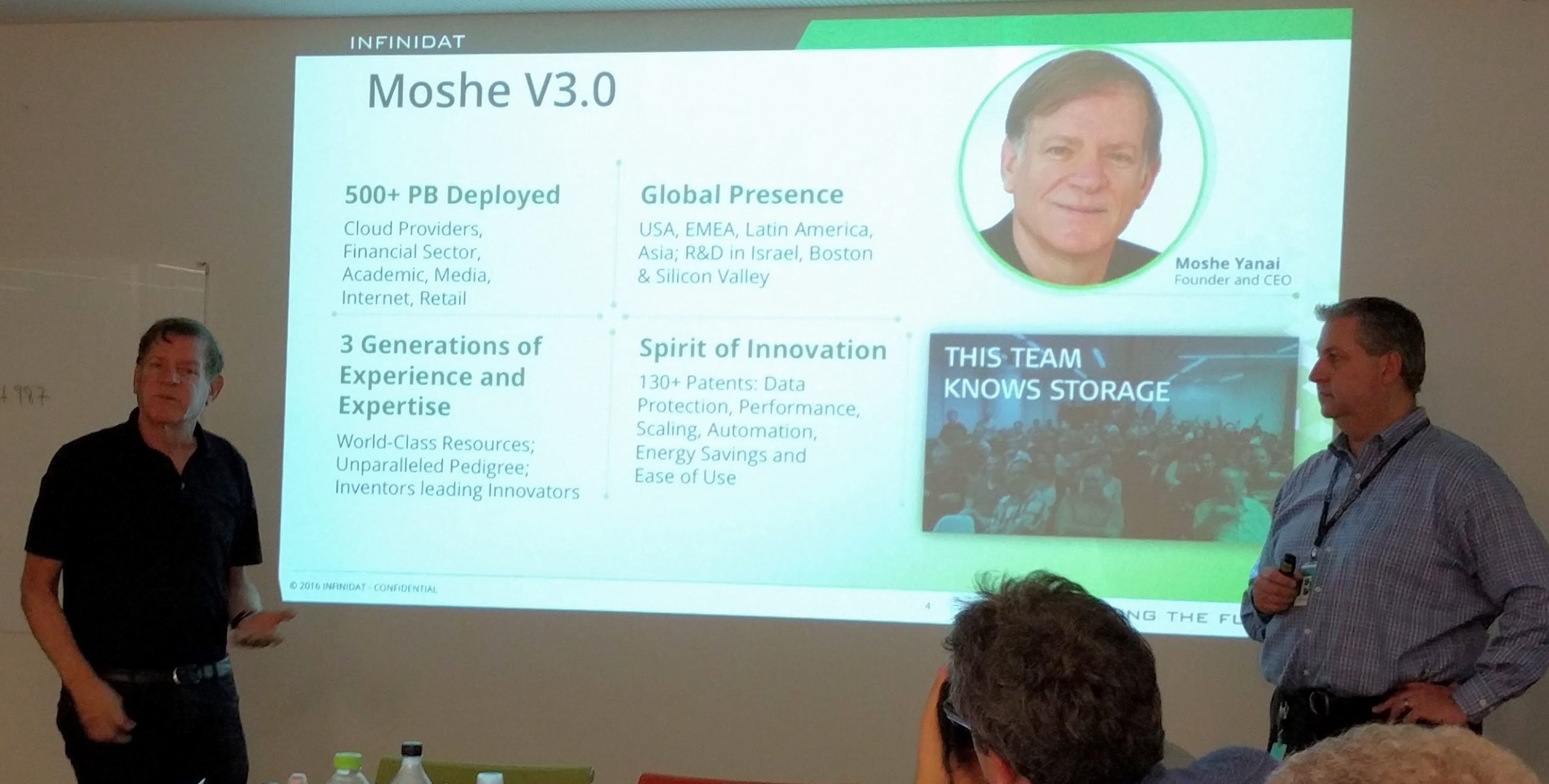

We can easily say the Israeli native company had 3 eras in terms of leadership: Moshe Yanai for the first part, second part non Yanai and then Phil Bullinger which ends with this exit. On the product side, the company has refused for years to deliver full flash array claiming that the delivered TCO is better with HDDs associated with super high resiliency and good performance levels. The market accepted that and even if Infinidat won many big deals, no doubt about that, when the market insisted on some directions with Flash plus RFP requiring to have full flash product, the vendor has to shake his head and realize that something has to be done. We called this the reality of the market, or market realism, and the market is always right.

Click to enlarge

We realized these waves with our several visits in Herzliya, Israel, to meet Infinidat management team under Moshe Yanai leadership and later Phil Bullinger. To put things in context the photo above was taken in November 2016 for the 20th IT Press Tour. When the board has recruited Bullinger, this idea to explore different form of exit was a key goal and the result confirms that. It also validates that founders have difficulty to sell company they found, remember Pat Martin who sold StorageTek to Sun Microsystems in 2005, Jonathan Schwartz for Sun to Oracle in 2010 or Joe Tucci with EMC to Dell more recently. Moshe Yanai was in the same seat as the 4 founders of StorageTek, 5 of Sun and 3 of EMC. But the question of age is also important, do these leaders just leave and nominate with the board their successor and potentially receive a bonus. Clearly they wish to leave with a bigger part of the cake.

For Lenovo, for sure it creates something and fill the high end hole in the product line. The company relies a lot on NetApp and suffers to not be listed in various analyst reports as the company doesn't own technology. It is the same situation for HPC and AI storage software with partnerships with IBM, ThinkParQ or WEKA. Software is another story at Lenovo, promoting and selling essentially hardware. In other words, it gives credit to the original technology provider and as Lenovo doesn't control its product destiny they're just absent, this is true for Gartner, Forrester, IDC or Coldago. And it represents a gap with revenue trackers where users find Lenovo not listed on other product oriented reports. For large companies, wishing to pick a stable leading vendor, it was a bit non understandable and for some of them create a difficulty. But also for lot of users, Lenovo has an obvious advantage as they select recognized players with strong products and offers one purchase and support point, paramount for large companies.

But we have to say that storage was not a top priority for Lenovo. We say "was" because with this acquisition it turns out that the focus changed. The dependency to external solution proves that, the last Lenovo TechWorld in September was very weak on this topic. The reverse is true, Lenovo insisted a lot on compute with several innovations and distinct product lines especially with AI oriented workloads to address.

We understand that this move confirms the desire to penetrate the high-end segment with a block storage array. We count the number of times the term "high-end" appears in the press release and we obtain 6. At the same time, mid-range appears 1 time and smb zero. Does this move the result of the new ISG leadership? probably coupled with remarks we added above. Now beyond filling a market segment they could have done with an other oem deal, they now own a brand, a product line and technologies and a brilliant engineering team.

High-end segment means also consolidation and clearly Infinidat is a key player here, again in block storage essentially for critical business applications. Even if the product can be seen as a unified data storage platform, it is, users pick Infinidat for block and consider file aspects as an option. We didn't see any users who picked Infinidat for file storage first. At the same time, secondary storage is a strategic adjacent domain to take position in and here it adds value for Lenovo especially in the high cyber threat moment we live.

This move, at the beginning of 2025, represents an event for the storage industry as it will change how Lenovo will be perceived. Lenovo will shake established positions and will see if that move will trigger or confirm some other potential deals.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter