Company Profile: ExaGrid

Leader in secondary storage dedicated to backup

By Philippe Nicolas | December 20, 2024 at 2:02 pmCompany name:

ExaGrid Systems, Inc.

HQ and offices:

Headquarters – Marlborough, MA, USA

Website:

exagrid.com

Date founded:

2002

Founders:

Dave Therrien, founder and long time CTO, left the company and is now retired.

In 2005, Bill Andrews came in as CEO of the company and has been the CEO for over 19 years. Bill has brought the passion and vision to ExaGrid to get it to where it is today. Build has a technology degree but spent 18 years before joining ExaGrid at various high tech vendors as the VP of Sales and Marketing. Bill has been in the high-tech industry for about 40 years.

In 2005, Bill Andrews came in as CEO of the company and has been the CEO for over 19 years. Bill has brought the passion and vision to ExaGrid to get it to where it is today. Build has a technology degree but spent 18 years before joining ExaGrid at various high tech vendors as the VP of Sales and Marketing. Bill has been in the high-tech industry for about 40 years.

Financial funding:

ExaGrid has not raised money in over 12 years, is Free Cash Flow (FCF) positive every quarter and has zero debt of any kind. The company has double-digit growth every year.

Employees numbers:

400+

Revenue:

ExaGrid has had record revenue growth in 2024, and is Free Cash Flow (FCF) positive, P&L positive, and EBITDA positive for the past 16 consecutive quarters.

Technology:

Tiered Backup Storage

Products:

Tiered Backup Storage – 7 appliance models available from to accommodate full backups plus retention for up to 6PB in a single scale-out system, the largest in the industry with data deduplication.

Click to enlarge

Release and Roadmap:

ExaGrid continues to innovate its Tiered Backup Storage with regular version software releases that enhance integration with the industry-leading backup applications, increase the system’s built-in security, and provide other improvements. 99% of ExaGrid customers are on a yearly maintenance and support plan which includes all point and full version software releases at no additional charge. In addition, in 2024, ExaGrid announced new appliance models that offer increased capacity with reduced rack space requirements for better efficiency, and has more announcements and releases on the roadmap for 2025.

Pricing model and price:

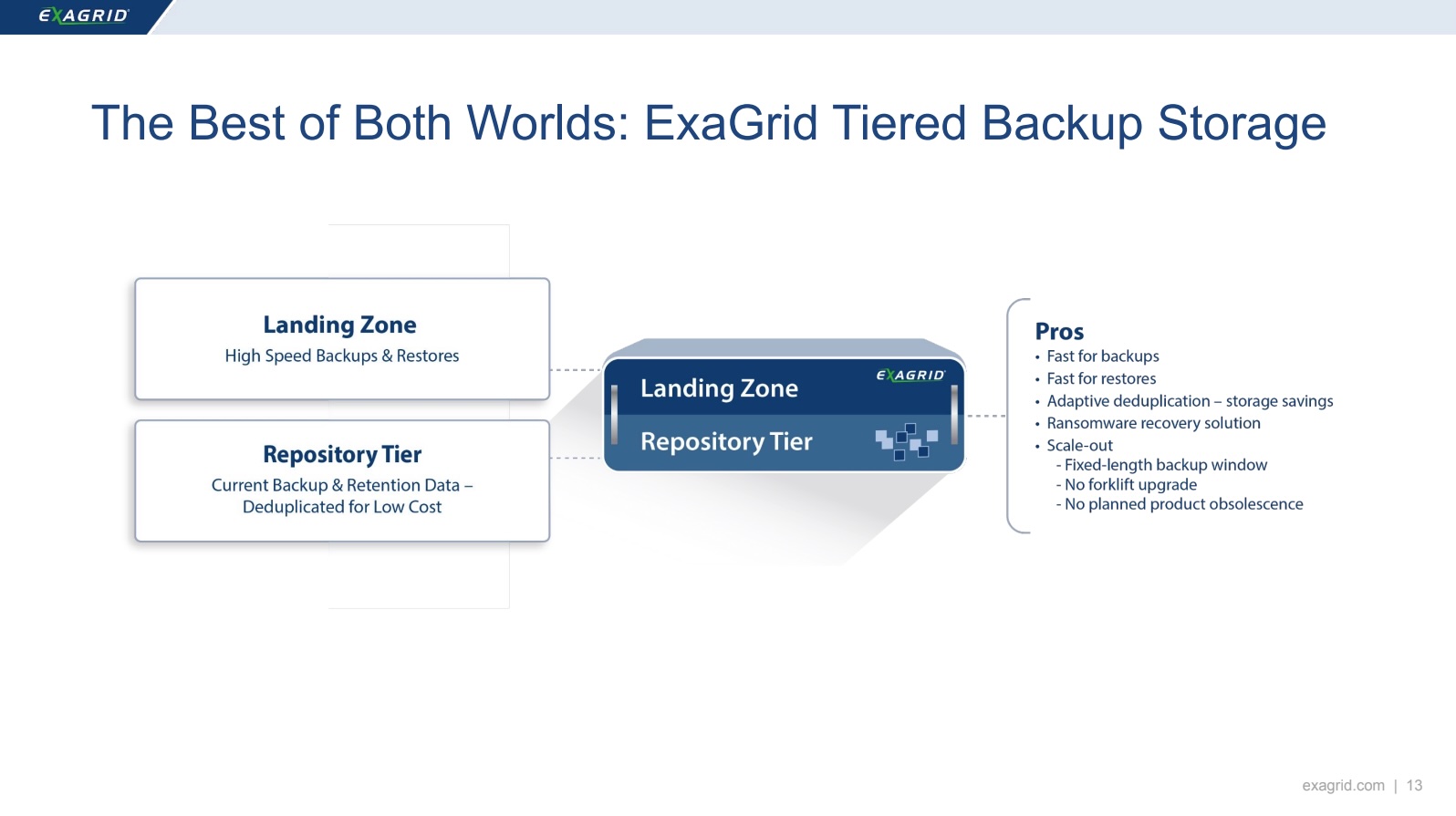

ExaGrid works with each customer to make sure their system is properly sized for full backups and retention before purchase, and recommends the right appliance models for each customer’s unique environment. In addition, ExaGrid uses a scale-out architecture, allowing customers to easily add appliances as data grows, so that customers only pay for what they need when they need it, and there is no planned product obsolescence or forklift upgrades. ExaGrid also offers a 5-year price protection. With ExaGrid, future costs are known. This makes future budget planning simple and straightforward.

- No future forklift upgrades

- No price increases for 60 months for appliance models purchased today

- No planned product obsolescence as any age or size appliance can be mixed and matched in a system and all models are support through full useful life

- Yearly maintenance and support will not be increased by more than 3% per year

GTM:

ExaGrid works with channel (reseller partners) to co-sell ExaGrid Tiered Backup Storage to upper mid-market to large enterprise organizations in every vertical.

Customers:

4,500+ customers worldwide in 80+ countries

Workloads/Use cases/Applications:

ExaGrid Tiered Backup Storage works with all industry-leading backup applications.

ExaGrid can take in backups from more than 25 backup applications and utilities. ExaGrid allows IT departments to use any combination of industry leading backup applications, utilities, and database dumps to a single ExaGrid system. ExaGrid works in true heterogeneous backup application environments.

Click to enlarge

Target market:

Organizations in any vertical who need backup storage with comprehensive security and ransomware recovery, and have 50TB to petabytes of data to back up. ExaGrid focuses on the upper mid-market, small enterprise, enterprise, and large enterprise for private and public companies, Federal and National governments, and SLED (State, Local, Education). ExaGrid also sells to the large service providers, including MSPs who offer Backup as a Service (BaaS) and large IT Data Center Outsourcers.

Competition:

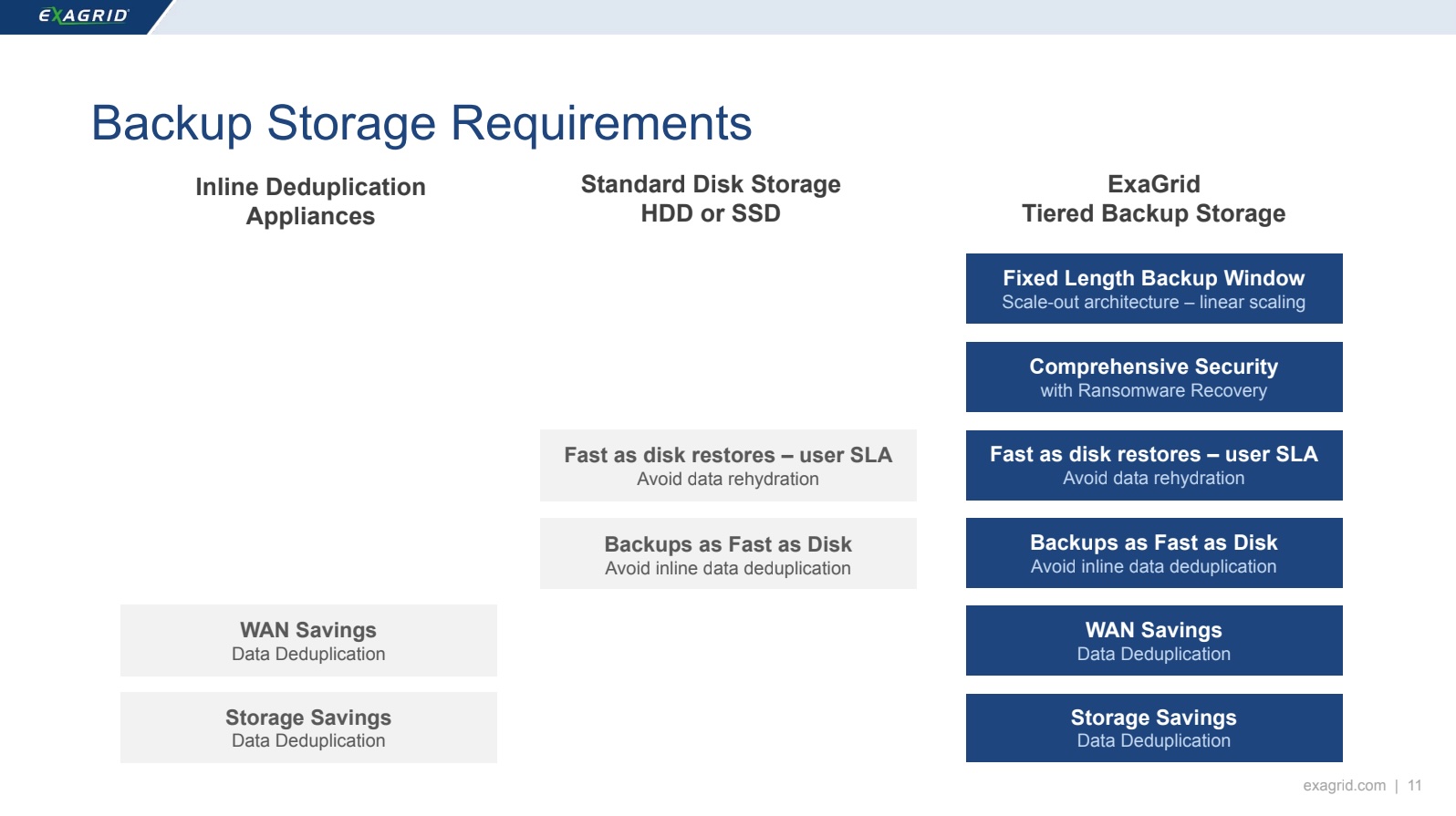

ExaGrid competes with:

- Primary storage/standard disk storage that some organizations also use for backup storage

- Inline Deduplication Appliances (such as Dell Data Domain and HPE StoreOnce)

Comments

Active player in secondary storage dedicated to backup, the product operates as an advanced backup target. The Tiered Backup Storage is a cluster of nodes, ExaGrid prefers the term grid as its names states, with a scale-up or scale-out approach, up to 32 appliances. The company develops software but sells full appliance. Each instance is split coupling a front-end and a back-end part. The backup exposed part uses classic interfaces such as NFS, SMB, S3 or specific backup integrated interface.

Click to enlarge

The idea is to acknowledge the backup session as fast as possible and reduce processing overhead on the landing zone. Things like deduplication are triggered later when data reside on the front-end part. The back-end or repository is highly efficiently optimized on the capacity dimension with data reduction ratio from 10:1 to 50:1. All front-end heads work in parallel and receive data flows from external backup source engines. To satisfy RTO, the landing zone operates as a cache and the vast majority of restored backup images come from that location.

For internal data protection, the product leverages RAID 6 considered as more efficient here and so far doesn't implement any erasure coding flavors. Purists would say that RAID assemblies are just specific or subsets of erasure coding examples. Encryption relies on SED - self encrypted disk - and doesn't impact the data processing on the long-term data appliance part.

To solidify data protection, WAN replication is supported in multiple configurations: on-premises to cloud, on-prem to on-prem, ExaGrid to ExaGrid, 1-1, 1 to many, many to 1, cascading...

In addition to Veeam, Commvault and Veritas NetBackup, the product team has chosen to add Rubrik in the coming months. As Cohesity officially swallows NetBackup, this move could represent a reduction of business opportunity and it would make sense to "replace" that partner solution.

We also understand that the product would receive a full flash flavor but no precise date has been shared yet.

On the company side, ExaGrid doesn't need to raise any new round and could investigate an IPO in the next few quarters. As Bill Andrews said, there is no pressure on this point with the financial trajectory of the company for the 16 consecutive quarters.

Regarding the revenue, the company is private but should pass the $200 million ARR very soon. With such positive results, it wouldn't be a surprise to see EaGrid joining the unicorn club soon.

It's worth mentioning as it is pretty unique in the data storage industry, Bill Andrews presents one of the longest CEO tenure as he joined ExaGrid in 2005 as CEO and he's still leading the company.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter