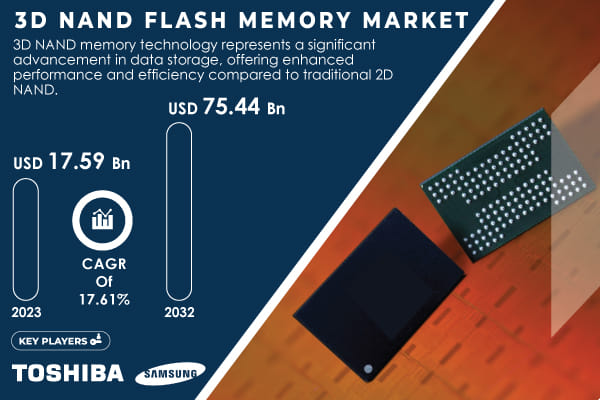

3D NAND Flash Market to Reach $75.44 Billion by 2032

CAGR of 17.61% from 2024 to 2032

This is a Press Release edited by StorageNewsletter.com on December 17, 2024 at 2:01 pmThe SNS Insider pvt Ltd.’s report indicates that The 3D NAND Flash Memory Market Size was USD 17.59 billion in 2023 and is expected to reach USD 75.44 billion by 2032, growing at a robust CAGR of 17.61% from 2024 to 2032.

Revolutionizing Data Storage with Enhanced Performance, Efficiency, and High-Density Solutions for Modern Devices

3D NAND technology marks a breakthrough in storage, offering superior performance and efficiency compared to traditional 2D NAND. Unlike the flat arrangement of memory cells in 2D NAND, 3D NAND stacks these cells vertically, creating a three-dimensional configuration.

This approach increases storage density, allowing for more memory cells in a compact footprint. With storage densities reaching up to 1Tb/chip, 3D NAND delivers faster data access and greater storage capacity.

This advanced technology is pivotal in modern devices such as smartphones, tablets, laptops, and data centers, offering high read/write speeds exceeding 500MB/s, better power efficiency, and durability of up to 1,000 write cycles. Manufacturing advancements have also reduced costs, enabling widespread adoption across consumer and enterprise sectors. The demand for faster, high-capacity storage solutions positions 3D NAND as a critical enabler of the digital era.

Dominant Market Players with their Products Listed in Report are:

- Samsung Electronics Co., Ltd. (V-NAND)

- Intel Corporation (Optane Memory)

- Toshiba Memory Corporation (BiCS FLASH)

- Western Digital Corporation (3D NAND SSDs)

- Micron Technology Inc. (NAND Flash Memory)

- SK Hynix Inc. (4D NAND)

- Kingston Technology Company, Inc. (NAND Flash SSDs)

- Crucial Technology (Crucial P5 Plus SSD)

- SanDisk Corporation (3D NAND SSDs)

- Transcend Information Inc. (3D NAND Flash SSDs)

- Phison Electronics Corporation (NAND Controllers)

- Infineon Technologies AG (3D NAND Solutions)

- Microchip Technology Inc. (NAND Flash Memory Solutions)

- ON Semiconductor (NAND Flash Memory Solutions)

- VIA Technologies Inc. (NAND Memory Solutions)

- Integrated Silicon Solution Inc. (ISSI) (NAND Flash Products)

- Western Digital Technologies, Inc. (3D NAND Technology)

- ADATA Technology Co., Ltd. (XPG SSDs)

- Seagate Technology Holdings plc (3D NAND SSDs)

- NetApp, Inc. (SolidFire 3D NAND Flash Storage).

Increasing Demand for High-Performance Storage Solutions

The increasing need for storage solutions is a significant driver in the 3D NAND Flash Memory Market. As the dependence on smartphones, tablets, and laptops increases, both consumers and businesses are demanding faster and more durable storage options to accommodate their needs. 3D NAND technology provides advantages such as faster data access speeds, increased storage capacities, and better energy efficiency when compared to older memory technologies. Moreover, the quick growth of data centers and the rising use of cloud services also boost the demand for improved memory solutions to manage the increasing data volume.

In-Depth Segment Analysis Unveils Key Drivers Shaping the Market’s Growth Trajectory

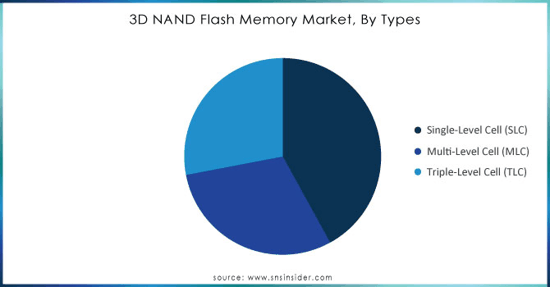

By Type: In 2023, TLC accounted for over 38% of the market share and dominated the market, due to its cost-efficiency and enhanced storage capacity. TLC stores 3 bits of data per cell, offering higher density than Single-Level Cell (SLC) and Multi-Level cell (MLC) technologies. This feature makes it a preferred choice for consumer electronics such as SSDs, smartphones, and tablets, balancing affordability and performance to meet growing storage demands.

By Application: The smartphones and tablets segment held the largest market share, accounting for over 42.06% in 2023. The demand for mobile devices with substantial storage has surged, driven by the growing use of mobile apps, multimedia content, and high-resolution cameras. 3D NAND memory, with its faster read/write speeds, improved endurance, and higher storage density, has become the preferred solution for mobile devices.

Key Market Segments:

By Types

- SLC

- MLC

- TLC

By Application

- Cameras

- Laptops and PCs

- Smartphone and Tablets

- Others

By End-Users

- Automotive

- Consumer Electronics

- Enterprise

- Healthcare

- Others

Navigating Regional Variations: Key Drivers and Challenges in Market Expansion

In 2023, the AsiaPac region held the largest market share of 32% in the 3D NAND Flash Memory Market. This is because of the existence of key semiconductor producers such as Samsung, SK Hynix, and Micron Technology.

The consumer electronics industry in the area, which includes smartphones, tablets, and laptops, is growing, leading to an increased need for innovative storage options. The growth of 3D NAND technology in countries such as South Korea, Japan, and China is being fueled by the strong emphasis on innovation and investments in R&D in the semiconductor industry in this region.

North America is anticipated to become the fastest-growing region during 2024-2032, driven by the growing need for cloud computing and the growth of data centers in the region. The demand for performing SSDs is increasing to meet the needs of cloud services, IoT applications, and HPC. Furthermore, in North America, companies like Intel and Western Digital are making substantial investments to improve 3D NAND technology. The increasing IoT network and rising data usage also play a part in the quick acceptance of advanced memory options in the area.

Table of Contents – Key Points Analysis

- 1 – Introduction

- 2 – Executive Summary

- 3 – Research Methodology

- 4 – Market Dynamics Impact Analysis

- 5 – Statistical Insights and Trends Reporting

- 5.1 – Wafer Production Volumes, by Region (2023)

- 5.2 – Chip Design Trends (Historic and Future)

- 5.3 – Fab Capacity Utilization (2023)

- 5.4 – Supply Chain Metrics

- 6 – Competitive Landscape

- 7 – 3D NAND Flash Memory Market Segmentation, by Types

- 8 – 3D NAND Flash Memory Market Segmentation, by Application

- 9 – 3D NAND Flash Memory Market Segmentation, by End Users

- 10 – Regional Analysis

- 11 – Company Profiles

- 12 – Use Cases and Best Practices

- 13 – Conclusion

Get a Sample Report of 3D NAND Flash Memory Market Forecast

3D NAND Flash Memory Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 17.59 Billion |

| Market Size by 2032 | USD 75.44 Billion |

| CAGR | CAGR of 17.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Types (Single-Level Cell (SLC), Multi-Level Cell (MLC), Triple-Level Cell (TLC)) |

| •By Application (Cameras, Laptops & PCs, Smartphone & Tablets, Others) | |

| •By End-Users (Automotive, Consumer Electronics, Enterprise, Healthcare, Others) | |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics Co., Ltd., Intel Corporation, Toshiba Memory Corporation, Western Digital Corporation, Micron Technology Inc., SK Hynix Inc., Kingston Technology Company, Inc., Crucial Technology, SanDisk Corporation, Transcend Information Inc., Phison Electronics Corporation, Infineon Technologies AG, Microchip Technology Inc., ON Semiconductor, VIA Technologies Inc., Integrated Silicon Solution Inc., Western Digital Technologies, Inc., ADATA Technology Co., Ltd., Seagate Technology Holdings plc, NetApp, Inc. |

| Key Drivers | • The surge in data-intensive applications like cloud computing, big data analytics, and AI is fueling the need for high-performance storage solutions, with 3D NAND memory providing the necessary density and speed for optimal performance. |

| • The widespread use of smartphones, tablets, and other portable devices drives the demand for compact and efficient storage solutions, with 3D NAND technology offering superior size, speed, and energy efficiency compared to traditional storage options. | |

| RESTRAINTS | •Market saturation in consumer electronics and mobile devices results in slower growth in demand for 3D NAND memory, restricting potential expansion. |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter