Weak Consumer Demand Leads to 28% Decline in DRAM Module Revenue in 2023

Drop attributed to inventory correction period for consumer electronics following pandemic, which drove down DRAM prices

This is a Press Release edited by StorageNewsletter.com on November 20, 2024 at 2:02 pmThis market report, published on November 7, 204, was written by TrendForce Corp.

Weak Consumer Demand Leads to 28% Decline in DRAM Module Revenue in 2023

TrendForce’s latest analysis reveals that the global revenue for the DRAM module market reached $12.5 billion in 2023 – a Y/Y decline of 28%. This drop was primarily attributed to the inventory correction period for consumer electronics following the pandemic, which drove down DRAM prices. High utilization rates by DRAM suppliers further intensified the price decline, before the market began to rebound in the second half of 2023.

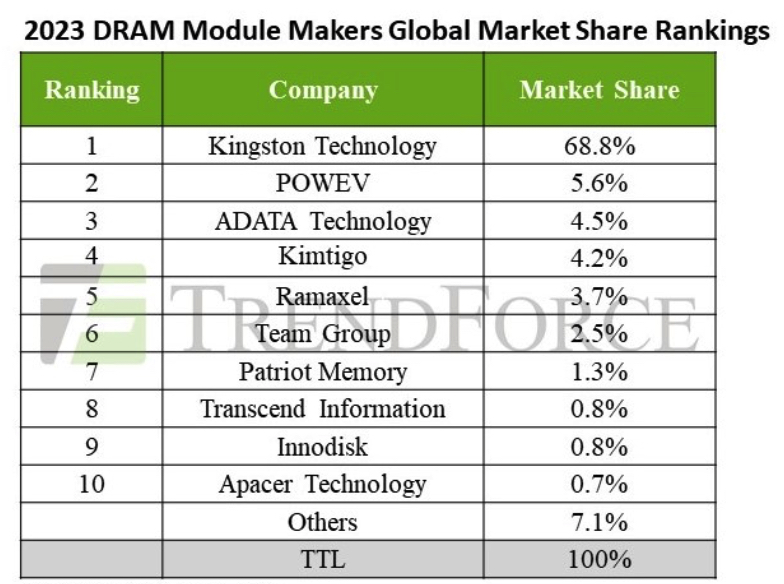

Differences in market focus and business strategies led to varied revenue performance across companies. The top 10 DRAM module makers accounted for 93% of total industry revenue in 2023. Kingston’s revenue scale declined primarily due to a trend of consumer downgrading in certain markets, which significantly impacted high-end brand sales. Nonetheless, the company has maintained its premium brand positioning and optimized its regional market layout to safeguard profitability.

Powev climbed to 2nd place, thanks to its brands Gloway, Asgard, and Sinker – which target the gaming and industrial markets. The company leveraged competitively-priced, locally produced DDR4 chips manufactured in China and promoted aggressively across both online and offline channels to help its revenue surge by almost 40% in 2023.

Adata retained 3rd place, maintaining steady revenue Y/Y by strategically building low-cost inventory in early 2H23 and ramping up shipments from 4Q22.

Kimtigo expanded both domestic and international sales channels, along with its gaming and industrial product lines, rising to 4th place in revenue.

Ramaxel, meanwhile, saw a decline in channel market shipments due to reduced market demand, dropping to fifth place. However, the company has established an initial presence in the server DRAM module business, and with growing demand in the server market and the drive for domestic production, it is poised to accumulate momentum for future growth.

TeamGroup has concentrated on the gaming sector, successfully expanding its e-commerce and distributor channels in North America and also securing enterprise-level server DRAM projects. In 2023, it achieved the highest revenue growth among the top ten module makers, climbing 3 positions to reach 6th place.

Patriot Memory maintained its 7th-place ranking by diversifying into consumer, gaming, and industrial sectors.

Companies with a higher focus on industrial applications, ranked 8th through 10th, saw revenue declines due to inventory adjustments. Transcend, in 8th place, expanded its consumer product line in 4Q23, re-entering the top 10 in revenue rankings.

Innodisk, ranked 9nth, has deeply rooted itself in the industrial market while actively expanding its edge AI product line.

Apacer, holding the 10th position, focuses on the industrial segment as well, with revenue impacted by client inventory adjustments.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter