Recap of 58th IT Press Tour in Boston, MA

With 8 companies: Congruity360, ExaGrid, HYCU, Hydrolix, iRODS, Swissbit, Sync Computing and Wasabi

By Philippe Nicolas | November 15, 2024 at 2:00 pm This article has been written by Philippe Nicolas, initiator, conceptor and co-organizer of the event launched in 2009.

This article has been written by Philippe Nicolas, initiator, conceptor and co-organizer of the event launched in 2009.

This 58th edition of The IT Press Tour took place in Boston, MA, early October and all the press group and organizations had time exchanging about IT infrastructure, cloud, networking, security, data management and storage and of course AI present across all these topics. 8 companies have been met, they are by alpha order Congruity360, ExaGrid, HYCU, Hydrolix, iRODS, Sync Computing, Swissbit and Wasabi Technologies.

Congruity360

Player a bit confidential, it appears to be an alternative player in the dynamic unstructured data management segment. The firm has developed a rich and comprehensive software solution, Classify360, to tackle ever growing pains to manage such data within enterprises. The company was founded in 2016 and raised $25 million so far.

The company acquired 2 organizations, NextGen Storage and Seven10, respectively in 2017 and 2020, and continues to leverage these technologies and AI to improve data migration services and cloud aspects. It appears that the Seven10 asset was sold to Park Place Technologies in 2022.

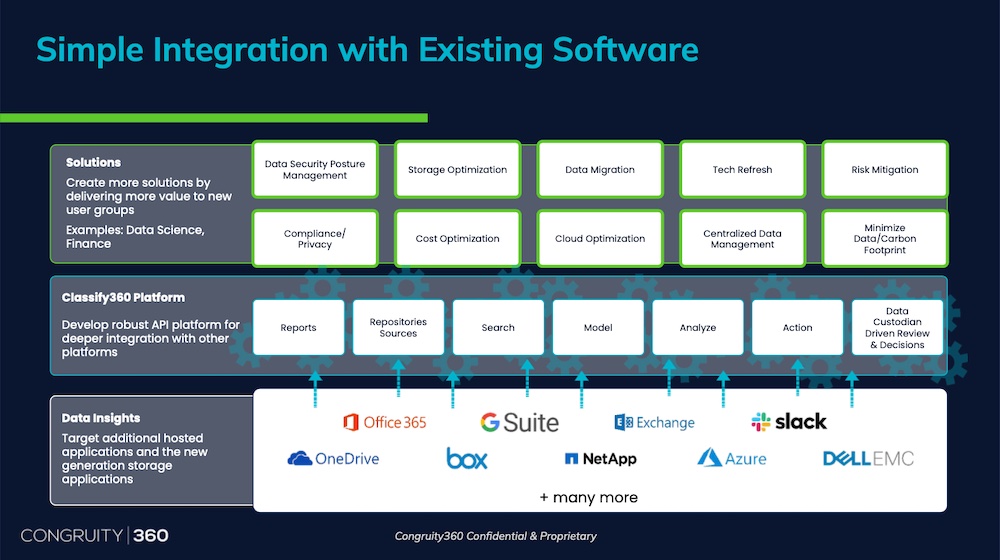

The product Classify360 covers several domains such as storage optimization, cloud migration, data protection, DSPM, AI enablement and GRC with competitors in each one. The team identified its competition with a reference actor in each category: storage optimization with Komprise, cloud migration with Datadobi, data protection with Veritas, DSPM with Laminar, AI enablement Microsoft and GRC with BigID. The interesting aspect is related to the market size and opportunity of each segment, the number of players and the absence of a clear established strong leader. Many of them are small and pretty limited in scope which is a paradox, Komprise and Datadobi are small companies when you consider their annual revenue. Laminar, small as well, was acquired by Rubrik mid 2023 as the backup player already identified DSPM as a key need.

Rich in terms of features, the solution works with 3 simple steps: understand the data environment with files, folders and content informations, centrally indexed and analyzed, then the second phase relies on the classification of all the data discovered based on supervised machine learning and rules and parameters set and finally actions on these collected data triggered by automated policies to move, delete, tag, secure, deduplicate, encrypt, alert… Several of these tasks remind me of what the industry delivered 10 or even 20 years ago with SRM or storage resource management but for sure, recent challenges have invited players to develop more rich and modern answers especially with embedded AI. This is of course obvious with the security pressure on the infrastructure, both on-premises and in the cloud, as data is present in both places.

Data sources are various supporting NFS, SMB and S3 plus collaboration software such as Office365, Google Workspace, Microsoft Exchange, OneDrive & Azure, Box, Slack, NetApp, Dell EMC…

The business model is fully indirect leveraging resellers, integrators and distributors as an extension of classic software and hardware storage players.

The company prepares an announcement soon with AI and DSPM.

Click to enlarge

ExaGrid

Reference in secondary storage dedicated to backup, it currently delivers an annual revenue just below $200 million and is confident to pass this barrier for the next fiscal year. The growth is strong and sustained for several quarters illustrating that the solution developed by the company finds its markets. The firm is still led by Bill Andrews, CEO for almost 20 years, one of the longest tenure in the industry. The current installed base touches more than 4,400 customers with deals becoming larger and larger, several of 7 digits, over 80+ countries. The firm confirms its desire to dig into the backup segment, the segment is big enough, with new challenges and regulations like DORA, NIS2 and others.

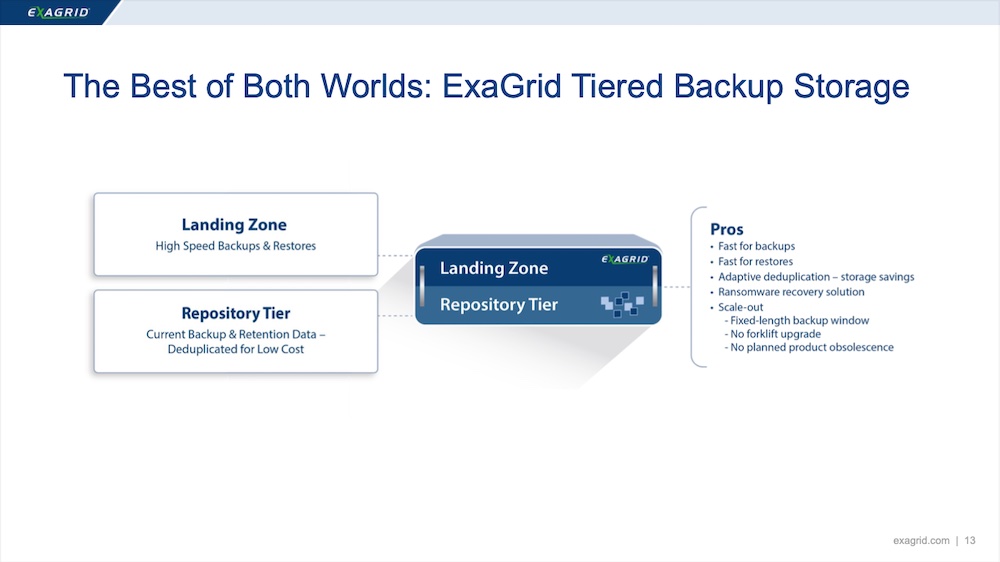

As backup has seriously evolved with strict requirements for a few decades, storing backup images on disk-based units became a natural answer for modern RPOs and RTOs.

The team develops storage software to deploy on commodity hardware for keeping backup data but sold as appliances. This is aligned with the engineering choice to leverage standard components but also modern and recent technology developments. Very scalable as users can start small and grow the configuration by adding nodes, the ExaGrid product supports up to 6PB. Unlike other backup storage products, ExaGrid’s idea is to store as fast as possible the received data stream to acknowledge the backup process in the shortest time. Then asynchronously, a data reduction process is triggered to reduce the data footprint and store this result in a secured, not exposed outside, data storage zone, named the repository tier. With this design in mind, restores are also fast as the vast majority of these operations consider recent images. It means that some data is maintained in dual state, on the landing and repository zones. For even more protection needs, replication to other ExaGrid targets are possible in star, up to 16 sites, cascade topology but also to the cloud.

Key partnerships are essential for the vendor, top ones are Veeam, Veritas and Commvault and we anticipate some extension with Rubrik. We realize that the company also started some activities with HYCU.

Regarding the future for the company, we understood that Andrews and his team still wish to stay independent but could potentially target an IPO to convert the success. At the same time, the team doesn’t need to raise any money from the private or public sector. As the trajectory is pretty impressive for several years, we realize that ExaGrid could join the candidate list of Storage Unicorn published bi-annually by Coldago Research.

Click to enlarge

HYCU

Obvious active and key player in SaaS and cloud backup, it continues to deliver new services around new applications to protect, regulations and data mobility.

It has more than 4,200 customers over 78 countries leveraging 440+ partners globally. Its market penetration is significant thanks to a vast list of supported applications both on-premises but above all online. This is clearly a direction for enterprises ignoring their real number of subscribed online services but maintaining a strong risk and security exposure. It was recently detailed in their SaaS survey available here. And recent events especially the famous Crowdstrike bug resonate in all people’s minds not to forget the Google accidental massive records deletion of pension data.

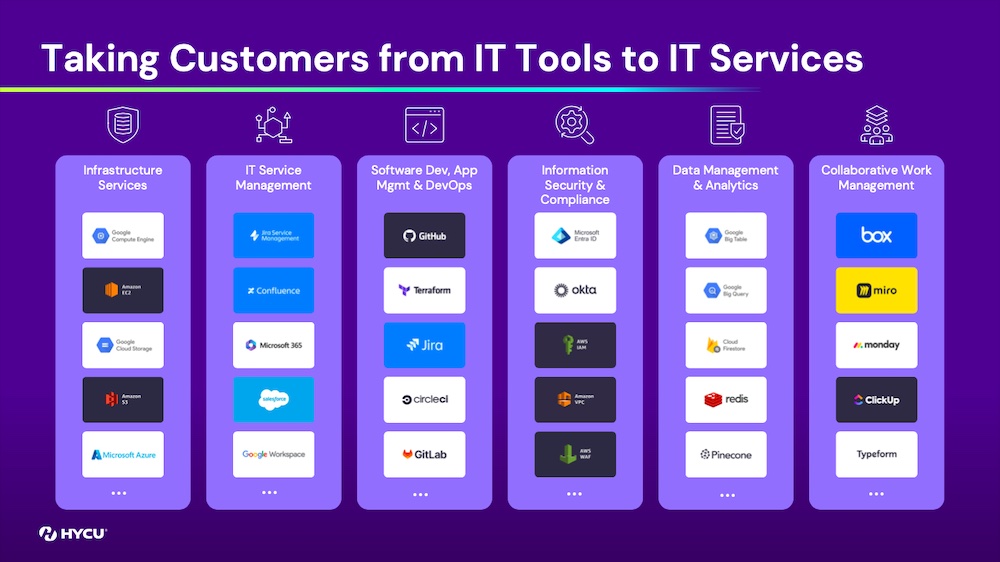

HYCU has shaken the SaaS backup landscape with a new approach offering the capability to develop fast specific application modules coupled with the R-Cloud engine. Today more than 80 applications and SaaS services are covered and more are coming, which appears to be the largest number available today. They support various domains like infrastructure services, ITSM, DevOps, IAM, Data Management & Analytics and Collaborative Work Management.

This is a critical aspect as backup suffers from the infrastructure diversity and applications choice from users. Finding a solution that can address at the same time on-premises and cloud deployments, bare-metal, VMs, containers and SaaS applications storing backup images locally or in the cloud as well is a real mission.

It explains why this IT part became a nightmare and offers some opportunities for new or recent players. Again it’s a classic cycle, the industry creates its own complexity trying to solve new challenges inviting new players to address these new levels, probably a virtuous circle.

Backup data is a foundation IT service and the Boston team has recognized the need to restore data anywhere, from VMware to AWS or GCP to Nutanix or Azure, mixing on-premises and cloud environments.

The latest news that puts pressure on data protection vendors such as HYCU and users is the soon in-place European Union regulations named DORA and NIS 2. This must do rules according to the article 12 will force users to keep a local copy of their data, pretty easy with on-premises applications as it is where we’ll come from but could represent a real difficulty for SaaS and cloud applications. It is confirmed by new secondary storage platforms supported by R-Cloud with Nutanix Objects, Dell, Cloudian, OVHcloud in addition to the ones currently available.

Click to enlarge

Hydrolix

Founded in 2018 by Marty Kagan, CEO, and Hasan Alayli, CTO, it raised so far $65 million with the mission to develop a modern observability platform dedicated for processing real time streaming logs. The Hydrolix streaming data lake has already penetrated 287 customers and delivers 12x Y/Y growth for just a fraction of classic solutions costs. The founding team leveraged its strong background in distributed observability with massive capability to process real time logs coming from CDNs or client telemetry. Real time observability coupled with historical dimension really creates a differentiator thanks to Hydrolix innovations in the product design.

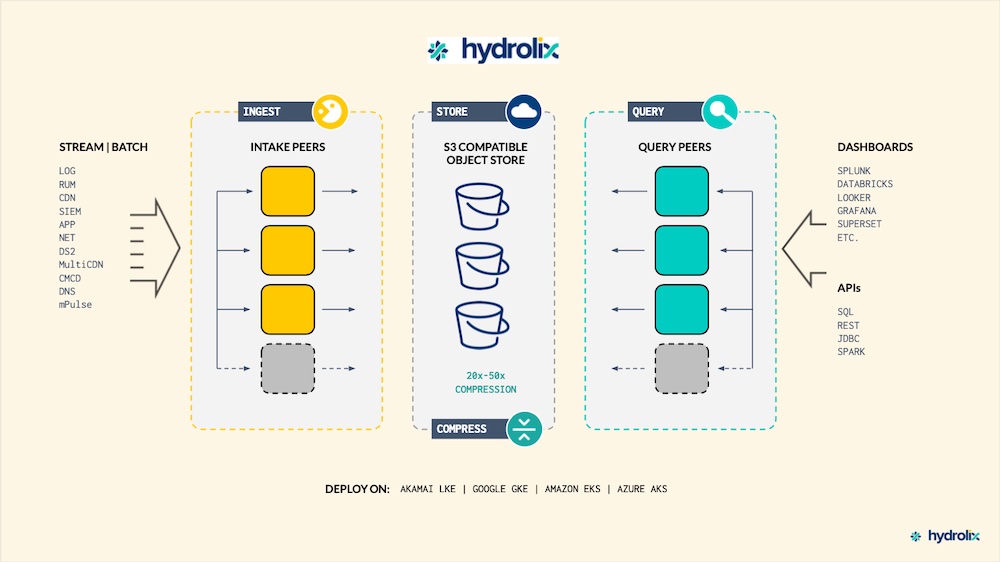

The architecture of the product is around 3 key services, ingest, store and query. On the ingest side, several access methods are available via stream or batch mode with data transformation realized in this phase and then all data is routed and stored on compatible S3 storage deployed on-premises or in the cloud. Very efficient compression methods are used to reach 20:1 or even 50:1 all queried via SQL, Spark and other APIs and visible in dashboards such as Splunk, Databricks, Looker, Kibana or Grafana. Each of these 3 cacheless decoupled services are independently scalable dynamically based on what is needed to align the platform SLA on key objectives.

The service is deployed to address real time and historical big data analytics use cases in various sectors. The first example is about the famous movie company Paramount. Its IT team is able to ingest data at 10.8 million rows per second rate and globally they collected 53 billions records that is translated into 41TB of data transformed finally stored as 5.76TB of compressed data. The second one is illustrated by Akamai, both a customer and a partner, who delivers this Hydrolix service under the name TrafficPeak on the Akamai Connected Cloud, the vendor’s massive distributed edge and cloud platform. Users realized that understanding all these CDNs data is a must in a very active security risk moment with very high volume of traffic but should cost less for efficiently collecting, storing and querying over a multi year period. Hydrolix insisted that these global costs drop by 75%.

The product is available as a container orchestrated by Kubernetes for Akamai LKE, Google GKE, Amazon EKS and Azure AKS but also on-premises. The service is promoted and marketed with a direct sales force but also via key partners like Akamai.

The firm also announced a partnership and technology integration with Quesma, a Polish database access software vendor, to connect their platform to Kibana and OpenSearch Dashboards via Beats/Logstash and Data Prepper ingestion tools.

Click to enlarge

iRODS

It’s not new, open source is everywhere and touches every IT segment and data management simply crystallizes this deep wave. Just see what Linux has triggered for a few decades on the market and you realize its ubiquitous presence. The iRODS consortium represents a strong initiative addressing the long time need of universal data management.

Historically, the project started in 1995 as a storage resource broker at San Diego Super Computer Center, General Atomics, then in 2006 the name iRODS has been introduced with an open source BSD-3 license, transitioned to UNC Chapel Hill/RENCI to finally landed as the consortium in 2013 with a community and membership but also services and support.

The solution is adopted in various sectors but clearly the vast adoption comes from super computers and research centers and universities. And we explain this by a financial criteria dimension, these public entities have human skilled resources that can leverage this open source software solution, contribute and extend it, instead of buying commercial software. They, of course, prefer to route their budget to buy hardware that can’t be replaced by human intelligence.

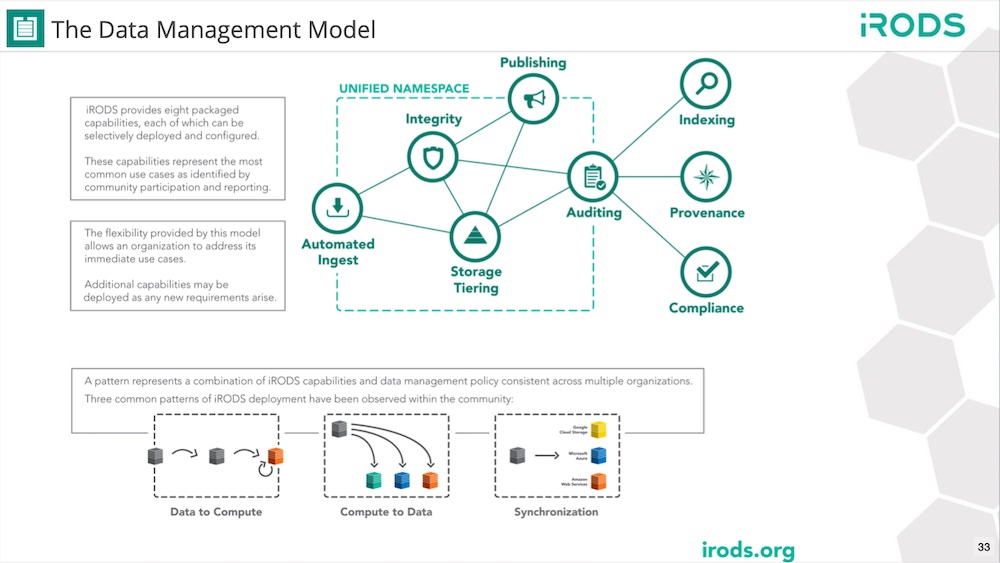

iRODS, as a software, provides an abstraction layer and represents a universal model for data integration, control, automate, search and access with a rich metadata and advanced policies management exposing a unified namespace from an existing infrastructure. It relies on a client-server architecture and the software is written in C++ introducing the iRODS protocol and RPC API. On the client side, it is offered as CLI, WebDAV, WebApp… leveraging the existing data silos, file servers, NAS, object and cloud storage and even archival storage entities. The policy engine is very comprehensive with movement, verification, retention, replication, placement, metadata extraction, application and conformance to build more global actions such as tiering, auditing, indexing, integrity, ingest, publishing and compliance. Then use cases and associated applications are pretty wide with file system synchronization across sites, providing data to compute for instance in HPC or specific compute zone or the reverse. Again the key element here, as seen by other players in the industry we mentioned for probably 2 decades now, is the unified namespace with of course some significant evolutions.

The team plans to have some vertical integrations with some identified key sectors applications, add time series and statistics and obviously dashboards with costs and visibility of all resources and advanced management capabilities.

iRODS will exhibit at the RENCI booth at SC24 in Atlanta, GA, very soon now.

Click to enlarge

Swissbit

Leader in Europe for flash media and SSD, Swissbit confirms its business trajectory with today 400 employees with 5,000 customers fueled by its production capacity of 3 million units per month.

A few milestones are key to better understand the current profile of Swissbit. First the story started with a MBO in 2001 from Siemens Memory, 2008 the creation of industrial memory solutions, 2013 the addition of security solutions, 2014 for SSD and 2019 for a production unit in Berlin, Germany. Another strategic event happened in 2020 with the investment of Ardian within Swissbit, 2 acquisitions, the 1st in 2021 with Hyperstone, the German developer of SATA SSD controller and later some synergy and assets swallowing of Colorado-based entity Burlywood Technology following a partnership announced in 2022. The production site in Berlin illustrates the level of independence Swissbit has achieved for a few years offering some guarantees for some specific markets or regions.

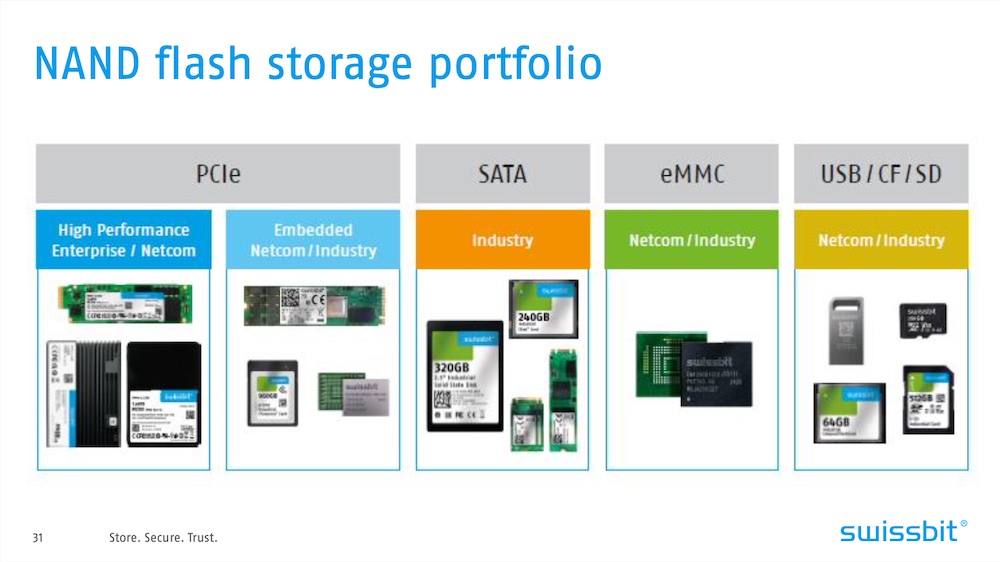

Designed to address industrial, networking and enterprise data storage, the memory and storage team has chosen to partner with NAND and SSD controllers key players such as FADU, Kioxia, Micron, Phison, Samsung, Silicon Motion and SK Hynix in addition to the technology they now master.

The product line is pretty wide with different form factors, capacity, connectivity and interfaces from PCIe, SATA, NVMe, eMMC and USB/CF/SD cards.

The second activity for the company is related to digital identity and secure access FIDO2 certified solutions. One of them is the phishing-resistant MFA represented by the iShield Key product family with 2 instances: the FIDO2 one and the Pro. A new one is coming named iShield Key MIFARE combining also FIDO2. All these advanced security products offer strong authentication, access control, time tracking, secure login and one time password. This instance supports up to 300 passkeys for passwordless logins. For government segments, the company signed a partnership with RSA and together they provide the RSA iShield Key 2 series.

For embedded systems, the security aspects must comply with various regulations and standards in Europe, US and globally. The vendor has released a security upgrade kit with encryption and access control for MicroSD/SD cards. The encryption uses a real time AES 256 bits and also the memory considered is based on industrial grade pSLC to improve endurance.

Swissbit will exhibit at SC24 in Atlanta, GA, very soon now.

Click to enlarge

Sync Computing

Initiated at MIT, Sync Computing is a very young company founded in 2019 with $22.9 million raised as of today. With roots in high performance computing, the team has already signed some key technology partnerships with Nvidia and Databricks.

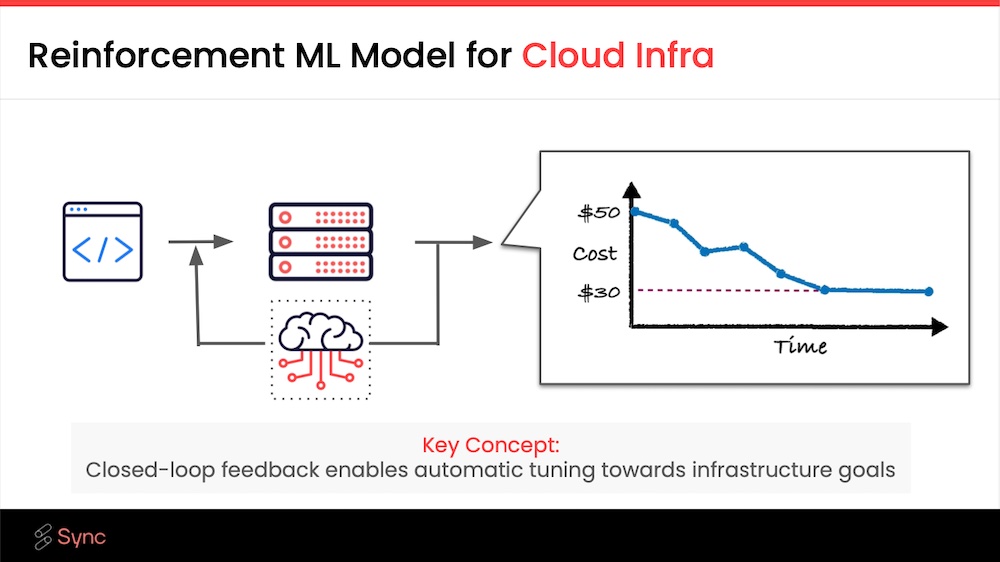

Already identified as a key need in HPC with job schedulers and we all know famous of them, some historical ones like NQS, Platform or Altair… and today a highly visible one is Slurm, the resource allocation problem is a complex challenge to solve. Globally two approaches addressed from different starting points: the resource itself or the task. In other words, it is again critical to allocate the right job to the right resource at the right time and profiling tasks and monitoring the IT computing environment are mandatory with pricey configurations. At scale, this is a real challenge that impacts significantly SLAs. And the declarative compute resources appear with ML models aligned with cloud infrastructure. The idea is to connect the environment to an intelligent service that learns from the usage and consumption and other key data such as cost inputs. The model is then perpetually enriched with closed-loop feedback and thus delivers better results as time goes.

Chosen to illustrate and validate their idea, Databricks is today widely used but with high associated cost. Sync develops Gradient as an AI-based software solution to solve these 3 dimensions: cost, optimization and SLAs.

Alternatives appear to be less dynamic and automatic, here the value is brought by the AI integration. Gradient relies on self-improving ML algorithms developed at MIT leveraging the close-loop feedback behavior.

Adoption has taken off with a few references like Duolingo, Forma.ai, Insider, Mediaradar, Abnormal or Handelsblatt confirming 2:1 ROI and 2x faster runtimes. As mentioned above, Sync Computing has identified Databricks as a first data intensive computing environment to optimize but more are coming.

Click to enlarge

Wasabi Technologies

Recognized as the elephant in the room, shaking seriously the top 3 cloud providers, AWS, GCP and Azure, Wasabi Technologies embodies a real leader targeting storage services. The company shared impressive figures with more than 100,000 customers, 15,000+ partners, several exabytes of data with more than 1EB just of Veeam backup images, all this stored on 14 storage regions on the planet. On the financial aspect, as their business is really capital intensive with hardware to buy and deploy, the firm has raised more than half a billion dollars. The revenue pace is impressive with more than 60% growth year-over-year.

On the service side, Wasabi offers an online S3 storage service at a fraction of the AWS price. It is charged at $6.99TB/month without any charges for egress, downloads or API requests which seriously impact the fee for other providers being a real cash machine. And this choice explains the success of the company, they pick a standard, a de-facto one, S3, and offer an alternative service at a lower price. The model also offers a reserved capacity option with 1, 3 or 5 years increments.

The business model relies on an indirect way with partners through channels. Partners integrate their products with Wasabi S3, it is the case in data protection, video surveillance or media and entertainment. For use cases, it means backup and recovery, archiving, data analytics, application development, content delivery, surveillance, IoT and AI/ML.

A few months ago, the company ran a survey and discovered that 92% of education respondents expect an increase of data stored in the cloud in the coming months spending half of their budget on egress fees. It is also 90% in the surveillance and 97% in the M&E segments.

But as structured data is inherently easy to search, for unstructured data it still is a challenge even if we saw and know some solutions for years with some interesting content indexing technologies, online or local. So the company has made a decision and has jumped into AI with the acquisition of Curio AI from GrayMeta early this year. Its CEO joined Wasabi as SVP of AI and ML. The idea here is to feed and enrich metadata with information discovered on the stored content and then offer this search capability to users to help them find the right info in seconds. Clearly this AI-powered object storage is a key direction for Wasabi.

Speaking about the future, David Friend told us that an IPO could be a natural next step for the company. On the product side, pushed by some European regulations, an on-premises flavor of the solution will appear with of course remote copy or replication to guarantee committed 11x9s data durability.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter