Intevac: Fiscal 3Q24 Financial Results

Sales up 59% Y/Y, not profitable

This is a Press Release edited by StorageNewsletter.com on November 13, 2024 at 2:02 pm| (in $ thousand) | 3Q23 | 3Q24 | 9 mo. 23 | 9 mo. 24 |

| Revenue | 17,915 | 28,505 | 39,758 | 52,662 |

| Growth | 59% | 32% | ||

| Net income (loss) | (2.2) | (1.6) | (7.0) | (10.3) |

Intevac, Inc. reported financial results for the quarter and nine months ended September 28, 2024.

“We are pleased to report third-quarter results favorable to our expectations going into the quarter,” commented Nigel Hunton, president and CEO. “Technology upgrades in support of next-generation HAMR media continue to drive the majority of our business, and total revenues from HDD upgrades, spares, and field service totaled over $13 million, exceeding our expectations. With an additional $15 million of largely pass-through revenue associated with the transfer of inventory to a customer, the gross margin and earnings per share performance of the core business likewise exceeded expectations. Positive free cash flow performance in the quarter drove an increase in total cash, restricted cash, and investments to over $72 million at quarter-end, and we remain on track to maintain the strength of the balance sheet in 2024 to enable strategic investments in support of future growth.”

Firm’s non-GAAP adjusted results exclude the impact of the following, where applicable: (i) restructuring charges and (ii) discontinued operations. A reconciliation of the GAAP and non-GAAP adjusted results is provided in the financial table included in this release. See also “Use of Non-GAAP Financial Measures” section.

3FQ24 Summary

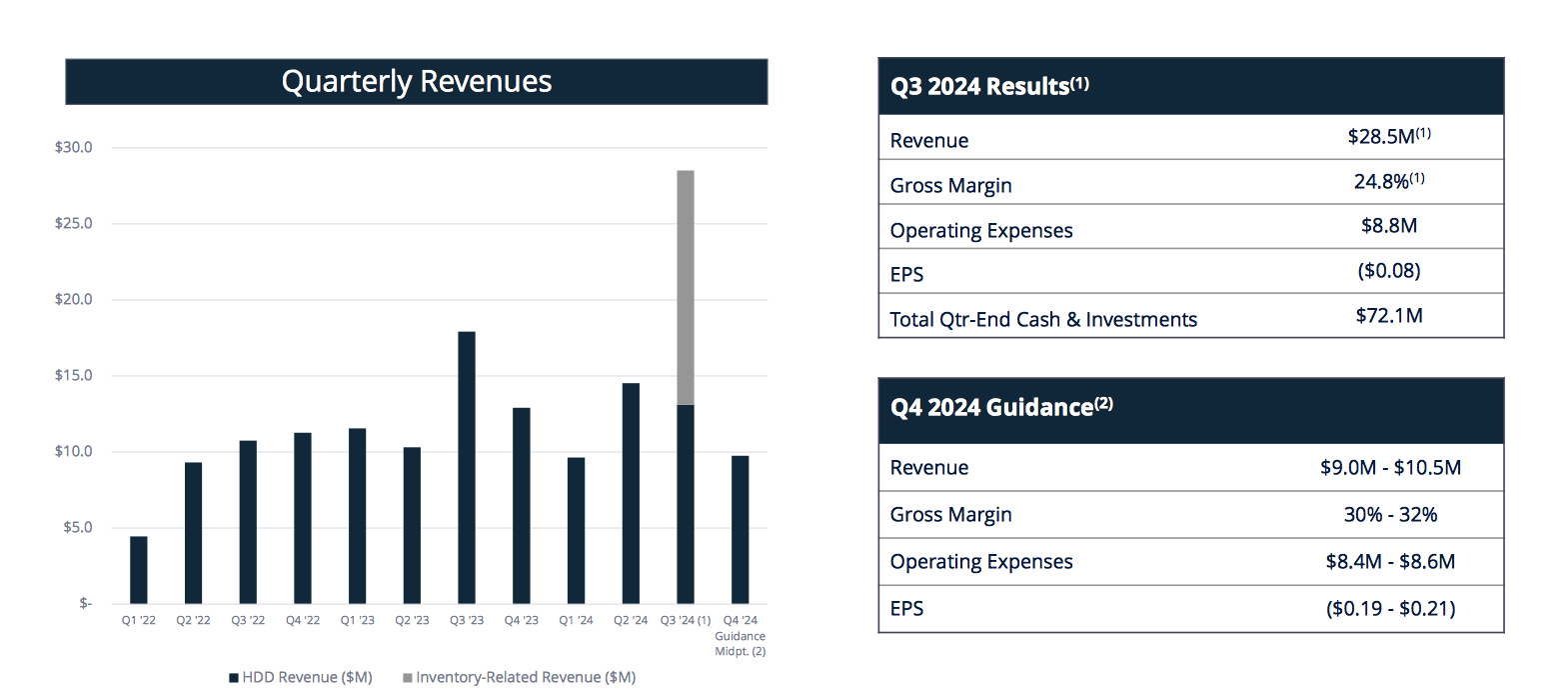

Revenues were $28.5 million, consisting of HDD upgrades, spares and service, as well as approximately $15 million of revenue related to the inventory agreement with a customer. Gross margin was 24.8%, compared to 39.1%, in 3FQ23. The inventory revenues included a small amount of gross profit to cover the operating expenses associated with procuring and storing the inventory, and the impact of this profit along with certain other inventory adjustments collectively impacted gross margin by approximately 20 percentage points. Operating expenses were $8.8 million, compared to $8.4 million in the third quarter of 2023. The operating loss was $1.8 million compared to $1.4 million in the third quarter of 2023.

The net loss for the quarter was $2.2 million, or $0.08 per diluted share, compared to a net loss of $1.6 million, or $0.06 per diluted share, in 3FQ23. The non-GAAP net loss for the third quarter of 2024 was $2.2 million, or $0.08 per diluted share, compared to a non-GAAP net income of $0.1 million, or $0.00 per diluted share, in 3FQ23.

Order backlog was $44.4 million on September 28, 2024 compared to $42.5 million on June 29, 2024 and $46.5 million on September 30, 2023. Backlog at September 28, 2024 and June 29, 2024 did not include any 200 Lean HDD systems. Backlog at September 30, 2023 included 2×200 Lean HDD systems.

The company ended the quarter with $72.1 million of total cash, cash equivalents, restricted cash and investments and $111.5 million in tangible book value.

First 9 Months 2024 Summary

Revenues were $52.7 million, compared to first 9 months of 2023 revenues of $39.8 million, and consisted of HDD upgrades, spares and service, as well as approximately $15 million of revenue related to the inventory agreement with a customer. Gross margin was 31.9%, compared to 35.9% in the first 9 months of 2023. The inventory revenues included a small amount of gross profit to cover the operating expenses associated with procuring and storing the inventory related to the cancelled order, and the impact of this profit along with certain other inventory adjustments collectively impacted year-to-date gross margin by approximately 13 percentage points. Operating expenses were $26.3 million, compared to $25.6 million in the first 9 months of 2023. The net loss was $7.0 million, or $0.26 per diluted share, compared to a net loss of $10.3 million, or $0.40 per diluted share, for the first 9 months of 2023. On a non-GAAP basis, the net loss was $8.1 million, or $0.30 per diluted share, compared to a net loss of $9.0 million, or $0.35 per diluted share, for the first 9 months of 2023.

Comments

Evolution of Enabling Technology Through Thin Film Deposition

HDD Solutions

- Global powerhouse in the design, development, and commercialization of thin film deposition and advanced materials technologies

- Intevac's flexible architecture enables continuing process technology and throughput advancements to support the long-term storage requirements at the data center

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter