SSD Unit Shipments Decreased by 8% Q/Q to 62.4 Million in 3Q24

Even as capacity jumped 10% to 99.187EB

This is a Press Release edited by StorageNewsletter.com on November 12, 2024 at 2:17 pmThis market report, published on November 8 2024, was written by Trendfocus, Inc. in its CQ3 ’24 Quarterly Update – Executive Summary.

3Q24 SSD Exabytes Post Another Strong Quarter

with Increases Driven by Solid Enterprise PCle Growth

With continued robust growth in all major market segments for enterprise SSDs, the sector once again offset a sluggish PC market:

- Overall SSD unit shipments decreased by 8% Q/Q to 62.443 million, even as capacity jumped 10% Q/Q to 99.187EB

- Due to ongoing sluggish PC OEM demand and some persistent inventory, overall client SSD units fell again to 48.142 million units, a 12% decline Q/Q, while capacity dipped slightly by 1 % in the same timeframe, totaling 37.716EB

- Enterprise PCQ/Qe units set a new record, climbing 29% Q/Q to 10.954 million, while capacity shipped achieved a third consecutive record quarter, reaching 55.654EB, an impressive 25% increase Q/Q

- Enterprise SATA had another lackluster quarter, down 23% in units and 45% in exabytes, dropping to 2.642 million and 2.546EB, respectively

- SAS SSD unit shipments declined by 11 % to 0.705 million, with capacity climbing slightly by 0.9% to a total of 3.270EB

- Total NAND bit shipments increased slightly to 218.40 total exabytes, up 2% Q/Q

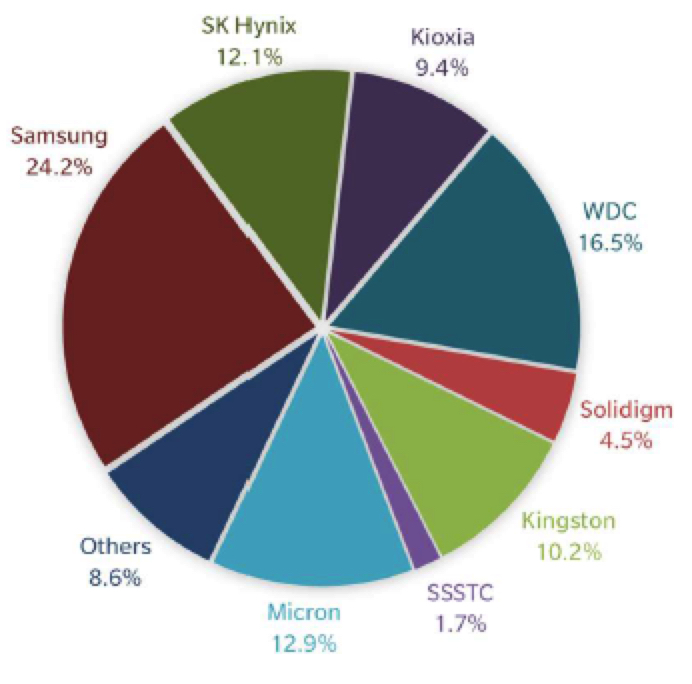

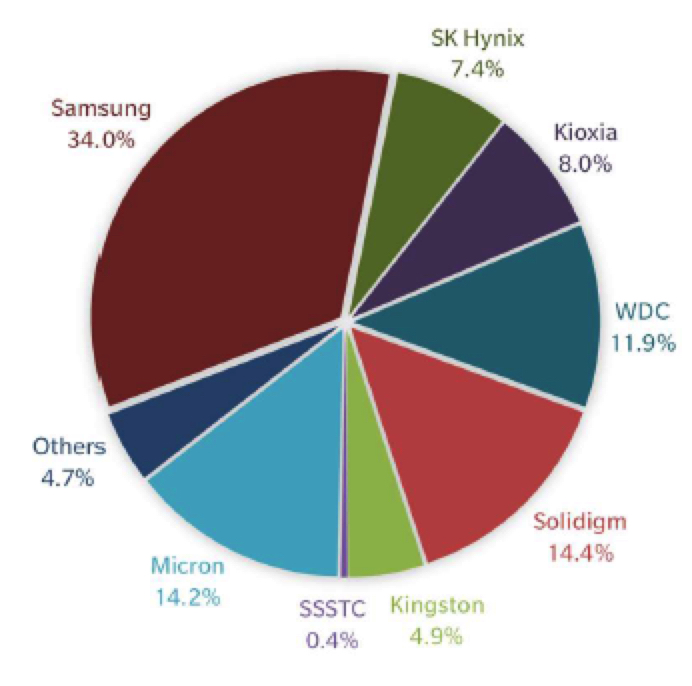

CQ3 ’24 SSD Market Share, by Supplier, Units (million), Exabytes

Total SSD Market: 62.443 Million Units

Total SSD Market: 99.187EB

Total SSD Market: 99.187EB

* Preliminary data – values may change.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter