Western Digital: Fiscal 1Q25 Financial Results

Western Digital: Fiscal 1Q25 Financial Results

Revenue at $4.1 billion, up 9% Q/Q and 49% Y/Y, good outlook

This is a Press Release edited by StorageNewsletter.com on October 28, 2024 at 2:01 pm

| (in $ million) | 1Q24 | 1Q25 | Growth |

| Revenue |

2,750 | 4,095 | 49% |

| Net income (loss) | (700) | 481 |

News Summary

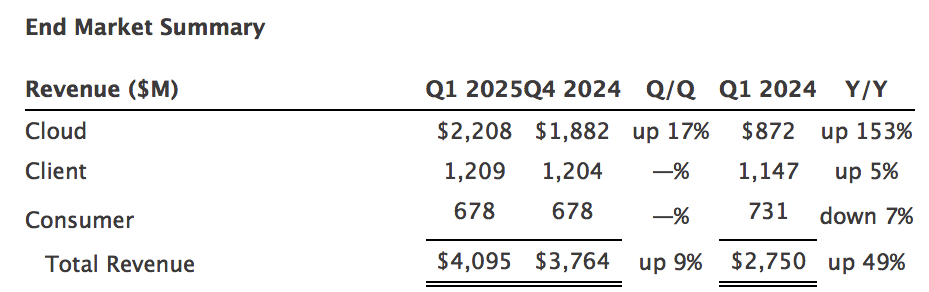

- 1FQ25 revenue was $4.10 billion, up 9% Q/Q. Cloud revenue increased 17% Q/Q, Client and consumer revenue remained flat Q/Q.

- 1FQ25 GAAP earnings per share was $1.35 and Non-GAAP EPS was $1.78.

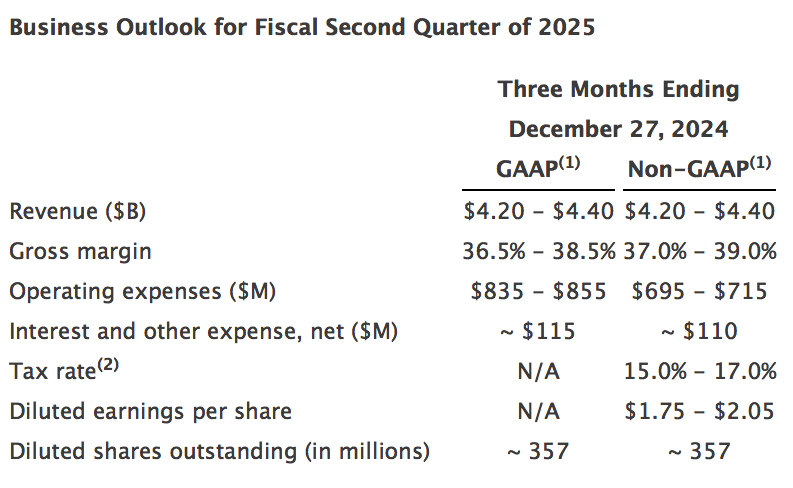

- Expect 2FQ25 revenue to be in the range of $4.20 billion to $4.40 billion.

- Expect Non-GAAP EPS in the range of $1.75 to $2.05.

Western Digital Corp. reported fiscal first quarter financial results.

“Western Digital’s performance in 1FQ25 demonstrates our commitment to operational excellence and disciplined capital investment as our focus on lasting quality and reliability, driven by industry leading innovation and a diversified portfolio, has allowed us to target the most attractive end markets to improve profitability,” said David Goeckeler, CEO. “The strength of our diversified product portfolio is demonstrated by the rapid emergence of enterprise SSD as a core pillar of growth within our flash business. The strength of our HDD product portfolio lies in our UltraSMR technology, delivering the industry’s highest capacity HDDs with unmatched reliability, quality, and performance, offering a compelling TCO to our customers. With the continued proliferation of the AI Data Cycle, our flash and HDD product portfolios are well-positioned to capitalize on significant opportunities as adoption continues to grow.”

In 1FQ25:

- Cloud represented 54% of total revenue. On a Q/Q and Y/Y basis, the increases were driven by higher nearline shipments in HDD and enterprise SSD bit shipments to data center customers.

- Client represented 29% of total revenue. Compared to last quarter, flash bit shipment growth in gaming and mobile was offset by a decline in PC OEM, while HDD revenue was flat. Y/Y, an increase in flash revenue was primarily due to higher ASPs as bit shipments declined, and was partially offset by lower HDD revenue.

- Consumer represented 17% of total revenue. Q/Q, a slight growth in HDD offset a decline in flash driven by softer consumer demand. Y/Y, the decrease was due to lower flash and HDD bit shipments partially offset by improved pricing in both flash and HDD.

(1) Non-GAAP gross margin guidance excludes stock-based compensation expense, amortization of acquired intangible assets and amortization of patent licenses related to a litigation matter, totaling approximately $20 million to $30 million. The company’s non-GAAP operating expenses guidance excludes stock-based compensation expense and expenses related to business separation costs, totaling approximately $130 million to $150 million. Non-GAAP Interest and other income (expense) guidance excludes approximately $5 million of interest expense related to a litigation matter. In the aggregate, Non-GAAP diluted earnings per share guidance excludes these items totaling $155 million to $185 million. The timing and amount of these charges excluded from non-GAAP gross margin, non-GAAP operating expenses, and Non-GAAP diluted earnings per share cannot be further allocated or quantified with certainty. Additionally, the timing and amount of additional charges the company excludes from its non-GAAP tax rate and non-GAAP diluted earnings per share are dependent on the timing and determination of certain actions and cannot be reasonably predicted. Accordingly, full reconciliations of non-GAAP gross margin, non-GAAP operating expenses, non-GAAP tax rate and non-GAAP diluted earnings per share to the most directly comparable GAAP financial measures (gross margin, operating expenses, tax rate and diluted earnings per share, respectively) are not available without unreasonable effort.

(2) Non-GAAP tax rate is determined based on a percentage of Non-GAAP pre-tax income or loss. Estimated non-GAAP tax rate may differ from our GAAP tax rate (i) due to differences in the tax treatment of items excluded from our non-GAAP net income or loss; (ii) the fact that our GAAP income tax expense or benefit recorded in any interim period is based on an estimated forecasted GAAP tax rate for the full year, excluding loss jurisdictions; and (iii) because our GAAP taxes recorded in any interim period are dependent on the timing and determination of certain GAAP operating expenses.

Accounting Assessment for Recent Development in Litigation Matter

On October 18, 2024, a jury returned a verdict in a patent infringement case vs. the company in the amount of $316 million. The company believes it has meritorious arguments to the verdict and believes it will ultimately prevail in this legal proceeding. The company is currently evaluating the appropriate accounting treatment for this matter, and the financial information reported in this press release does not include any impact related to these recent developments, pending completion of that assessment. The company expects to complete its accounting assessment in connection with the preparation of its Quarterly Report on Form 10-Q, which it expects to file on or before November 6, 2024. As a result, the financial information included in that report may differ from the preliminary 1FQ24 US GAAP financial results reported in this press release. The company does not expect a change to its reported non-GAAP financial results in connection with its assessment of this matter.

Comments

Western Digital delivered revenue of $4.1 billion up 9% Q/Q and 49% Y/Y. Expectations was in the range of $4.0 billion to $4.2 billion. Firm's dedication to lasting quality and reliability through its innovation and diversified portfolio have allowed to proactively mix bits into the most profitable end markets, resulting in sequential revenue growth and margin improvement across both flash and HDD.

Looking at end markets, cloud represented 54% of total revenue at $2.2 billion, up 17% Q/Q and more than doubling Y/Y. On a Q/Q and Y/Y basis, the increases were driven by higher nearline shipments in HDD and enterprise SSD bit shipments to data center customers.

Client represented 29% of total revenue at $1.2 billion, flat Q/Q and up 5% Y/Y

Compared to last quarter, flash bit shipment growth in gaming and mobile was offset by a decline in PC OEM, while HDD revenue was flat.

Y/Y, an increase in flash revenue was primarily due to higher ASPs as bit shipments declined and was partially offset by lower HDD revenue.

Consumer represented 17% of revenue at $0.7 billion flat Q/Q and down 7% Y/Y.

Q/Q, a slight growth in HDD offset a decline in flash driven by softer consumer demand. Y/Y, the decrease was due to lower flash and HDD bit shipments, partially offset by improved pricing in both flash and HDD.

Turning now to revenue by segment. In the fiscal first quarter, flash revenue was $1.9 billion, up 7% from 4FQ24 and 21% Y/Y. Continued recovery in data center drove strong demand for enterprise SSD products. Sequentially, flash ASPs increased 4% on a like-for-like basis and decreased 6% on a blended basis.

Bit shipments were up 14% from 4FQ24 and down 12% compared to 1FQ24. HDD revenue was $2.2 billion, up 10% Q/Q and 85% Y/Y. Q/Q, strong performance in the nearline portfolio led to a 14% increase in HDD exabyte shipments. On a Y/Y basis, total HDD exabyte shipments increased 107% and average price per unit increased 46% to $164.

Nearline bit shipments were at a record level of 141EB, up 12% from 3FQ24 and 157% compared to 1FQ24.

In HDD, we expect continued growth momentum in the nearline product portfolio. We anticipate revenue to be in the range of $4.2 billion to $4.4 billion.

Furthermore, we are seeing high demand for enterprise SSD product offering and anticipate it to serve as the primary driver for revenue growth for FY25. With qualifications doubling since the start of 4FQ24, we now expect our enterprise SSD mix to comprise over 15% on of our overall portfolio shipments in FY025, growing at a pace significantly faster than previously anticipated.

| in $ million | 1FQ24 | 2FQ24 | 3FQ24 | 4FQ24 | 1FQ25 | 4FQ24/1FQ25 growth |

| HDDs | 1,194 | 1,367 | 1,752 | 1,781 | 2,211 | 24% |

| Flash | 1,556 | 1,665 | 1,705 | 2,003 | 1,884 | -6% |

By business, and HDD

| Period | Client revenue (1) |

Cloud revenue (1) |

Consumer revenue (1) |

Total HDDs (2) |

HDD ASP |

| 1FQ23 |

1,229 | 1,829 | 678 | 14.7 | $125 |

| 2FQ23 |

1,089 | 1,224 | 794 | 12.9 | $99 |

| 3FQ23 |

975 | 1,205 | 623 | 12.6 | $109 |

| 4FQ23 |

1,035 | 994 | 643 | 11.8 | $99 |

| 1FQ24 |

1,147 | 872 | 731 | 10.4 | $112 |

| 2FQ24 | 1,122 | 1,071 | 839 | 10.8 | $109 |

| 3FQ24 | 1,174 | 1,553 | 730 | 11.7 | $145 |

| 4FQ24 | 1,204 | 1,882 | 678 | 12.1 | $163 |

| 1FQ25 | 1,209 | 2,208 | 678 | 13.2 | $164 |

| Period | Revenue | Y/Y sales growth | Net income (loss) |

| FY18 | 20,647 | 8% | 675 |

| FY19 | 16,569 | -20% | (754) |

| FY20 | 16,376 | 1% | (250) |

| FY21 | 16,922 | 1% | 1,406 |

| FY22 | 18,783 | 11% | 1,500 |

| FY23 | 12,318 | -34% | (1,708) |

| 1FQ24 | 2,750 | -26% | (685) |

| 2FQ24 | 3,032 | -2% | (268) |

| 3FQ24 | 3,457 | 23% | 135 |

| 4FQ24 | 3,754 | 9% | 330 |

| FY24 | 13,003 | 6% | 561 |

| 1FQ25 | 4,095 | 40% | 481 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter