NAND Flash Shipments Growth Slows in 2Q24

Revenue up 14% driven by AI SSD demand

This is a Press Release edited by StorageNewsletter.com on September 12, 2024 at 2:01 pmThis market report was published on September 9, 2024 by TrendForce Corp.

NAND Flash Shipments Growth Slows in 2Q24

Revenue Up 14% Driven by AI SSD Demand

NAND flash prices continued to rise in 2Q24 as server inventory adjustments neared completion and AI spurred demand for high-capacity storage products.

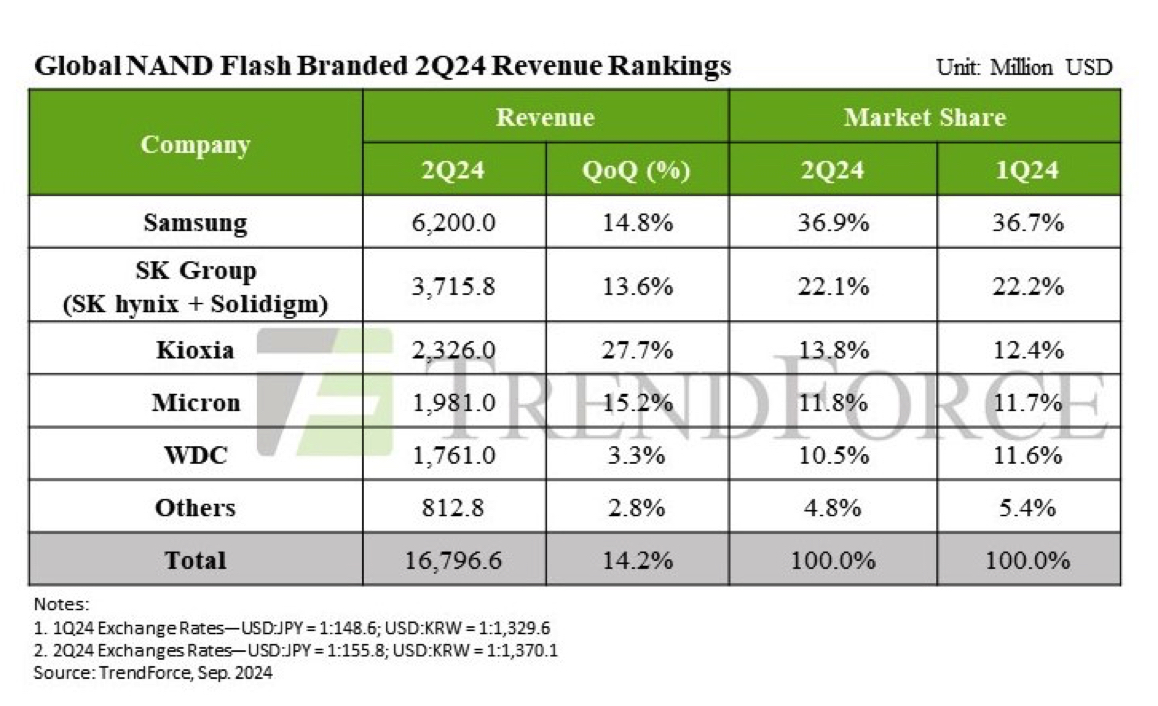

However, high inventory levels among PC and smartphone buyers led to a 1% Q/Q decline in NAND flash bit shipments. Despite this, ASP increased by 15% and drove total revenue to $16.796 billion, a 14.2% growth compared to the previous quarter.

All NAND flash suppliers returned to profitability starting in 2Q24 and are expanding capacity in 3Q24 to meet strong demand from AI and server markets.

However, weaker-than-expected PC and smartphone sales in 1H24 are likely to constrain NAND flash shipment growth.

In 3Q24, the ASP of all NAND flash products will rise by 5% to 10% Q/Q, while bit shipments are expected to decline by at least 5% due to a lackluster peak season. Overall industry revenue is expected to remain largely flat compared to 2Q24.

Samsung’s revenue continues to rise in 3Q24 as SK Group set to increase shipments of enterprise SSD

In 2Q24, Samsung responded to customer demand for enterprise storage products. However, due to weakness in the consumer electronics market, its NAND flash bit shipments saw a slight quarterly decline. Meanwhile, ASP rose by 20% and brought 2Q24 revenue to $6.2 billion—up 14.8% from 1Q24. Samsung expects its 3Q24 shipments to outperform the overall market, with higher price increases for enterprise SSDs driving further revenue growth.

The SK Group (SK hynix and Solidigm) maintained its position as the 2nd-largest NAND flash supplier by revenue in 2Q24. The rising demand for AI significantly boosted Solidigms’ shipments, although demand for PCs and smartphones was revised downward. As a result, the group’s bit shipments saw a slight decline, but the ASP increased by 16%, leading to a 13.6% Q/Q rise in NAND flash revenue to $3.716 billion. With AI continuing to drive demand for high-capacity enterprise SSDs, SK hynix plans to increase the proportion of enterprise SSD shipments to 40% in the long term.

Kioxia remained the 3rd-largest NAND flash supplier by revenue in 2Q24. Despite ongoing inventory adjustments by PC and smartphone customers, improved server demand led to a 12% increase in Kioxia’s bit shipments and a 20% rise in ASP. This brought 2Q24 revenue to $2.326 billion, a 27.7% increase from 1Q24.

Micron also saw a slight decline in bit shipments in 2Q24, but a 20% rise in ASP boosted its NAND flash revenue to $1.981 billion, a 15% Q/Q increase. It attributes its 2Q24 revenue growth to the strong uptake of high-capacity enterprise SSDs and plans to shift its product focus, expecting continued growth in enterprise SSD shipments in 3Q24.

WDC experienced a slight increase in ASP in 2Q24. However, weak demand in the retail and PC markets led to a small dip in bit shipments. This resulted in NAND flash revenue of $1.761 billion – up 3.3% from 1Q24. Moving forward, WDC plans to launch 2 new products to capture opportunities in the AI market.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter