NetApp: Fiscal 1Q25 Financial Results

NetApp: Fiscal 1Q25 Financial Results

Strong growth driven by AFAs

This is a Press Release edited by StorageNewsletter.com on August 30, 2024 at 2:02 pm| (in $ million) | 1Q24 | 1Q25 | Growth |

| Revenue |

1,432 | 1,541 | 8% |

| Net income (loss) | 149 | 248 |

- Net revenues of $1.54 billion for the 1st quarter; 8% Y/Y increase

- AFA annualized net revenue run rate1 of $3.4 billion, an increase of 21% Y/Y

- First party and marketplace cloud storage services revenue grew approximately 40% Y/Y

- Record 1st quarter GAAP operating margin of 18%; record 1st quarter non-GAAP operating margin of 26%

- Record 1st quarter GAAP net income per share of $1.17; record 1st quarter non-GAAP net income per share of $1.56

- Returned $507 million to stockholders through share repurchases and cash dividends

NetApp, Inc. reported financial results for the first quarter of fiscal year 2025, which ended on July 26, 2024.

“We started FY25 on a high note, delivering strong revenue growth and setting records for first quarter operating margin and EPS. These results are a testament to our strong execution in a continued uncertain macroeconomic environment, our unwavering confidence in the customer benefits of the highly differentiated NetApp intelligent data infrastructure platform, and our disciplined management of the business,” said George Kurian, CEO. “I am confident in our ability to capitalize on this momentum, as we address new market opportunities, extend our leadership position in existing markets, and deliver increasing value for all our stakeholders.”

1FQ25 Financial Results

- Net revenue: $1.54 billion, compared to $1.43 billion in 1FQ24; a Y/Y increase of 8%.

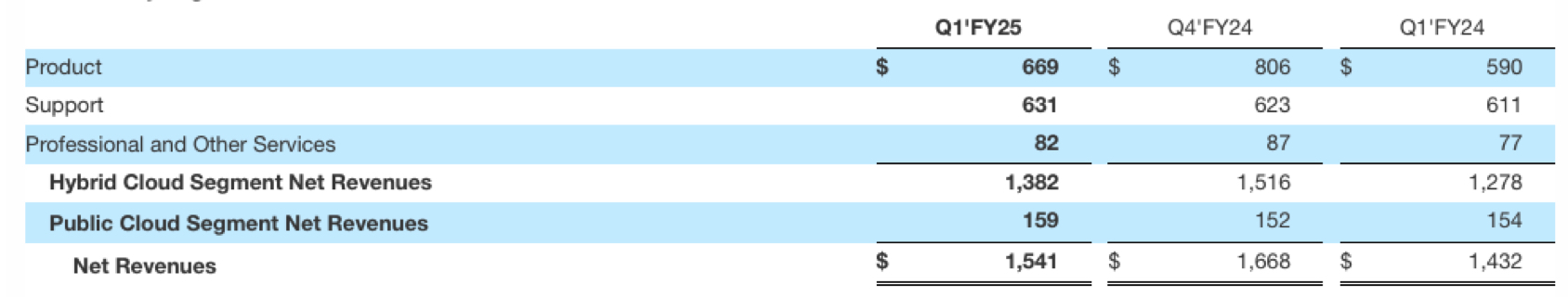

- Hybrid Cloud segment revenue: $1.38 billion, compared to $1.28 billion in 1FQ24.

- Public Cloud segment revenue: $159 million, compared to $154 million in 1FQ24.

- Billings: $1.45 billion, compared to $1.30 billion in 1FQ24; a Y/Y increase of 12%.

- AFA ARR: $3.4 billion, compared to $2.8 billion in 1FQ24; a Y/Y increase of 21%.

- Net income: GAAP net income of $248 million, compared to $149 million in 1FQ24; non-GAAP net income of $330 million, compared to $249 million in 1FQ24.

- Earnings per share: GAAP net income per share of $1.17 compared to $0.69 in 1FQ24; non-GAAP net income per share of $1.56 compared to $1.15 in 1FQ24.

- Cash, cash equivalents and investments: $3.02 billion at the end of 1FQ25.

- Cash provided by operations: $341 million, compared to $453 million in 1FQ24.

- Share repurchases and dividends: Returned $507 million to stockholders through share repurchases and cash dividends.

2FQ25 Financial Outlook

Net revenues are expected to be in the range of $1.565 billion – $1.715 billion

FY25 Financial Outlook

Net revenues are expected to be in the range of $6.480 billion – $6.680 billion

Dividend

The next cash dividend of $0.52 per share is to be paid on October 23, 2024, to stockholders of record as of the close of business on October 4, 2024.

CFO Retirement

NetApp also announces that Mike Berry, EVP and CFO, has given notice of his intent to retire from the company as of May 23, 2025. The company will engage in a comprehensive search for his successor. He will remain in his role until his successor is named and the company has completed the successful transition.

“On behalf of the board and everyone at NetApp, I would like to thank Mike for his deeply valued partnership and significant contributions to the company over the last 4+ years,” said “Kurian. “Mike has been a great asset to NetApp, having brought with him a wealth of knowledge and insight that helped us to enhance our strategic focus, strengthen our financial foundation, and drive shareholder value. I would like to thank Mike for his service and dedication and wish him all the best in his well-deserved retirement. We are committed to identifying a successor of equal caliber and to ensuring a seamless transition with Mike’s assistance.”

Comments

Revenue of $1.54 billion increased 8% Y/Y, above the midpoint of guidance range, and set records for 1FQ25 operating margin and EPS.

Revenue by segment

Top-line billings and revenue exceeded expectations, growing 12% and 8% Y/Y respectively in 1FQ25.

The firm again delivered robust Y/Y performance in Hybrid Cloud segment, with revenue growth of 8% and product revenue growth of 13%, driven by strength in all-flash storage. Broad-based demand across our all-flash storage portfolio propelled all-flash array annualized revenue run rate to $3.4 billion, up 21% Y/Y.

Product revenue of $669 million was up 13% Y/Y. Support revenue of $631 million grew 3% Y/Y. Public Cloud revenue of $159 million increased 3% from 1FQ24, driven by hyperscaler first party and marketplace storage services, offset by expected declines in subscription services.

Public Cloud segment revenue was $159 million, up 3% Y/Y. Highly differentiated first party and hyperscaler marketplace storage services remain firm's focus and top priority. These services continue to grow rapidly, increasing roughly 40% Y/Y and performing ahead of expectations at each of hyperscaler partners. As the firm outlined on previous calls, it expects the headwinds from subscription services to lessen over the course of FY25, allowing the strength of 1st party and marketplace storage services to shine through.

NetApp's financial results since FY16 in $ million

| Fiscal Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| FY18 | 5,911 | 7% | 75 |

| FY19 |

6,146 | 4% |

1,169 |

| FY20 |

5,412 | -12% |

819 |

| FY21 | 5,744 | 6% | 730 |

| FY22 | 6,318 | 10% | 937 |

| FY23 |

6,362 | 1% |

1,230 |

| 1FQ24 |

1,432 | -10% | 149 |

| 2Q24 |

1,562 | -6% | 230 |

| 3FQ24 |

1,606 | 5% | 313 |

| 4FQ24 | 1,668 | 6% | 291 |

| 1FQ25 | 1,541 | 8% | 248 |

| 2FQ25 (estim.) | 1,565-1,715 | 0% -10% | NA |

| FY25 (estim.) |

6,480-6,680 | 2% - 5% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter