SSD Shipments Down 18.4% Q/Q to 67.5 Million in 2Q24

Although capacity grew 4.1% to 90.6EB.

This is a Press Release edited by StorageNewsletter.com on August 21, 2024 at 2:02 pmThis market report from Trendfocus, Inc. is an abstract of its NAND/SSD Information Service CQ2 ’24 Quarterly Update – Executive Summary, August 14, 2024.

2CQ24 SSD Exabytes Post Another Quarter of Increases

Solely on enterprise PCle growth

• While every other category declined, ePCle growth was driven by higher demand across all of its end markets

• Overall SSD unit shipments decreased 18.4% Q/Q to 67.549 million, although capacity grew 4.1 % to 90.553EB.

• Sluggish PC OEM and channel markets coupled with some inventory caused overall cSSD units to fall by 22.5% Q/Q to 54.869 million while capacity shipped dropped 21.6% to 38.101EB

• Enterprise PCle units climbed once again, growing 19.7% Q/Q to 8.487 million, while capacity shipped achieved a 2nd consecutive record quarter, reaching 44.614EB, an impressive 46.2% increase Q/Q.

• SAS SSD shipments declined again, by 10.1 % in units to 0.794 million with capacity also declining very slightly, by 0.5%, to 3.242EB.

• Enterprise SATA followed SAS with declines in both units and exabytes – 3.399 million units and 4.595EB represented declines of 15.6% and 0.8%, respectively.

• Total NAND bit shipments decreased for the 2nd quarter in a row, this time by 5.4% to 213.84EB.

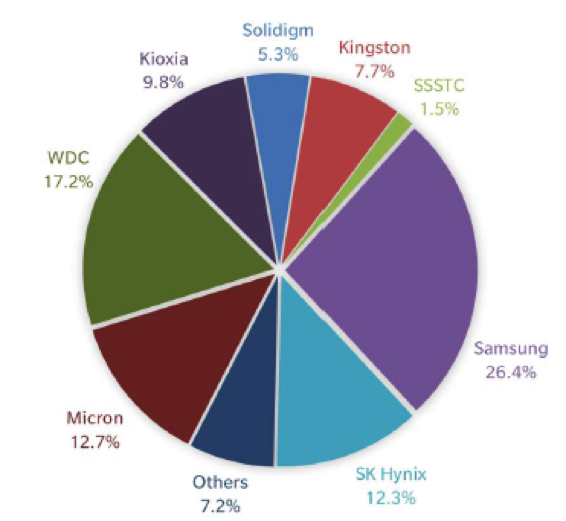

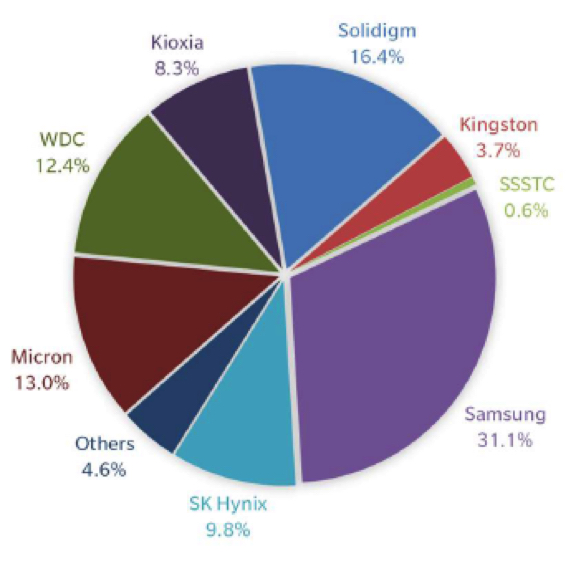

CQ2 ’24 SSD Market Share, by Supplier, Units (M), Exabytes

Total SSD Market: 67.549 Million Units

Total SSD Market: 90.553 Exabytes

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter