Backblaze: Fiscal 2FQ24 Financial Results

Backblaze: Fiscal 2FQ24 Financial Results

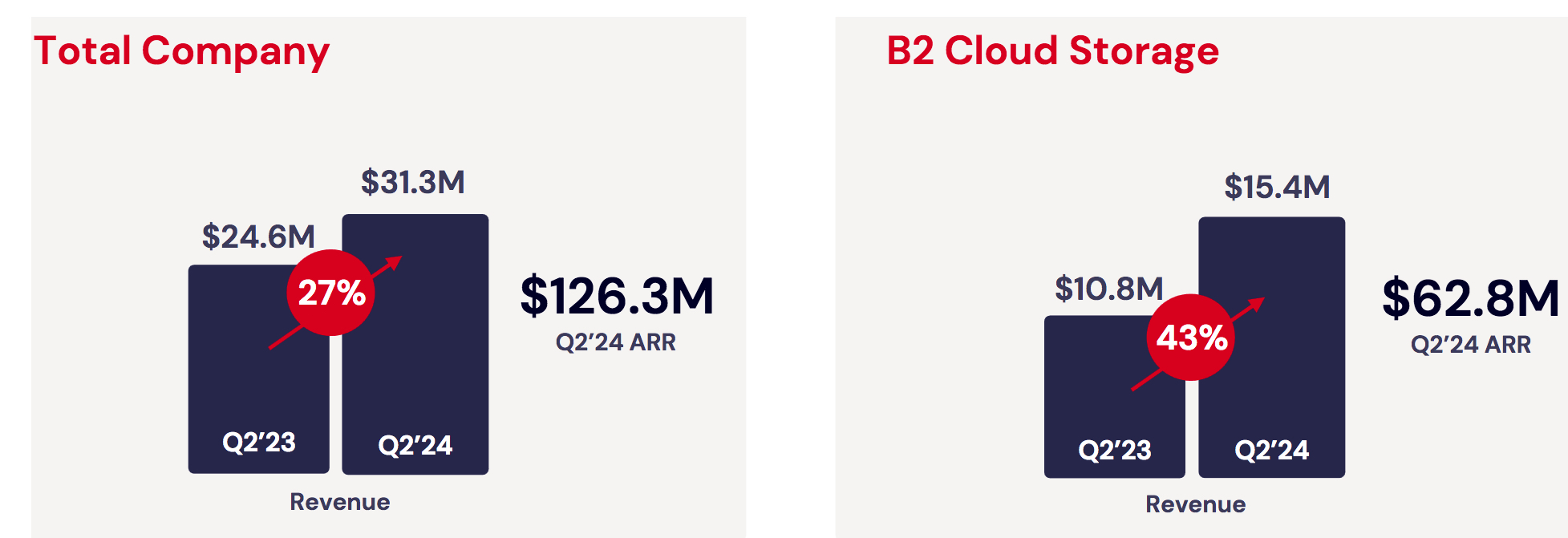

27% revenue growth, never profitable but net loss regularly diminishing

This is a Press Release edited by StorageNewsletter.com on August 12, 2024 at 2:02 pm

| (in $ million) | 2Q23 | 2Q24 | 6 mo. 23 | 6 mo. 24 |

| Revenue | 24.6 | 31.3 | 38.0 | 61.3 |

| Growth | 27% | 61% | ||

| Net income (loss) | (14.3) | (10.3) | (31.5) | (21.4) |

Backblaze, Inc. announced results for its second quarter ended June 30, 2024.

“2FQ24 marked another strong growth quarter for Backblaze, along with efficient execution driving continued margin expansion and momentum moving up-market,” said Gleb Budman, CEO. “We continued our recent string of innovations with the launch of Backblaze B2 Live Read in June. This transformative, patent-pending feature enables customers to use their data during the upload process, which has unique value for live broadcast workflows. Additionally, we are excited to introduce our new CRO Jason Wakeam and CFO Marc Suidan, both accomplished leaders who will help drive our growth strategy.”

2FQ24 Financial Highlights:

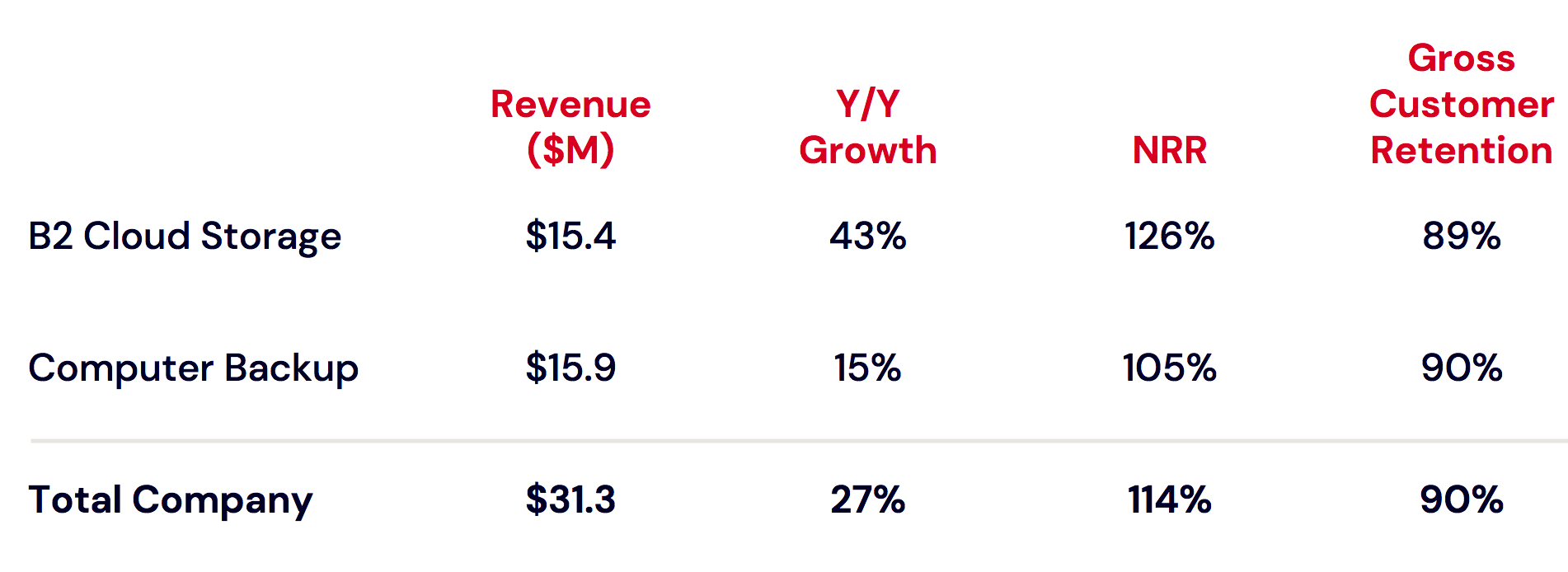

- Revenue of $31.3 million, an increase of 27% Y/Y.

- B2 Cloud Storage revenue was $15.4 million, an increase of 43% Y/Y.

- Computer Backup revenue was $15.9 million, an increase of 15% Y/Y.

- Gross profit of $17.2 million, or 55% of revenue, compared to $12.1 million or 49% of revenue, in 2FQ23.

- Adjusted gross profit of $24.5 million, or 78% of revenue, compared to $18.4 million, or 75% of revenue, in 2FQ23.

- Net loss was $10.3 million compared to a net loss of $14.3 million in 2FQ23.

- Net loss per share was $0.25 compared to a net loss per share of $0.41 in 2FQ23.

- Adjusted EBITDA was $2.7 million, or 9% of revenue, compared to $(1.8) million, or (7%) of revenue, in 2FQ23.

- Non-GAAP net loss of $4.8 million compared to non-GAAP net loss of $8.3 million in 2FQ23.

- Non-GAAP net loss per share of $0.11 compared to a non-GAAP net loss per share of $0.24 in 2FQ23.

- Cash, short-term investments, and restricted cash, non-current totaled $28.3 million as of June 30, 2024.

2FQ24 Operational Highlights:

- ARR was $126.3 million, an increase of 30% Y/Y.

- B2 Cloud Storage ARR was $62.8 million, an increase of 44% Y/Y.

- Computer Backup ARR was $63.5 million, an increase of 18% Y/Y.

- Net revenue retention (NRR) rate was 114% compared to 110% in 2FQ23.

- B2 Cloud Storage NRR was 126% compared to 121% in 2FQ23.

- Computer Backup NRR was 105% compared to 103% in 2FQ23.

- Gross customer retention rate was 90% in Q2 2024 compared to 91% in 2FQ23.

- B2 Cloud Storage gross customer retention rate was 89% in Q2 2024 compared to 90% in 2FQ23.

- Computer Backup gross customer retention rate was 90% compared to 91% in 2FQ23.

Recent Business Highlights:

- Launched Backblaze B2 Live Read: This patent-pending cloud solution enables customers to access and edit files during the upload process. The initial focus will be on media and entertainment use cases, which will help production teams accelerate their speed to market.

- Continued Up-Market Momentum: Customers contributing over $50,000 in ARR grew more than 55% Y/Y.

- Introduced Internet2 Peering: The integration of Internet2’s network provides the world’s largest research and educational institutions fast access to and easier adoption of B2 Cloud Storage.

- Announced Marc Suidan to Join as CFO: Marc brings over 20 years experience as a public company CFO, strategic advisor and management consultant. As a senior partner at PricewaterhouseCoopers, he advised the largest global technology companies. He is expected to join Backblaze as CFO on August 16, 2024.

- Hired Jason Wakeam as CRO: He adds decades of experience in building high impact sales, channel, and partner teams and driving competitive market share growth at Hewlett-Packard, Microsoft, Cloudera and SnapLogic.

- Selected for the Russell 2000 Index: The widely used benchmark brings added investor awareness to Backblaze.

For 3FQ24 the company expects:

- Revenue between $32.4 million to $32.8 million

- Adjusted EBITDA margin between 9% to 11%

- Basic shares outstanding of 43.0 million to 43.5 million shares

For FY24 the company expects:

- Revenue between $126.5 million to $128.5 million

- Adjusted EBITDA margin between 9% to 11%

Comments

In 2FQ24, the company grew in both revenue and EBITDA, beating guidance on both. Revenue grew 27% Y/Y with 43% growth for B2 Cloud Storage. 2FQ24 revenue totaled $31.3 million. The B was driven by a faster-than-expected ramp-up in storage for new B2 deals signed in 1FQ24, better-than-expected renewals and expansions from B2 Reserve, and lower churn from computer backup. This represents an increase of 27% Y/Y vs. 19% in 2FQ23. B2 cloud storage revenue was $15.4 million, reflecting 43% growth. Computer backup revenue totaled $15.9 million, reflecting 15% growth.

At the end of 3FQ24, the number of customers contributing over $50,000 in ARR stands at 115, a 55% increase over 2FQ23.

Turning now to Net Revenue Retention, or NRR. Total company NRR increased to 114% from 110% in 2FQ23, with B2 cloud storage at 126% and computer backup at 105%. Gross customer retention was 90% overall, with 89% for B2 cloud storage and 90% for computer backup.

Moving down the P&L, both adjusted gross margin and GAAP gross margin reached all-time highs at 78% and 55%, respectively, up from 75% and 49% last year. This improvement was driven by the price increase and data center optimization.

Looking ahead, the firm expects 3FQ24 revenue to be in the range of $32.4 million to $32.8 million. Continuing firm's trend of increasing adjusted EBITDA, 3FQ24 margin is expected to be between 9% and 11%.

For FY24, the company is raising its annual guidance and now expect total revenue between $126.5 million and $128.5 million, an increase fromprior guidance of $126 million to $128 million. It continues to see FY24 growth for B2 at about 40%. It also now expects adjusted EBITDA to be in the range of 9% to 11%, an improvement over the prior guidance of 8% to 10%.

| (in $ million) | Revenue | Y/Y growth | Net income (loss) |

| FY19 | 40.7 | NA | (1.0) |

| FY20 | 53.8 | 32% | (6.6) |

| FY21 |

67.5 | 25% | (21.6) |

| FY22 |

85.2 |

26% |

(51.7) |

| 1FQ23 | 23.4 | 20% | (17.1) |

| 2FQ23 | 24.6 | 19% | (14.3) |

| 3FQ23 | 25.3 | 15% | (16.1) |

| 4FQ23 | 28.7 | 25% | (10.8) |

| FY23 | 102.0 | 20% | (58.9) |

| 1FQ24 | 30.0 | 28% | (11.1) |

| 2FQ24 | 31.3 | 27% | (10.3) |

| 3FQ24 (estim.) | 32.4-32.8 | 28%-30% | NA |

| FY24 (estim.) |

126.5-128.5 |

24%-26% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter