Intevac: Fiscal 2Q24 Financial Results

Intevac: Fiscal 2Q24 Financial Results

Backlog did not include any 200 Lean HDD systems.

This is a Press Release edited by StorageNewsletter.com on August 6, 2024 at 2:02 pm

| (in $ million) | 2Q23 | 2Q24 | 6 mo. 23 | 6 mo. 24 |

| Revenue | 10.3 | 14.5 | 21.8 | 24.2 |

| Growth | 41% | 11% | ||

| Net income (loss) | (4.9) | (3.3) | (8.8) | (4.9) |

Intevac, Inc. reported financial results for the quarter and six months ended June 29, 2024.

“We witnessed strengthening demand for HDD media technology upgrades during 2FQ24, and our team in Singapore provided solid execution, which led to revenues well ahead of expectations,” commented Nigel Hunton, president and CEO. “Today’s media upgrade initiatives, including those in support of the HAMR (heat-assisted magnetic recording) technology transitions now underway, demonstrate Intevac’s critical role within the HDD ecosystem. Our flagship 200 Lean is the world’s leading platform for media production, both today and for the years to come, providing strong visibility for a solid base of business as we drive incremental growth with our groundbreaking TRIO platform, which will serve multiple markets, including the display cover glass coating market. We are now in the process of qualifying our first TRIO system, which has been successfully installed at a new customer facility in Asia and is currently demonstrating the benefits of its modular and flexible design. Our focus is now on completing the field qualification and securing initial orders. Strong collections in the quarter drove an increase in total cash, restricted cash, and investments to over $70 million at quarter-end, and we remain steadfast in our commitment to maintain the strength of the balance sheet while still aggressively pursuing the strong growth opportunities ahead. Overall, an excellent quarter for Intevac across all fronts.”

2FQ24 Summary

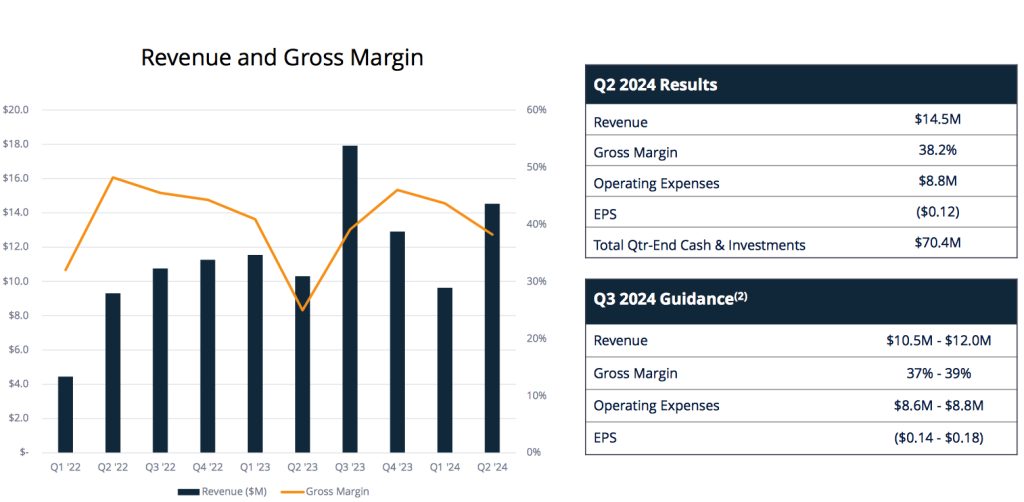

Revenue was $14.5 million, compared to $10.3 million in 2FQ23, and consisted of HDD upgrades, spares and service. Gross margin was 38.2%, compared to 24.9% in 2FQ23. Operating expenses were $8.8 million, compared to $8.0 million in 2FQ23. The operating loss was $3.3 million compared to $5.5 million in 2FQ23.

The net loss for the quarter was $3.3 million, or $0.12 per diluted share, compared to a net loss of $4.9 million, or $0.19 per diluted share, in 2FQ23. The non-GAAP net loss for 2FQ24 was $3.3 million, or $0.12 per diluted share, compared to a non-GAAP net loss of $4.9 million, or $0.19 per diluted share, in 2FQ23.

Order backlog was $42.5 million on June 29, 2024, compared to $53.1 million on March 30, 2024, and $58.2 million on July 1, 2023. Backlog at June 29, 2024 and at March 30, 2024 did not include any 200 Lean HDD systems. Backlog at July 1, 2023 included 2 200 Lean HDD systems.

The company ended the quarter with $70.4 million of total cash, cash equivalents, restricted cash and investments and $111.7 million in tangible book value.

1H24 Summary

Revenue was $24.2 million, compared to 1H23 revenues of $21.8 million, and consisted of HDD upgrades, spares and service. Gross margin was 40.4%, compared to 33.4% in 1H23. Operating expenses were $17.5 million, compared to $17.2 million in 1H23. The net loss was $4.9 million, or $0.18 per diluted share, compared to a net loss of $8.8 million, or $0.34 per diluted share, for 1H23.

Comments

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter