Commvault: Fiscal 1Q25 Financial Results

Commvault: Fiscal 1Q25 Financial Results

Record revenue at $224.7 million, up 13% Y/Y, flat outlook

This is a Press Release edited by StorageNewsletter.com on July 31, 2024 at 2:02 pm| (in $ million) | 1Q24 | 1Q25 | Growth |

| Revenue |

198.2 | 224.7 | 13% |

| Net income (loss) | 12.6 | 18.5 |

Commvault Systems, Inc. announced its financial results for the fiscal first quarter ended June 30, 2024.

“The need for resilience is paramount and we are leading the charge,” said Sanjay Mirchandani, president and CEO. “Our ability to empower customers globally, to regularly test their readiness and quickly recover their data and applications is not only a differentiator, but enabled Commvault to start the fiscal year strong, generating 13% total revenue growth and 17% annualized recurring revenue growth in 1FQ25.”

1FQ25 Highlights

- Total revenue was $224.7 million, up 13% Y/Y

- Total ARR grew to $803 million, up 17% Y/Y

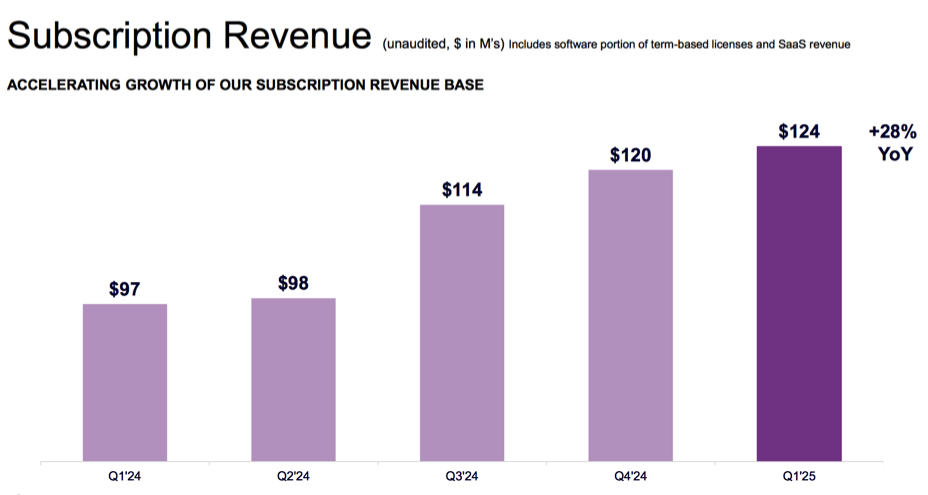

- Subscription revenue was $124.1 million, up 28% Y/Y

- Subscription ARR grew to $636 million, up 27% Y/Y

- Income from operations (EBIT) was $18.4 million, an operating margin of 8.2%

- Non-GAAP EBIT was $48.3 million, an operating margin of 21.5%

- Operating cash flow was $44.7 million, with free cash flow of $43.8 million

- First quarter share repurchases were $51.4 million, or approximately 471,000 shares of common stock

Guidance for 2FQ25:

- Total revenue expected to be between $218 million and $222 million

- Subscription revenue expected to be between $120 million and $124 million

- Non-GAAP operating margin expected to be between 19% and 20%

Guidance for FY25:

- Total revenue expected to be between $915 million and $925 million

- Total ARR expected to grow 15% Y/Y

- Subscription revenue expected to be between $522 million and $527 million

- Subscription ARR is expected to grow between 23% and 25% Y/Y

- Non-GAAP operating margin expected to be between 20% and 21%

- Free cash flow expected to be at least $200 million

Comments

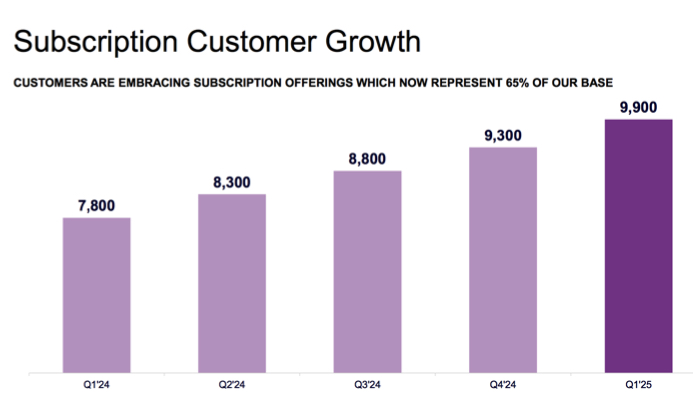

Total revenue increased 13% to $225 million, driven by a 28% increase in subscription revenue, which now exceeds 55% of total revenue. Total ARR rose 17% to $803 million. Subscription ARR accelerated 27% to $636 million.

Company saw revenue from term software transactions over $100,000 increase by 13% as it close an accelerated volume of larger deals.

It ended the quarter with approximately 3,000 employees, an increase of 4% sequentially,

Revenue and net income (loss) in $ million

| Fiscal Period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| FY18 | 699.4 | 8% | (61.9) |

| FY19 | 711.1 | 2% |

3.6 |

| FY20 |

670.9 |

-6% |

(5.6) |

| FY21 | 723.5 | 8% | (31.0) |

| FY22 | 769.6 | 6% | 33.6 |

| 1FQ23 | 198.0 | 8% | 3.5 |

| 2FQ23 | 188.1 | 6% | 4.5 |

| 3FQ23 | 195.1 | -4% | (0.3) |

| 4FQ23 | 203.5 | -1% |

(43.5) |

| FY23 | 784.6 | 2% |

(35.8) |

| 1FQ24 | 198.2 | -3% |

12.6 |

| 2FQ24 | 201.0 | 7% |

13.0 |

| 3FQ24 | 216.8 | 11% |

17.1 |

| 4FQ24 | 223.3 | 10% | 126.1 |

| FY24 | 839.3 | 7% | 168.9 |

| 1FQ25 | 224.7 | 13% |

18.5 |

| 2FQ25 (estim.) | 218-222 | 10% - 12% | NA |

| FY25 (estim.) | 915-925 | 15%-17% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter