SK hynix: 2Q24 Financial Results

SK hynix: 2Q24 Financial Results

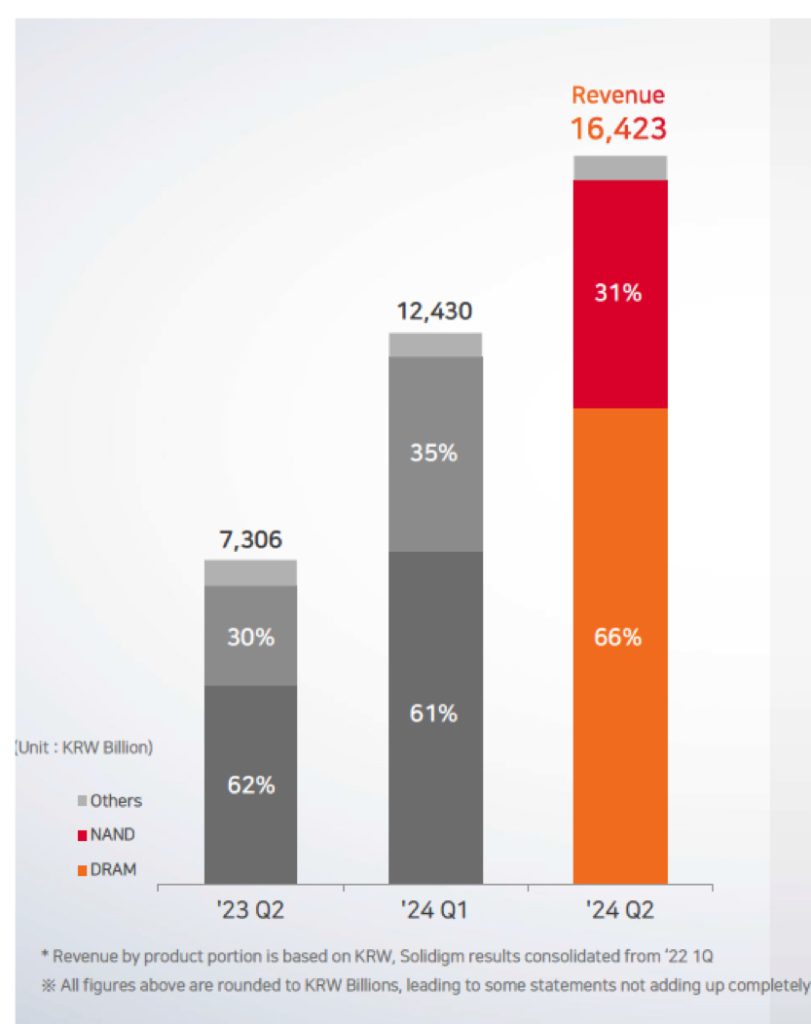

Sales more than doubling Y/Y and 32% Q/Q, and largely profitable

This is a Press Release edited by StorageNewsletter.com on July 29, 2024 at 2:02 pm|

(in KRW billion) |

2Q23 | 2Q24 |

| Revenue | 7,306 | 16,423 |

| Growth | 125% | |

| Net income (loss) | (2,988) | 4,129 |

- Revenue at 16.4233 trillion won, operating profit at 5.4685 trillion won, net profit at 4.12 trillion won

- Quarter revenues all-time high, operating profit hits 5 trillion won for the 1st time since the 2018 boom

- AI memory products including HBM, eSSD in a boom, NAND turning to profit for 2 straight quarters

- Borrowings fall by 4.3 trillion won in a quarter, confident that company will solidify its global ≠1 AI memory provider position based on stable financial structure

SK hynix Inc. recorded 16.423 trillion won in revenue, 5.4685 trillion won in operating profit (with an operating margin of 33%), and 4.12 trillion won in net profit (with a net margin of 25%) in 2FQ24.

Quarter revenues marked all-time high, far exceeding the previous record of 12.811 trillion won in 2FQQ2. Operating profit also increased significantly, marking 5 trillion won for the first time in 6 years since 2FQ18 (5.5739 trillion won) and 3FQ18 (6.4724 trillion won) of 2018 during the semiconductor super boom.

The company said that continuous rise in overall prices of DRAM and NAND products with strong demand for AI memories including HBM led to 32% increase in revenue compared to 1FQ24. Also, with the sales for premium products on the rise and exchange rate effects adding, the operating profit ratio in 1FQ24 rose 10 percentage points from 1FQ24 to 33%, performing to market expectations.

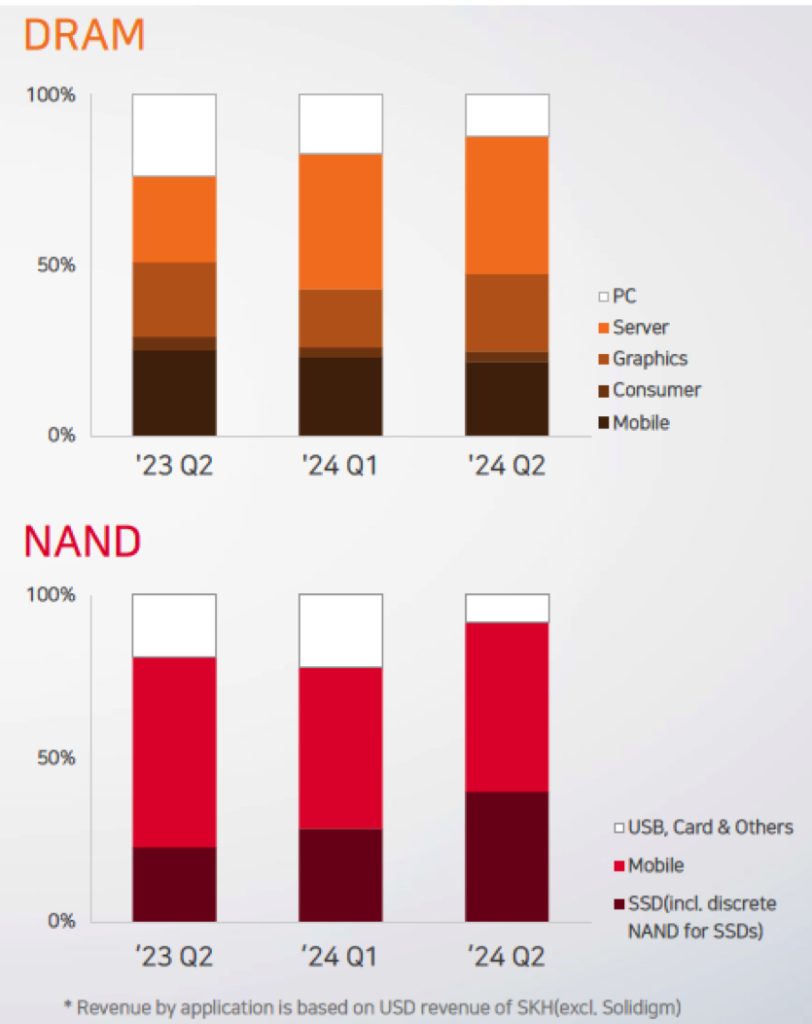

In the DRAM area, SK hynix increased the proportion of high-value-added products such as HBM3E and DRAM for servers, which the company began mass production since this March. In particular, HBM sales went up by more than 80% compared to 1FQ24 and more than 250% compared to 2FQ23, leading the company’s improvement.

For the NAND business, the sales of eSSD and mobile products increased for the most part. Especially eSSD sales, which continued to grow steeply, rose by about 50% from 1FQ24. The company emphasized that the ASP has continued to rise across NAND products since 4FQ23, turning to profit for 2 consecutive quarters.

It forecasts that the demand for AI server memory will continue to rise in 2H24, and sales of high-performance memory products will increase as new PC and mobile products supporting On-Device AI will be released on the market. The company also expects general memory product market to be on a steady growth path as well.

In accordance with this movement, SK hynix plans to continue its leadership in the HBM market by mass-producing 12-layer HBM3E products, which the company provided samples to major customers, in 3FQ24.

It also plans to launch 32Gb DDR5 DRAM for servers and MCRDIMM1 for high-performance computing in 2H24 to maintain its competitive advantage in the DDR5 area, where the company is the only provider of the highest capacity 265GB products for servers.

1MCR DIMM (Multiplexer Combined Ranks Dual In-line Memory Module): A module product with multiple DRAMs bonded to a motherboard, in which 2 ranks, basic information processing units, operate simultaneously, resulting in improved speed.

For NAND, the firm plans to expand sales of high-capacity eSSD and lead the market in the 2H24 with 60TB products, expecting eSSD sales to be more than quadrupled compared to last year. In addition, it plans to continue its earnings growth by introducing competitive solutions to customers across its NAND product portfolio.

Separately, it is working on the construction of Cheongju M15X, which is under construction, with the goal of starting mass production in 2H25 to cope with the growing demand for AI memory. In addition, it plans to start construction of the first fab of the Yongin semiconductor cluster in March next year and complete it in May 2027 as scheduled.

It explained that although the yearly Capex might be higher than planned at the beginning of the year, the company will establish an investment plan by closely analyzing customer demand and profitability, while securing financial soundness by efficiently executing it within the operating cash flow.

“We were able to reduce the borrowings by 4.3 trillion won compared to 1FQ24 while making essential investments during 2FQ24 in line with its profitability-oriented investment stance.” CFO Kim Woohyun said. “The company will further solidify the position as a leader in AI memory products by focusing on developing the best process technology and high-performance products based on a stable financial structure.”

Comments

Revenue analysis

Positive

- Reported a record quarterly revenue of KRW16.4 trillion, marking a 32% Q/Q increase and a 125% Y/Y increase.

- Operating profit for 2FQ24 increased by KRW2.58 trillion from the previous quarter to KRW5.47 trillion, with an operating profit margin of 33%.

- HBM sales grew significantly, with an 80% increase from 1FQ24 and over 250% Y/Y growth.

- Plans to release high-density server DRAM and MCRD products in 2H24, targeting the high-performance computing market.

- Is expanding its enterprise SSD sales, expecting annual sales to grow nearly 4x compared to last year.

Negative

- Shipments of enterprise SSD and mobile products decreased by low single digits Q/Q due to muted demand recovery.

- Non-GAAP operating loss net of gain for 2FQ24 was KRW0.42 trillion, including net interest expense and net foreign currency-related loss.

- Consolidated cash and cash equivalents decreased by KRW0.6 trillion from the end of 1FQ24.

- Expects a mid-single digit percent sequential decrease in bit shipment despite an increase in ESSD sales volume.

- Investment needs are rising to meet demand for conventional DRAM and HBM, leading to higher than expected CapEx levels for the year.

Revenue by product

Revenue by application

In trillion won

| Period | Revenue | Net income (loss) |

| 1FQ22 | 12,156 | 1,987 |

| 2FQ22 | 12,811 | (2,881) |

| 3FQ22 | 10,983 | (2,185) |

| 4FQ22 | 7,699 | (3,524) |

| FY22 | 44,622 | 2,242 |

| 1FQ23 | 5,088 | (2,586) |

| 2FQ23 | 7,306 | (2,988) |

| 3FQ23 | 9,066 | 1,108 |

| 4FQ23 | 11,306 | (1,380) |

| FY23 | 32,766 | (9,138) |

| 1FQ24 | 12,430 | 1,917 |

| 2FQ24 | 16,243 | 4,120 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter