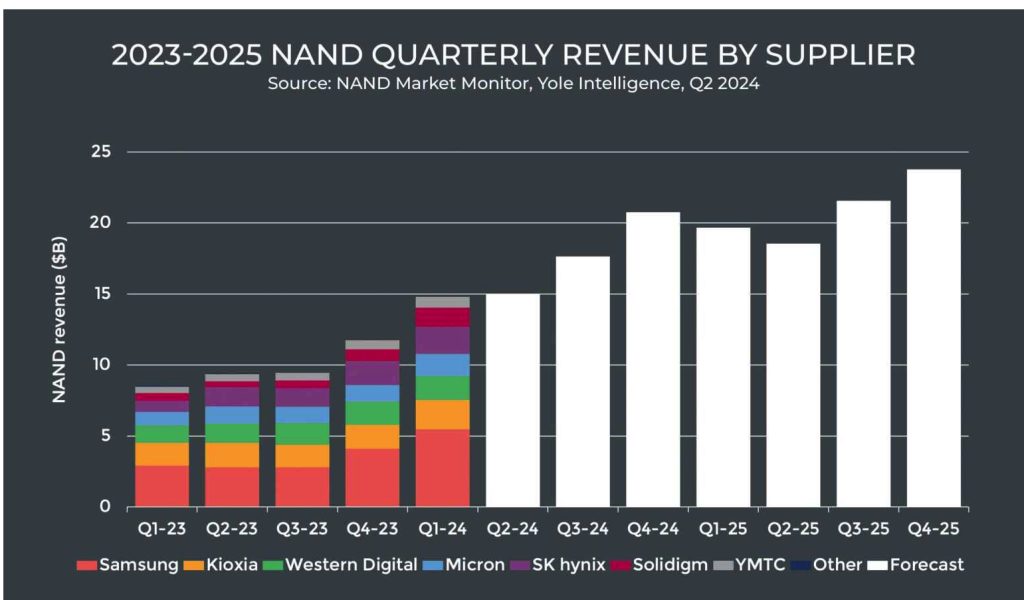

1Q24 Marks Return to Profitability for NAND Industry

Significant demand surges in enterprise SSD segment, with memory suppliers experiencing ~26% Q/Q growth in shipments.

This is a Press Release edited by StorageNewsletter.com on July 10, 2024 at 3:11 pmThis market report was published on June 25, 2025 by Yole Group.

Is the NAND industry back to profit ?

In 2024, suppliers are limiting supply to boost prices and improve margins.

After 5 quarters of losses, 1Q24 marks a return to profitability for the industry.

1Q24 outlook

1Q24 saw a significant demand surge in the enterprise SSD segment, with memory suppliers experiencing ~26% Q/Q growth in shipments.

This boost led to a sharp rise in the blended ASP of NAND flash, bringing the average industry operating margin back to positive after 5 quarters of negative margins.

AI servers, requiring up to 10 server-attached SSDs and demanding low latency storage, appear to be the main driver of this increase.

Memory suppliers have further reduced their inventory and started increasing capacity utilization to meet the rising demand.

Looking ahead to 2024 and 2025, AI’s impact on NAND demand is anticipated to go beyond server applications, announces Yole Group, in its quarterly NAND Market Monitor. AI integration in smartphones and PCs is expected to speed up device refresh cycles, boosting NAND demand further. Additionally, AI will likely hasten the adoption of faster existing interfaces like PCIe 5.0 and UFS 4.0, and new AI-tuned interfaces like ZUFS 4.0 are expected to emerge.

NAND flash memory suppliers will need to manage production ramp-up carefully to avoid oversupply and critical shortages. Capex for NAND is projected to remain low in 2024, similar to 2023 levels. Consequently, the installed wafer capacity by early 2025 is expected to be lower than pre-production cut capacity. Despite suppliers increasing their capacity utilization rate, the market is expected to be undersupplied throughout 2024.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter