DRAM Prices Expected to Increase by 8–13% in 3Q24

Demand for servers to support 2H24

This is a Press Release edited by StorageNewsletter.com on July 2, 2024 at 2:02 pmThis market report was published on June 27, 2024 by TrendForce, Inc.

Demand for Servers to Support Second Half of the Year

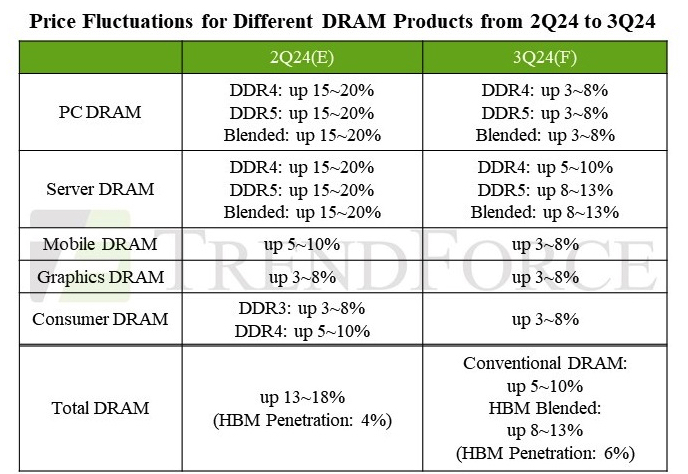

DRAM Prices Expected to Increase by 8–13% in Q3

A recovery in demand for general servers-coupled with an increased production share of HBM by DRAM suppliers-has led suppliers to maintain their stance on hiking prices. As a result, the ASP of DRAM in 3Q24 is expected to continue rising, with an anticipated increase of 8-13%. The price of conventional DRAM is expected to rise by 5-10%, showing a slight contraction compared to the increase in 2Q24.

Buyers were more conservative about restocking in 2Q24, and inventory levels on both the supplier and buyer sides did not show significant changes. Looking ahead to 3Q24, there is still room for inventory replenishment for smartphones and CSPs, and the peak season for production is soon to commence. Consequently, it is expected that smartphones and servers will drive an increase in memory shipments in 3Q24.

PC DRAM prices expected to increase by 3-8% in 3Q24

PC DRAM prices are expected to continue their upward trend in 3Q24 considering the recovery in demand for general servers and the increased production share of HBM by suppliers. The average price is projected to rise by 3-8% Q/Q. This increase is lower than that of server DRAM and shows a contraction compared to the 2Q24. The main reasons are the high inventory levels of PC DRAM and the lack of significant improvement in consumer demand.

Server DRAM prices are expected to increase by 8-13% in 3Q24

Benefiting from seasonal stocking demand for general servers in 3Q24, the contract price of DDR5 server DRAM will increase by 8-13%. Due to high average inventory levels of DDR4 among buyers, purchasing momentum will be focused on DDR5, leading to a higher price increase for DDR5 compared to DDR4. As a result, the average contract price for server DRAM – considering both DDR4 and DDR5 – is expected to rise by 8–13% Q/Q.

Mobile DRAM prices expected to increase by 3-8% in 3Q24

Continuous price increases for mobile DRAM in 4Q23 have posed significant challenges to the profitability of brands. Additionally, with current inventories being quite sufficient, brands are not in a hurry to enter price negotiations for the third quarter and have adopted a passive stance in negotiations. However, manufacturers are aiming to fill the profit gaps from previous quarters and anticipate a tightening supply-demand balance next year, thereby maintaining their intention to raise contract prices. Nonetheless, due to the passive negotiation stance of buyers and high inventory levels, the price increase in 3Q24 may be limited. The quarterly price increase will be between 3-8%, with LPDDR4(X) experiencing the smallest increase and possibly even further contraction.

Graphics DRAM prices expected to increase by 3–8% in 3Q24

In 3Q24, overall demand for graphics DRAM remains relatively flat, with price trends mainly influenced by the interconnected effects of other DRAM products. With manufacturers firmly entering an upward pricing cycle and the price increase momentum not yet abating, buyers are adopting a continuous stocking strategy, making them more amenable to price hikes proposed by sellers. On the supply side, as new GPUs enter the verification stage, manufacturers are gradually increasing the production of GDDR7, which currently carries a 20-30% premium over GDDR6. The shipment of GDDR7 samples in 3Q24 is expected to slightly push up the average selling price. As such, graphics DRAM prices are anticipated to increase by 3-8% Q/Q.

DDR3 and DDR4 prices expected to increase by 3-8% in 3Q24

The overall consumer DRAM market continues to exhibit oversupply, but the 3 major suppliers are clearly intent on raising prices due to the capacity squeeze from HBM production. Additionally, Taiwanese manufacturers have yet to return to profitability, creating further upward pressure on prices. As a result, prices are expected to maintain a slight upward trend.

Looking further ahead to 4Q24, the need for inventory replenishment by smartphone manufacturers and CSPs – along with an increased production share of HBM by suppliers – will support the continuation of rising prices. As the end of the year approaches, both buyers and sellers will formulate procurement strategies based on the current supply and demand outlook for 2025. Therefore, TrendForce does not rule out the possibility that buyers will continue to raise inventory levels in anticipation of potential shortages caused by the increased share of HBM production in 2025.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter