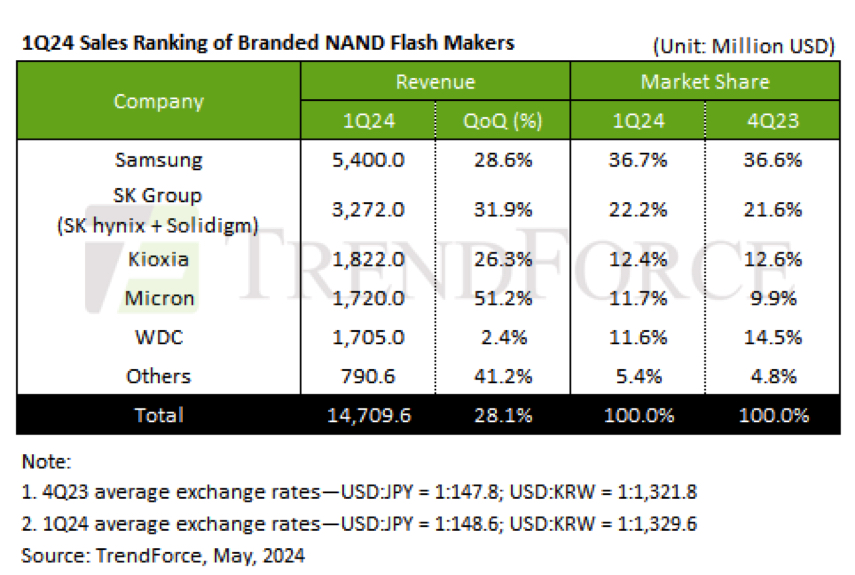

NAND Flash Industry Revenue Grew 28% in 1Q24 at $14.7 Billion

10% Q/Q growth expected in 2Q24

This is a Press Release edited by StorageNewsletter.com on June 18, 2024 at 2:02 pm This market report, published on May 29, 2024, was written by Bryan Ao, analyst, Trendforce Corp.

This market report, published on May 29, 2024, was written by Bryan Ao, analyst, Trendforce Corp.

That adoption of enterprise SSDs by AI servers began in February, which subsequently led to large orders. Additionally, PC and smartphone customers have been increasing their inventory levels to manage rising prices. This trend drove up NAND flash prices and shipment levels in 1Q24 and boosted quarterly revenue by 28.1% to $14.71 billion.

There were significant changes in market rankings this quarter, with Micron overtaking Western Digital to claim the 4th spot. Micron benefited from slightly lower prices and shipments than its competitors in 4Q23, resulting in a 51.2% Q/Q revenue growth to $1.72 billion in 1Q24 – the highest among its peers.

Samsung maintained its market leadership with a 28.6% Q/Q revenue jump to $5.40 billion, driven by continued inventory build-up among buyers and a revival of enterprise SSD orders. Despite a cautious outlook for consumer product orders in 2Q24, rising NAND flash contract prices are expected to help Samsung’s revenue grow by over 20% in 2Q24.

SK Group (SK hynix and Solidigm) saw a 31.9% Q/Q increase in revenue to $3.27 billion in 1Q24, driven by strong smartphone and server orders. Solidigm’s unique floating gate QLC architecture helped sustain robust demand for high-capacity enterprise SSDs. SK Group’s shipment growth is expected to outpace other suppliers in 2Q24, with an anticipated revenue jump of around 20%.

Kioxia’s 1Q24 output was still affected by production cuts from the previous quarter, resulting in a modest 7% QIQ increase in shipments. However, rising NAND flash prices led to a 26.3% QoQ rise in revenue to $1.82 billion. Kioxia expects to grow 2Q24 revenue by approximately 20%, supported by increased supply bits and more flexible pricing, which will further expand enterprise SSD shipments.

Western Digital’s 1Q24 shipments were impacted by a significant decline in retail market demand starting in February. Nevertheless, rising NAND flash contract prices led to a 2.4% QoQ revenue increase, reaching $1.71 billion. Despite a cautious market outlook for the PC and smartphone sectors, Western Digital plans to boost its enterprise SSD product development to drive future growth. However, due to longer verification times for enterprise products, short-term shipment growth is limited, and 2Q24 revenue is expected to remain flat.

PC and smartphone customers have already raised their NAND flash inventory levels for 2Q24, and growth in end-consumer demand remains below expectations, leading to more conservative buying from branded makers. Meanwhile, the surge in large enterprise SSD orders continues to drive up the ASP of NAND flash by 15%.

TrendForce forecasts 2Q24 NAND flash revenue to increase by nearly 10% Q/Q.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter