Kalray and Pliops Enters into Exclusive Negotiations to Create Firm in Data Accelerators for AI and Storage Acceleration

Confirming real European ambition in coming tsunami AI wave

This is a Press Release edited by StorageNewsletter.com on June 10, 2024 at 2:02 pm- Two industry leaders join forces to develop SoC solutions for Generative AI (GenAI) and storage data acceleration;

- By merging Pliops’ KV technology with Kalray’s MPPATM architecture, the combined entity will deliver unparalleled data processing performance for AI and GenAI applications;

- The proposed merger will be executed through a share exchange, with Kalray shareholders retaining majority control;

- Existing investors in Pliops would become shareholders in the combined entity as a result of the proposed merger;

- The merger brings together complementary teams with a solid international presence, poised to drive innovation and growth;

- The companies are in advanced discussions, with an exclusivity period agreed upon until mid-July 2024.

Kalray, Inc., French provider of hardware and software solutions to accelerate data-intensive and AI workflows from cloud to edge, entered exclusive negotiations to merge with the Israeli company Pliops, by way of a contribution (apport) of Pliops shares to Kalray. Pliops specializes in developing advanced technologies and acceleration solutions for AI and storage servers in data centers.

“This proposed merger with Pliops represents a major strategic opportunity for our companies. By combining our strengths, we aim to become the global leader in data acceleration solutions for storage and AI GPUs. We are confident that this alliance would offer our customers even more disruptive solutions and present a unique value, including to the most advanced players in the market,” says Eric Baissus, CEO of Kalray. “Discussions are at an advanced stage, and we seek to converge them and sign a definitive agreement in the coming weeks.”

Ido Bukspan, CEO of Pliops and former SVP of chip design at NVIDIA says: “The potential in this proposed merger between our two companies is tremendous. Combining our technological expertise, teams, and products to make this new entity a global leader will significantly accelerate our time to market with a novel storage paradigm for AI data acceleration solutions.”

Pliops, expert in acceleration solutions for next-gen AI storage servers and data centers

The Israeli start-up has gained renown for its innovative development of advanced technologies and acceleration solutions, specifically targeting next-gen storage servers and GPU computing platforms. These solutions aim to significantly enhance AI data access speed, propelling the industry to unprecedented levels of performance in AI and data processing. The company collaborates with industry giants, leveraging its technology to enhance market-leading GPU-based AI solutions.

Furthermore, Pliops’ technology plays a pivotal role in accelerating the next gens of NVMe storage arrays and database applications. These 2 rapidly expanding markets benefit from Pliops’ enhancements, all achieved without necessitating any infrastructure changes.

Located near Tel Aviv in the Israeli Silicon Valley, Pliops has renowned WW shareholders in its capital, including AMD, Intel Capital, KDT, Nvidia, SK Hynix, SBVA, and WD. After the proposed merger’s completion, existing Pliops shareholders would become shareholders of Kalray. Pliops has raised about $200 million since its inception in 2017 and employs approximately 120 employees in Israel, USA and China.

It is expected the integration of Pliops would consolidate additional cash, covering Pliops financial needs for 12 months, and would start having a positive impact on the turnover and EBITDA of the new group from 2025.

“This merger represents a significant strategic advancement. By combining Pliops and Kalray’ s exceptional assets, we are poised to enhance business opportunities for both companies,” stated Eyal Waldman, chairman of Waldo Holdings LLC and former CEO and co-founder of Mellanox (acquired by Nvidia).

“KDT is excited to see this merger bring together two companies that can rapidly deliver a robust storage AI acceleration solution to the market.” stated by Isaac Sigron, MD at KDT ( Koch Disruptive Technologies), one of the largest shareholder of Pliops.

A major opportunity to become a key player in the AI market and to accelerate Kalray’s roadmap

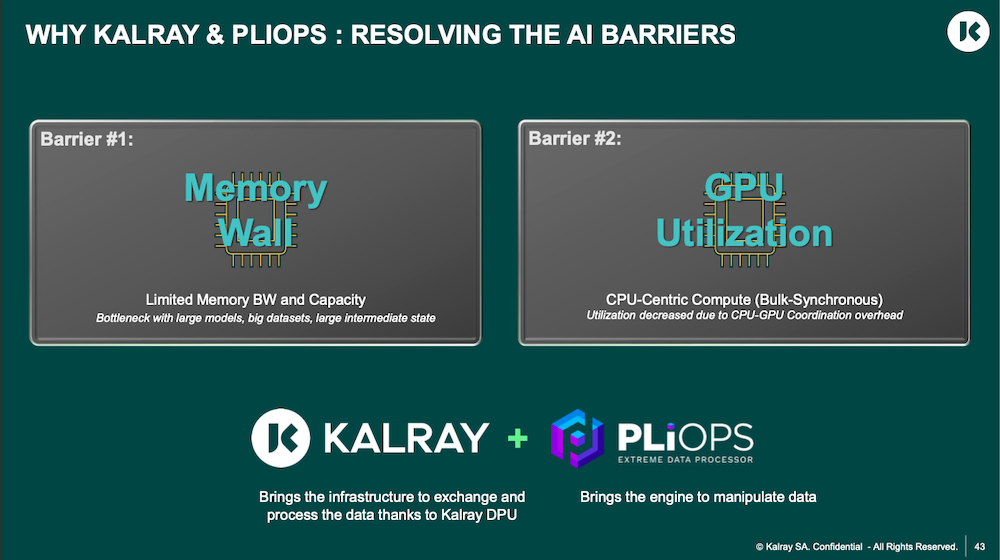

Kalray and Pliops have already been working to combine their respective technologies for several months. This transaction would allow Kalray to accelerate its roadmaps and add unique AI acceleration technology into its solution in full alignment with the current strategy. It would also allow Kalray to become the leader in built-for-storage chip data acceleration solutions. These solutions are designed to complement GPUs perfectly, optimizing their use in environments where cost and energy consumption are significant concerns.

With this operation, Kalray aims to significantly accelerate in the strategic and high-potential AI sector in data centers while continuing Kalray development solutions and strategic partnerships, such as the one with ARM[1].

This merger would bring powerful synergies:

1. Technologically: By merging, the combined company can leverage the strengths of both firms to provide cutting-edge solutions in Data Acceleration for AI and Storage. Specifically:

- Optimized Pliops IPs: The merger allows for the optimization of Pliops’ IPs, enhancing the technological value of Kalray’s solutions. This synergy will be particularly beneficial for next-gen Data Acceleration System-on-Chips (SoCs), reducing time-to-market (TTM).

- Data Center Acceleration and GPU Farms: The joint expertise can address the growing demand for data center acceleration and GPU farms, where efficient data access and processing are critical.

2. Operationally:

- Strengthened Teams: Pliops’ technological expertise (with 80% of its staff in R&D) will significantly bolster the merged company’s capabilities. The shared costs resulting from the merger will also streamline development efforts.

- Independence vs. Collaboration: Instead of continuing separate development paths, the merger enables collaboration, resource sharing, and operational efficiency.

3. Commercially:

- Expanded Opportunities:

- Europe and China: The Kalray group’s presence in Europe and China will be strengthened, opening up new markets and business opportunities.

- USA (Hyperscalers): Integration with Hyperscalers in the US market will enhance the combined company’s reach and influence.

- NGenea Integration: Pliops’ existing offerings will seamlessly integrate into NGenea, Kalray’s Data Acceleration platform, creating a comprehensive solution.

4. Financially:

- Increased Valuation: The merger will boost the overall valuation of both companies’ activities, creating a more valuable entity in the market.

Principal terms of the contemplated transaction

The contemplated merger would involve Pliops’ shareholders contributing100% of the shares of Pliops to Kalray, with payment made in new shares of Kalray, to preserve financial resources for the development of the combined entity and to bring Pliops shareholders into the capital.

The envisaged ratios would give Kalray shareholders 65% of the combined entity’s capital, compared to 35% for Pliops shareholders, with a possibility of increasing to 40% for Pliops, vs 60% to Kalray, upon achieving predefined strategic objectives.

The LOI establishes an exclusivity period until July 15, 2024, during which the 2 firms will work together to finalize the deal’s details. Financial and legal due diligence is ongoing, and both companies are exploring all the opportunities for synergies and added value that this merger could offer.

The transaction’s completion would be subject to customary conditions, including consultation with Kalray’s works council (comité social et économique) and approval by Kalray’s and Pliops general assembly of shareholders.

Kalray draws investors’ attention to the fact that the ongoing negotiations may or may not result in the completion of the transaction.

It will keep the market updated with the next steps.

In the meantime, Kalray (standalone) confirms its ambition to achieve strong annual revenue growth for FY24 with 2H24 expected higher than in 1FH24 due to previously announced business cycles[2] and supply difficulties for certain components. Based on the billings to date and orders to be recognized by June 30, 2024, the company anticipates the 1H24 revenue comparable to that of the 2H23.

The parties are also considering raising significant funds from various channels, concurrently with the merger, to accelerate its development. Kalray recalls its use of non-dilutive financing; a revolving bank loan of up to €15 million has been signed and Kalray is preparing to launch a EuroPP (Euro Private Placement).

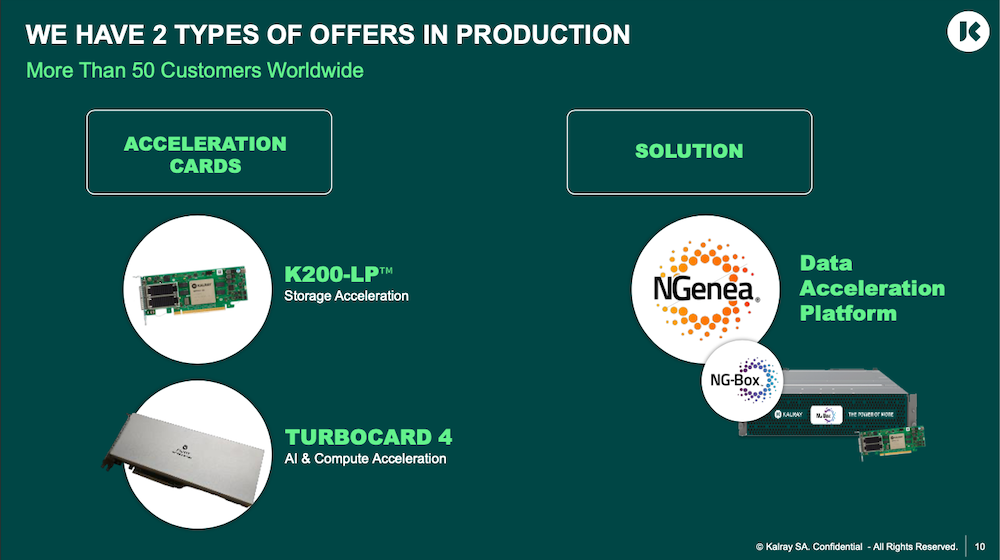

About Kalray

It is a technology innovator specializing in software and hardware solutions to accelerate data-intensive workflows in M&E, HPC, and AI. Its comprehensive product range features ngenea, a leading data acceleration platform, and accelerated data processing cards for storage and compute.

With its solutions, customers can scale their infrastructures to efficiently meet performance and capacity needs for data-intensive tasks, all without being tied to specific data formats or vendors.

Founded in 2008 as a spin-off from the French CEA research lab, Kalray has corporate and financial backing from notable investors such as Alliance Venture (Renault-Nissan-Mitsubishi), NXP Semiconductors, and Bpifrance. Committed to innovation and excellence, it strives to deliver value to its customers, developers, and the planet through technology and expertise.

[1] Kalray recently announced joining the Arm Total Design (ATD) ecosystem to streamline the integration of its AI acceleration and data processing technology with Arm ecosystem partners. Refer to the press releases dated February 7, 2024, and April 24, 2024, for further details.

[2] See press release April 24, 2024

Comments

It's a real surprise for the industry that didn't anticipate this and there is no real information or comments about it yet, we're among the real firsts to make a comment. Let's try to give some perspectives and analyze this deal a bit to understand the rationale and reasons behind.

The first remark we have to make is that press release is not available on Kalray website, neither on Pliops one. We found it on Actusnews wire and here is a direct link to it. There is an about section about Kalray, but the one about Pliops was omitted. All these elements confirms that Pliops undergoes the deal with a sort of urgency and at the same time, it represents an amazing opportunity for Kalray that can re-converge towards its original mission.

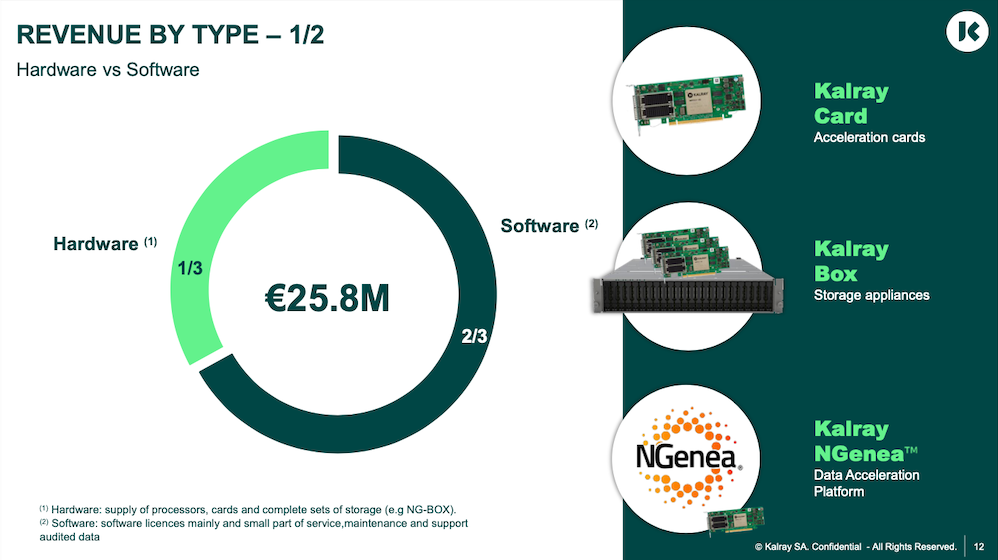

In terms of revenue, Kalray generated:

- €1 million in 2020,

- €1.5 million in 2021,

- €16 million in 2022, and

- €26 million in 2023

2/3 of the revenue come from software, support and services thanks to the acquisition of Arcapix Holdings in 1H22, who owns Pixitmedia. It had a significant positive impact of the company revenue trajectory but it is well below the goal of €100 million in 2023, reaching just 25% of it but the team still is there, perhaps the beauty of a french managed company. The Pliops deal should influence positively the revenue and illustrates again that the growth and the vast majority of the revenue comes from outside by acquisitions as the organic business is tough and slow to take off. We understand that Pixitmedia could be interpreted as a tactical move to "feed the machine".

Click to enlarge

DPU or xPU?

We also notice that the term DPU is not mentioned at all in this press release. It was a hot acronym a few quarters ago but some market events generated some negative comments and have weakened players messages and positions.

The Israeli company Annapurna Labs has been acquired by Amazon in 2015 and various sources mentioned a transaction that reached $350 million. AMD acquired Pensando in 2022 for $1.9 billion following Xilinx one in 2021 for $35 billion with their Alveo and Versal cards. Microsoft bought Fungible end of 2022 for "just" $190 million, well below the $300 million raised by the company. Nebulon disappeared from the market, many of you read what we published a few months ago. We could even listed the acquisition for $687 million in cash of Exar by MaxLinear in 2017 for its storage accelerators cards among other things. Also, BittWare, a Molex company, integrates partners technologies to offer specialized cards such the Eideticom's Query Processing Unit (QPU) that targets database query, analytics or format conversion. Even ServiceNow entered the game and swallowed the small European player Swarm64 in 2021.

In as adjacent segment, computational storage, NGD Systems hit a wall and disappeared, we continue to see ScaleFlux or BittWare in that category.

Globally DPU is a hard business that could appear as orthogonal with the market size and needs in data processing with the exponential growth of data volumes. But opportunities are huge in this red ocean explaining all these transactions, disappointments and failures as well.

And at the same time DPU morphed itself to a network oriented notion, SmartNIC, today representing the essential of it, largely promoted by Nvidia BlueField following Mellanox acquisition in 2019 for $6.9 billion and the Amazon push.

What is sure is the need on the market for some additional processing power to offload CPUs for very specific tasks such as AI oriented jobs like the inference phase but also database or data protection that could be encryption or erasure coding and other functions or very generic ones like networking. We speak today more about accelerators in all these domains, the third socket as the perfect companion of CPUs and GPUs.

We read leaders…

That press release starts saying "2 industry leaders join forces…", we probably don't have same definition of leaders or the 2 companies don't have in mind market share and revenue as Kalray and Pliops are small, very small players in their respective core domains. Our readers also didn’t see any spectacular successes from them or hockey stick or t2d3 trajectory, again in the DPU segment.

Why does Pliops need to find a new land?

As mentioned in the press release, Pliops has renowned worldwide shareholders in its capital, including AMD, Intel Capital, KDT, Nvidia, SK Hynix, SBVA, WD and more. It appears that even with a large amount raised, Pliops has suffered from some technical limitations and then commercial difficulties that have prevented the company to take off. In 2023, Uri Beitler move from CEO to CSO replaced by Ido Bukspan coming from Nvidia, one of its investors. First warning at least a public one. But now the time to find an exit appears to be urgent and with all these famous investors, none of them is ready to make a move or influence a transaction in its ecosystem. Even AMD, with Pensando and Xilinx, neither Nvidia moved a finger to acquire Pliops. What kind of sign is it? As mentioned above, there is no presence of this deal with Kalray on Pliops website, is it positive? Kalray is a public company, Pliops is not. Pliops people refused to comment obviously, being in the exclusive period until July 15.

We don't know of course if Pliops spoke with other players such as MaxLinear or Marvell, but Kalray realized the unique opportunity it is to continue its journey…

And for Kalray?

As the company stated recently, the "big" DPU deal what the company named the "Jumbo contract" with a server vendor didn't generate, at least today, what was expected. And clearly, the image of Kalray is, once again, impacted. Dell, JB&A and ARM continue to be a priority associated with the Dolomites project plus other European initiatives.

Click to enlarge

Kalray surprised the market with an unimaginable deal with a storage software UK-based entity Pixitmedia via Arcapix Holdings. Generating revenues this software asset contributes to a new image for Kalray, a bit fuzzy now, but it is clearly not enough and not in the DNA of the company that came from CEA as a spin-off.

On Kalray website, the message is still about DPU and obviously acceleration cards. We found the famous Flashbox, built with Viking Enterprise Solutions, a product division of Sanmina, announced in 2021 that won an award at FMS 2022, under the name NG-Box even if sometimes the product also is named Kalray Box as slides state.

Click to enlarge

Like with Piximedia, we see in the Pliops deal the hand and talent of Lior Gal Genzel, today only mentioned on Kalray web site, he was also a few weeks ago on NeuroBlade one. NeuroBlade also is a card accelerator player with what they call SPU - SQL Processing Unit - dedicated to analytics. At Kalray, he is VP of business development and is always looking for bargain to boost value for companies he leads or works for, he's a real maximizer. He was instrumental in the Pixitmedia deal and also here obviously with the Israeli connection and he’s living there. We still don’t understand what he found at Pixitmedia, still a mystery for lots of people, but the tactical move to generate cash fast is legitimate.

For our readers, he co-founded Excelero in 2014, an early block software-defined storage vendor targeting NVMe environments, that finally landed at Nvidia for the same amount they raised, $35 million, interesting right? Probably too early like Apeiron, Mangstor then Exten now at OVH cloud, E8 swallowed by AWS or even ScaleIO acquired by EMC in 2013. Speaking about this block SDS, we'll monitor the trajectory of players like Lightbits Labs, Simplyblock, Blockbridge Networks, NGX, StorPool, DataCore, Datafy or Volumez who all compete against the Kalray NG-Box.

Or we can imagine that many of these interesting ideas at Kalray could come from some special advisors that know very well the market with their brilliant track record?

The new entity

The result entity, named Kalray, will have 65% Kalray shareholders for 35% for Pliops. It represents a real bargain for Kalray that will again shine its image, oscillating from a pure hardware image, a mix hardware and software and now a well balanced towards hardware again.

As a key European player, it would be good for Kalray to finally take off thanks to these recent moves and decisions and especially Pliops additional R&D, IP, ideas, products and team.

Click to enlarge

Click to enlarge

We also understand that the goal is to announce a definitive merge at the FMS conference early August where both companies used to exhibit.

It appears that Kalray organizes a video call June 12 at 6pm Paris time to cover that merger with Pliops.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter