Pure Storage: Fiscal 1Q25 Financial Results

Pure Storage: Fiscal 1Q25 Financial Results

Growing 18% Y/Y but decreasing 13% Q/Q at $693 million with high loss ($35 million)

This is a Press Release edited by StorageNewsletter.com on May 30, 2024 at 2:03 pm| (in $ million) | 1Q24 | 1Q25 | Growth |

| Revenue | 589.3 | 693.5 | 18% |

| Net income (loss) | (67.4) | (35.0) |

Pure Storage, Inc. announced financial results for its first quarter fiscal year 2025 ended May 5, 2024.

“Pure Storage is uniquely positioned to integrate fragmented data storage environments, which hinders enterprises from easily deploying artificial intelligence, hybrid cloud, and modern application deployment,” said Charles Giancarlo, chairman and CEO. “At our June Accelerate conference, global customers will see how our latest innovations enable enterprises to adapt to rapid technological change with a platform that fuses data centers and cloud environments.”

1FQ25 Highlights

- Revenue $693.5 million, an increase of 18% Y/Y

- Subscription services revenue $346.1 million, up 23% Y/Y

- Subscription annual recurring revenue (ARR) $1.4 billion, up 25% Y/Y

- Remaining performance obligations (RPO) $2.3 billion, up 27% Y/Y

- GAAP gross margin 71.5%; non-GAAP gross margin 73.9%

- GAAP operating loss $(41.8) million; non-GAAP operating income $100.4 million

- GAAP operating margin (6.0%); non-GAAP operating margin 14.5%

- Operating cash flow $221.5 million; free cash flow $172.7 million

- Total cash, cash equivalents, and marketable securities $1.7 billion

“We are pleased with the strong start to our year as 1FQ25 revenue growth of 18% and profitability both outperformed,” said Kevan Krysler, CFO. “We are well positioned with our highly differentiated data storage platform for substantial long-term growth.”

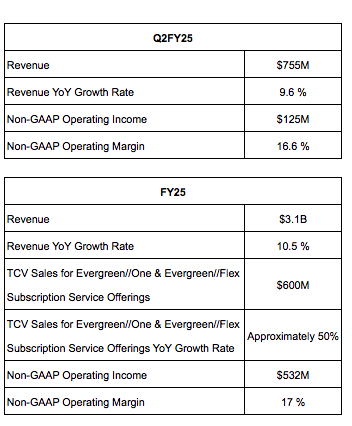

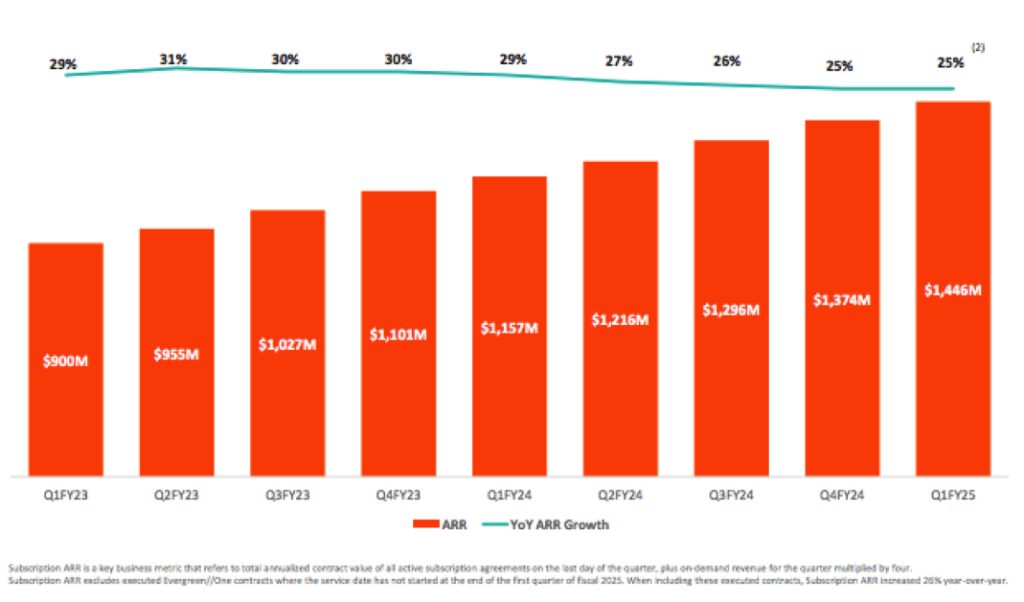

Guidance

Comments

In 1FQ25, revenue grew 18% Y/Y and operating profit of $100 million dollars, but decreased 13% Q/Q at $693 million with high loss ($35 million)

1FQ25 at a glance

Two key drivers of revenue growth this quarter were:

- sales to new and existing enterprise customers across entire storage platform; and

- strong customer demand for our Flashblade solutions, including FlashBlade//E.

Total contract value, or TCV sales for storage-as-a-service offerings during 1FQ25 were $56 million dollars. It saw building demand and pipeline, including large opportunities, for storage-as-a-service offerings during 1FQ25. Consistent with original FY25 forecast, the firm expects 50% growth of its storage-as-a-service offerings, including Evergreen//One and

Evergreen//Flex, achieving $600 million in TCV sales.

US revenue for 1FQ25 was $489 million dollars and international revenue was $204 million dollars.

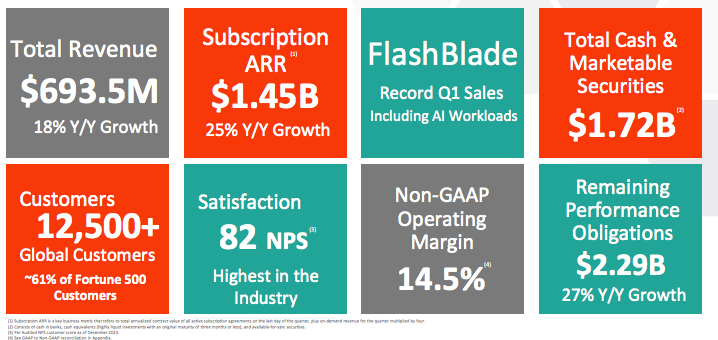

Customers

New customer acquisition grew by 262 during 1FQ25, and the company now serves 61% of the Fortune 500.

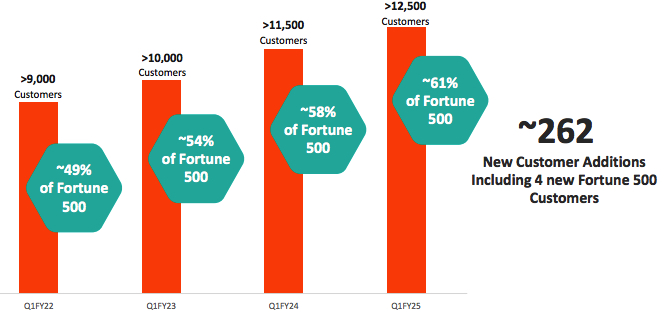

Subscription ARR

In 1FQ25, subscription services was healthy growing 25% to over $1.4 billion.

Headcount decreased slightly to approximately 5,500 employees at the end of 1FQ25.

Revenue in $ million

(FY ended in January)

| Period | Revenue | Y/Y growth | Net income (loss) |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| FY20 |

1,643 | 21% | (201.0) |

| FY21 |

1,684 | 2% |

(282.1) |

| FY22 |

2,181 |

30% |

(143.3) |

| 1F23 | 620.4 | 50% |

(11.5) |

| 2F23 | 646.8 | 30% |

10.9 |

| 3F23 | 676.1 | 20% | (0.8) |

| 4F23 | 810.2 | 14% | 74.5 |

| FY23 |

2,753 |

26% |

73.1 |

| 1Q24 |

589.3 |

-5% |

(67.4) |

| 2Q24 | 688.7 |

6% |

(7.1) |

| 3Q24 | 762.8 | 13% | 70.4 |

| 4F24 | 789.8 | -3% | 65.4 |

| FY24 |

2,831 | 3% |

61.3 |

| 1F25 | 693.5 | 18% | (35.0) |

| 2F25 (estim.) | 755 | 10% | NA |

| FY25 (estim.) |

3,100 |

10% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter