WW SSD Shipments in 1Q24 Decreased 5% Q/Q to 83.8 Million

With capacity growing 6.5% to 90.9EB

This is a Press Release edited by StorageNewsletter.com on May 27, 2024 at 2:02 pmAnalysts from Trendfocus, Inc. published on May 16, 2024 a report, NAND/SSD Information Service CQ1 2024 Quarterly Update – Executive Summary. Here is an abstract.

CQ1 ’24 SSD results mixed,

with enterprise PCIe the bright spot in both units and exabytes

Client SSDs slowed for the second quarter in a row

as PC OEMs continue to wait for increased end market demand

- Overall unit shipments decreased 5.1% Q/Q to 83.789 million, with capacity growing 6.5% to 90.866EB.

- Client module units fell by 9.5% while exabytes declined even more, by 11.5%, with shipments dropping to 65.649 units and 43.671EB, respectively.

- Enterprise PCle units climbed drastically, growing 50.0% Q/Q to 8.078 million, while capacity shipped also achieved massive growth of 45.5% in the same time frame reaching 33.709EB, helped by several form factors and a variety of capacities.

- SAS SSD shipments contracted by 19.9% in units to 0.751 million and fell 5.6% in exabytes to 3.027, giving back some of the gains from the previous quarter.

- Although increases were moderate, enterprise SATA SSD shipments did rise in both units and exabytes, which grew 2.1 % and 3.7%, respectively, to 3.638 million units and 5.123EB.

- As expected, total NAND bit shipments decreased slightly, by 5.4%, dropping to 219.39EB shipped.

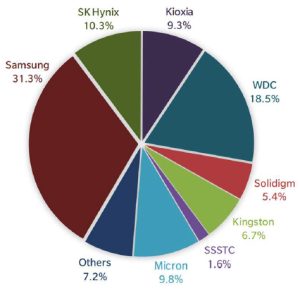

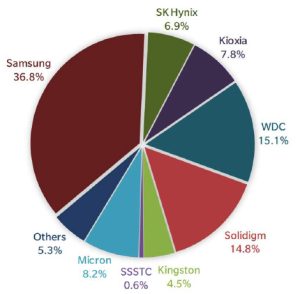

1CQ24 SSD Market Share, by Supplier, Units (in million), Exabytes*

Total SSD Market: 83.789 Million Units

Total SSD Market: 90.866 Exabytes

* Preliminary data – values may change.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter