Weka.IO Raised $140 Million, Total at $415.1 Million

Post-money valuation to $1.6 billion

This is a Press Release edited by StorageNewsletter.com on May 17, 2024 at 2:02 pmWeka.IO Ltd. has raised $140 million in an oversubscribed series E funding round comprised of a combined primary and secondary transaction led by Valor Equity Partners, a previous investor in the company.

Under the terms of the deal, Antonio Gracias, founder, CEO, and chief investment officer, Valor Equity Partners, will join Weka’s board.

The round brings Weka’s post-money valuation to $1.6 billion. The funds will augment the company’s considerable cash reserves, giving it options for how it can scale its business rapidly to meet accelerating global demand for AI-native data infrastructure while expanding its investments in developing its data platform software and providing liquidity to Weka employees.

With over 300 of the world’s largest AI and GPU deployments running on the Weka Data Platform, the investment comes at a time of business growth as the company expands to meet significant global demand for modern data infrastructure that efficiently and sustainably addresses the scale and performance demands of advanced technologies like generative AI and high-performance GPUs.

“The recent acceleration of generative AI and enterprise cloud adoption has triggered a sharp increase in customer demand, driving an unprecedented number of eight-figure ARR deals-an impressive feat when you factor in that Weka is a software-based business,” said Intekhab Nazeer, CFO. “It was an opportune time to fortify our cash reserves, allowing our investors to increase their position in the company while minimizing share dilution for our employees.”

This series E round is unique in that it was raised entirely with existing investors, like Valor, seeking to increase their positions in the company. Generation Investment Management, NVIDIA, Atreides Management, 10D, Hitachi Ventures, Ibex Investors, Key1 Capital, Lumir Ventures, MoreTech Ventures, and Qualcomm Ventures joined Valor in contributing to the round.

“The continued backing of this preeminent group of investors speaks volumes: Weka is building something truly transformative that modern data-driven organizations need now, more than ever,” said Liran Zvibel, co-founder and CEO. “We are grateful to our returning backers for their support and are honored to welcome Antonio Gracias to our board of directors. Antonio has played a pivotal role in helping build some of the world’s most innovative and disruptive companies. We look forward to collaborating with him as we scale to create new value for WEKA’s customers, partners, and shareholders.”

The company began architecting a wholly new approach to the enterprise data stack in 2013 that has set the standard for modern data infrastructure in the AI era. Firm’s software can be deployed anywhere, delivering unparalleled speed, simplicity, scale and sustainability for GPUs, AI and other performance-intensive workloads, helping customers to achieve faster insights, discoveries, breakthroughs, and business outcomes.

“Weka pioneered the concept of a software, platform-based approach that is revolutionizing modern enterprise data, then forged and hardened its technology in some of the largest, most demanding AI projects on the planet,” said Antonio Gracias, CEO and chief investment officer, Valor Equity Partners. “Valor has a long history in the development of AI, beginning with our investment in DeepMind in 2013, and we believe Weka is positioned to be an integral part of the acceleration of the technology going forward. Valor is proud to partner with Weka to support the company through its next phase of growth and beyond.”

“The rapid increase in enterprise AI adoption has led to exponential growth in demand for computing resources. This is why the world needs solutions like the Weka Data Platform, which helps customers achieve radical improvements in the performance, efficiency, and utilization of next-gen GPUs. Weka’s business has continued to scale since Generation joined as an investor in 2022, and we are pleased to again be supporting the company’s continued growth., said Dave Easton, growth equity partner, Generation Investment Management LLP and Weka board member.

“Weka unequivocally increases the utilization rate of GPUs for both training and inference. The AI companies with the highest GPU utilization rates should be able to choose between faster time to market, lower cost or higher quality than competitors with lower GPU utilization rates,” said Gavin Baker, managing partner and chief investment officer, Atreides Management, LP.

Comments

Once again, Weka surprises the market with this new round and they officially join the Coldago Research Storage Unicorn list that we’ll be publish in June, as it is done for several years twice a year.

This news is huge, good for the market and good for Weka obviously. They will accelerate in the coming months. The total raised is $415.1 million according to Crunchbase.

It’s impressive but also the result of a methodical plan the firm started a few years aligned with the arrival of Jonathan Martin, well known for his innovative marketing ideas that really make breakthrough and impacts at Weka. His association with Liran Zvibel has changed the company’s trajectory.

It also confirms the leadership of the company in its traditional markets with several use cases they excel in.

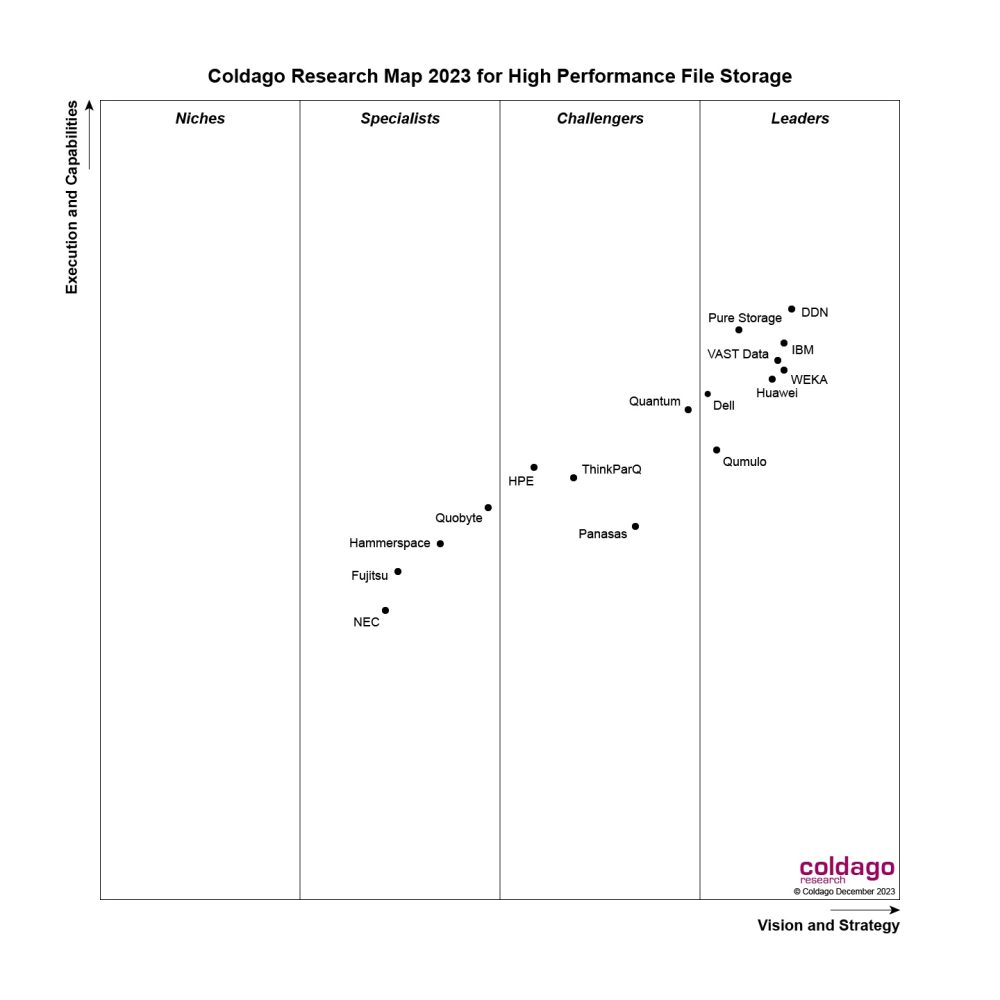

Weka is well ranked in various industry analysts reports like the recent Map 2023 for File Storage in the High Performance File Storage category.

The positioning of the company and solution around the AI era fueled by a versatile data platform has proven the right direction, well beyond the limited and traditional message of a parallel file system stuff that is seen by some other players and explained why some of them hit a wall or continue to stay confidential. They also illustrated perfectly the U3 - Universal, Unified and Ubiquitous - Storage message promoted by Coldago for many years.

At ISC, the booth was central, the Lamborghini was in the entrance hall, everyone saw it, you can try to drive a fast car on their booth. The firm was also present at different partner booth as well like Lenovo and others.

This market segment is interesting with strong commercial and open source solutions and we'll see how the competition will react to this, Panasas changed its name to Vdura, some others continue their confidential journey and it seems to be enough for them or rely on partnerships or acquisitions to feed their lack of innovations ...

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter