Commvault: Fiscal 4Q24 Financial Results

Commvault: Fiscal 4Q24 Financial Results

Outstanding period with sales and net income increasing

This is a Press Release edited by StorageNewsletter.com on May 1, 2024 at 2:02 pm| (in $ million) | 4Q23 | 4Q24 | 12 mo. 23 | 12 mo. 24 |

| Revenue | 203.5 | 223.3 | 784.6 | 839.3 |

| Growth | 10% | 7% | ||

| Net income (loss) | (43.5) | 126.1 | (35.8) | 168.9 |

Commvault Systems, Inc. announced its financial results for the fourth quarter and fiscal year ended March 31, 2024.

“We had an outstanding quarter and a breakout year, highlighted by 10% total revenue growth and 15% total ARR growth in the fourth quarter,” said Sanjay Mirchandani, president and CEO. “Our Commvault Cloud platform is resonating with customers, who entrust us with their data and resilience in this era of unrelenting cyber threats.“

4FQ24 Highlights

• Total revenue was $223.3 million, up 10% Y/Y

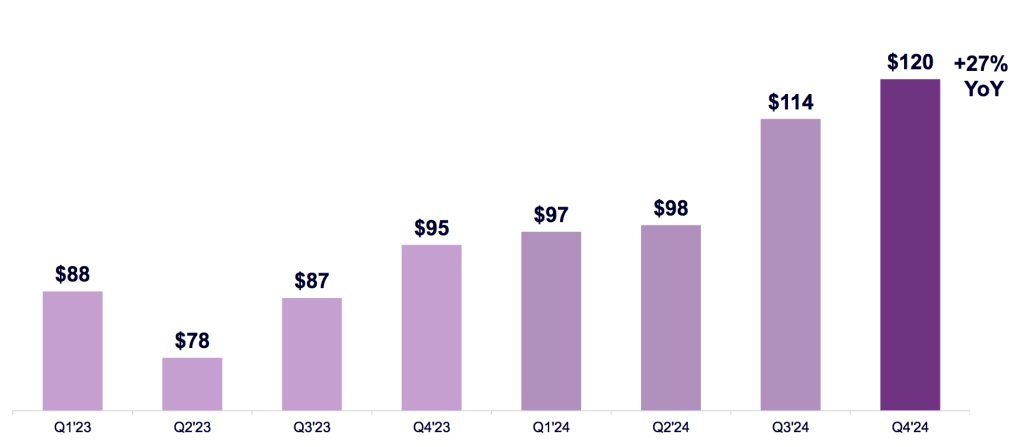

• Subscription revenue was $119.9 million, up 27% Y/Y

• Income from operations (EBIT) was $18.2 million, an operating margin of 8.1%

• Non-GAAP EBIT was $45.2 million, an operating margin of 20.2%

• Operating cash flow was $80.0 million, with free cash flow of $79.1 million

• Share repurchases were $50.4 million, or approximately 547,000 shares of common stock

FY24 Highlights

• Total revenue was $839.2 million, up 7% Y/Y

• Total ARR grew to $770 million, up 15% Y/Y

• Subscription revenue was $429.2 million, up 23% Y/Y

• Subscription ARR grew to $597 million, up 25% Y/Y

• Income from operations (EBIT) was $75.4 million, an operating margin of 9.0%

• Non-GAAP EBIT was $177.5 million, an operating margin of 21.1%

• Operating cash flow was $203.8 million, with free cash flow of $200 million

• Full year share repurchases were $184.0 million, or approximately 2,479,000 shares of common stock

Guidance for 1FQ25:

• Total revenue is expected to be between $213 million and $216 million

• Subscription revenue is expected to be between $116 million and $119 million

• Non-GAAP operating margin1 is expected to be between 18% to 19%

Guidance for FY25:

• Total revenue is expected to be between $904 million and $914 million

• Total ARR is expected to grow 14% Y/Y

• Subscription revenue is expected to be between $514 million and $518 million

• Subscription ARR is expected to grow between 21% to 23% Y/Y

• Non-GAAP operating margin is expected to be between 20% to 21%

• Free cash flow is expected to be at least $200 million

Comments

Total revenue grew 10% Y/Y to $223 million, more than expected (between $210 million and $214 million), driven by a 27% increase in subscription revenue, which now exceeds 50% of total revenue.

Perpetual license revenue was flat sequentially at $15 million as perpetual licenses are generally sold in limited verticals and geographies. Firm expects the headwinds from perpetual license sales to diminish in FY25 and beyond.

Subscription revenue

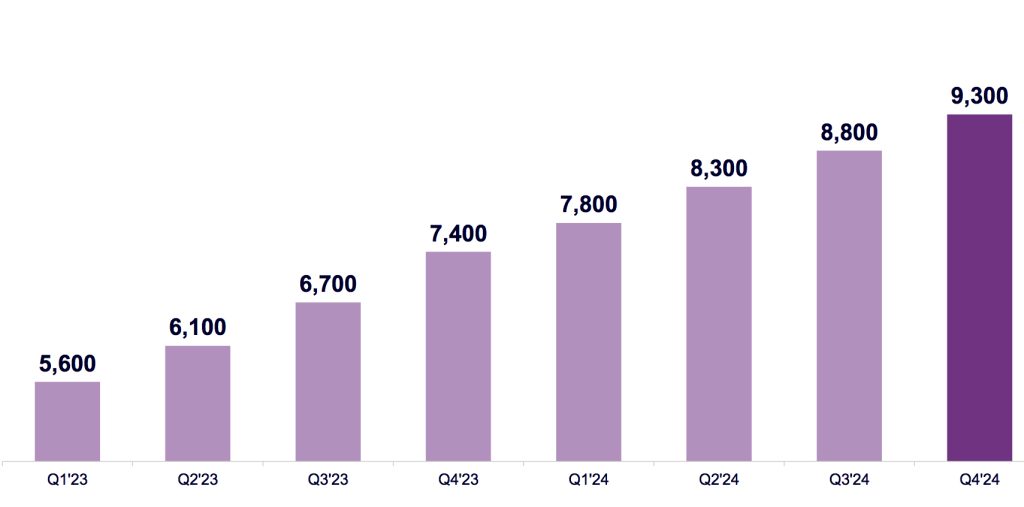

Subscription customer growth

4FQ24 customer support revenue, which includes support for both term based and perpetual software licenses, represented $77 million flat Q/Q and Y/Y.

Customers for revenue from term software and related arrangements accelerated to 47% of total customer support. This compares to just 40% in FY23, and the company expects customer support revenue from term-based software licenses to become the majority of its customer support revenue in FY25, driven by the attach on term software license growth.

4FQ24 total ARR was $770 million, an increase of 15% Y/Y, which reflects the underlying strength of business when revenue was presented on an annualized basis. Subscription ARR, including term-based licenses and SaaS contracts, grew 25% Y/Y to $597 million. This includes $168 million of SaaS ARR, which jumped 65% from a year ago.

3FQ24 to 4FQ24 SaaS ARR growth was impacted by $2 million of foreign exchange headwinds as the US dollar strengthened primarily vs. the euro in 4FQ24. On a constant currency basis, Commvault added approximately $18 million of net new SaaS ARR in both 3FQ24 and 4FQ24 as the underlying strength of SaaS business continues.

New SaaS ARR contributed 2/3 of total ARR growth for FY24, and thery now represents 22% of total ARR compared to just 15% a year ago. From a customer perspective, existing customer expansion was strong with 4FQ244. Saas net dollar retention of 123% being benefited by both upsell and cross-sell activities.

The company ended the quarter with approximately 2,900 employees, which was flat Q/Q and an increase of 4% Y/Y.

For 1FQ25, it expects subscription revenue, which includes both the software portion of term-based licenses and sense to be $116 million to $119 million. This represents 21% Y/Y growth at the midpoint. As a result, the firm expects revenue to be $213 million to $216 million with growth of 8% at the midpoint.

Revenue and net income (loss) in $ million

| Fiscal Period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| FY18 | 699.4 | 8% | (61.9) |

| FY19 | 711.1 | 2% |

3.6 |

| FY20 |

670.9 |

-6% |

(5.6) |

| FY21 | 723.5 | 8% | (31.0) |

| FY22 | 769.6 | 6% | 33.6 |

| 1FQ23 | 198.0 | 8% | 3.5 |

| 2FQ23 | 188.1 | 6% | 4.5 |

| 3FQ23 | 195.1 | -4% | (0.3) |

| 4FQ23 | 203.5 | -1% |

(43.5) |

| FY23 | 784.6 | 2% |

(35.8) |

| 1FQ24 | 198.2 | -3% |

12.6 |

| 2FQ24 | 201.0 | 7% |

13.0 |

| 3FQ24 | 216.8 | 11% |

17.1 |

| 4FQ24 | 223.3 | 10% | 126.1 |

| FY24 | 839.3 | 7% | 168.9 |

| 1FQ25 (estim.) | 213-216 | 7%-9% |

NA |

| FY25 (estim.) | 904-915 | 15%-17% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter