90% of Enterprises Plan to Increase Cloud Storage Budgets in 2024

As per 2024 Wasabi Global Cloud Storage Index conducted by Vanson Bourne

This is a Press Release edited by StorageNewsletter.com on March 7, 2024 at 2:02 pm- 53% of respondents are exceeding cloud storage budget, in part because they are using more capacity than they planned (42%) and are migrating more apps and data to the cloud than planned (45%)

- AI/ML applications and services adopted or planning to adopt by almost all organizations (99%), with specific focus on accelerating product innovation and operational efficiencies

Organizations WW are increasing public cloud storage use and budgets to accelerate innovation.

According to the 2024 Wasabi Global Cloud Storage Index, 93% of organizations plan to grow their public cloud storage capacity in 2024. This rate of capacity increase is up 9 points from last year’s survey (which indicated 84% expected an increase). Commissioned by Wasabi Technologies, Inc., and conducted by Vanson Bourne Ltd, the index uncovers the changing attitudes toward public cloud storage adoption, the factors that influence storage buying decisions, and the market’s top priorities when it comes to budget, capacity, vendor selection, billing, features and satisfaction.

Cloud storage budgets increase as more enterprises move to the cloud, but the market still suffers from expensive public cloud storage fees.

- More than half of respondents say they exceeded their budgeted spend on public cloud storage. The main reasons for budget excess include using more storage than they planned (42%) and migrating more apps and data to the cloud than planned (45%).

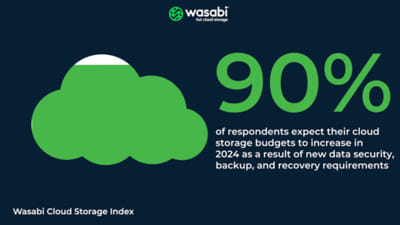

- 90% of respondents expect their cloud storage budgets to increase in 2024, up from 84% in 2023, in part due to new data security, backup, and recovery requirements, with 95% of C-level respondents saying they expect cloud storage budgets to increase in 2024.

- On average, 47% of cloud storage billing is allocated to data and usage fees (including API calls, operations, egress, retrieval, etc.), this finding aligns with last year’s results, indicating that organizations continue to struggle with complex and material fee charges.

- 53% of respondents exceeded budgeted spend for cloud object storage in 2023, 2 points higher than the previous year’s average (52%).

- 72% of new cloud storage adopters, those who purchased services in 2022 and 2023, exceeded budget spend, and interestingly, these respondents cited high storage usage and growth, unanticipated egress fees and API call fees, as the 3 main reasons they exceeded budget.

“Results from this year’s Wasabi Global Cloud Storage Index show cloud storage use isn’t slowing down, in fact, many organizations are asking more of their cloud storage services; improved security, low-latency storage for frequently accessed data, and tools to improve data management,” said Andrew Smith, senior manager of strategy and market intelligence, Wasabi, and former IDC analyst. “The 2024 Cloud Storage Index also assessed cloud storage adoption, deployment and challenges associated with emerging AI/ML workloads, showing that while nearly all organizations are planning to adopt or are already implementing AI/ML apps and services, they are taking a low-risk approach by applying new technology to internal operations first. Also, coming as no surprise, Generative AI leads the AI/ML workload adoption pack with 49% of enterprises already implementing, or planning to implement this technology at their organization.“

Over 40% of respondents identify their organization as “cloud-first” when it comes to IT services adoption, and much of their stored data is considered “hot“

- The number of respondents self-identifying as “cloud-first” in 2024 (42%) – increased from 2023, illustrating a continued shift towards cloud IT services adoption when it comes to infrastructure solutions, including storage.

- Respondents ranked their cloud object storage performance requirements on a scale of “cold” to “hot” Only 18% of cloud object storage data, on average, sits within the “cold” category. The remaining 82% of cloud object storage is classified as more active data (I.e., hot, warm, or cool). This allocation is indicative of the growing applicability of object storage across a wide range of enterprise applications; as well as enterprise requirements to do more with their data.

“The 2024 Global Cloud Storage Index shows organizations are vastly underestimating the cost of egress and API call fees,” said David Friend, Co- founder and CEO, Wasabi. “Our findings show almost half of the average cloud storage bill is attributed to various data access and usage fees. We believe this unfavorable mix practically doubles total cloud storage costs. Even more concerning is the impact of these fee structures as nearly every organization expects to store and do more with their data. There is evidence that some of this growth is being driven by the need to train AI models.“

AI/ML workload adoption will catalyze infrastructure modernization to accommodate data sprawl across new environments.

- 99% of respondents plan to adopt, or are already implementing AI/ML solutions and services in 2024.

- 49% of respondents say AI/ML workload adoption will create new challenges storing data across a wider range of locations (e.g., edge, core, and cloud).

- Current or planned AI workload adoption is dominated by Generative AI (49% of respondents), followed by AI/ML solutions for security and compliance (45%) and product design (39%)

- This year the index asked specifically about storage-related concerns and challenges associated with AI/ML solution adoption; and 97% of respondents believe their organization has storage-related concerns associated with AI/ML.

- The top 3 concerns facing enterprises include: requirements to store data across a wider range of locations (49%); new or increased data movement/migration requirements, including hybrid cloud and multicloud (44%); and the need for enhanced data security and compliance capabilities (43%).

Methodology

Wasabi commissioned independent market research agency Vanson Bourne to conduct research into cloud storage. The study surveyed 1,200 IT decision makers who had at least some involvement in or responsibility for public cloud storage purchases in their organization. The research took place in November and December 2023, and included organizations with more than 100 employees across all public and private sectors. All interviews were conducted using a multi-level screening process to ensure that only suitable candidates were given the opportunity to participate.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter