Nutanix: Fiscal 2Q24 Financial Results

Nutanix: Fiscal 2Q24 Financial Results

Finally profitable, for first time since inception in 2012

This is a Press Release edited by StorageNewsletter.com on March 5, 2024 at 2:02 pm| (in $ million) | 2Q23 | 2Q24 | 6 mo. 23 | 6 mo. 24 |

| Revenue | 486.5 | 565.2 | 920.1 | 1,076 |

| Growth | 16% | 17% | ||

| Net income (loss) | (70.8) | 32.8 | (170.3) | 16.9 |

Nutanix, Inc. announced financial results for its second quarter ended January 31, 2024.

“Our disciplined execution enabled us to deliver a solid second quarter financial performance vs. an uncertain, but stable macro backdrop,” said Rajiv Ramaswami, president and CEO. “We continue to remain focused on being a long-term strategic and innovative partner to our customers as they look to operate in a hybrid multicloud world.”

“Our second quarter results demonstrated a good balance of top and bottom line performance with 26% Y/Y ARR growth and strong free cash flow generation,” said Rukmini Sivaraman, CFO. “We also achieved GAAP operating profitability for the first time, reflecting the progress we’ve made in driving operating leverage in our model and optimizing the difference between our GAAP and non-GAAP results.“

3FQ24 Outlook

- ACV Billings: $265 to $275 million

- Revenue: $510 to $520 million

FY24 Outlook

- ACV Billings: $1.09 to $1.11 billion

- Revenue: $2.12 to $2.15 billion

Comments

As we wrote, commenting former financial quarter, the company was: "Not far to be profitable for first time since inception in 2012." It's done and just appears for this 2FQ24 with $33 million net income.

More than that, revenue in 2FQ24 was a record $565 million, higher than the guided range of $545 to $555 million, and growth rate of 16% Y/Y and 11% Q/Q.

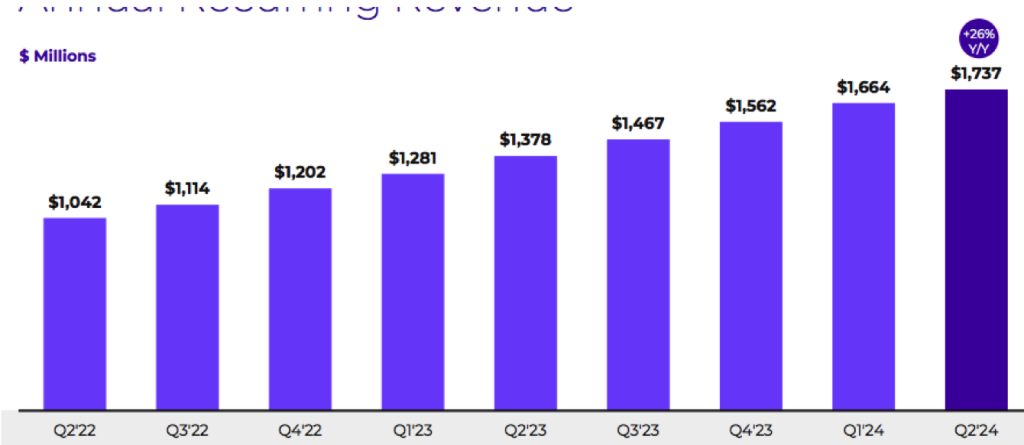

Annual Recurring Revenue

ARR at the end of 2FQ24 was $1.737 billion representing Y/Y growth of 26%. For this period,, the company continues to see modestly elongated average sales cycles compared to historical levels. Average contract duration in this quarter was 2.8 years, slightly lower than in 1FQ24, and more or less in line with expectations.

ACV billings in 2FQ24 were $329 million above the guided range of $295 million to $305 million representing Y/Y growth of 23%.

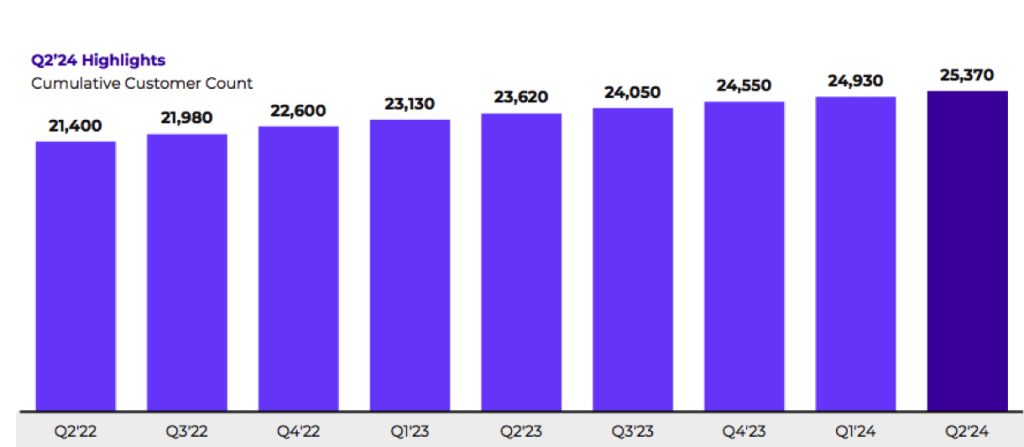

Customer growth

Nutanix ended 2FQ24 with cash, cash equivalents and short term investment of $1.644 billion up from $1.571 billion at the end of 1FQ24.

Guidance for 3FQ24 is as follows: ACV billings of $265 million to $275 million, revenue of $510 million to $520 million down 10% to 8% Q/Q and up 14% to 16% Y/Y, non-GAAP gross margin of 85%, on-GAAP operating margin of 7.5% to 8.5%.

The updated guidance for FY24, which is higher than previously provided is as follows: ACV billings of $1.09 billion to $1.11 billion, representing a Y/Y growth of 15% at the midpoint of the range, record revenue of $2.12 billion to $2.15 billion representing a Y/Y growth of 15% at the midpoint.

Revenue and net income (loss)

(in $ million)

|

FY ended |

Revenue | Net income (loss) |

| FY12 | 6.6 | (14.0) |

| FY13 | 30.5 | (44.7) |

| FY14 | 127.1 | (84.0) |

| FY15 | 241.4 | (126.1) |

| FY16 | 444.9 | (168.5) |

| FY17 | 845.9 | (379.6) |

| FY18 | 1155 | (297.2) |

| FY19 | 1136 | (621.2) |

| FY20 | 1308 | (872.9) |

| FY21 |

1,394 | (1,034) |

| FY22 |

1,581 | (797.5) |

| 1FQ23 | 443.6 | (99.5) |

| 2FQ23 | 486.5 | NA |

| 3FQ23 | 448.6 | (71.0) |

| 4FQ23 | 494.2 | (13.3) |

| FY23 |

1,863 | (254.6) |

| 1FQ24 |

511.1 | (15.9) |

| 2FQ24 |

565.2 | 32.8 |

| 3FQ24 (estim.) | 510-520 | NA |

| FY24 (estim.) |

2,120-2,150 | NA |

($238 million IPO in 2016)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter