Pure Storage: Fiscal 4Q24 Financial Results

Pure Storage: Fiscal 4Q24 Financial Results

Quarterly revenue at $789.8 million down 3% Y/Y, FY sales at $2.8 billion up 3% Y/Y

This is a Press Release edited by StorageNewsletter.com on February 29, 2024 at 2:01 pm| (in $ million) | 4Q23 | 4Q24 | 12 mo. 23 | 12 mo. 24 |

| Revenue | 810.2 | 789.8 | 2,753 | 2,831 |

| Growth | -3% | 3% | ||

| Net income (loss) | 74.5 | 65.4 | 73.1 | 61.3 |

Pure Storage, Inc. announced financial results for its fiscal fourth quarter and full year 2024 ended February 4, 2024.

“Our data platform strategy is revolutionizing the storage industry. It helps enterprises and service providers unify fragmented data environments into a seamless, modern, and efficient system – a system performance-ready for artificial intelligence,” said Charles Giancarlo, chairman and CEO. “And this can all be done now with flash reliability, performance and economics, even at hard disk system price levels.”

4FQ24 and FY24 financial highlights

- 4FQ24 revenue $789.8 million, a decrease of 3% Y/Y

FY24 revenue $2.8 billion, up 3% Y/Y - 4FQ24 subscription services revenue $328.9 million, up 24% Y/Y

Y/Y subscription services revenue $1.2 billion, up 26% Y/Y - 4FQ24 subscription annual recurring revenue (ARR) $1.4 billion, up 25% Y/Y

Remaining performance obligations (RPO) $2.3 billion, up 31% Y/Y - 4FQ24 GAAP gross margin 72.0%; non-GAAP gross margin 73.7%

Y/Y GAAP gross margin 71.4%; non-GAAP gross margin 73.2% - 4FQ24 GAAP operating income $57.4 million; non-GAAP operating income $157.8 million

FY24 GAAP operating income $53.6 million; non-GAAP operating income $458.4 million - 4FQ24 GAAP operating margin 7.3%; non-GAAP operating margin 20.0%

Y/Y GAAP operating margin 1.9%; non-GAAP operating margin 16.2% - 4FQ24 operating cash flow $244.4 million; free cash flow $200.9 million

Y/Y operating cash flow $677.7 million; free cash flow $482.6 million - Total cash, cash equivalents, and marketable securities $1.5 billion

- Returned approximately $21.4 million and $135.7 million in 4FQ24 and FY24, respectively, to stockholders through share repurchases of 0.6 million shares and 4.7 million shares, respectively.

- Authorized incremental share repurchases of up to an additional $250 million under its stock repurchase program.

“We closed FY24 delivering strong RPO growth, and exceeded our revenue and operating margin guidance in 4FQ24,” said Kevan Krysler, CFO. “Looking to FY25, we expect double-digit revenue growth and strong growth of RPO, fueled by our highly differentiated data storage platform, and strength of our Evergreen and Portworx consumption and subscription offerings.“

FY24 Company Highlights

- Strong Subscription Services Momentum: Set a new industry standard in FY24 with 8 total SLAs across its Evergreen portfolio, including the first and only Paid Power & Rack commitment for Evergreen//One and Evergreen//Flex, in addition to first-of-its-kind energy efficiency and ransomware recovery guarantees.

- Market-Leading Platform Innovation: In FY24, introduced the cost-optimized E//Family with FlashBlade//E, followed by FlashArray//E, enabling customers to leverage flash storage for any workload. Additionally, delivered its largest ever performance, efficiency, and security advancements with the next gen FlashArray//X and FlashArray//C, expanded its strategic partnership with Microsoft with the introduction of Pure Cloud Block Store for Azure VMware Solution, and delivered the first and only native, unified block and file experience purpose-built for flash storage with the GA of File Services for FlashArray.

- AI Customer Impact: Among the first enterprise data storage vendors to receive the Nvidia DGX BasePOD certification, and delivering critical validated designs with key alliance partners, the company continued to add to its 100+ customers across a variety of AI use cases, including self-driving cars, financial services, genomics, gaming, and manufacturing.

- Industry Recognition and Accolades: In FY24, the firm was recognized as a leader for the 10th consecutive year in the Gartner Magic Quadrant for Primary Storage, and the 3rd consecutive year in the Gartner Magic Quadrant for Distributed File Systems and Object Storage. Additionally, it was named a leader in the inaugural IDC MarketSpace: Worldwide Container Data Management 2023 Vendor Assessment.

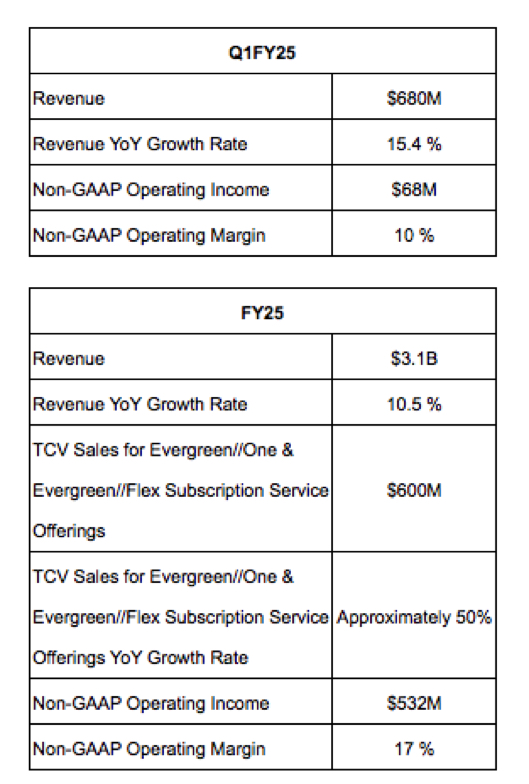

1FQ25 and FY25 Guidance

Comments

4FQ24 financial performance, exceeds guidance for both revenue and operating profit, with revenue down 3% Y/Y and up 4% Q/Q.

The company ended the year with increasing sales momentum and balanced performance across its theaters and product portfolio. This momentum and growing customer interest in its platform strategy provides us with increased confidence for the coming year.

After 18 months of steep declines, NAND market pricing has stabilized, which should improve storage market growth.

As expected, customer demand for consumption and subscription-based offerings was strong, especially for Evergreen/One, its SaaS offering and Portworx. Annual sales for both offerings grew over 100% in FY24 and total contract value or TCV sales for Evergreen/One and Evergreen/Flex exceeded $400 million. Remaining performance obligations, or RPO, associated solely with firm's subscription service offerings at the end of 4FQ24 was strong, growing 29%. Subscription services net dollar retention, or MDR at the end of the year was 120%.

In 4FQ24, subscription services ARR grew 25% to approximately $1.4 billion, highlighting the strong traction for company's consumption and subscription-based service offerings. As mentioned previously, subscription services ARR excludes noncancelable Evergreen subscription contracts where the effective service date has not started. Including noncancelable subscription contracts where the effective service date has not started, subscription services ARR at the end of 4FQ24 grew 27%. Subscription services revenue during this period was $329 million, growing 24% and comprising 42% of total revenue.

U.S. revenue for 4FQ24 was $522 million, and international revenue was $268 million.

New customer acquisition grew by 349 during 4FQ24, including 6 new Fortune 500 customers.

Headcount increased slightly to nearly 5,600 employees at the end of 4FQ24.

Revenue in $ million

(FY ended in January)

| Period | Revenue | Y/Y growth | Net income (loss) |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| FY20 |

1,643 | 21% | (201.0) |

| FY21 |

1,684 | 2% |

(282.1) |

| 1F22 | 412.7 | 12% |

(84.2) |

| 2F22 | 496.8 | 23% |

(45.3) |

| 3F22 | 562.7 | 29% |

(28.7) |

| 4F22 | 708.6 | 41% |

14.9 |

| FY22 |

2,181 |

30% |

(143.3) |

| 1F23 | 620.4 | 50% |

(11.5) |

| 2F23 | 646.8 | 30% |

10.9 |

| 3F23 | 676.1 | 20% | (0.8) |

| 4F23 | 810.2 | 14% | 74.5 |

| FY23 |

2,753 |

26% |

73.1 |

| 1Q24 |

589.3 |

-5% |

(67.4) |

| 2Q24 | 688.7 |

6% |

(7.1) |

| 3Q24 | 762.8 | 13% | 70.4 |

| 4F24 | 789.8 | -3% | 65.4 |

| FY24 |

2,831 | 3% |

61.3 |

| 1F25 (estim.) | 680 | 15% |

NA |

| FY25 (estim.) |

3,100 |

10% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter