SoftBank-Backed Cohesity to Buy Veritas Data Protection Business

To create $7 billion firm

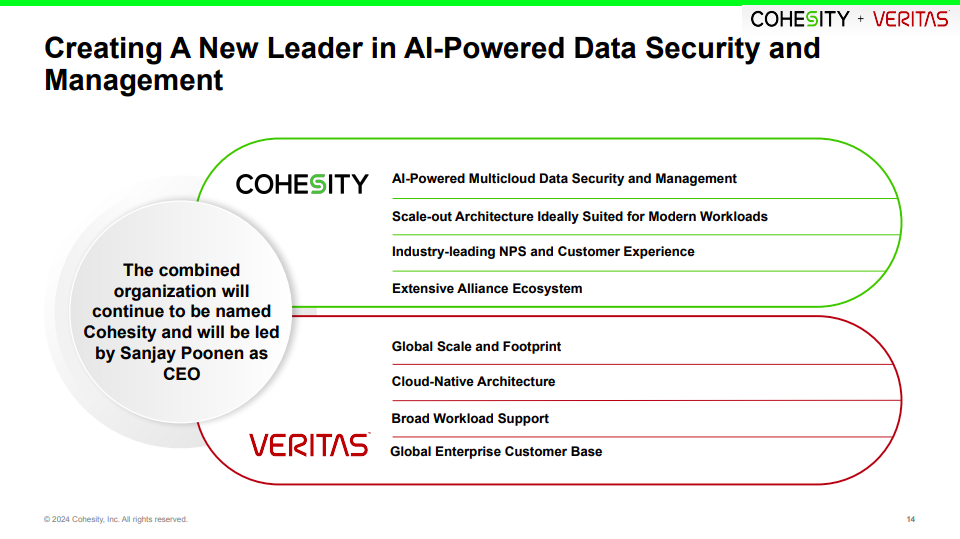

This is a Press Release edited by StorageNewsletter.com on February 9, 2024 at 2:02 pmCohesity, Inc. and Veritas Technologies LLC are announcing their definitive agreement under which Cohesity intends to combine with Veritas’ data protection business, which will be carved out of Veritas, to create a new leader in data security and management.

Customers will benefit from the accelerated innovations unlocked by the joint company’s scaled R&D investment, its unwavering support for customer success, and one of the industry’s most extensive partner ecosystems.

Sanjay Poonen will lead the combined organization as CEO and president. Greg Hughes, CEO of Veritas, will serve as a board member and strategic advisor to Poonen after the close of the transaction.

Protecting the world’s data and gaining insights from that data are top imperatives for IT practitioners all the way to board members. Given the rampant threat of ransomware, every organization needs a cyber resilience strategy. Furthermore, technology and business executives now have a unique opportunity to leverage the power of generative AI for data-driven insights to unleash new levels of efficiency, innovation, and growth.

The combined innovations of the the 2 companies will address challenges directly, offering organizations a comprehensive, multicloud data protection portfolio with a powerful, simple user experience, and a high-performance, centrally-managed hyperconverged platform. This complementary combination will create a new leader in data security and management with numerous product offerings to help customers address their needs for data security and data insights. The combined company will bring together hundreds of exabytes of data protected, a global go-to-market footprint, high penetration in the enterprise with 96 of the Fortune 100 and 80% of the Global 500, and a strong partner ecosystem across all segments of cloud service providers, security players, VARs, system integrators, and hardware OEMs.

The combined company will continue to invest in and advance the roadmap and strategy of all Cohesity products and services, as well as Veritas NetBackup, NetBackup appliances, and Alta data protection offerings, while working towards the delivery of an integrated solution combining the best technology across the two companies.

“We are deeply committed to our mission to protect the world’s data. This deal will combine Cohesity’s speed and innovation with Veritas’ global presence and installed base. We will lead the next era of AI-powered data security and management by bringing together the best of both product portfolios – Cohesity’s scale-out architecture ideally suited for modern workloads and strong Generative AI and security capabilities and Veritas’ broad workload support and significant global footprint, particularly in the Global 500 and large public sector agencies,” said Poonen. “This combination will be a win-win for our collective 10,000 customers and 3,000 partners, and I can’t wait to work with the Veritas team to bring our vision to life.”

Hughes stated: “Veritas and Cohesity share a common vision of empowering businesses to protect their critical data assets in the face of evolving cyber threats and complex hybrid cloud environments. Bringing Veritas’ differentiated cloud-native architecture to Cohesity’s strong innovation engine will ideally position us to offer our customers transformative solutions against cyber attacks while delivering the flexibility and scalability required to thrive in the multicloud era.”

“Both companies have high Net Promoter Scores and share a steadfast, long-term commitment to customers. Existing products will continue to be supported for many years while leveraging joint best-of-breed technologies to provide the most innovative roadmap for a future that delights customers,” Poonen continued. “We are deeply committed to both Cohesity and Veritas customers, partners, and employees as we accelerate customer-driven innovation as one company.”

“I believe customers could benefit from the combination of Cohesity’s simple and secure, high-performance platform and AI-enabled data insights together with Veritas’ global footprint and cloud-native capabilities,” said Patrick Moorhead, founder, CEO, and chief analyst at Moor Insights & Strategy. “The combined company will benefit from scaled R&D efforts and industry-leading capabilities to help make customers more secure and offer them advanced capabilities in data management and insights.“

Together, the companies will target a total addressable market (TAM) of over $30 billion. This figure includes the data replication and protection software market, estimated to be $12.2 billion in 2024 by IDC (1). The expanded go-to-market breadth, geographic footprint, and R&D resources will allow the combined company to accelerate new customer adoption and help drive the deployment of innovative solutions within the fast-growing data security and management segment.

The combination will provide compelling benefits for customers, with increased resources to invest in technology innovation while simultaneously adding scale to support customers worldwide. On a pro forma basis for the fiscal year ending July 2023, the combined entity had revenues of over $1.6 billion, ARR of $1.3 billion, and a 27% adjusted cash EBITDA margin. Further, the combination will augment long-term growth with incremental product and geographic expansion opportunities, ensuring customers can access best-in-class tools and services to safeguard their data.

Transaction Details

The transaction has been unanimously approved by each of Cohesity’s and Veritas’ boards of directors and is expected to close by the end of 2024, subject to regulatory approval and other customary closing conditions. Cohesity will finance the transaction through a combination of equity and debt. The transaction values the combined company at approximately $7 billion. In connection with the transaction, Veritas expects to commence exchange offers or similar transactions in connection with its existing debt.

The combined company will receive support from current marquee investors, including Softbank Vision Fund, Sequoia Capital, Wing Venture Capital, Premji Invest, and others. Existing Veritas shareholders, including majority owner Carlyle, will become Cohesity shareholders upon the closing of the transaction.

Patrick McCarter, MD and co-head of global technology at Carlyle, will join the Cohesity board of directors after the close of the transaction. Haveli Investments will participate as a new significant investor as part of this transaction, and Premji Invest will increase its holdings in Cohesity. In addition, Madrona will become a new investor in the combined company. In conjunction with these investments, Brian Sheth, founder and CIO of Haveli Investments, will join Cohesity’s board of directors upon the close of the transaction, and Sandesh Patnam, managing partner of Premji Invest, will join the Cohesity board of directors later this month. This robust backing ensures the financial and operating resources essential for propelling the company’s growth, extending its global presence, and driving continued product innovation.

The remaining assets of Veritas’ businesses will form a separate company, “DataCo.” that will comprise Veritas’ InfoScale, Data Compliance, and Backup Exec businesses, and will function autonomously, enhancing agility and adaptability. This newfound independence will enable these businesses to implement a sharply focused, customer-centric approach. Each entity will have dedicated R&D efforts, aiming to deliver specialized solutions tailored precisely to their respective markets. DataCo will be led by CEO Lawrence Wong, currently SVP of strategy and products at Veritas.

Advisors

J.P. Morgan Securities LLC served as Cohesity’s exclusive M&A financial advisor, and JPMorgan Chase Bank, N.A. has provided committed financing for the transaction. PJT Partners served as debt capital markets advisor to Cohesity. Simpson Thacher and Bartlett LLP and Gunderson Dettmer LLP served as primary legal advisors to Cohesity. Guggenheim Securities, LLC and Morgan Stanley & Co. LLC served as Veritas’ financial advisors. Alston & Bird LLP and Latham & Watkins LLP served as Veritas’ legal counsel for the transaction.

(1) IDC Worldwide Data Replication and Protection Software Forecast, 2023–2027: Steady Demand, doc #US51037523, July, 2023.

Comments

Is it real? The first immediate feeling invited us to think about the "direction" of this merge, we mean acquisition, as Cohesity is acquiring the data protection business of Veritas Technologies.

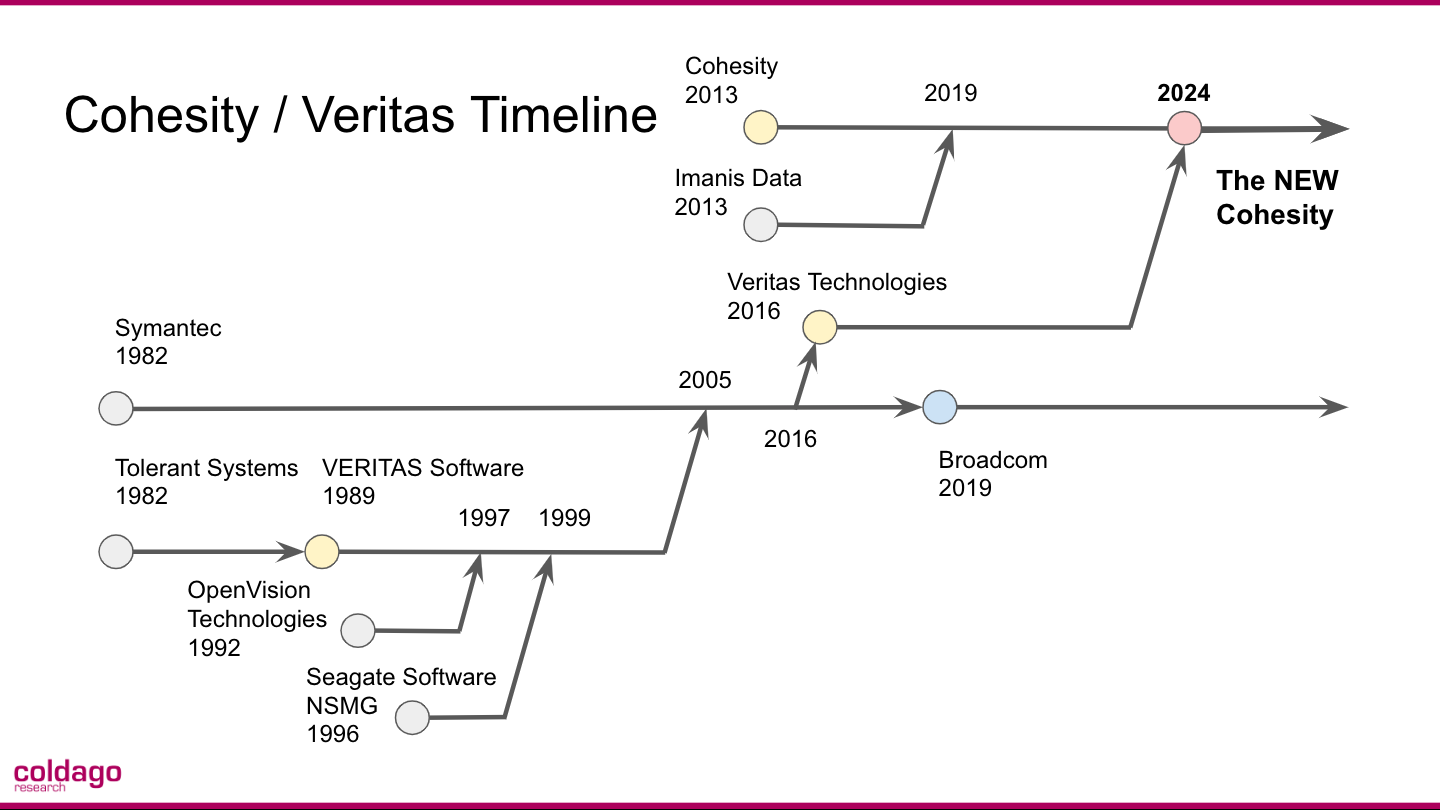

For our readers, VERITAS Software was founded in 1989 as the evolution of Tolerant Systems itself founded in 1982. Known as the reference in file system with VxFS and volume management with VxVM for Unix systems, the company expanded its product coverage with OpenVision Technologies acquisition in 1997 and especially with NetBackup. This was the 2nd era of VERITAS. NetBackup has its roots at Control Data under the name AWBUS (Automated Workstation BackUp System) originally developed for Chrysler in 1987. The 3rd era arrived with the significant acquisition of Seagate NSMG for $1.6 billion in 1999 that added a strong Windows presence for the company. The 4th period arrived with Symantec acquisition of VERITAS in 2005 under Gary Bloom leadership who took the CEO position in 2000. This Symantec move would have probably never happened under Mark Leslie control. And even if some synergies existed on the paper, this still is questionable, it didn't really takeoff as enterprise and channel businesses are different with a strong OEM path for VERITAS, Unix and Windows world, storage and data management versus security... But as we saw for a few years now, JT Thompson, CEO of Symantec, past and new entity, has anticipated what we live today with security everywhere, we mean, all IT solutions embed and integrate some sort of security features, functions... it was just very early trying to mix 2 very different animals. Mid 2015, The Carlyle Group announced the purchase of the Veritas assets in cash for $8 billion. It was effective in January 2016 and marked the fifth era under the name Veritas Technologies, with Veritas no longer in capital letters. And the business and solutions have changed dramatically as the majority of the revenue comes from NetBackup, a strong brand in the industry for more than 3 decades. And now the last news, 20 years after Symantec announced the acquisition of VERITAS Software, Cohesity unveiled the acquisition of Veritas Technologies' data protection business that should be effective before the end of this year. It marks the 6th era but above all the extinction of Veritas name. The new entity will have to pay attention to the NetBackup brand on the market.

The timeline below shows the major acquisitions and mergers for associated companies but we masked several ones made by Veritas.

Why this deal? and why now?

For approximately 8 years, The Carlyle Group has made his move and finally this Veritas business even strong never found a new dynamism besides a significant market footprint. And so the question of exit as a global investment firm active in the PE domain remains open.

When you saw Cohesity and Veritas you even imagine that Veritas could acquire Cohesity but it wouldn't probably change Carlyle position within Veritas and doesn't a positive outcome like this one this year. The idea to make the opposite, find a new entity, let's say more modern, and "insert" Veritas active business had some appealing components. And we can even imagine the next step with an official IPO. Remember the S1 filed confidentially by Cohesity in December 2021. But at what price and under which market conditions, it's now over... for the moment.

For Cohesity, a unicorn for several years with more than $800 million raised, never became public and invites users and partners to have doubt on its capacity to leverage AI, security challenges and above all become a leader. The firm was seen as an alternative and innovator playing immediately after Veritas... But at that level of money raised, nobody would accept to pay 2, 3 or $4 billion on the table so what can they do and Carlyle understood this season searching a landing zone for Veritas. For sure, the new Cohesity fueled by Veritas is now in a different dimension. We saw some key strategic partnerships with Microsoft and IBM that invited people to speculate around these as the next phase, if one needs to occur, took time to happen.

It appears that the transaction is valued at over $3 billion that invites Cohesity to raise about $1 billion in equity and $2 billion in debt from investors including Haveli Investments, Premji Invest and Madrona as it is written in the Reuters post. But $3 billion is far below what Carlyle paid for Veritas in 2016. The story is not ended for the investment firm as they stay in the Cohesity capital structure and at the board level. And as a next step, we could imagine an IPO to allow Carlyle to fully monetize this investment that has been started almost 10 years ago.

For Veritas, the company suffered to be a star in the past with real difficulties to be associated with new technologies and market needs. We remember that Symantec finally froze their storage and data management developments, we already wrote about this but how a company like Veritas didn't join the object storage, global file services and namespace or distributed storage wave. It tried but very late and gave up on object. It got brilliant ideas that where stopped under Symantec umbrella and all this was hyper visible with Veritas became independent in 2016. Suddenly visible holes existed in the product line. So what could be done for Carlyle with Veritas? And they found and imagine a route and a clever one that helps them, Cohesity, Veritas and protect users.

Separating from Veritas Technologies, DataCo will remain the Veritas entity with InfoScale, Data Compliance and BackupExec. It is very strange that BackupExec stays in that entity without any link with InfoScale. We'll see what will happen to InfoScale as we could imagine an acquisition as well.

Cohesity is strong in VM and cloud, Veritas in bare metal and VM and applications coverage and they both had difficulties with the modern data protection started with containers and more recently SaaS applications as they needed external integrations, partnerships and they even did some acquisitions in the domain. With security everywhere and AI demands and requirements, this merge makes sense to consolidate positions and present a brilliant future but we'll see as 2 they're 2 big boats...

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter