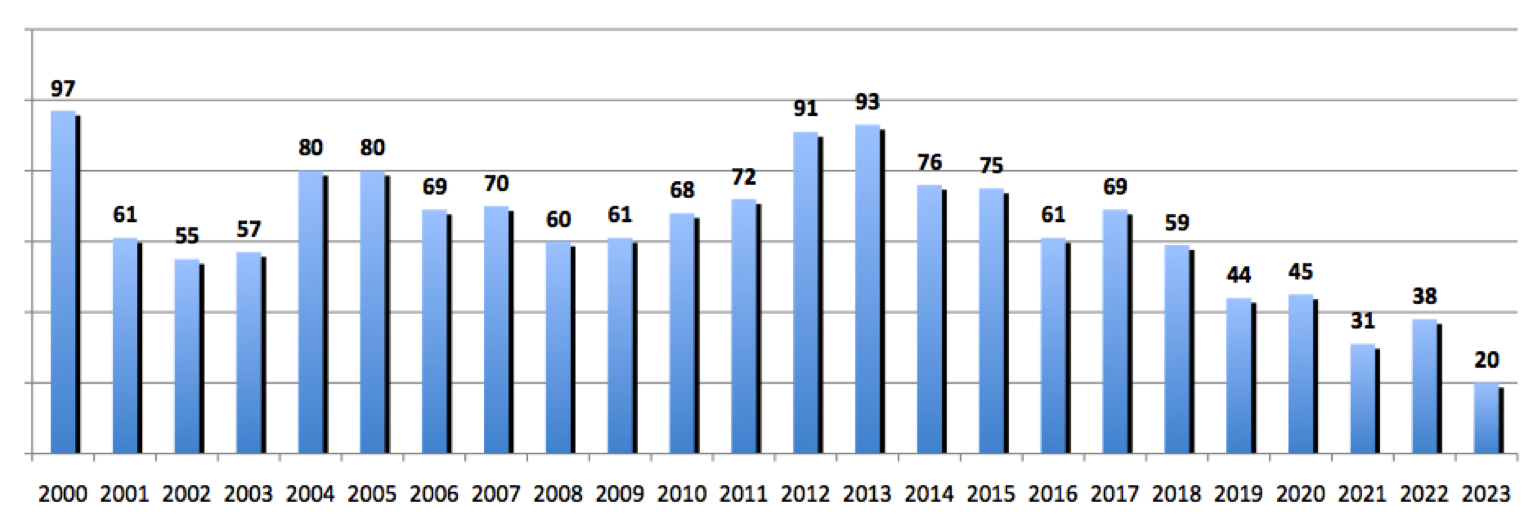

All Financial Rounds of Funding of Storage Start-Ups Since 2000

Total of 1,532, but less and less, 93 in 2013, only 20 in 2023 up to now

By Jean Jacques Maleval | January 15, 2024 at 2:42 pmWe have collected all financial rounds of funding raised since 2003 when known.

But there was several others before that, the first one apparently being raised by Memorex, born in 1961 and, at this time, in tape and HDD IBM compatible subsystems and later, in 1965, being public through probably the first IPO in the storage industry, and then acquired by Burroughs in 1982.

1,532 rounds were recorded from 2000 to 2023 with a record of 93 in 2013 and then generally decreasing with 38 in 2022. For 2023, the figure is only 20 up to now.

≠ of financial rounds since 2000 in storage industry

(Source: StorageNewsletter.com)

Note that we also record the total investment when it was announced but, for some start-ups, we got only the figure for one or more rounds.

Historical records in total financial funding in $ million

(more than $300 million)

Databricks 4,200 (new one in 2023)

Dropbox 1,700

Cloudera 1,041

Cohesity 660

Kaseya 567.4

Box 554.5

Pillar Data 544

Rubrik 553

Wasabi 534.1

Pure Storage 531

Own Company 507.3

Twist Bioscience 503.1

Veeam 500

DigitalOcean 491.3

Druva 475

Dremio 421.5

Acronis 408

Vast Data 381

Nutanix 370.3

Actifio 352.5

Qumulo 351

Infinidat 325

Fungible 319.9

(Source: StorageNewsletter.com)

Largest financial round in 2023 in $ million

Databricks 684.6

(Source: StorageNewsletter.com)

18 financial rounds in 2023

| Companies (HQs) |

Born in | 2003 funding | Total Funding | Business |

| Alcion (Santa Clara, CA) | 2022 | 21 | 29 | AI-driven BaaS platform for Microsoft 365 |

| Arpio (Durham, NC) | 2018 | 8.2 | 8.2 | cloud DR for AWS |

| Astran (Paris, France) | 2021 | 5 | 7.3 | software that unlocks cloud adoption without compromising data confidentiality, security, and compliance |

| Cloudian (San Mateo, CA) | 2011 | 60 | 233 | hybrid cloud storage platform; formerly Gemini Mobile Technologies; acquired Infinity Storage in 2018 |

| Cumulus Encrypted Storage System (Manchester, UK) | 2019 | 8 | 8 | blockchain-powered decentralized storage and CDN infrastructure for Web3 |

| Databricks (San Francisco, CA) | 2013 | 684.6 | 4,200 | cloud data platform that interacts with corporate information stored in the public cloud |

| Evonetix (Essex, UK) | 2015 | 25.4 | 68.1 | DNA for storage; Cambridge Consultants spin-out |

| FilSwan (Toronto, Canada) | 2021 | 3 | 3 | storage and computing infrastructure layer for Web3 |

| Floadia (Tokyo, Japan) | 2011 | 7 | 33.28 | embedded flash memory IP cores |

| Genomika (Kaunas, Kauno Apskritis, Lithuania) | 2019 | 5 | 5 | DNA storage technologies |

| Hammerspace (San Mateo, CA) | 2018 | 56.7 | 56.7 | SaaS to simplify availability and control of unstructured data across hybrid cloud |

| Impossible Cloud (Hamburg, Germany) | 2021 | 10.9 | 10.9 | cloud storage solution, which bridge gap between traditional and web3 businesses |

| Inspeere (Poitiers, France) | 2019 | 0.6 | 0.6 | blockchain-based backup solution |

| Intrinsic Semiconductor Technologies (London, UK) | 2017 | 8.5 | 9.9 | memristive RRAM devices, UCL spinout company |

| Komprise (Campbell, CA) | 2014 | 37 | 85 | software using analytics-driven adaptive automation to manage massive data growth transparently across all storage silos |

| LucidLink (San Francisco, CA) | 2016 | 75 | 90 | cloud backed distributed file service |

| Panmesia (Daejeon, Korea) | 2022 | 12.5 | 12.5 | fabless semiconductor company focused on CXL |

| UltiHash (San Francisco, CA) | 2022 | 2.5 | high-performance and sustainable storage solution | |

| Vast Data (New York City, NY) | 2016 | 118 | 381 | Universal Storage Architecture with flash memory to bring end to enterprise HDD and storage tiering area; also in Israel |

| Volumez (Santa Clara, CA) | 2020 | 20 | 20 | SaaS composable data infrastructure; also in Israel |

| Weebit Nano (Hod Hasharon, Israel) | 2015 | 40 | 106.3 | in semiconductor memory elements to become faster, more reliable energy efficient and cost effective NVM |

Read also: Where did the VCs invest storage startup dollars in 2023? (Clue: AI)

Venture Capitalists invested $1.3 billion in 17 storage startups in 2023

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter