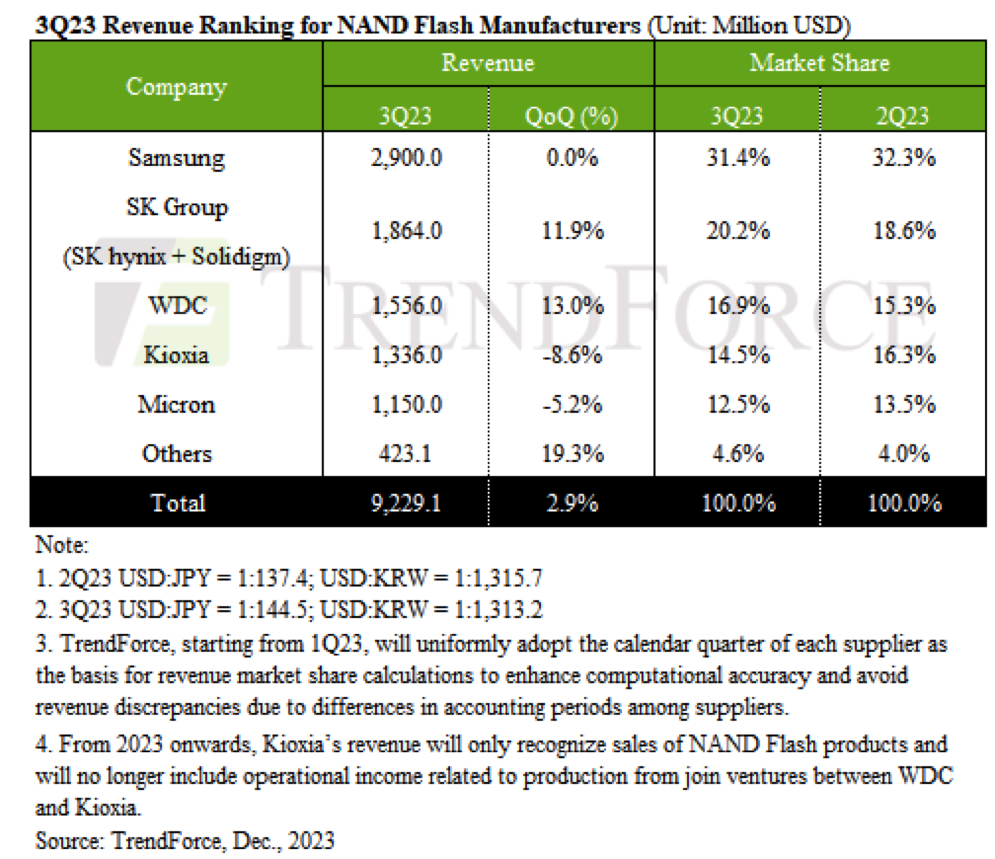

NAND Flash Industry Revenue Grows 2.9% Q/Q in 3Q23 at $9.229 Billion

And expected to surge over 20% in 4Q23.

This is a Press Release edited by StorageNewsletter.com on December 14, 2023 at 2:02 pm![]() This market report, published on December 5, 2033, was written by Bryan Ao, research staff member at TrendForce Corp.

This market report, published on December 5, 2033, was written by Bryan Ao, research staff member at TrendForce Corp.

NAND Flash Industry Revenue Grows 2.9% in 3Q23,

Expected to Surge Over 20% in Q4

It reports a pivotal shift in the NAND flash market for 3Q23, primarily driven by Samsung’s strategic decision to reduce production.

Initially, the market was clouded by uncertainty regarding end-user demand and fears of a subdued peak season, prompting buyers to adopt a conservative approach with low inventory and slow procurement. However, as market leaders like Samsung implemented substantial production cuts, buyers’ attitudes shifted toward a more aggressive procurement strategy in anticipation of a market supply decrease. This led to a stabilization and even an uptick in NAND flash contract prices by quarter-end, driving a 3% Q/Q increase in bit shipments and culminating in a total revenue of $9.229 billion, marking an approximate 2.9% increase.

The story unfolds with Kioxia and Micron – the only 2 to witness a dip in revenue rankings this quarter – while Samsung maintained its robust performance.

Despite sluggish demand in the server sector, Samsung’s fortunes rebounded thanks to a boost in consumer electronics, especially with high-capacity products in PCs and smartphones. Samsung emerged from a trough in 3Q23, with strategic inventory replenishments fueling further strategic stocking, and a shift in operational focus toward maximizing profit. This led to a minor 1-3% decrease in shipped bits, but a 1-3% increase in ASP, stabilizing 3Q23 NAND flash revenue at $2.9 billion.

Kioxia saw a 3% increase in 3Q23 ASP, boosted by rebounding wafer contract prices and early strategic stockpiling by laptop clients. However, a delay in orders from American smartphone brands led to a 10-15% decrease in shipped bits, causing a dip in NAND flash revenue to $1.34 billion, marking an 8.6% decline in Q/Q.

Micron was characterized by steady orders from PC and mobile sectors and inventory restocking by some enterprise SSD clients. Despite maintaining bit shipments from 2Q23, a 15% drop in ASP led to a slight slip in revenue to $1.15 billion, a 5.2% decrease in Q/Q. Yet, 4Q23 forecasts a more vibrant scenario, with a comprehensive rebound in contract prices and a surge in order growth driven by price hikes, setting Micron up for over 20% revenue growth Q/Q.

Other industry giants like SK Group (SK hynix and Solidigm) and WDC rode the wave of renewed demand in consumer electronics.

SK Group, buoyed by renewed demand for high-capacity products in the PC and smartphone arenas, maintained a steady increase in bit shipments, catapulting 3Q23 NAND flash revenue to $1.86 billion – an 11.9% uptick.

WDC’s narrative echoed this success, with 3Q23 PC demand outstripping forecasts and resilient demand in mobile and gaming categories underscoring an effective price-driven increase in bit shipments, thus boosting the NAND flash division’s revenue to $1.556 billion, a significant 13% climb Q/Q.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter