Atempo Requests Opening of Judicial Recovery Procedure

Aiming for return to investors in spring or summer 2024

This is a Press Release edited by StorageNewsletter.com on December 5, 2023 at 2:02 pmAtempo SAS has requested the opening of a judicial recovery procedure to finalize the restructuring of its activities and accelerate its business development.

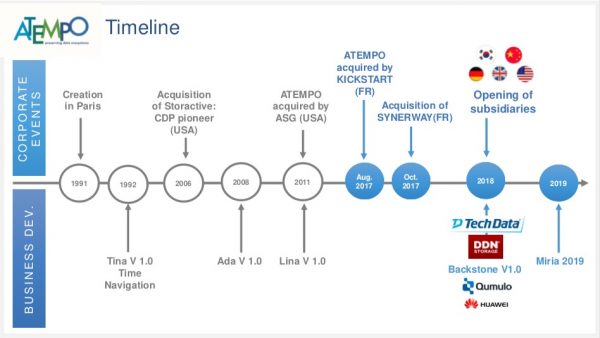

The Data Management and Data Protection European ISV, brought back under private control by Luc d’Urso and Cyprien Roy in August 2017, has heavily invested in the development of its software offering for data management and protection solutions over the past six years. It has also successfully operated a change in its economic model, which allows it to display a turnover consisting of 75% of recurring revenues this year.

At the same time, the sales go to market has been revised to deploy a worldwide indirect sales strategy. The publisher has thus concluded resale and distribution agreements with many manufacturers (DDN, Quantum, Huawei, Panasas, Eviden, etc.), leading cloud providers (OVH, Oustcale, Scaleway, etc.) and a powerful network of national and regional system integrators.

To accelerate its commercial development, Atempo planned to raise funds this year. However, this operation was thwarted by a dispute over the exit requirements of a long-time financial partner forcing Atempo to ask the protection of the Commercial Court.

In addition to settling this dispute, this protection procedure of the Commercial Court will allow Atempo to finalize its restructuring initiated since the merger of Wooxo and Atempo entities in January 2021.

“Atempo is a strategic European actor. Our software contributes to the resilience of many government agencies, communities, health, and research establishments, as well as thousands of customers from different verticals in more than forty-seven countries. Our fundamentals are solid: our trusted codes are acclaimed by major public order givers, our expertise in data orchestration of large volumes is recognized on the international scene.” said Luc d’Urso, president. “This protection period allows us to tour restructuring and ensure the continuation of our developments and the growth of our revenues while aiming for a return to investors in the spring or summer,” he added.

Comments

First we have to recognize that we still are surprised to see that Atempo needs to raise money after 31 years of existence, even if the company raised $43.9 million (see below) and acquired 5 companies (see below).

Let say the reality is different as the current story really restarted in 2017 when Luc d’Urso and Cyprien Roy took over the company from ASG with their Kickstart structure. And they rebuilt everything, merging teams, rationalize product lines and adapt the business model. It takes time and money in a very dynamic business climate that never waits you. We speak about this wave here and then the money campaign makes sense confirming that Atempo has had several lives.

We hope that this current justice action will end in a positive way that won’t impact and delay too much the original plan.

Anticipating the future, the software ecosystem in Europe is very fragmented with several players in competition against each other but also with US-based companies or other part of the world. This is perfectly the case in the data management category.

But there is something better to do in order to create a significant European entity that would seriously compete in data management - this model could be not limited to that segment - at a worldwide level and not regionally or just winning anecdotic deals. With all the talent existing on the continent, why not create a meta structure with players like Atempo, BackupLabs, Datadobi, Disk Archive, Grau Data, iTernity, Leil, Leviia, Linbit, Nodeum, Odaseva, Pro Backup, PoINT, Quobyte, Scality, StorPool, ThinkParQ, Tiger Technology, and Vawlt, to list some of them. Of course, it exists overlaps but it is better than holes and means than unifying forces should create a strong player. Recently, we already lost Rozo Systems swallowed by Hammerspace or Compuverde acquired by Pure Storage just to illustrate the issue and erosion of talents and technologies. We lost players and we continue to operate with just small points of presence unable to scale at the end.

Europe already missed the cloud, AI soon, and we continue to insist on the regulation space watching the game as a spectator unable to react or impact seriously the world. Are we resigned to Europe becoming a museum?

$43.9 million raised in 4 rounds

2003: $6.3 million

2006: $7.7 million

2007: $22 million

2019: $8 million

Acquisitions of Atempo, formerly Quadratec

2006 Storactive

2008 Lighthouse Global Technologies

2011 ASG Software Solutions

2017 Synerway

2019 assets of Lima

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter