SK hynix: Fiscal 3Q23 Financial Results

SK hynix: Fiscal 3Q23 Financial Results

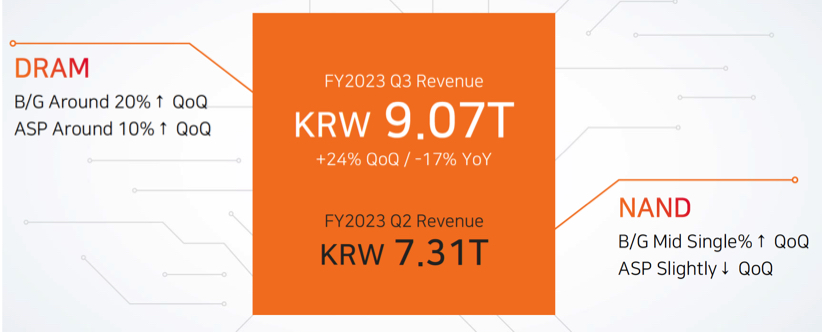

Revenue up 24% Q/Q but down 17% Y/Y

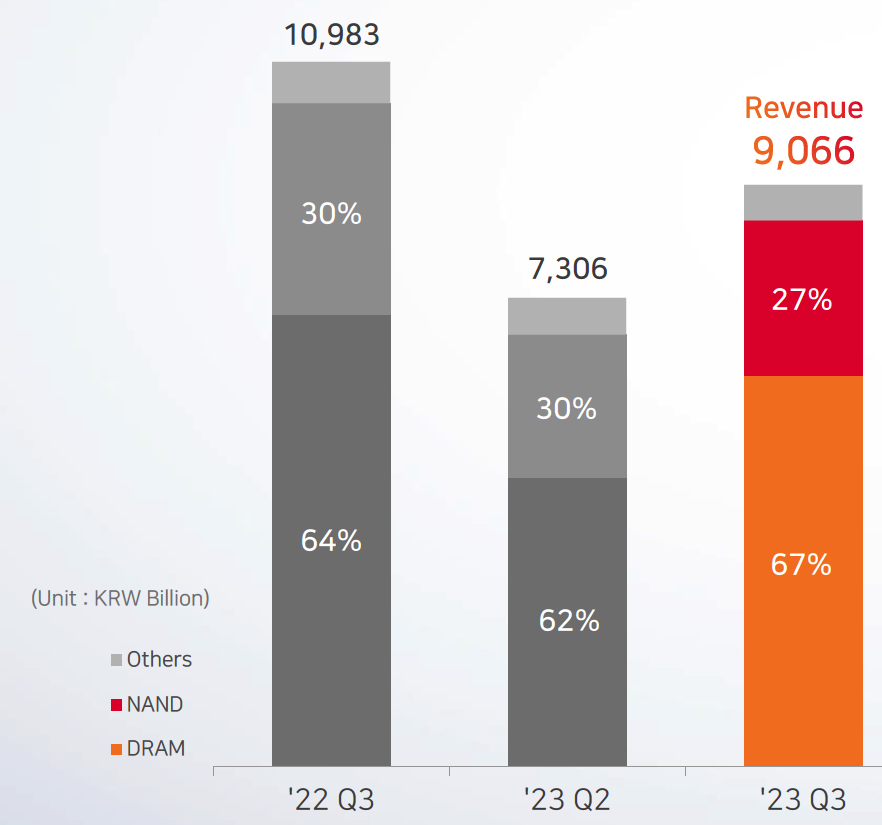

This is a Press Release edited by StorageNewsletter.com on October 30, 2023 at 2:02 pm| (in trillion won) | 3Q22 | 3Q23 | 9 mo. 22 | 9 mo. 23 |

| Revenue | 10,983 | 9,066 | 35,850 | 21,460 |

| Growth | -17% | -40% | ||

| Net income (loss) | (2,185) | 1,108 | 212 | (4,466) |

Highlights

- Technical prowess, competitive products help expand revenues, narrow operating losses

- DRAM turns around from 2 quarters of losses, helped by brisk sales of premium products

- “Company to open up new markets with advanced technology as key player of future AI infrastructure”

SK hynix Inc. reported the financial results for 3FQ23 ended September 30, 2023. The company recorded revenues of 9.066 trillion won, operating losses of 1.792 trillion won and net losses of 2.185 trillion won in the 3-month period. The operating and net margins were a negative 20% and 24%, respectively.

After bottoming out in 1FQ23, the business has been on a steady recovery track, helped by growing demand for products such as high-performance memory chips, the company said.

“Revenue grew 24%, while operating losses narrowed 38%, compared with the previous quarter, thanks to strong demand for high-performance mobile flagship products and HBM3, a key product for AI applications, and high-capacity DDR5,” the company said, adding that a turnaround of the DRAM business following 2 quarters of losses is particularly hopeful.

The firm attributed the growth in sales to increased shipments of both DRAM and NAND and a rise in the ASP.

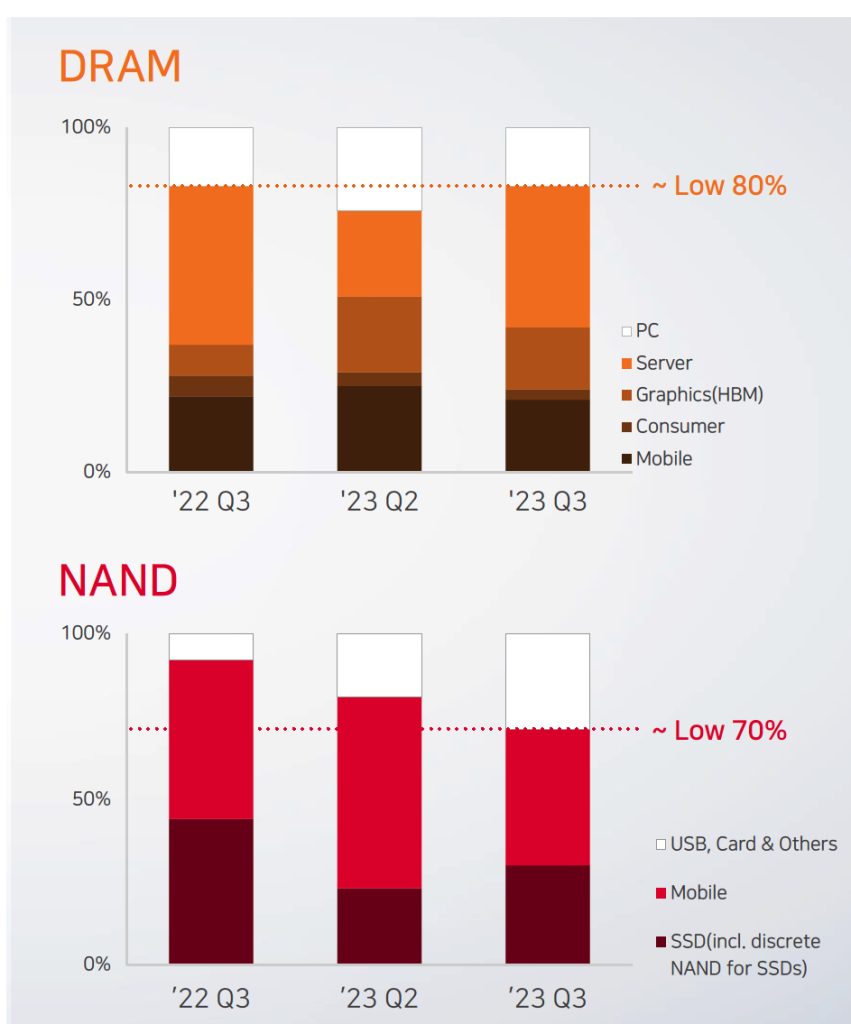

By products, shipments of DRAM increased 20% from the 2FQ23, thanks to strong sales of high-performance products for server applications such as the AI with the average selling price also recording a 10% rise. Shipments of NAND also rose with high-capacity mobile products and SSD products taking the lead.

Following a turnaround, an improvement in the DRAM business is forecast to gain speed, backed by popularity of the generative AI technology, while there are looming signs of a steady recovery in the NAND space as well.

With the effect of the production reduction by global memory providers starting to be seen and customers, following efforts to reduce inventories, placing new orders now, semiconductor prices are starting to stabilize, the company said.

To meet new demands, the company plans to increase investments in high-value flagship products such as HBM, DDR5, and LPDDR5. It will increase the share of the products manufactured from the 1anm and 1bnm, the 4th and the 5th generations of the 10nm process, respectively, while increasing investments in HBM and TSV1.

1TSV (Through Silicon Via): An interconnecting technology used in advanced packaging that links the upper and lower chips with electrode that vertically passes through thousands of fine holes on DRAM chips.

Kim Woohyun, CFO, said that the company has been consolidating its position as the key player in the future AI infrastructure with its leadership in the high-performance memory market.

“Our strong position as the world’s key provider of the products such as HBM and DDR5 will help us discover new markets differentiated from the past,” he said. “We will work toward strengthening our position as the world’s best provider of the high-performance, premium memory products.“

Comments

Revenue analysis

Revenue by product

Revenue by application

In 3FQ23, the overall IT demand continued to show a gradual recovery. Following 2FQ23, there was a strong demand for high-density DDR5 and HBM for AI servers, according to the company. Along with the release of new products, there was a noticeable increase in demand for high performance, high-density mobile memory driven by new product launches and the trend of higher performance flagship models in smartphones.

The firm expanded sales of products such as DDR5 high performance, high-density mobile products and HBM resulting in a 24% sequential increase in 3FQ23 to won 9.07 trillion.

For DRAM, sales to server systems increased due to the continued strong demand for DDR5 and HBM leading to a shipment increase of approximately 20% compared to the previous quarter. The ASP also rose by around 10% due to price increases in key products and higher contribution from high value added products.

Despite the base effect of a strong bit growth in the previous quarter, NAND recorded mid-single digit bit growth compared to the previous quarter, driven by the expansion of high-density mobile products and SSD sales.

However, ASP declined slightly. As revenue increased compared to the previous quarter and some of the recognized inventory valuation losses were reversed due to the rise in DRAM prices, 3FQ23 operating loss improved by won 1 trillion compared to 2FQ23 to won 1.79 trillion with an operating margin of negative 20%.

DRAM business expanded to a mix of high performance premium products driven by industry-leading technological capabilities and therefore, starting from 2FQ23, ASP turned positive surpassing the industry average. Based on this, firm's DRAM margins turned to profitability after 2 consecutive quarters of losses since 2012.

Yields over 1 nanometer DRAM and 176 layer NAND have reached maturity for most of company's products last quarter. Its next gen 1b nanometer and 238 layer products yields are also improving smoothly according to schedule. Furthermore, following this year's mainstream product, HBM3, the manufacturer started providing samples of 1b nanometer HBM3E products to its customers in August.

Next year's demand for DRAM and NAND is expected to grow by a high-teen percentage. Meanwhile, demand growth for this year has been revised downward from the previous quarter expectations to mid-single digit percent for DRAM and high-single digit percent for NAND.

For the first quarter, sales bit growth is expected to be around 10% for DRAM due to higher DDR5 sales. NAND shipment is expected to decrease by around 10% sequentially with lower sales of low-margin products to improve profitability amidst muted demand recovery.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter