Micron: Fiscal 4Q23 Financial Results

Micron: Fiscal 4Q23 Financial Results

Revenue for FY23 divided by as much as two (!), and huge loss

This is a Press Release edited by StorageNewsletter.com on September 28, 2023 at 2:02 pm| (in $ million) | 4Q22 | 4Q23 | FY22 | FY23 |

| Revenue | 6,643 | 4,010 | 30,758 | 15,540 |

| Growth | -40% | -49% | ||

| Net income (loss) | 1,492 | (1,430) | 8,687 | (5,833) |

Micron Technology, Inc. announced results for its fourth quarter and full year of fiscal 2023, which ended August 31, 2023.

4FQ23 highlights

- Revenue of $4.01 billion vs. $3.75 billion for 3FQ23 and $6.64 billion for 4FQ22

- GAAP net loss of $1.43 billion, or $1.31 per diluted share

- Non-GAAP net loss of $1.18 billion, or $1.07 per diluted share

- Operating cash flow of $249 million vs. $24 million for 3FQ23 and $3.78 billion for 4FQ22

FY23 highlights

- Revenue of $15.54 billion vs. $30.76 billion for FY22

- GAAP net loss of $5.83 billion, or $5.34 per diluted share

- Non-GAAP net loss of $4.86 billion, or $4.45 per diluted share

- Operating cash flow of $1.56 billion vs. $15.18 billion for FY22

“During fiscal 2023, amid a challenging environment for the memory and storage industry, Micron sustained technology leadership, launched a significant number of leading-edge products, and took decisive actions on supply and cost,” said president and CEO Sanjay Mehrotra. “Our 2023 performance positions us well as a market recovery takes shape in 2024, driven by increasing demand and disciplined supply. We look forward to record industry TAM revenue in 2025 as AI proliferates from the data center to the edge.”

Investments in capital expenditures, net were $1.01 billion for 4FQ23 and $7.01 billion for FY23, which resulted in adjusted free cash flows of negative $758 million for 4FQ23 and negative $5.45 billion for FY23. The company ended the year with cash, marketable investments, and restricted cash of $10.52 billion.

On September 27, 2023, board of directors declared a quarterly dividend of $0.115 per share, payable in cash on October 25, 2023, to shareholders of record as of the close of business on October 10, 2023.

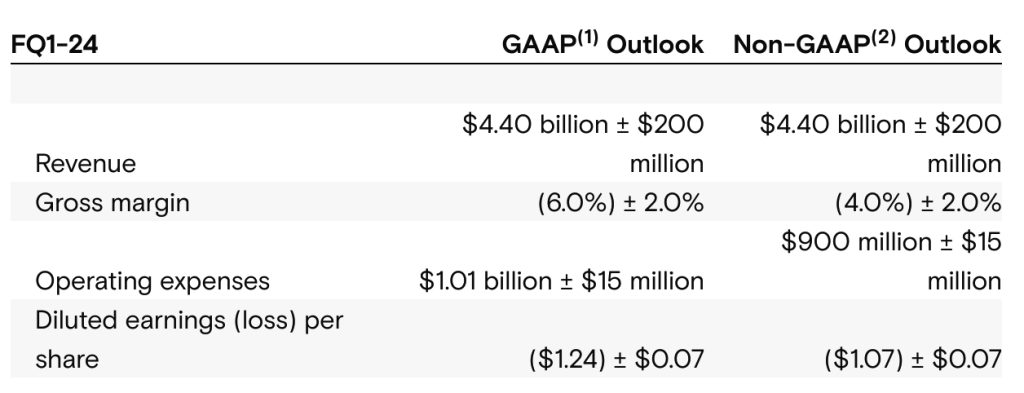

Guidance for 1FQ24

Comments

4FQ23 revenue was $4.010 million, up 7% Q/Q and down 40% Y/Y, as outlook was in the midrange, between $3,700 million and $4,100 million.

FY23 revenue was $15.5 billion, down 49% Y/Y.

Customers continued to reduce their excess inventory for memory and storage in 4FQ23. Most customer inventories for memory and storage in the PC and smartphone markets are now at normal levels, consistent with prior forecasts. Inventory levels are normal across most customers in the automotive market as well. Data center customer inventory is also improving and will likely normalize in early calendar 2024. Consequently, the company sees demand continuing to strengthen, which has led to an

inflection in pricing. Some customers have made strategic purchases in DRAM and NAND to take advantage of unsustainably low pricing as the market begins its recovery.

FY23 highlights

- Achieved record automotive revenue, record NAND QLC bit shipments for the full fiscal year, and reached record levels in CQ2 for revenue share in data center and client SSDs.

- First in to introduce 1-beta DDR5 and LP5X DRAM products, and to ship HBM3E samples with performance and power efficiency.

- First to introduce 232-layer NAND SSD products in data center, client and consumer markets.

- These accomplishments were underpinned by technology and continued strong progress in manufacturing execution.

- Achieved world-class mature yields in record time on industry-leading 1-beta DRAM and 232-layer NAND technology.

- In addition, the firm took several prudent and timely actions to reduce Capex and supply in order to address the market imbalances through the course of FY23.

Technology and production

- Technology roadmap continues to progress well.

- Vast majority of bits are on leading edge nodes 1-alpha and 1-beta in DRAM and 176-layer and 232-layer in NAND.

- Continue to make good progress on 1-gamma DRAM development using EUV, and are on track for production in calendar 2025.

- Development of our next-gen NAND node is also well on track.

End markets overview

- Customers continued to reduce their excess inventory for memory and storage in 4FQ23.

- Most customer inventories for memory and storage in the PC and smartphone markets are now at normal levels, consistent with prior forecasts.

- Inventory levels are normal across most customers in the automotive market as well.

- Data center customer inventory is also improving and will likely normalize in early calendar 2024.

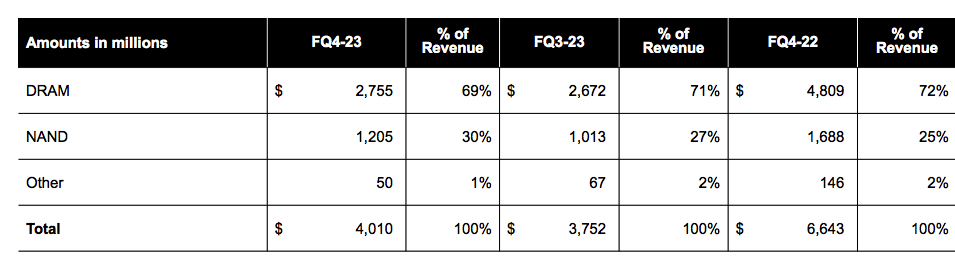

Performance by technology

DRAM 4FQ23

- $2.8 billion, representing 69% of total revenue in 4FQ23

- Revenue increased 3% Q/Q

- Bit shipments increased in the mid-teens percentage range Q/Q

- ASPs declined in the high-single digit percentage range Q/Q

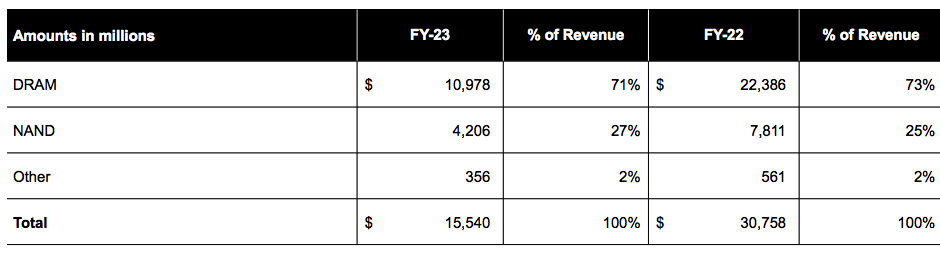

DRAM FY23

- $11.0 billion, representing 71% of total revenue in FY23

- Revenue declined 51% Y/Y

NAND 4FQ23

- $1.2 billion, representing 30% of total revenue

- Revenue increased 19% Q/Q

- Bit shipments increased over 40% Q/Q

- ASPs declined in the mid-teens percentage range Q/Q

NAND FY23

- $4.2 billion, representing 27% of total revenue in FY23

- Revenue declined 46% Y/Y

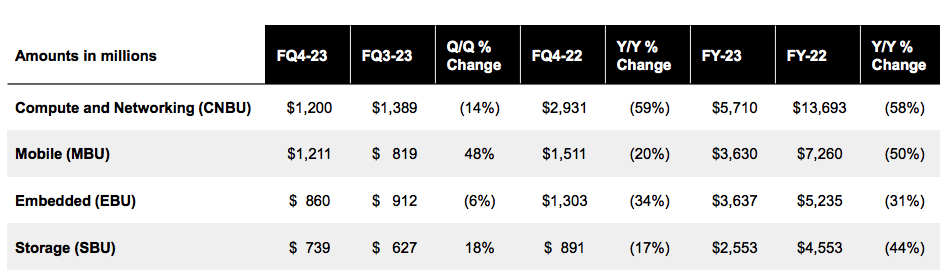

Revenue by business unit

Outlook and Capex Plan

- Expect CY23 DRAM bit demand to grow in the mid-single digit percentage range. In NAND, expectations increased from high-single digits to high teens percentage demand growth Y/Y. These are below the expected long-term bit demand growth CAGRs of mid-teens in DRAM and low 20s percentage range in NAND.

- While macroeconomic factors remain a risk, the company expects robust Y/Y bit demand growth in CY24 for both DRAM and NAND, driven by improving end market demand, normalized customer inventory levels, content growth across products and ongoing growth in AI. CY24 bit demand growth is expected to exceed the long-term CAGR for DRAM and to be near the long-term CAGR for NAND.

- Both DRAM and NAND Y/Y supply growth in CY23 to be negative for the industry. Firm's Y/Y bit supply growth to be meaningfully negative for DRAM. The vendor also expects to produce fewer NAND bits in CY23 than in CY22. In CY24, it expects industry DRAM and NAND supply growth to be below industry demand growth, and meaningfully so for DRAM. It believes CY24 is positioned to be a year of recovery in the memory and storage industry.

- The company has redeployed a portion of the underutilized equipment to support production ramp of leading-edge nodes in both DRAM and NAND. Transitioning this equipment results in a significant and structural reduction to our overall wafer capacity in both DRAM and NAND. DRAM and NAND wafer starts will remain significantly below 2022 levels for the foreseeable future. The firm expects underutilization to continue in its legacy nodes well into CY24. It sees its demand at leading-edge nodes exceeding our supply in fiscal and CY24, particularly in the second half of the year.

NAND revenue only

| Period | Revenue in $ million |

Q/Q or Y/Y change for FY |

% of global revenue |

| FY19 | 5,335 | NA | 23% |

| FY20 | 6,131 | 14% | 29% |

| FY21 | 7,007 | 14% | 25% |

| 1FQ22 | 1,878 | -5% | 24% |

| 2FQ22 | 1,957 | 4% | 25% |

| 3FQ22 | 2,300 | 18% | 26% |

| 4FQ22 | 1,688 | -26% | 25% |

| FY22 | 7,811 | 11% | 25% |

| 1FQ23 |

1,103 |

-35% | 27% |

| 2FQ23 | 885 | -20% |

24% |

| 3FQ23 | 1,013 | 14% |

27% |

| 4FQ23 | 1,205 | 19% |

30% |

| FY23 | 4,206 | -46% |

27% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter