NetApp: Fiscal 1Q24 Financial Results

NetApp: Fiscal 1Q24 Financial Results

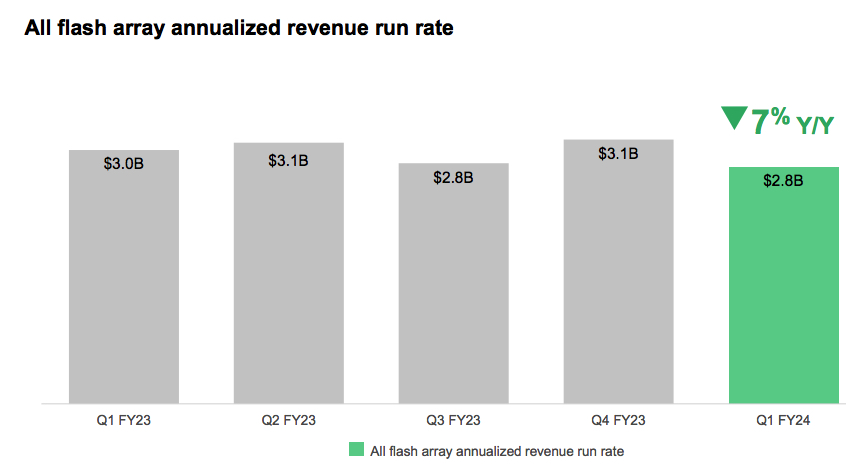

Even AFA revenue down (-7% Y/Y)

This is a Press Release edited by StorageNewsletter.com on August 24, 2023 at 2:02 pm| (in $ million) | 1Q23 | 1Q24 | Growth |

| Revenue |

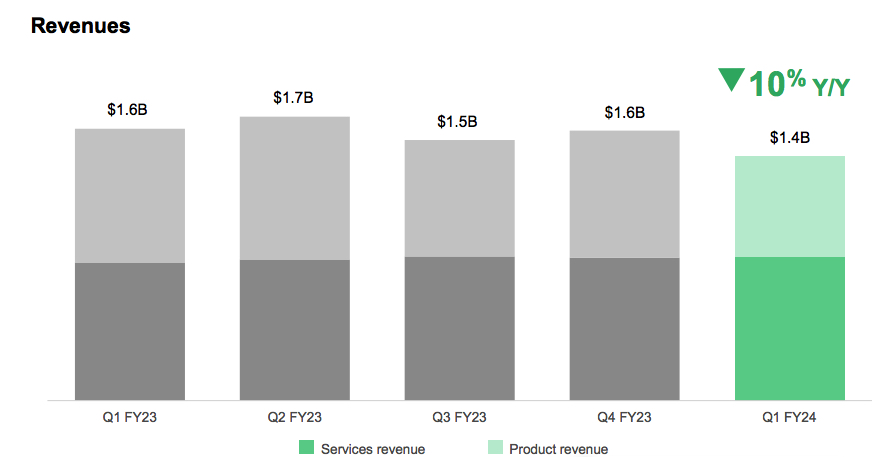

1,592 | 1,432 | -10% |

| Net income (loss) | 214 | 149 |

Highlights:

- Net revenues of $1.43 billion for the first quarter

- Introduced significant innovations, including ASA A-Series, a new line of all-flash SAN storage systems

- Announced the Ransomware Recovery Guarantee, using firm’s comprehensive suite of integrated technologies to help customers protect against, detect, and recover from ransomware attacks

- AFF C-series fastest ramping all-flash systems launch in company history; strong demand across all products in the family

- Cash from operations of $453 million increased 61% Y/Y; free cash flow of $418 million grew 94% Y/Y

- $506 million returned to stockholders in share repurchases and cash dividends in 1FQ24; representing 112% of cash from operations and 121% of free cash flow

NetApp, Inc. reported financial results for the first quarter of fiscal year 2024, which ended on July 28, 2023.

“We delivered a solid start to FY24 in what continues to be a challenging macroeconomic environment. We are managing the elements within our control, driving better performance in our storage business, and building a more focused approach to cloud,” said George Kurian, CEO. “In 1FQ24, we introduced substantial innovation that helps our customers build stronger, smarter and more efficient hybrid multicloud infrastructures. I am delighted by the positive reception to our new products, as well as the differentiation and continued growth of our hyperscaler-managed storage services native to the leading public clouds.”

1FQ24 financial results

- Net revenues: $1.43 billion, compared to $1.59 billion in 1FQ23; a Y/Y decrease of 10%.

- Hybrid Cloud segment revenue: $1.28 billion, compared to $1.46 billion in 1FQ23.

- Public Cloud segment revenue: $154 million, compared to $132 million in 1FQ23.

- Billings: $1.30 billion, compared to $1.56 billion in 1FQ23; a Y/Y decrease of 17%.

Public Cloud annualized revenue run rate (ARR): $619 million, compared to $584 million 1FQ23; a Y/Y increase of 6%. - AFA ARR3: $2.8 billion, compared to $3.0 billion in 1FQ23; a Y/Y decrease of 7%.

- Net income: GAAP net income of $149 million, compared to $214 million in 1FQ23; non-GAAP net income of $249 million, compared to $269 million in 1FQ23.

- Earnings per share: GAAP net income per share of $0.69 compared to $0.96 in 1FQ23; non-GAAP net income per share of $1.15 compared to $1.20 in 1FQ23.

- Cash, cash equivalents and investments: $2.98 billion at the end of 1FQ24.

- Cash provided by operations: $453 million, compared to $281 million in 1FQ23.

- Share repurchase and dividends: Returned $506 million to stockholders through share repurchases and cash dividends.

Dividend

The next cash dividend of $0.50 per share is to be paid on October 25, 2023, to stockholders of record as of the close of business on October 6, 2023.

2FQ24 outlook

Net revenues to be in the range of $1.455 billion to $1.605 billion

FY24 outlook

Net revenues to be down year-over-year in the low-to-mid single digits on a percentage basis.

Comments

Down 10% Y/Y and 9% Q/Q, revenue of $1,432 billion for 1FQ24 if on par with what was expected the former quarter ($1.325 billion to $1.475 billion).

1FQ24 Hybrid Cloud segment revenue of $1.3 billion was down 12% Y/Y.

Public Cloud segment revenue in 1FQ24 was $154 million, an increase of 17% Y/Y. Public Cloud DBNRR declined to 107%. Within these numbers, strength in 1st party and marketplace consumption services was masked by weakness in subscription services. Company's strategic focus is on 1st party cloud storage services, and continues to see customer expansion and deepening partnerships, as well as revenue and ARR growth in this part of the portfolio.

Public Cloud ARR grew 6% Y/Y to $619 million. First party and marketplace services grew as customers continue to choose solutions based on NetApp technology for mission critical and cloud native workloads. This growth was offset by underperformance in subscription services.

Public Cloud did not meet our expectations for the quarter, and the firm is taking action to hone its approach and reaccelerate growth.

AFA business decreased 7% from 1FQ23 to an annualized revenue run rate of $2.8 billion. The demand environment is unchanged from the last half of FY23, with headwinds from enterprise continuing to weigh on product and AFA revenue. 1FH23 benefited from elevated backlog, impacting the Y/Y comparisons.

The AFF C-series has been the fastest ramping all-flash product launch in company's history, with strong demand across all products in the family. Similarly, the AFF A150, entry-level, high performance AFA, grew quickly in its first full quarter of shipping.

For next quarter, NetApp expects sales from $1.455 to $1.605 billion, or between -9% and +1%.

For FY24, it will be down but no figures were revealed, only these worlds: "in low-to-mid single digits."

NetApp's financial results since FY16 in $ million

| Fiscal Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| FY18 | 5,911 | 7% | 75 |

| FY19 |

6,146 | 4% |

1,169 |

| FY20 |

5,412 | -12% |

819 |

| FY21 | 5,744 | 6% | 730 |

| 1Q22 |

1,458 | 12% | 202 |

| 2Q22 |

1,566 | 11% | 292 |

| 3Q22 |

1,614 | 10% | 252 |

| 4Q22 | 1,680 | 8% | 259 |

| FY22 | 6,318 | 10% | 937 |

| 1Q23 |

1,592 | 9% | 214 |

| 2Q23 |

1,663 | 6% | 750 |

| 3Q23 | 1,526 | -5% | 65 |

| 4Q23 | 1,581 | -6% | 334 |

| FY23 |

6,362 | 1% |

1,230 |

| 1FQ24 |

1,432 | -10% |

149 |

| 1Q24 (estim.) | $1.455-$1.605 | -9% +1% |

NA |

| FY24 (estim.) | Down | in low-to-mid single digits | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter